INDUSTRY UPDATE: Financial Services

Introduction

Financial Services seems to be a growth industry just at the moment. It encompasses more than 1.2 million professionals in The Barrett Group (TBG) core geography [see Editor’s Note for definitions] having grown by 3% in the past year. In total, more than 86,000 Financial Services executives changed jobs in the past year in these regions.

That is a lot of movement.

Let’s begin with a better understanding of what disciplines Financial Services actually comprises.

The National Archives in the US shares this definition:

“The term financial services includes loans, transfers, accounts, insurance, investments, securities, guarantees, foreign exchange, letters of credit, and commodity futures or options.” [See source.]

If that seems a bit broad, the IMF agrees, commenting:

“At its heart, the financial sector intermediates. It channels money from savers to borrowers, and it matches people who want to lower risk with those willing to take on that risk.”

But the IMF goes on to acknowledge…

“…distinctions within the financial sector are not neat…” [See source.]

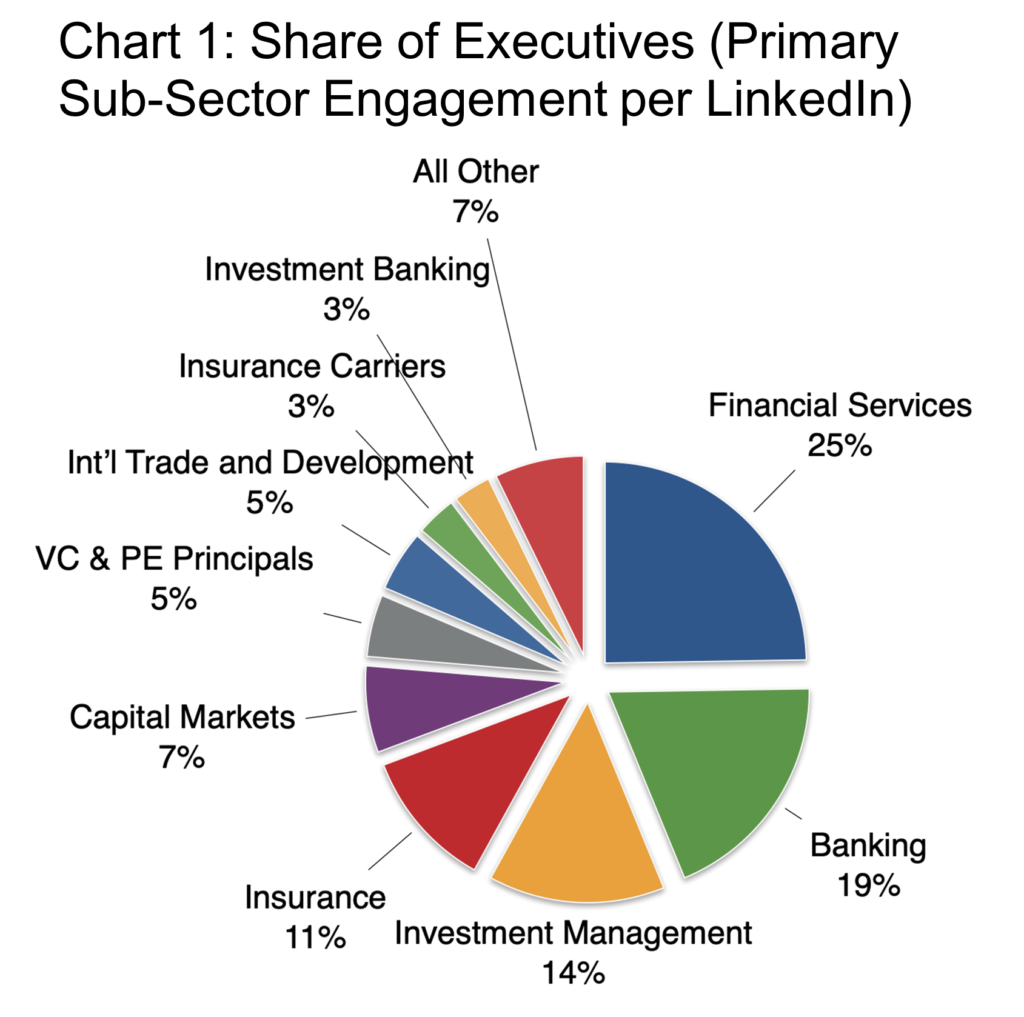

That is quite an understatement, but it is also very true. There is considerable potential for overlap in the activity of financial executives. LinkedIn attempts to separate the inseparable in Chart 1, which shows the share of executives in each major sub-industry based on their LinkedIn profiles. However, because distinctions are not “neat”, there is still a catch-all subcategory ambiguously called “Financial Services.” TBG understands this as containing all services not enumerated in other categories: for example, accounting, tax advice, or CPA services.

