Do You Hear the Macroeconomic Message?

Have you ever had the feeling that someone was trying to tell you something or something was sending you a message? Simple signs sometimes appear…

- The first daffodil — a sure sign of spring.

- All green lights in traffic — things are going my way.

- Unexpected smiles — what a wonderful world.

- You, know—messages.

Well, we read different tea leaves perhaps than most people because we are focused on executive opportunity, and our leaves show a lot of promise right now. Almost 11 million executives work in the US, Canada, UK, EU, and Middle East—our principal markets—and 500,000 of them have changed jobs in the past year according to LinkedIn.

That is an enormous pool of executive opportunity!

The quality of the market has also improved, in the sense that the share of larger and more lucrative jobs has increased. Here’s a recruiter market specialist reporting on the latest trend:

While search volume continues to rise so far in 2024, the makeup of those searches is following a prolonged trend to skew more heavily to C-level hires. [That figure stands now at] 58% of all new searches opened, according to Thrive data. […] That figure was just 36% in Q1 2020. [Thrive Marketing, Weekly Saturday Trends Report, 3/16/2024.]

At the Barrett Group, we regard executive recruiters as an important component of the executive market, but they comprise only about 10% of our client landings. We open our clients’ eyes to the much larger and less competitive unpublished market where fully 75% of our clients land and where we have also seen a surge in executive landings at the higher end.

Part of the answer is the macroeconomy and its message for you…

Economically, times are good.

Of course, there is too much misery in the world, in Gaza, in the Ukraine, and in so many other places. We must all do more to alleviate that suffering.

Still, economically for the vast majority of executives, this is an excellent time to take a career step. Here are a few of the key indicators underpinning our argument.

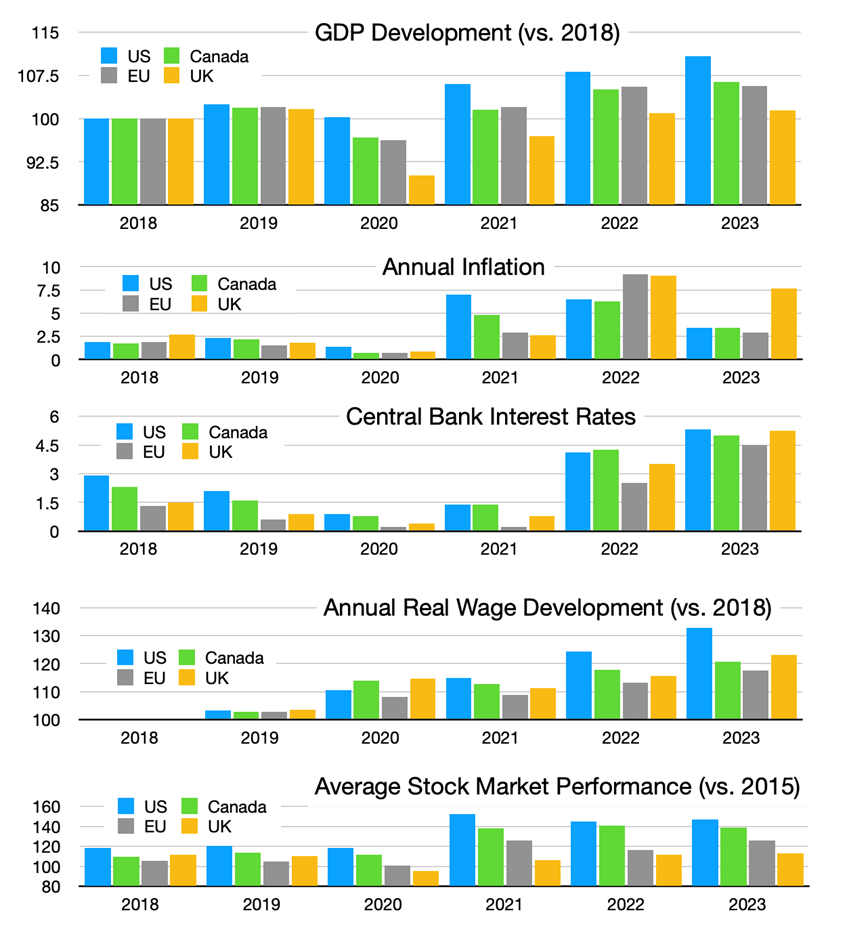

As you may recall, the smart money expected a recession in 2024. But so far, growth in Gross Domestic Product (GDP) has exceeded expectations (see the GDP chart). That means more economic activity, and that leads inexorably to executive opportunity.

One reason so many economists were down in the mouth is a spike in inflation that undermines the value of goods and services. Well, inflation is coming down in most major markets rather faster than expected. (See the Annual Inflation chart.)

Yes, interest rates continue to be a brake on many capital-intensive businesses, but they will inevitably follow inflation down again, probably as early as 2024. (See the Central Bank Interest Rates chart.)

In fact, real wages (income net of inflation) are improving for the first time in many years, meaning consumers have more purchasing power, an engine that will continue to propel economic growth. (See the Annual Real Wage Development chart.)

Stock markets tend to lead when times are good and this period is no exception. Overall, stocks are up and many indices have recently hit record highs. (See the Average Stock Market Performance chart).

[See the footnote for all of our sources.]

