INDUSTRY UPDATE: The Market for Executives

Introduction: The Market for Executives

At the Barrett Group we have seen 32 clients receive offers or land senior executive positions in the last four weeks—all of them at compensation levels much higher than those quoted below by Indeed (an on-line jobs market). So we believe that the market for executives is strong, particularly the unpublished market where three-quarters of our clients typically land. [Read more.] However, let us see what the market data says and then you as the reader can draw your own conclusions.

The US Bureau of Labor Statistics says, “Overall employment of top executives is projected to grow 6 percent from 2021 to 2031, about as fast as the average for all occupations. […] About 318,100 openings for top executives are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.” [See source.]

It may be a secondary indicator, but in Europe, the executive search market is expected to expand from “USD 4,862.85 Million in 2021 […to…] USD 11,551.80 Million by 2030, growing at a CAGR of 10.46% from 2023 to 2030. […] Information technology and the telecom industry [are] booming due to rising demand across different industry verticals including retail, entertainment, education, and healthcare, amongst others.” [See source.]

In fact, the demand for qualified executives apparently exceeds the supply in many industries and regions, including the Middle East which has led some to think more broadly about recruitment: “People are exploring major shifts in their careers ever since 2020 and this trend has continued. Organisations, therefore, are looking beyond traditional credentials in a candidate to fill the roles. This has drastically changed the hiring process. Therefore, it is imperative to rethink about making the hiring decisions just based on qualifications.” [See source.]

Overall the labor market remains relatively tight so that even lay-offs are not having a major effect, though they may be helping to slow inflation. As one source puts it, “layoff announcements from U.S.-based employers reached more than 80,000 in May — a 20% jump from the prior month…” [See source.] The same source continues, “Of those cuts, AI [artificial intelligence] was responsible for 3,900, or roughly 5% of all jobs lost, making it the seventh-highest contributor to employment losses in May cited by employers.”

The risk from AI for middle management may be even higher, though, if this source is to be believed: “In a global survey by Pega, 78% of the executives surveyed believe that increasing the use of AI and robots will dramatically reduce the middle management ranks.” [See source.] On the other hand, technology so far has always ultimately generated more jobs, not fewer. “A report by the Institute for the Future […] estimated that nothing less than 85 percent of the jobs that will exist in 2030 haven’t even been invented yet.” [See source.]

In any case, there is demand for senior executives today, and these are the positions allegedly most in demand [See source.].

Another source (Indeed) lists a somewhat different ranking, but in general concurs with the titles above, however, the compensation Indeed cites seems very much on the low end compared to what our landed clients are earning. Perhaps that is only the usual variation between the average and the upper end, or perhaps that is the Barrett Group effect.

The Executive Market

Numbering some 9.2 million, the executive market as we define it (see Editor’s Note below) has only grown by about 1% but some 376,000 have also changed jobs, meaning there have been something on the order of 470,000 executive opportunities in the past year. Gender-wise, this population remains three-quarters male so far, slightly less in the US and Canada while somewhat more so in Europe and the Middle East. LinkedIn reports that the average tenure for these roles is 3.2 years and also that the hiring demand overall is “high.” While the US and Canada comprise 5.4 million, the EU and UK add another 3.3 million, and the Middle East comes in at 466,000 executives.