Why is this overall industry apparently growing relatively fast? The answer is that this is not the staid and traditional business prior generations experienced. There is enormous change occurring both internally and externally to the industry itself. Let us look at some of the largest segments to illustrate. (See Chart 1.)

Banking, for example, had a reasonable year in 2023, benefiting from higher margins due to higher interest rates. But it also suffered from lower trading and deal-making revenue, as well as one-off charges.

McKinsey had this to say in October of 2023, “The past 18 months have been the best period for global banking overall since at least 2007, as rising interest rates have boosted profits in a more benign credit environment.” [See source.] But the sector also took some hits, particularly in the last quarter of the year in the US: “Fourth quarter net income for the 4,587 FDIC-insured commercial banks and savings institutions declined by $30 billion (43.9 percent) from the prior quarter to $38.4 billion. […] it is estimated that 70 percent of the decrease in net income was caused by specific, nonrecurring, noninterest expenses at large banks.[…] These expenses include the special assessment, goodwill impairment, and legal, reorganization, and other one-time costs.” [See source.]

As interest rates begin to decline later in 2024, the higher rates banks promised to depositors will become a margin drain, too. Lenders will have to look to other sources of income going forward. “Bank profitability in many regions will be tested in 2024 due to higher funding costs and sluggish revenue growth […] However, banks with more diversified revenue streams and a strong cost discipline should be able to boost their profitability, and possibly their market valuation, more than most.” [See source.]

To enable this development of new income streams, banks will need to innovate. “Many banks will also continue to invest in technology to remain competitive. Attracting talent in specialized areas such as artificial intelligence, cloud, data science, and cybersecurity should bump up compensation expenses, even as banks rationalize in other areas. In addition, tight labor markets and accelerated wage growth in traditional offshore locations should add to the industry’s cost pressures.” [See source.]

In other words, in addition to innovation, cost containment will also be a major priority for the banking industry. This may lead to downsizing in lower value-add activities. But it probably represents opportunity for executives with the skills most in demand who may well come from alternative industries.

As far as Investment Management is concerned, “Investment management companies are now facing new threats and uncommon opportunities in the post-pandemic business environment. Even though some asset classes performed better than others, overall industry performance across asset classes remained subdued, driven by various economic and industry pressures. The difficult operating environment is causing many firms to reconsider larger M&A deals in favor of smaller, more tactical ones. In addition, firms also seem more selective to transformative projects with an eye towards shorter duration projects that balance cost cutting with innovation.” [See source.]

Artificial Intelligence and global factors like climate change and the slowdown in China are both buoying and depressing investment markets. This makes it ever more challenging to provide exceptional returns. Technology, customer-centricity, and theme investing (e.g., environment, ESG, digital currencies) will likely take on fresh relevance in these challenging circumstances.

The Insurance segment has seen horrific damage from climate change-driven weather events in past years. Consequently, many in the industry are rethinking the focus on post-catastrophe clean-up versus actively minimizing damage in advance. “Existential threats, such as catastrophic climate change, the explosion in cybercrime, and concern over vast uninsured and underinsured populations, are driving many insurers to reimagine how to confront disruptions caused by the changing environment and help consumers across all segments prevent or mitigate risks before they occur, rather than merely paying to rebuild and recover after the fact. Even while the most extreme events may appear unavoidable, insurance combined with proactive risk management can still help minimize the degree of their impact on affected individuals and communities[.]” [See source.]

The same source continues, “To achieve this level of transformation, insurance companies may need to adopt new technology, including generative AI, to harvest actionable insights from any new data at the industry’s disposal. Industry convergence for access to more information sources, products, and services, as well as talent with the skill sets and know-how of emerging capabilities are becoming table stakes.” [See source.]

In other words, the Insurance sub-industry will most likely also need executives with new skill sets, implying new career opportunities. One method to accelerate transformation is acquiring companies with the desired capabilities rather than building them from the ground up. PWC reports in their latest survey of financial services CEOs that 47% expect to make an acquisition within three years. [See source.]

For the wealth management side of the industry, merger and acquisition (M&A) can add specialist capabilities. Environmental investment is one example. M&A can also bolster sluggish organic growth and help companies achieve scale that allows them to invest in accelerating the digitization of business processes, continued migration to cloud computing, and, of course, AI.

In the Insurance sector, the scope for M&A is large due to the relatively unconcentrated state of this marketplace. This is particularly true in Europe and the Middle East. A re-examination of legacy risk portfolios is underway, and a reshuffling of risk exposure is highly probable, too. Specialist firms will gather risks they feel particularly competent to manage while others gladly exit. Consumers in the US have already seen some of the first instances of this migration. Most notably, major insurers have decided to no longer serve Florida or California due to extreme storm or fire exposure.

