INDUSTRY UPDATE: Energy

Energy Introduction

Fossil Fuels in Retreat

A slowing economy has reduced demand for oil in 2022 even while the supply has tightened with OPEC+ curbing production again after an increase in Q3. Global oil inventories rose as a result while refining capacity throttled back at least in the short term, in spite of which oil prices have slipped from their recent highs. (See source.)

Russia’s invasion of Ukraine continues to foment uncertainty in the gas market. The European Union promptly set about finding alternative supply lines and has broadly succeeded in filling reserves as the winter began in earnest. However, a so-far milder winter, energy-saving measures and sourcing adjustments are also reducing demand, including a record 10% contraction in Europe. Nevertheless, numerous factors cloud the outlook for 2023 including China’s economy, possible recession in Europe and elsewhere, and the ongoing conflict in Ukraine. (See source.)

The energy stage is set for renewables to step up. But will they?

McKinsey offers an interesting prediction that coal demand already peaked in 2013, that oil demand will peak by 2025, and gas demand will peak by 2035. After these peaks, the demand will likely decline fairly rapidly, leading to a scenario whereby 50% of power generation by 2050 will be supplied by renewable sources in the form of hydrogen and electricity. (See source.)

Looking ahead, the IEA also foresees rapid change…

“The global energy crisis has triggered unprecedented momentum behind renewables, with the world set to add as much renewable power in the next 5 years as it did in the past 20.”

“Energy security concerns caused by Russia’s invasion of Ukraine have motivated countries to increasingly turn to renewables such as solar and wind to reduce reliance on imported fossil fuels, whose prices have spiked dramatically. Global renewable power capacity is now expected to grow by 2 400 gigawatts (GW) over the 2022-2027 period, an amount equal to the entire power capacity of China today, according to Renewables 2022, the latest edition of the IEA’s annual report on the sector.” (See source.)

McKinsey adds that these changes do not only affect power generation or transmission:

Today’s fast followers include major oil and gas companies, which aim to shift their business models to profit from the increased demand for renewables and the electrification of vehicles, and private-equity players and institutional investors that make renewable energy a central component of their investment strategy. Leaders in the shipping industry are investing in renewables to enable the production of hydrogen and ammonia as zero-emission fuel sources; steel manufacturers are eyeing green hydrogen to decarbonize their steel production, with renewables providing the green electricity for the process. Car manufacturing companies are also striking renewable-energy deals to help power their operations and manufacturing, as well as making investments in wind and solar projects. (See source.)

Deloitte draws our attention to five significant trends affecting renewables (See source.):

- Domestic manufacturing – Rising clean energy component manufacturing capacity could ease supply chain snags over time.

- Decarbonized fuel – New clean hydrogen economics could open avenues for renewable providers.

- Energy equity – IRA [Inflation Reduction Act] helps spur renewable providers to pursue opportunities in low-income communities.

- Cybersecurity – Renewable energy industry focuses on managing increasing cyber risk.

- Offshore wind – Offshore wind industry addresses challenges to unlock rapid growth.

PitchBook confirms that private equity has been investing in renewables and related infrastructure at record rates and shows no signs of slowing down:

“It all adds up to a fertile environment for startups in the space, as PitchBook senior analyst John MacDonagh lays out in our newly launched Clean Energy Report: VC activity has been remarkably resilient, with $11 billion raised across 401 deals in the segment. That’s on pace to match the record set in 2021.” (See source.)

In short, if ever there was a time to climb on board this particular locomotive, the time is now.

The Executive Market

From the introduction readers will have understood that this is a market at a crossroads. While the demand for fossil fuels will continue, it will also decline. We will attempt in this Update to facilitate transparency in both of these markets—the large but sluggish energy executive market and the narrower but faster-growing renewables market.

