Private Money in Your Future – Part 4 (Be Part of The Bigger Picture)

Because Private Equity money is ill-understood outside the industry, we have dedicated three articles to the topic.

- Explaining the fundamentals of Private Equity (PE) (Read Dry Powder),

- Recounting who is who in the industry with particular focus on the underlying portfolio companies (where the true executive opportunities lie; Read Who’s Who), and

- Sharing how our clients have landed in PE portfolio companies of late (Read Life after Landings).

This fourth article will back off about 30,000 feet and look at the bigger picture. We will then return to earth and consider what all of this means for executives considering a career change.

From this perspective, many funds have adopted so-called ESG (environment, social, and governance) guidelines. These guide and constrain investment activity. Without joining the debate about whether these are effective or helpful, we will look at initiatives announced and underway in the hopes of remaining both realistic as well as aspirational.

Green energy and related infrastructure projects are clearly a major focus for the coming years. The US will invest more than $500 billion. The EU plans to invest €584 billion through 2030. And even India also expects to invest $500 billion. These are only three large but hardly unique examples. The same trend continues essentially worldwide. Much of this spending will attract private investments as well. And almost all of it will create executive opportunity. (See “Energy Extracts Addendum” below.)

In the US much of this $500 billion investment will provide incentives. These include battery development and production facilities, offshore wind installations, and carbon-capture technology. Also included are electric vehicle production and charging stations. These are only a few growth spots.

The European Commission proposes to spend €584 billion until 2030. Their plan is “to support the planned rapid uptake of electric vehicles, renewable energy and heat pumps, and shift away from fossil fuels.” (See source.) The expected outcomes are several. They include a 55% reduction in emissions. A 45% renewables share for energy generation. 30 million zero-emission vehicles on the roads by 2030. Also solar panels on all new homes by 2029. (See “Energy Extracts Addendum” below.)

India wants to essentially double its generation capacity with a wholly new green infrastructure. They expect to spend $500 billion in the process. India will have a heavy emphasis on hydrogen as the fuel of the future. Private industry has already announced significant plans to participate in this new energy boom as well. (See “Energy Extracts Addendum” below.)

Where will the funding for all of this money and spending come from?

Tax credits, loans, grants and other government incentives will help coax private companies to co-invest in many cases. For example, Bill Gates has opened a new clean energy fund. This fund is focused on the EU to the tune of $116 billion. (See source.) Government spending will also be plentiful. We have already highlighted recent and relevant US legislation. The European Commission website lists 12 programs to co-fund this sea change at the regional level, and individual countries are also anteing up. Witness Germany’s $180 billion commitment to accelerate energy independence—especially green energy.

Beyond Bill Gates, what does this mean for PE and their portfolio companies? In their “Christmas for Climate Tech” article in August, 2022, PitchBook collected reactions to the US legislation. Here is a sample:

- “…the package will supercharge an already strong environment for climate tech investment. US VC funding for climate tech has been on a tear in recent years, topping $16 billion in 2021, more than double the prior year…”

- “The largest slugs of money are going to accelerate adoption of mature technologies like solar energy and electric vehicles. But there are also significant incentives for technologies that are in embryonic stages of development.”

- “Two standout beneficiaries within the emerging tech set are carbon capture and low-carbon hydrogen production.” (See source.)

Beyond the obvious benefits for human health and the environment, infrastructure projects more generally have other benefits including:

- Relatively low volatility

- Stable cash flows

- Strong cash yields

- Acting as inflation hedges, and

- Low correlation to other asset classes. (See source.)

You may want to know whether all of the headline buzz about climate tech and infrastructure is actually having an effect on executive opportunity. The answer is “yes.”

LinkedIn tells us that the growth in executive employment as we define it (see Editor’s Note, below) is 27% p.a. This is more than 10 times the average demand growth for all executives in the same period for three key areas: climate tech, green energy, and hydrogen, all of which seem to be in “high demand” according to this source.

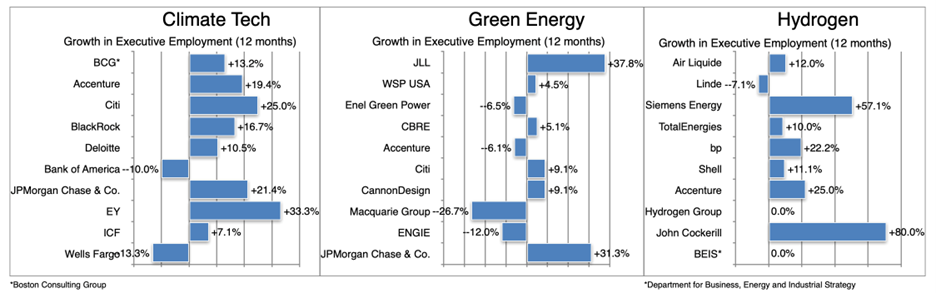

Here are the top ten executive employers in each of these segments with their respective growth rates. Bear in mind, too, that these executives are not only specialists. Expertise in product development, new business generation, business planning, manufacturing, finance, program management, sales and operations management, analytical skills, and procurement all feature high on the list of priorities.

This is just the tip of the iceberg, too, as much of the growth is occurring in the PE portfolio company area (and not only among the top ten). Read on to discover multiple examples of how smaller, PE-backed companies are changing the way humanity generates and consumes energy.

Larger PE companies continue to add climate-related investments. Take for example PE stalwart Sequoia Capital. It is expanding its cadre of more than 200 portfolio companies by leading the funding drive for an e-bike company in China. (See source.)