Private equity drives or just lubricates many of these M&A transactions, with specialist teams focusing on specific segments and portfolios. “Investors with increasing specialisation in FS [Financial Services], dedicated FS teams and increasing fund volumes are focusing on FS and FS-related topics such as insurance brokerage, payments, platforms, fintech, insurtech and regtech. Hence, we expect to see further M&A activity in these areas. However, with PE investors facing greater pressure on returns due to the higher cost of capital and limitations regarding leverage, a focus on value creation will be more important than ever.” [See source.]

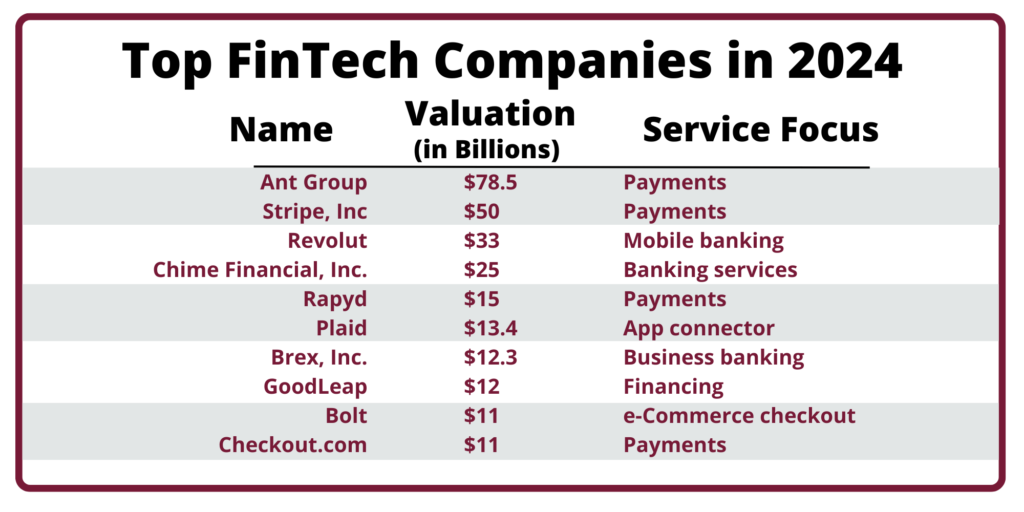

Payments represent another avenue with a lot of life at the moment. Though this is intimately connected to the bubbling caldron we generally call FinTech. [See our FinTech Spotlight.] As funding becomes more scarce for these ventures due to higher interest costs, the M&A route to capital has perked interest in the sub-sector. Overall, “2023 was a difficult year for the fintech market globally, with both total fintech investment ($113.7 billion) and the number of fintech deals (4,547) experiencing their weakest results since 2017.” [See source.]

The decline in FinTech investments was widespread in 2023. Asia/Pacific has shown the largest drop (down $40 billion). EMEA is down by half to $24.5 billion. The Americas, meanwhile, are looking relatively robust at $78.3 billion (down just $17 billion year on year). Payments accounted for the largest share of investment, even as it dropped by $37 billion. But the property and insurance subsegments of FinTech both attracted more investment than in 2022. In total, KPMG describes the current FinTech investor sentiment as “restrained.” [See source.]

Longer term, “The fintech sector, which currently holds a 2% share of the $12.5 trillion in global financial services revenue, is estimated to grow up to 7%, of which banking fintechs are expected to constitute almost 25% of all banking valuations worldwide by 2030.” [See source.] Forbes seems to agree with this bullish outlook because, “Fintech is bringing about change by making it easier for underbanked and unbanked populations to obtain financial services.

Access is being democratized through fintech at a level that has yet to be seen through traditional banking methods.” [See source.]

McKinsey also sees FinTech as a catalyst: “Banking is facing a future marked by fundamental restructuring.” The mass acceptance of digital banking means FinTech now enjoys a similar level of consumer trust versus traditional, branch-based retail banking but with far lower operating costs. Embedded finance, buy-now-pay-later options, and expanded B2B services also contribute to the acceleration in FinTech adoption. This leads McKinsey to predict that, “…revenues in the fintech industry are expected to grow almost three times faster than those in the traditional banking sector between 2022 and 2028. Compared with the 6 percent annual revenue growth for traditional banking, fintechs could post annual revenue growth of 15 percent over the next five years.” [See source.]

Nevertheless, the free-for-all that has characterized the early days of FinTech may well be over. For here, too, investors are far more selective in the current environment. McKinsey says the preferences have shifted to:

- sustainable business models

- cost containment

- focused (selective) growth

- expansion into adjacent segments and geographies, and

- programmatic M&A—all while

- keeping the culture alive. [See source.]

We must address one more elephant in the room. We relentlessly hear that AI will be a game changer, also in Financial Services. But how? And when? The specifics are still a bit vague.