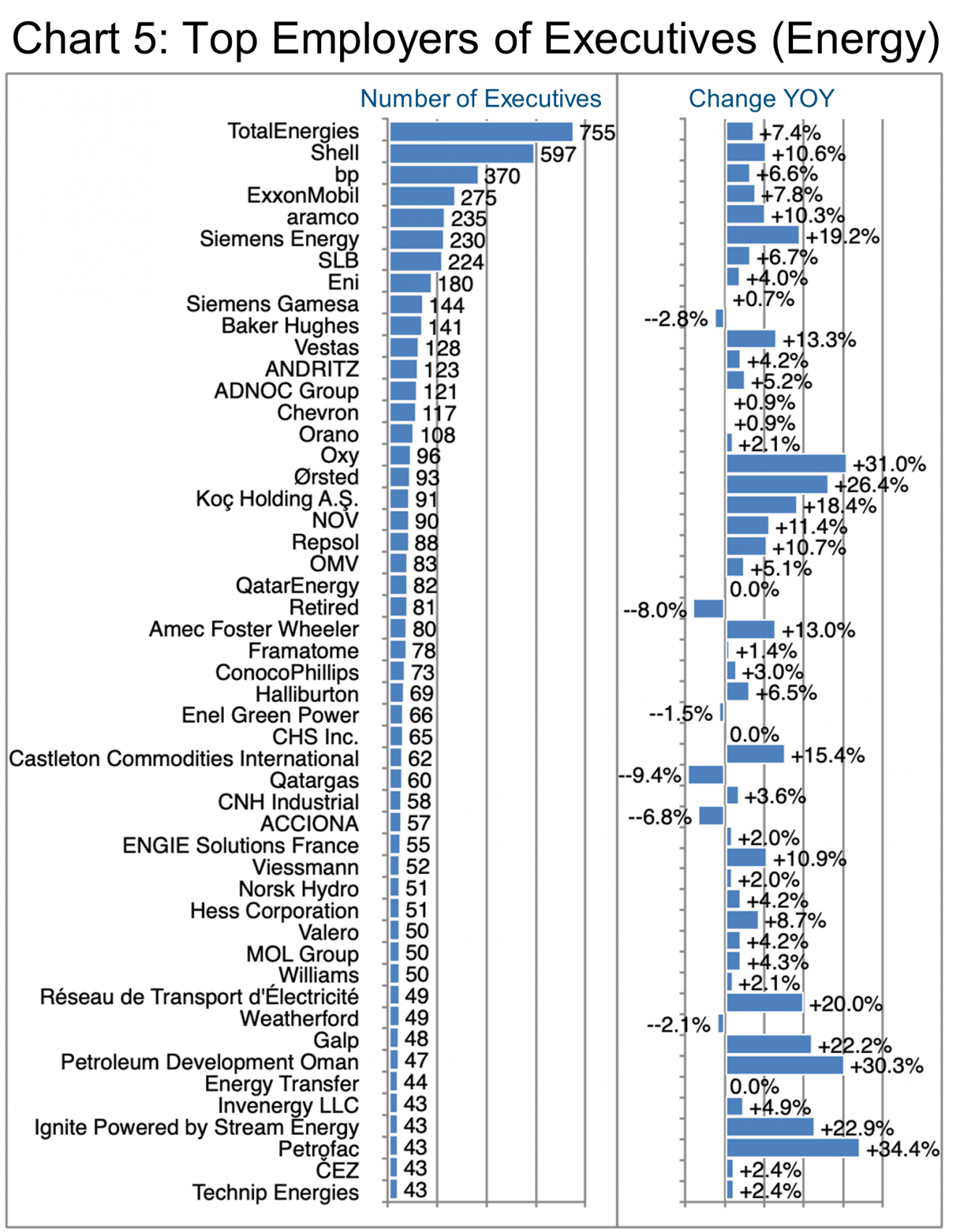

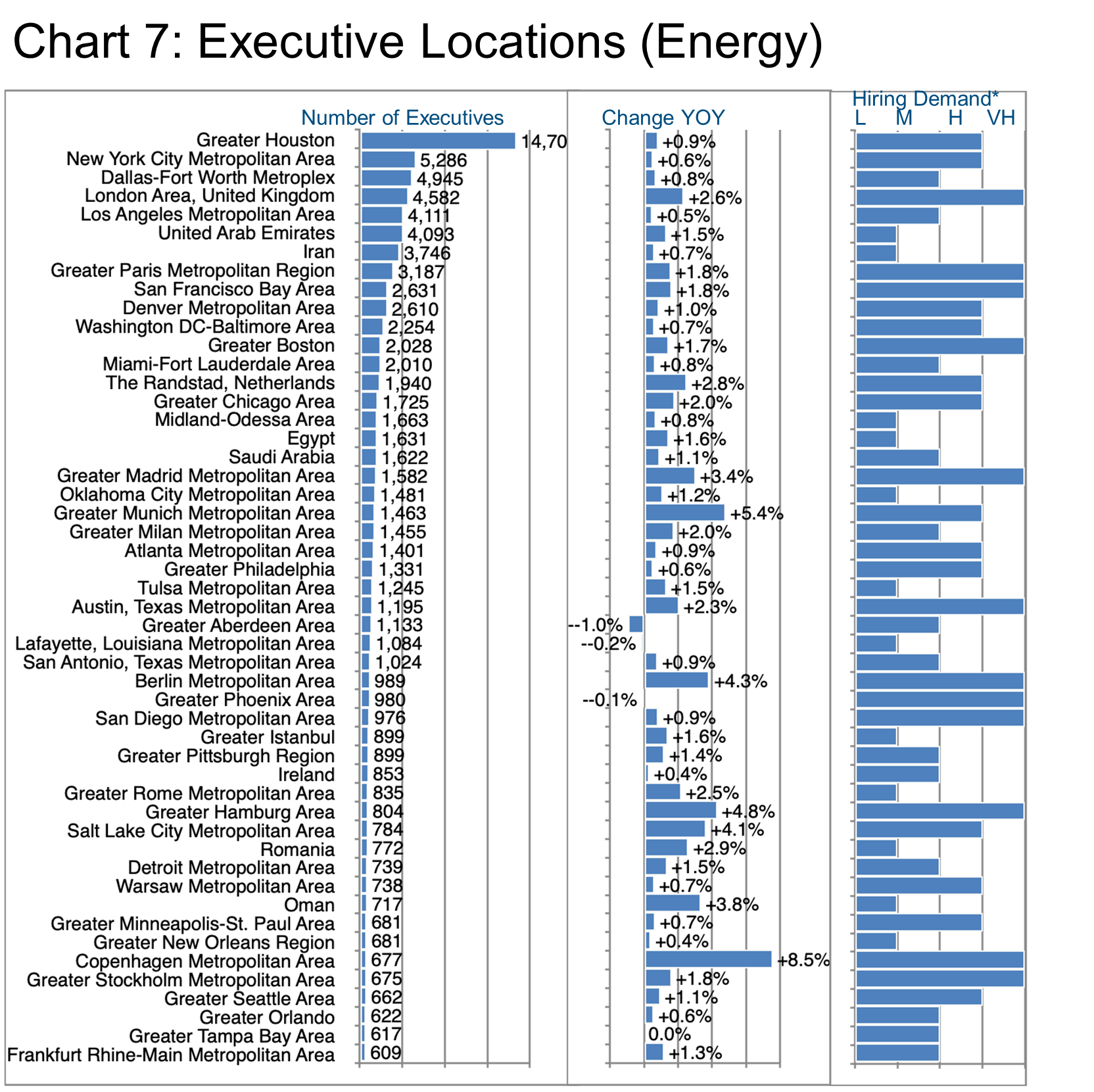

The “Oil & Energy” market (as LinkedIn calls it) contains about 105,000 executives as we define them (see Editor’s Note). It has grown by just 0.5% in the past year with some 3,300 also changing jobs, it remains predominantly male (86%) and is dominated by major multiples such as TotalEnergies (755), Shell (597), BP (370), ExxonMobil (275), and Aramco (235)—all of whose executive ranks have grown between 7-11% in the past year. Houston, Dallas, the UAE, Iran, and New York are the top five locations for this cohort—home to 27% of industry execs.