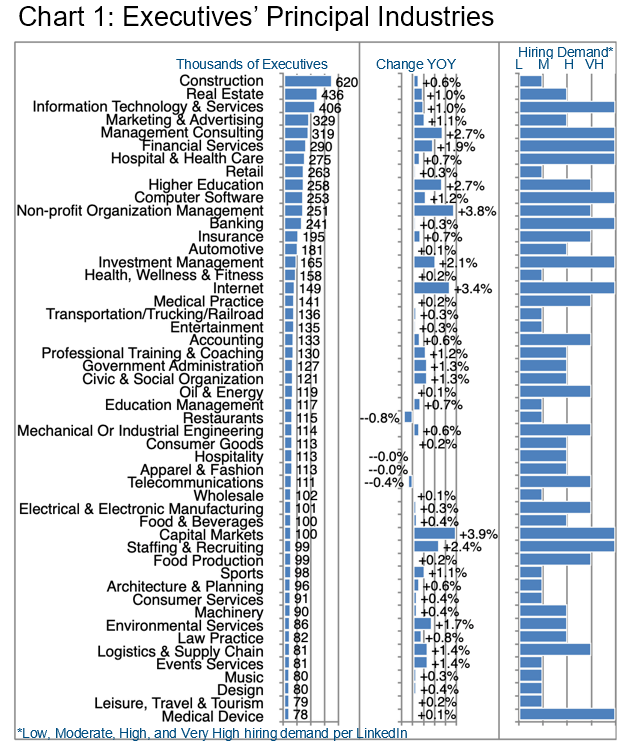

Industrially, Construction and Real Estate top the bill (Chart 1) in terms of the largest number of executives but neither shows particularly high hiring demand or growth. This may well have to do with rising interest rates crimping growth in these sectors even as hybrid and remote work are undermining commercial real estate.

“High-interest rates and a recession will make 2023 a challenging year for commercial real estate. […] ESG considerations and the growth of the digital economy will continue to affect real estate demand. Hybrid working offers many benefits for businesses and employees, but companies and the office sector will have to evolve. Cities too will need to adjust to new commuting patterns and reduced office demand. The resurgent retail sector is just now reaping the benefits of a long period of change, which is attracting keen investor interest.

“Data centers and industrial real estate will probably be the most resilient sectors and the housing shortage will benefit the multifamily sector. The hotel sector’s recovery from pandemic restrictions will continue but life sciences activity, which was turbocharged by COVID, will ease for a while as venture capital becomes scarcer. All sectors in all places will be required by governments, occupiers, and investors to make significant decarbonization efforts.” [See source and our Industry Update.]

Still, Construction and Real Estate are doing better than Restaurants (-0.8%) or Telecommunications (-0.4%).

On the more positive side of the ledger, Information Technology & Services, Management Consulting, Financial Services, Hospital & Health Care and a number of other sectors continue to experience very high hiring demand for executives. These positive developments are nuanced, however, as, for example, management consultants such as Accenture are also going through significant restructuring periods (See source) in Q2 2023, or Financial Service companies, for example, UBS, which has announced major lay-offs as it completes its acquisition of Credite Suisse (See source.) Nevertheless, both of these sectors show significant net growth and high hiring demand as other aspects of their businesses demand fresh executive talent.

One persistent theme in most industries is the lack of qualified personnel, which explains why Staffing and Recruiting firms are also showing high growth and hiring demand. Firms (and applicants) have also had to adapt to remote interviewing, more flexible experience-related criteria, the growing importance of diversity and inclusion as hiring metrics, and the increasing use of automation and even AI in the recruitment process to help fill demand. (See source.)