One source tells us that 60% of surveyed banks believe AI will be mainstream in the industry within two years. Meanwhile, 45% say they have already adopted some aspect of AI. Allegedly AI will bring benefits by managing direct conversational interactions with customers, automating mundane tasks, enhancing fraud detection, and cherry-picking big data volumes to minimize risk. For example, Socure, an identity verification enterprise reports that their AI system results in “13x fewer false positives when it comes to fraud detection and up to a 90% reduction in manual reviews of identities.” [See source.]

AI may also be able to grow the top line. Mass personalization is a phrase we have heard many times before. With AI rapidly assessing masses of data, however, the dream may well become a reality as systems identify specific consumer needs and quickly offer tailored insurance, loan, or investment opportunities that perfectly match a customer’s requirements while taking into account the risk that particular customer represents to the service provider.

Such personalization may lead to higher customer satisfaction and therefore higher utilization rates by improving customer experiences. Investors can also benefit from similar personalization extracted rapidly from masses of data: “Based on big-data analysis, AI-powered tools can help to optimise portfolios, analyse market sentiment and events, and generate risk profiles for traders, allowing firms to offer their clients the most adequate investment products. Investment managers are also increasingly using AI and automation to mine the large amounts of qualitative and unstructured data needed for environmental, social and governance (ESG) scoring.” [See source.]

In short, AI has the potential to reduce operating costs while growing revenue. The only fly in the ointment may be adequately protecting customer data. In this context, AI seems poised to both reduce fraud and cybercrime while simultaneously facilitating criminal activities by enabling deep fake voice imitation or allowing the infiltration of machine learning systems before their operators really recognize the new vulnerabilities. [See source.]

Obviously, these are exciting times in the Financial Services industry that demand skilled executives to manage myriad threats and opportunities. Let us now examine the population of execs engaged in juggling these weighty questions day to day.

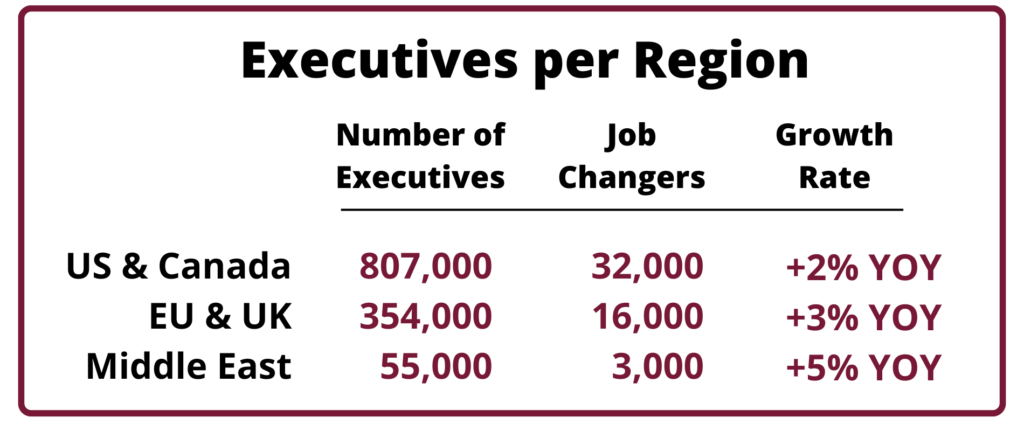

The Market for Executives

As noted in the introduction, TBG counts about 1.2 million executives in this industry (see Editor’s Note for definitions). The cohort is growing relatively fast (+3%) and there is fairly strong “churn.” Within the defined geography in total some 86,000 execs changed jobs in the past year. Even so, the average tenure is quite long at 4.4 years. Only about 25% of these professionals are female. Females range from a low of 16% in the Middle East to 23% in the EU and UK and a high of 26% in the US and Canada.

More specifically, here is how the regions compare:

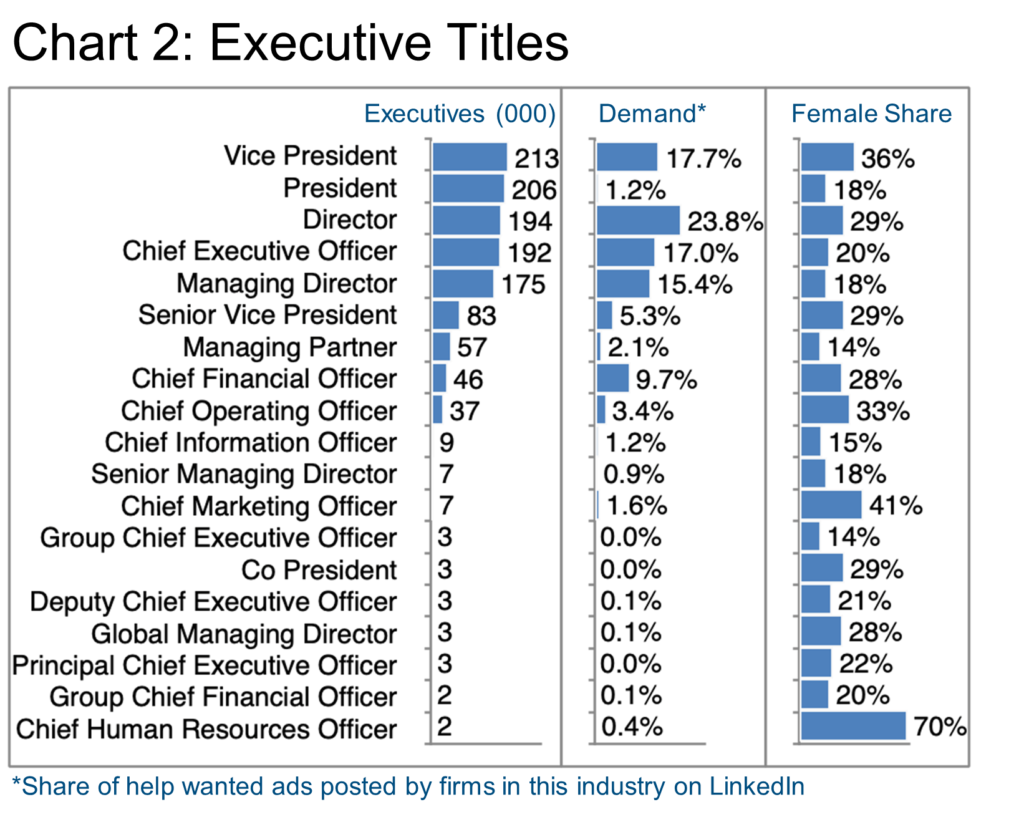

Chart 2 explores the titles these executives post on their LinkedIn profiles. The structure is one of a relatively concentrated industry with, for example, fewer CEOs than Vice Presidents. Note that LinkedIn requires TBG to round to the nearest thousand in these analyses. Hence, there is a long tail of similar values at the lower end.

While “help wanted ads” are only part of the market, they nevertheless provide a snapshot of demand for various titles. In the “Demand” column readers will see the relative interest in hiring Directors (23.8% of all help wanted ads on LinkedIn in this cohort) versus Vice Presidents (17.7%), CEOs (17.0%), Managing Directors (15.4%), and CFOs (9.7%). Clearly, in this industry there has been a healthy and broad demand for talent over the past year.

Though the overall share of female executives may be low in this industry, the shares vary considerably based on role. As usual, the human resources responsibility comes in very high (70% female), followed by Chief Marketing Officer (41%) and Vice President (36%). Other key roles, like CEOs (20% female), Presidents and Managing Directors (both 18% female), remain predominantly in male executives’ hands. Regardless of women’s obvious capabilities, it seems that, unfortunately, the glass ceiling still holds back women in this industry even as it slowly erodes. If this interests you, see TBG’s Industry Update on Female Executives for more information on this subject.

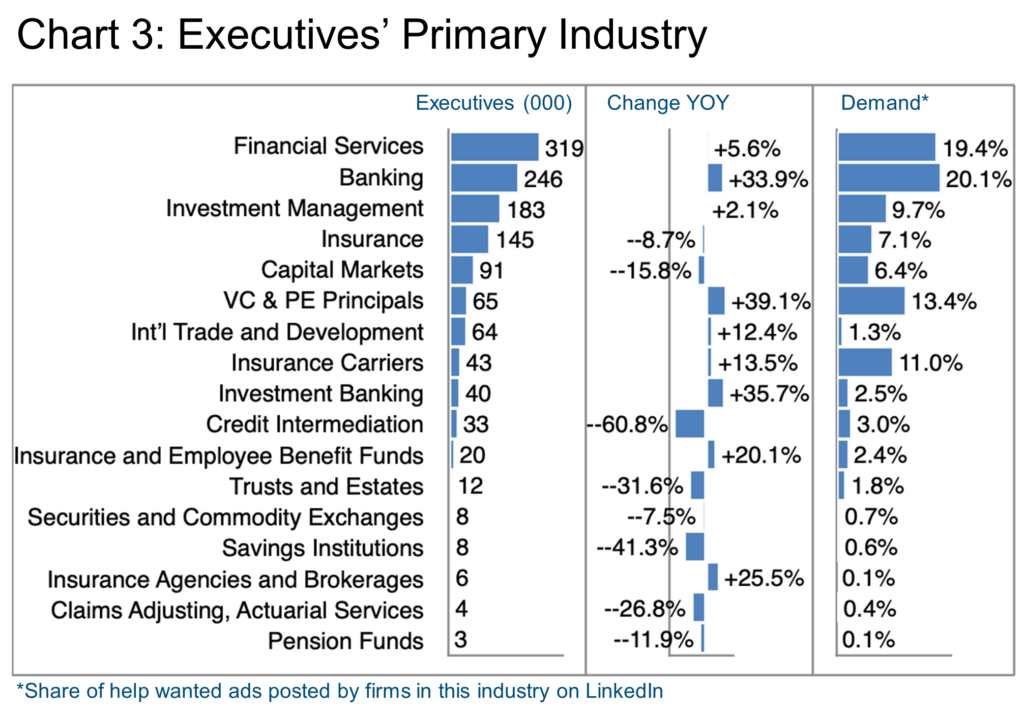

Chart 3 summarizes the major sub-sectors participating in the Financial Services industry with the continuing ambiguity that some sub-sectors remain lumped together. Nevertheless, some segments are clearly growing while others retrench.