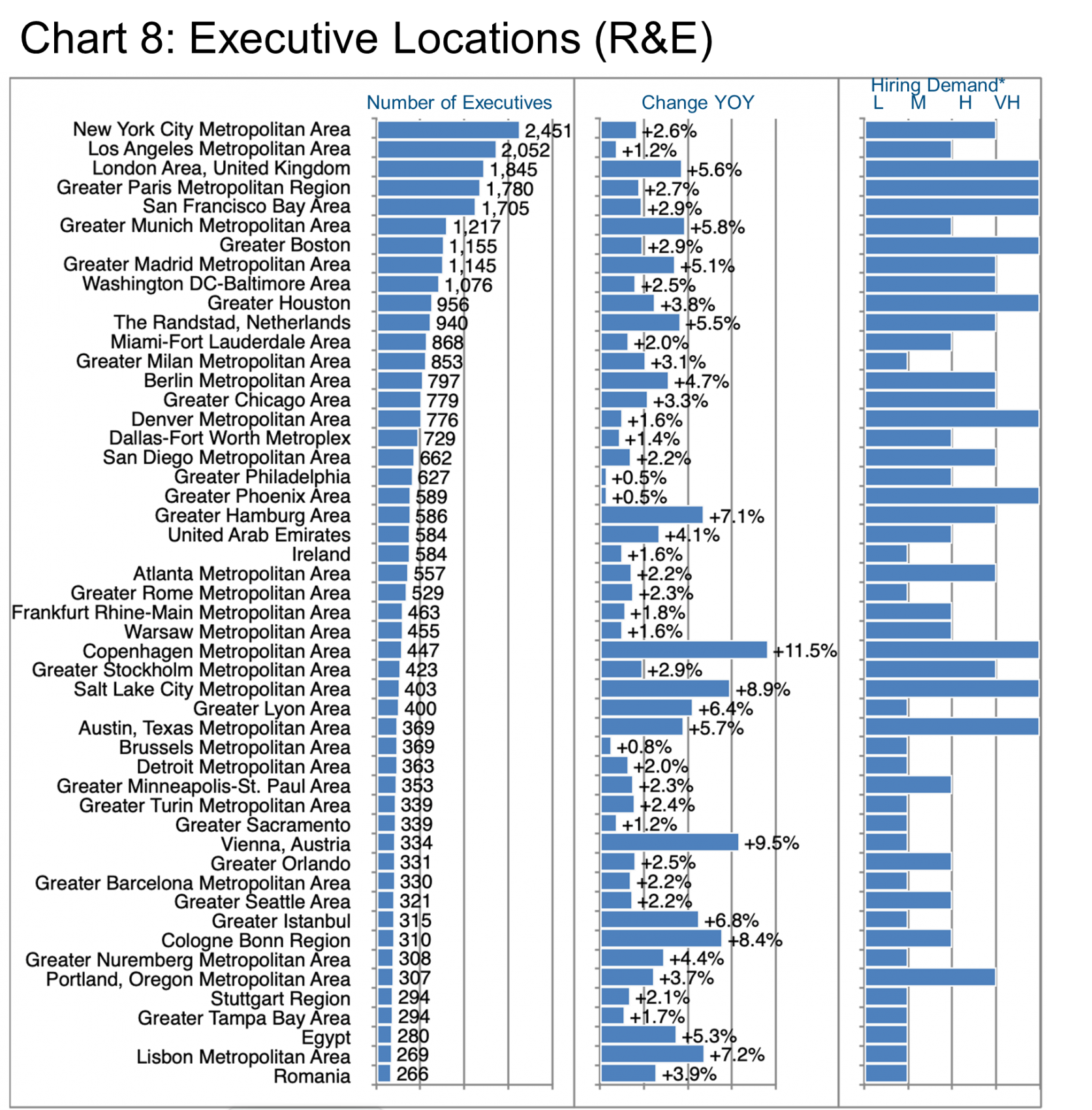

The “Renewables & Environment” (as LinkedIn styles it) executive market encompasses almost 77,000 executives, up 3% in the past year, 3,600 of which changed jobs in the last 12 months—a 7.6% churn, meaning there were in total almost 6,000 executive opportunities in this segment in the past 12 months—50% more than in the Oil & Energy market. This group is still 86% male but its geography is completely different: New York, Los Angeles, London, Paris, and San Francisco are the top five locations, totaling just 10% of the total population.

Together, this total market comprises some 181,000 executives, a group that grew by 2% YOY, and of whom 6,911 changed jobs—about 10,000 executive opportunities in the past year all told. For convenience, let us agree to call the Energy & Oil market “O&E”, the Renewables & Environment cohort “R&E”, and the combined market, the “Energy” market as it must surely be seen going forward.