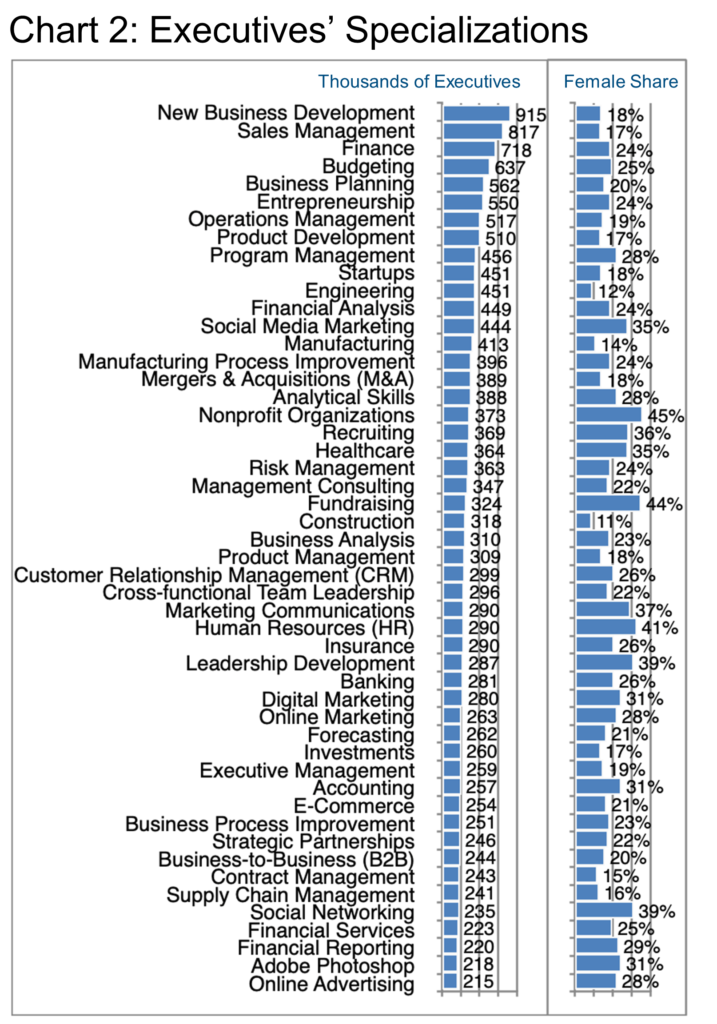

Chart 2 examines in more detail the specializations executives note on their LinkedIn profiles.

Bear in mind that most will highlight more than one skill. As usual, New Business Development and Sales Management are the most common specializations, followed by business fundamentals such as Finance, Budgeting, and Business Planning. In fact, relatively few of these are industry specific, the exceptions being Engineering, Manufacturing, and Construction, for example. This underlines the fact that moving from one industry or role to another is entirely possible if you know how to highlight and promote your transferrable skills—one major reason executives seek out the Barrett Group. [Read more.]

The other major content of Chart 2 has to do with the gender balance in various specializations, where, as usual, some seem to be very male-oriented while others offer far more opportunity for women. Non-profit Organizations (45%), Fundraising (44%), Human Resources (41%), Social Networking and Leadership Development (both 39%) demonstrate the highest shares of female executives in this population.