Credit Intermediation clearly had a rough year, down some 60.8%. Bloomberg confirms: “The US Bureau of Labor Statistics reports that the number of people working in credit intermediation and related areas fell by 2.1% last year, the steepest drop since the global financial crisis.” This statistic refers to total employment, of course, not just executives. The source goes on to allude to the use of automation to eliminate some previously manual activities in this area. [See source.]

In fact, for overall employment (not just executives), “20 of the world’s largest lenders cut at least 61,905 jobs [in 2023]. It was one of the worst years for job cuts at banks since the 2007-2008 financial crisis, when banks eliminated 140,000 positions.” The same source identified the largest downsizing at UBS after the Credit Suisse acquisition (some 13,000 fewer roles), and Wells Fargo (another 12,000) in 2023. [See source.] This explains much of the negative developments in Chart 3.

Insurance and Claims Adjusting are also showing significant reductions. “In 2023, Farmers cut 2,400 jobs — 11% of its workforce. GEICO eliminated 2,000 positions and Liberty Mutual cut 850 jobs. From big brands to insuretechs like Hippo that laid off roughly 20% of its employees, the cuts are undeniable. […] CEOs cite several drivers behind their decisions, from restructuring to improving efficiency to automation to re-evaluating product offerings.” [See source.]

Are the cuts in Insurance indicative of an AI-induced bloodbath? One insurance industry source has this to say:

“AM Best said the layoffs are likely cyclical rather than structural — in other words, fluctuations driven by the business cycle rather than changes that render current employees’ skills obsolete or that replace jobs with automation. With AI dominating the headlines, there’s a temptation to conclude that artificial intelligence is replacing people, but AM Best cautions that it’s too soon to tell.” [See source.]

The source goes on to underline the currents highlighted in our introduction. To repeat, there is a lot of reassessment of risk portfolios going on and that is, of course, impacting the skills and workforce required to manage the business.

On the positive side of the ledger, the top employers of executives in the ambiguously named catch-all “Financial Services” sub-sector per Chart 3 including KPMG, CEO, and CIBC US all report strong staffing demand. They specialize in areas such as audit and tax advice, ESG investing, and private banking.

In the Banking segment, First National, Wells Fargo, and PNC illustrate the turbulence in this sub-sector. While First National and PNC were relatively stable, Wells Fargo apparently let people go in its retail banking arm but bolstered its executive ranks by 8%, particularly in specializations such as Capital Markets as well as Banking. The company hired strongly from JP Morgan, Citi, and Credit Suisse.

On the other hand, while it is not the largest in Banking, the largest employer of executives in this entire Financial Services cohort, Citi, apparently shed some 1,000 staff in 2023 and announced plans for further reductions as it revamps its business portfolio. [See source.]

Continuing down the list of business segments in Chart 3, Investment Management giants BNY Mellon (+11%), BlackRock (+8%), and Marsh (+2%) diverged, the first two expanding their current businesses by focusing on Banking and Investment Management while Marsh acquired talent from the Insurance sector.

For a deeper dive in the swirling Private Equity and Venture Capital markets, please consult our Industry Update on that segment [Industry Update: Private Equity & Venture Capital.]