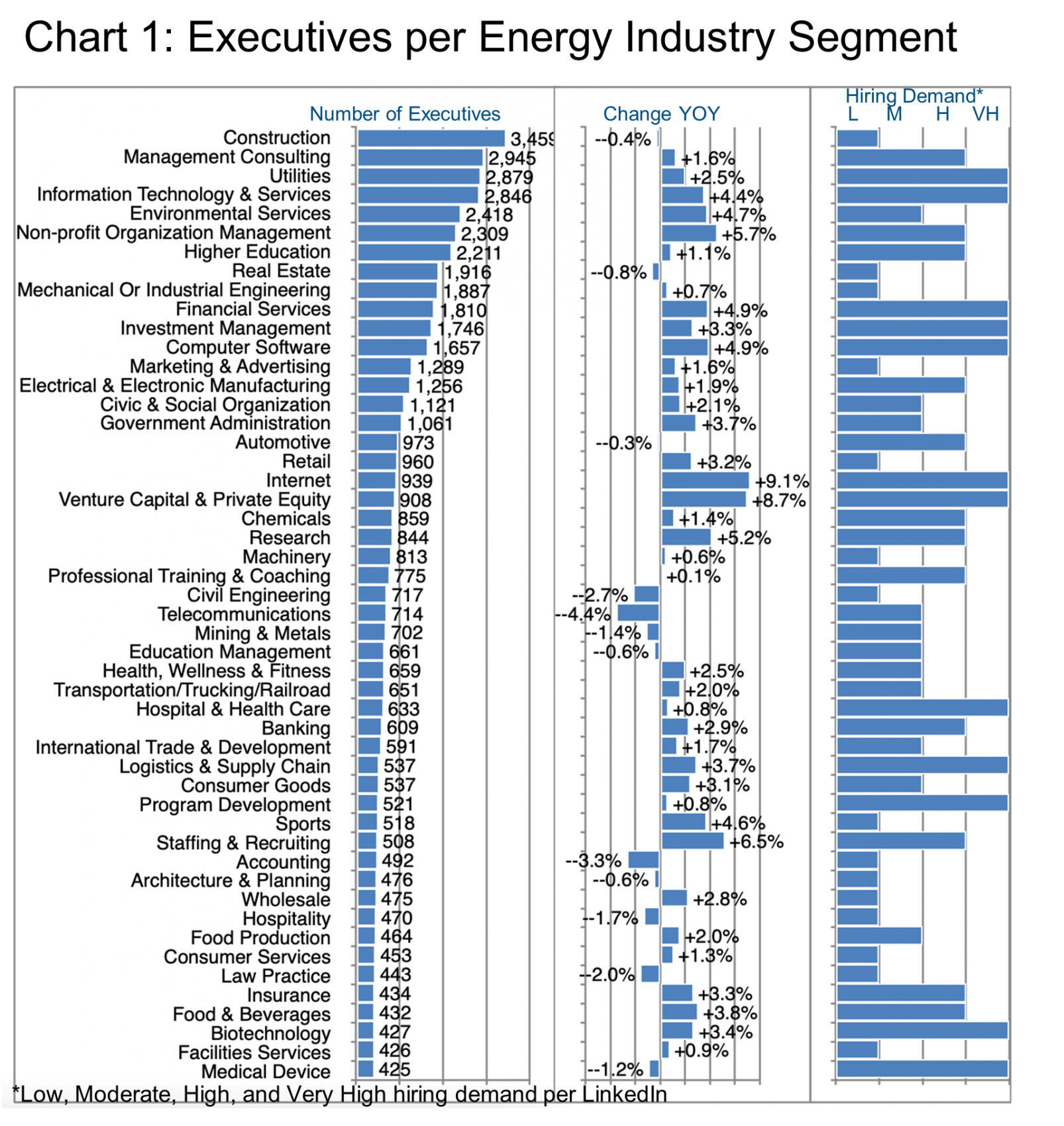

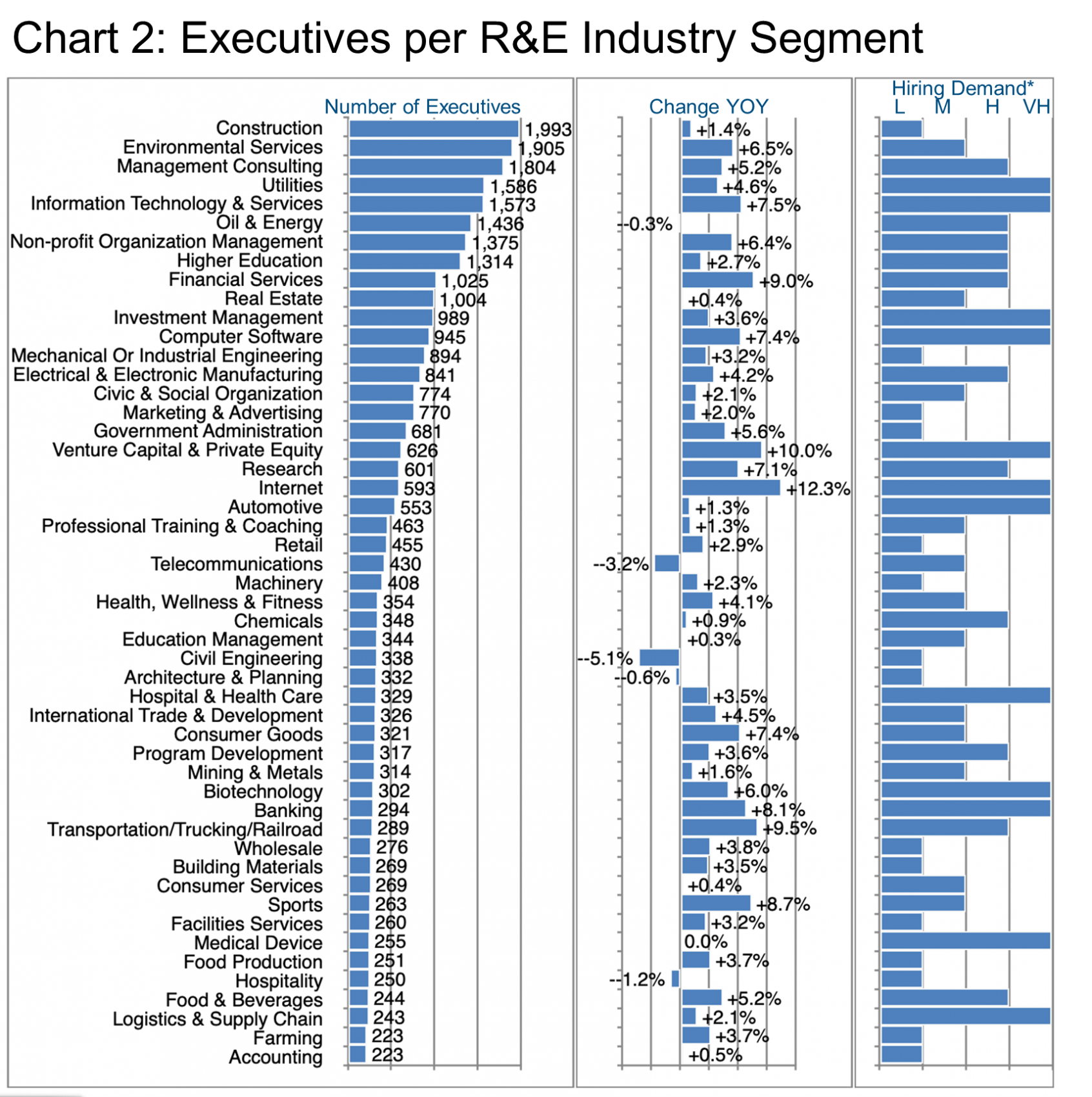

Charts 1 and 2 compare the Energy executive market to the R&E market by industrial subsegment. While Construction comes out on top in both cases, it is shrinking in the first case and growing slightly in the second. This seems to often be the case where the R&E market shows higher growth than the Energy market in general for all the reasons we explained in the introduction, though there are exceptions such as Civil Engineering that is shrinking faster in the R&E market.

While Management Consulting ranks highly on both charts, one can imagine that the emphasis in the O&E market is more on restructuring while the focus in the R&E market will be on growth and scaling.

Many Barrett Group clients come to us because they feel that their industry or niche has limited growth potential and they desire assistance in making a change, whether of role, industry, location or all three (not to mention income and quality of life). Charts 1 and 2 offer a microcosm, a petri dish for considering such changes. For example, suppose you were in the IT industry and you had a choice of joining a company in the O&E market where the segment grew by +1% or a company in the R&E area where the segment expanded by +7.5%. The same logic applies almost across the board in each segment. Consider a segment in the middle of the ranking such as Consumer Goods: +7.4% (R&E) or -3% (O&E).

Of course there are many other factors to take into consideration. For example, look at Financial Services where the hiring demand seems lower in the R&E market. It may be more difficult to attract top talent to a declining industry or the locations for such positions may be less attractive and therefore the demand may well remain high even if there is little growth. Indeed, the underlying O&E growth in Financial Services executives was -1% in the past year even as the demand for such talent remains very high.