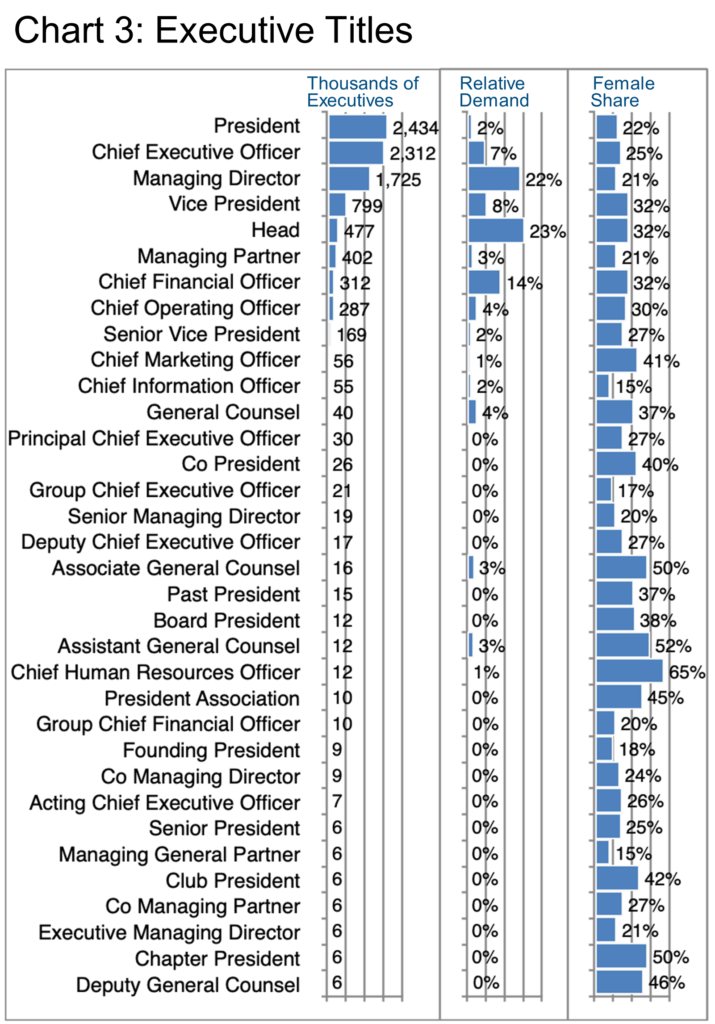

Continuing on the subject of gender balance, Chart 3 highlights the top titles of female executives including Chief Human Resources Officer (65%), General Counsel variations (46-52%), and Chapter President (50%). “Relative Demand” in this context refers to the share of title-specific want ads published (according to LinkedIn) divided by the total number of want ads. On this measure, Head, Managing Director, and Chief Financial Officer showed the highest relative demand. Note too, though that most executive positions are never actually advertised. Fully three-quarters of our clients land through the so-called unpublished market. [Read more.]

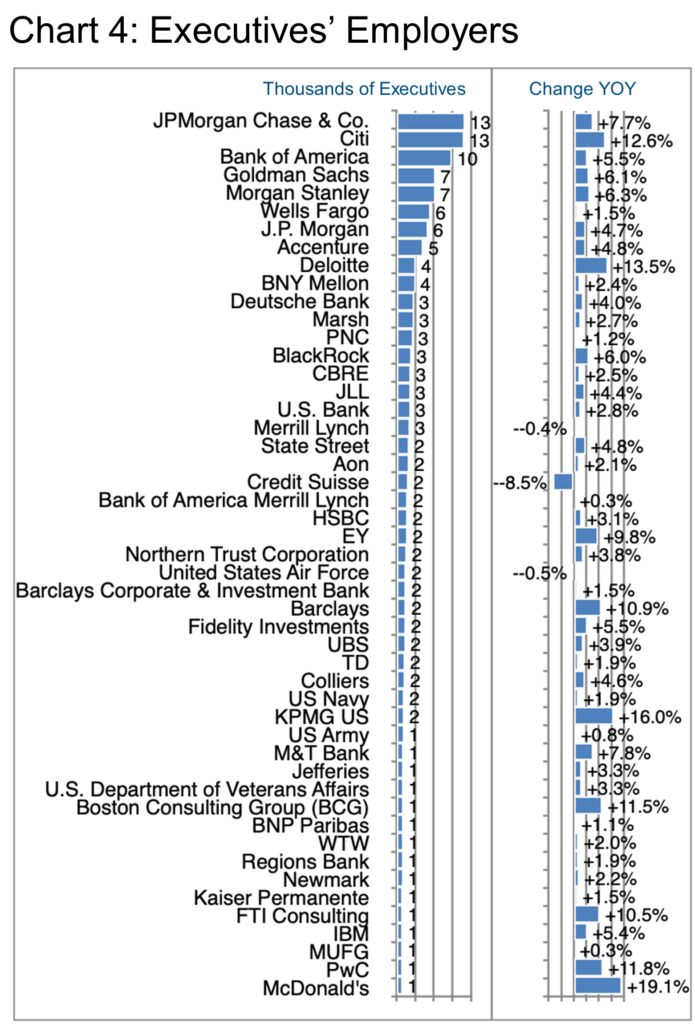

Chart 4 ranks the largest employers of executives in our cohort and excludes those executives who are identifiably self-employed. Starting at the top end with JP Morgan Chase & Co., we find a net change of +7.7%, the talent mainly coming from Morgan Stanley, HSBC, Silicon Valley Bank, UBS, Goldman Sachs, and Deutsche Bank. From a specialization point of view, our data suggests the bank hired mainly for Finance and Financial Analysis skills. Chronologically, the uptick began in November 2022.