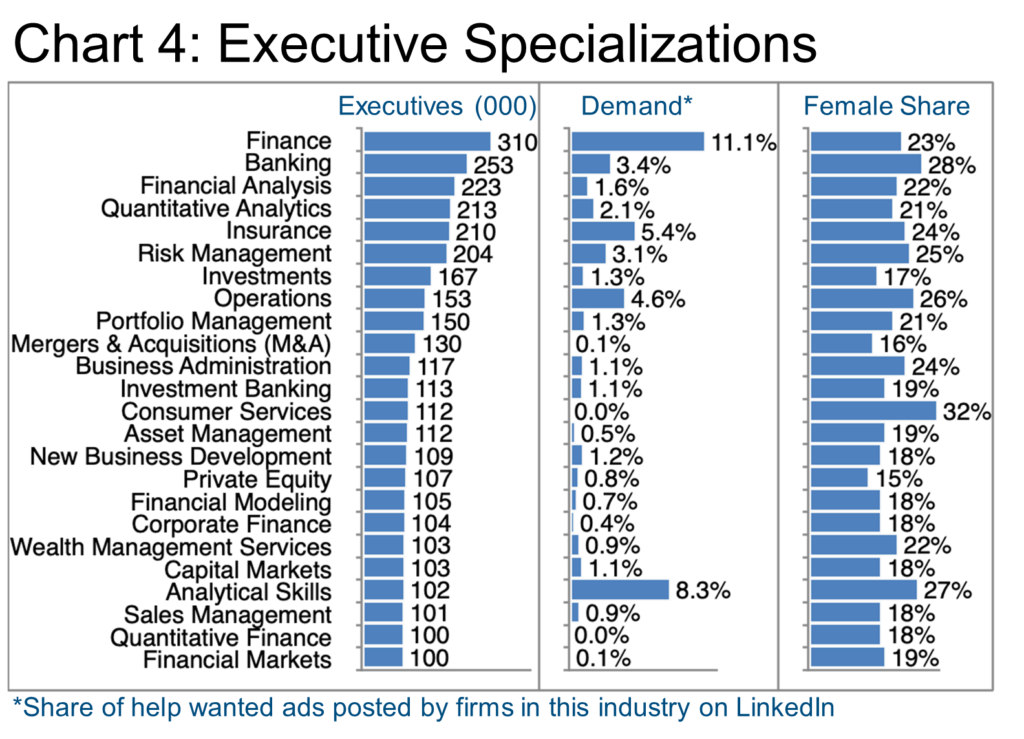

Most executives list more than one specialization on their LinkedIn profiles. So, Chart 4 naturally counts any given executive multiple times. Nevertheless, it provides a snapshot of which skills are particularly relevant and in demand in Financial Services.

TBG certainly sees a trend across most industries in that Analytical Skills are highly in demand everywhere. This means executives with a strong track record of analysis may be able to transfer fluidly from one industry vertical to another, (particularly if they are supported by a consummate career management professional organization such as The Barrett Group.)

The first step in the TBG process examines in detail who each executive really is personally and professionally. It then explores alternatives before defining the ultimate search target. TBG has made an art of helping executives identify and communicate their transferable skills and experience. See our Success Studies for myriad examples.

As noted elsewhere, help wanted ads represent only about 15% of the executive market in TBG’s experience. Meanwhile, the unpublished market seethes with opportunity (circa 75% of TBG’s client landings). Nevertheless, as an indicator of demand (Chart 4), help wanted ads can be useful. Bear in mind that demand can represent either growth in demand or scarcity of supply (or both). So, it is not necessarily the best indicator of opportunity.

Female executives are universally underrepresented in Chart 4, unfortunately. Only one line item exceeds 30%—Consumer Services.