Another fifteen smaller climate tech companies recently raised more than $40 billion. These funds are for a wide array of strategies from recycling textiles to transparent solar technology, manufacturing in space, carbon market accountability, sustainable packaging, avoiding e-waste, and many more. Discover more about these companies including which PE and other investors provided the funding. (See source.)

What about growth? Are climate tech companies still spawning start-ups and growing despite a looming recession? Absolutely!

According to this source, “By 2023, total investment in the climate and cleantech sectors is expected to reach $6.4 trillion.” From hydrogen power for aircraft to expanding EV charging stations, e-bikes, robotic recycling, lithium battery manufacturing, electric bus fleets, and numerous other examples, these companies are alive and well and receiving further funding as they change the world. (See source.)

Even in your home, green tech is thriving. Counter-top composting, home hydroponics, reducing in-fridge spoilage, geothermal energy for the home, recycling of e-waste, and many more consumer-oriented start-ups are making a difference today. (See source.)

What does all of this money and opportunity mean for your career?

Obviously, there is a lot of funding and growth in green energy and related infrastructure. These are ideal conditions for redirecting your professional trajectory.

But how?

Many of our clients want to make a change of industry, contribute to a better future, flee stagnant sectors in search of growth, or just do something new and challenging. They often find these career changes difficult on their own because their frame of reference is usually constrained by their industrial background and work history. They generally have no idea how to make the shift without help.

That is one reason clients hire us: to better understand their own potential in a fast-changing executive market. Beyond this, our initial targeting step (the Clarity Program©) actually opens clients’ eyes. They learn their own sweet spots by taking their personalities, current circumstances, and longer-term goals into account to define a new future path. Once we jointly define where our clients want to go professionally, then we help them lay out a strategic plan to get there. This process includes re-packaging their experience and achievements, accessing executive markets they have never even heard of, preparing them for interviews, stimulating highly profitable offer negotiations, and on-boarding seamlessly to avoid pitfalls while maximizing their promotion potential.

Is there work involved? Yes. Clients need to move their feet to succeed.

After all, employers want to meet our clients, not our staff! However, each client has the support of a team of six professionals. Our research infrastructure covers more than 800 million companies and individuals worldwide (read Research to the Rescue). The Barrett Group process has worked for thousands over the decades. We can and do shorten executives’ curves because we have been helping clients change roles, industries, and/or locations now for more than 30 years. We are simply good at it. That is why Forbes cites us repeatedly as one of the best in the business of helping executives land that next role.

Want to read about clients who have landed at PE portfolio companies? (Read more.)

PE portfolio companies are changing the world, reinventing whole industries, and creating new futures every day.

Don’t you want to be a part of this wave? We can help.

Peter Irish, CEO,

The Barrett Group

Energy Extracts (Addendum)

The Economist has reported recently on three major swaths of infrastructure spending focused on decarbonization of human civilization. Here are short extracts but please look up and read the whole articles for more thorough background:

“Adieu, laissez-faire” (October 29, 2022) highlights the fact that the United States’ recent legislation created a climate budget of roughly $500 billion to invest in manufacturing batteries, and expanding offshore wind facilities, solar energy generation, and hydrogen-based technologies. Tax credits and subsidies will encourage private investment. The Department of Energy now estimates that emissions in the US will drop by 40% until 2030 vs. the level as of 2005 (10% points more than before these investments were legislated). Examples of specific investments include electric vehicle manufacturing in Ohio, wind farms in West Virginia, and robotics in Pennsylvania. “[The government] will need to hire lots of experienced managers to oversee its sprawling industrial plans…”

“Can Europe decarbonise its heavy industry?” (September 19, 2022) reminds us that making steel, cement, or chemicals conventionally requires enormous amounts of energy and typically releases large amounts of carbon. The article quotes a source as suggesting that these basic industries and their major downstream clients deliver a large share of the EU’s GDP (approximately 14%). Beyond solar and wind, hydrogen is the main focus, due to the energy impacts from Russia’s curtailment of the gas supply, and electrolysis seems to be the major extraction technology. Another source has identified 70 projects focused on “commercializing technology to reduce carbon emissions. in basic-materials industries.” The list of companies investing is a who’s who of European industry: HeidelbergCement, BASF, Electrolux, Miele, Mercedes-Benz, etc.

“Skunk No More” (October 22, 2022) lays out the case for India which has announced plans to invest $500 billion in clean energy investments over the next half-decade. India has been highly dependent on coal for energy, allegedly digging up and burning more of it than any other country except China. According to this source, India wants to more or less double its 400 gigawatts (GW) national electricity capacity by building a second, green energy infrastructure. There is a precedent: China, for example, managed to go from 44 GW of solar to 300 GW in six years. Besides curbing emissions and improving public health, India is also motivated to reduce its importation of fossil fuels, currently running at about 4% of GDP. Major industrialists in India are also climbing on board.

The founder of Adani Group has said his firm will invest $70 billion in green projects in India by 2030. Another Indian conglomerate, Reliance Industries, apparently expects to spend $80 billion on “full spectrum” green energy projects from generation to storage and transmission. Pumped hydro storage is also attracting investment as are various hydrogen-based strategies such as fuel cells and electrolyzers. By one forecast, India may be making 8 GW of electrolyzers a year by 2025—roughly half the planned output of Europe. Goldman Sachs, TotalEnergies, and many other foreign investors are piling into Indian infrastructure projects, investing into and in some cases acquiring whole divisions. They have their eyes on the eye-watering projected demand for energy by 2040—as much as Europe consumes today.

Editor’s Note

In this particular article “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Human Resources Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles. The geography used as a baseline for LinkedIn statistics includes the US, the EU, UK, and Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? (Read more). LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year and “attrition” as the departures in the last 12 months divided by the average headcount over the last year.