Citi grew its executive ranks by even more (+12.6%) and focused mainly on Banking and Capital Markets in terms of targeted specializations, especially in New York, London, and Dallas. They hired from a long list of industry competitors, though they also sold off interests in India to Axis Bank.

Deloitte also stands out in the ranking, growing by +13.5% and fairly consistently over the past year as they hired from EY, Accenture, AWS, IBM, Booz Allen Hamilton, and KPMG (among others). In terms of experience, Deloitte seems to have focused mainly on Management Consulting, Accounting, and Information Technology & Services.

Similarly, KPMG also added +16% to its executive ranks, mainly in New York, Washington DC, and Chicago, but also in Dallas, San Francisco, and Los Angeles. However, their fastest-growing locations (probably from a small base) include Seattle, Denver, and Austin. Competency in Accounting, Management Consulting, Banking, and Information Technology & Services appear to have been their main targets.

Then there is Mcdonald’s which has grown its executive pool by a whopping +19.1%, strengthening its organization in Paris (+16%), London (+14%), New York (+48%), Los Angeles (+50%), Sydney (+29%), and Miami (+25%) among other locations. Mcdonald’s hired very broadly from restaurant and hospitality firms.

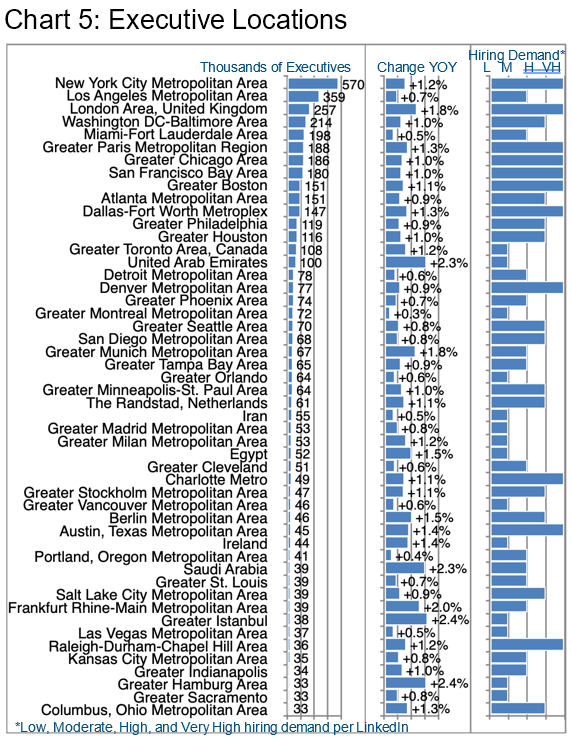

The ranking of executive locations contained in Chart 5 will probably look familiar as New York is usually on top while the strongest growth is often outside the US. And so it is in this cohort.

JP Morgan Chase & Co., Citi, and Goldman Sachs appear to be the biggest employers of executives in New York, underlining the importance of the city in the Financial Services sector. But banking also predominates in Los Angeles, with City National Bank, Bank of America, and Wells Fargo employing the most executives in that market, too.

In London, Citi, JP Morgan, and Deutsche Bank weigh in as the largest employers of executives. In Paris, Societe Generale, BNP Paribas, and Total Energies head the roster. And in the UAE, First Abu Dhabi Bank, GEMS Education, and ADNOC Group occupy the top slots.

However, size and historical growth rates are important but perhaps not as critical for the candidate as the overall hiring demand that LinkedIn reports per the right-hand column in Chart 5. Clients of the Barrett Group have access to much more granular data, of course, not to mention a team of six career change professionals. In any case, we encourage all readers to do the required homework before even considering a career change.

Peter Irish, CEO

The Barrett Group

Click here for a printable version of Industry Update – The Executive Market 2023.

Editor’s Note:

In this particular Update, “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn. It represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.