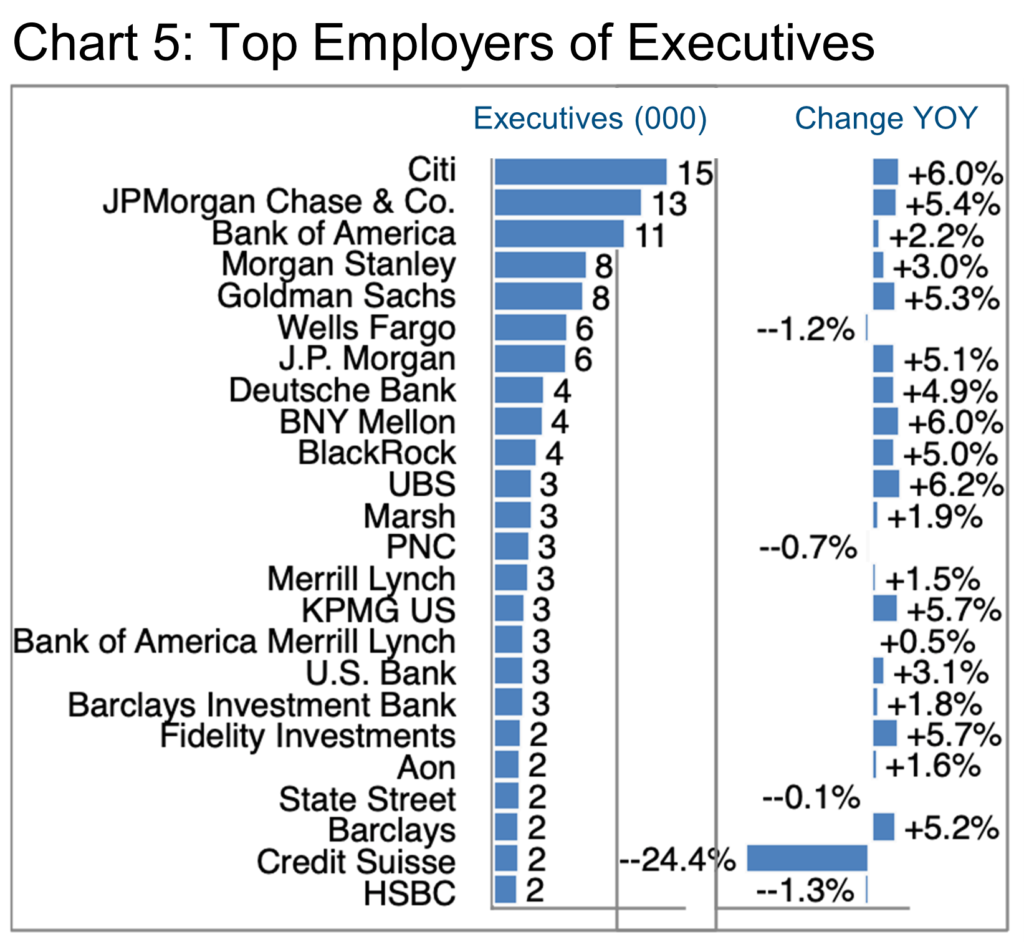

We have already mentioned many of the companies in Chart 5 previously in this Update. So, we will comment here only on those top employers not yet addressed. JP Morgan Chase & Co added significantly to its executive ranks in the past year. It absorbed 31 from First Republic during its crisis, but also hired a smattering from all top competitors. The company’s net hiring focused on Banking, Capital Markets, IT Services and IT Consulting, Investment Management, and Software Development specializations.

Apparently, in addition to the CEO’s pay cut and overall poor performance in 2023, “Bank of America still has an issue with people leaving.” [See source.] For example, Wells Fargo hired a large number of Bank of America’s executives in 2023, mainly with Banking specializations.

Morgan Stanley saw only modest changes in its executive head count losing talent to Citi and JP Morgan while gaining from Credit Suisse. Goldman Sachs on the other hand, significantly revamped its Capital Markets, Investment Management, and Banking teams shedding talent in favor of JP Morgan Chase & Co. and Citi among others.

Wells Fargo apparently focused on streamlining its executive teams in regional locations such as Chicago, Miami, and Salt Lake City while reinforcing its Banking and Capital Markets capabilities with net hiring from JP Morgan, Citi and Credit Suisse among others. Deutsche Bank mainly hired from Credit Suisse in support of its Banking and Capital Markets capabilities.

FinTech Spotlight

Those of us focused on the Tech sector are familiar with its fondness for disturbing industries and “disintermediation” (removing the middleman) as a path to value creation, often fueled by VC or PE money. Forbes provides this useful summary:

“Tech companies have been disrupting and revolutionizing every corner of the economy for decades, but financial services were long considered a stubborn holdout to this trend. But over recent years, tech startups have made serious inroads, applying software, analytics and data to build online platforms and apps with features that improve—or even replace—conventional financial services.” [See source.]

“As an industry, fintech covers a wide range of solutions that cater to diverse financial needs, including but not limited to online payments, peer-to-peer lending, digital wallets, crowdfunding, robo-advisors, blockchain and mobile banking.” [See source.]

[See source.]

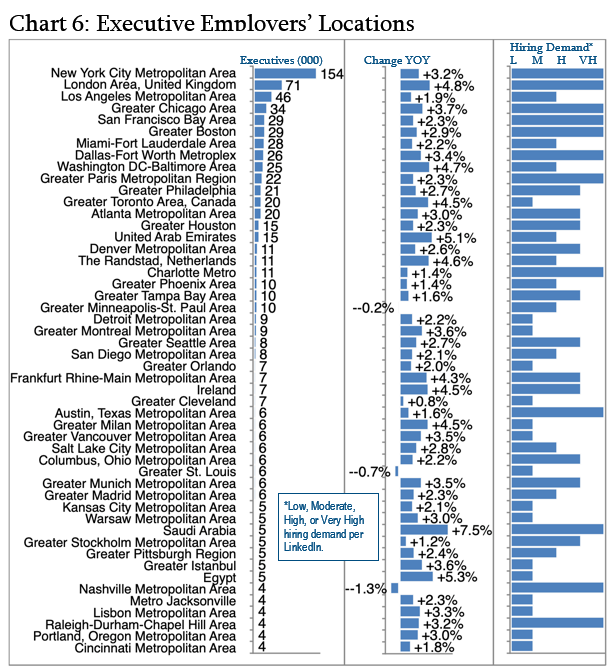

It is no secret where these regions’ financial capitals lie. Chart 6 confirms this, particularly New York, London, and Los Angeles. As readers review this data, we suggest they bear in mind that high hiring demand can represent either genuine growth in demand or scarcity of qualified talent. So, we always encourage candidates to research their targets carefully. Naturally, clients of The Barrett Group receive access to considerably more detailed research whether at the screening stage, interview preparation stage, or even during the offer negotiation stage when it may be necessary to have a more detailed understanding of the negotiator on the other side of the table.

Peter Irish, Chairman, The Barrett Group

Click here for a printable version of Financial Services 2024.

Editor’s Note:

In this Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles. They are principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn. The data represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 1 billion users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.