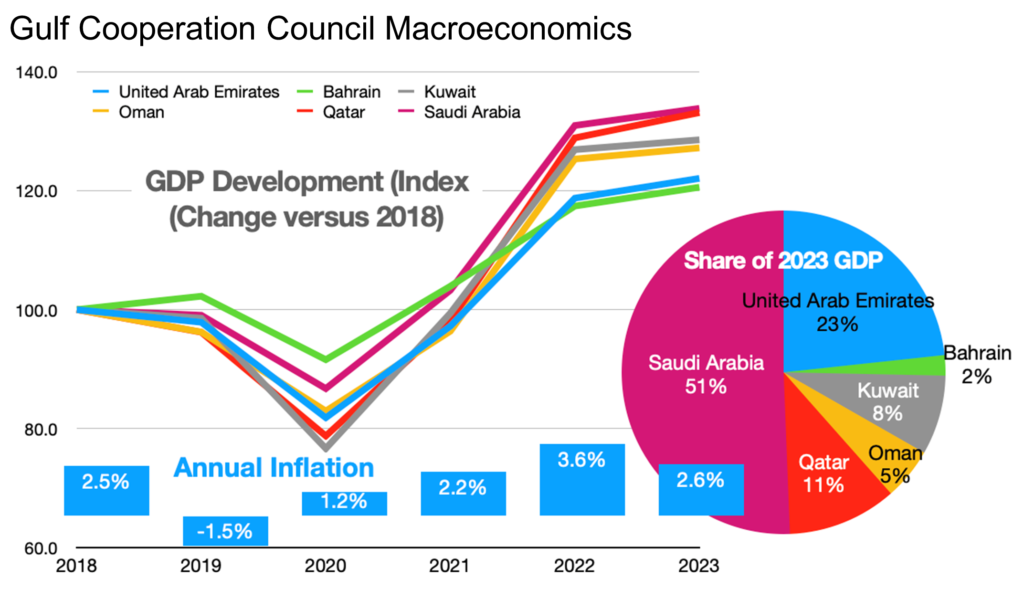

We must not neglect the Middle East, either, though a common source for the region is harder to come by. So let us here focus on the Gulf Cooperation Council as an indicator for the region. Here too, the recovery since the pandemic is obvious with GDP growth accelerating and inflation falling. The region is actively diversifying away from its dependence on fossil fuels. (See the Gulf Cooperation Council Macroeconomics chart.)

As a result, demand for a diverse pool of executive talent is strong.

Even the IMF (International Monetary Fund) had to confirm the obvious:

Global activity proved resilient in the second half of last year, as demand and supply factors supported major economies. On the demand side, stronger private and government spending sustained activity, despite tight monetary conditions. On the supply side, increased labor force participation, mended supply chains and cheaper energy and commodity prices helped, despite renewed geopolitical uncertainties. [See source.]

Certainly there are still numerous challenges, particularly in countries or businesses affected by China’s slowdown (e.g., Germany, Apple, and Tesla to name but a few). Still, there may never have been a better time for an executive to take a good look ahead and decide whether he or she is on the right path at the right company in the right industry, or whether it isn’t better to listen to what the macroeconomy is telling you and consider a change.

When you decide to make that change, we are the only career change expert with a holistic (full market) view and more than three decades of experience; one who works for you (the candidate—not the employer), and one who has garnered recognition from none other than Forbes as being one of the best in the business now for years.

The macroeconomy is calling. Will you take the hint? Let’s explore your opportunities! Give us a call.

Footnotes:

EU GDP: https://www.statista.com/statistics/1070317/eu-gdp-growth-rate/

EU Inflation: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Consumer_prices_-_inflation

US Inflation: https://www.usinflationcalculator.com/inflation/current-inflation-rates/#:~:text=The annual inflation rate for,12 at 8:30 a.m .

UK Inflation: https://www.statista.com/statistics/270384/inflation-rate-in-the-united-kingdom/

Interest Rates: https://data.oecd.org/interest/long-term-interest-rates.htm

US Interest Rates: https://www.statista.com/statistics/247941/federal-funds-rate-level-in-the-united-states/

EU Interest Rates: https://www.statista.com/statistics/621489/fluctuation-of-fixed-rate-interest-rates-ecb/

Canadian Interest Rates: https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

UK Interest Rates: https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp

Real Wage Growth: https://data.oecd.org/lprdty/labour-compensation-per-hour-worked.htm

US Real Wage Growth: https://www.stlouisfed.org/on-the-economy/2024/jan/revisiting-wage-growth-in-2023#:~:text=For example, the average annual,pandemic wage growth, albeit slightly.

EU Real Wage Growth: https://www.reuters.com/markets/europe/ecb-faces-bumpy-road-low-inflation-wages-rise-2024-01-18/

UK Real Wage Growth: https://www.hiringlab.org/uk/blog/2024/01/17/global-wage-growth-slowing/

Canadian Real Wage Growth: https://centreforfuturework.ca/2024/01/21/real-wages-are-recovering-and-thats-good-news/#:~:text=The beginning of 2024 brought,almost 5% for the year.

Stock Market Indices: https://data.oecd.org/price/share-prices.htm

Gulf Cooperation Council (GCC) GDP Growth: https://www.worldbank.org/en/news/press-release/2023/05/17/gcc-economic-growth-expected-to-slow-to-2-5-in-2023#:~:text=The GCC is expected to,for most of that year.

GCC Interest Rates: https://www.statista.com/statistics/1396107/gcc-consumer-price-inflation/