While these few examples may seem merely tantalizing, rest assured that Barrett Group clients have access to a broad array of research data via their six-member client teams—including industry, geography, company, competitors, and even individual interviewer profiles, for example in advance of a job interview.

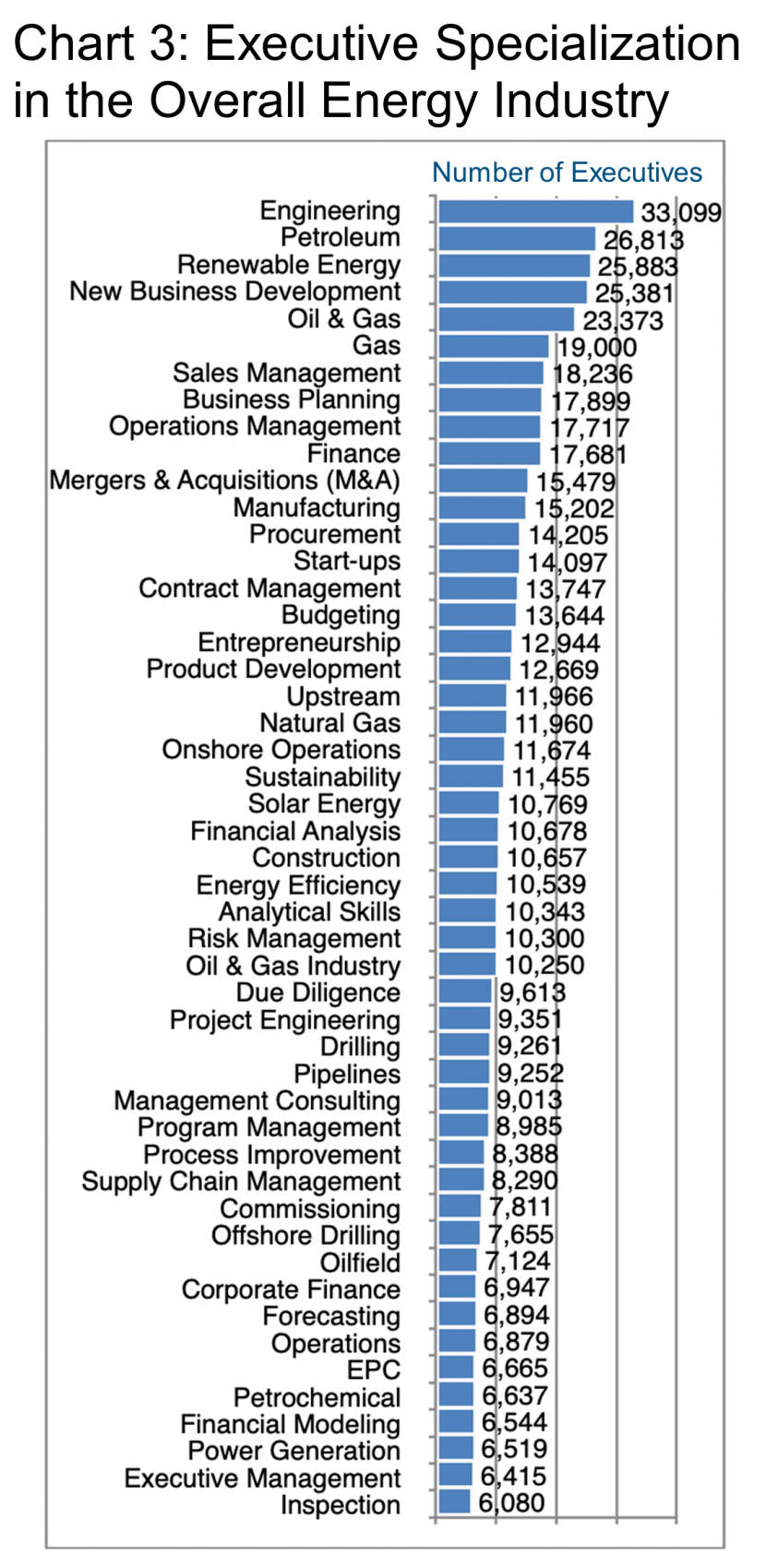

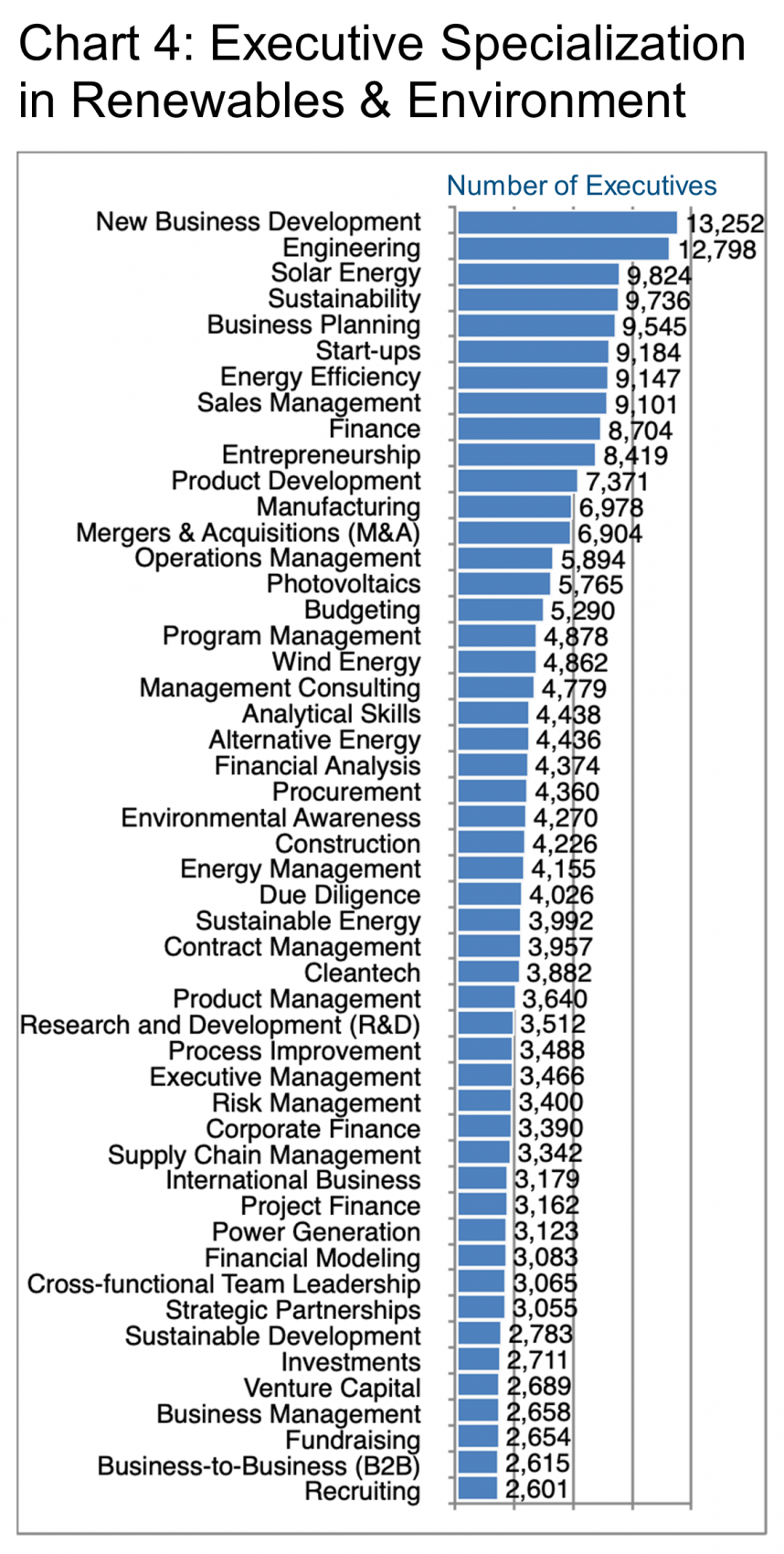

Charts 3 and 4 compare the relative populations of executives highlighting specializations on their LinkedIn profiles in the overall Energy industry (Chart 3) and the Renewables & Environment (R&E) segment thereof (Chart 4). Bear in mind that one executive will probably flag more than one specialization on his/her profile, however, the differences are fairly obvious as Petroleum, Gas, or Oil & Gas come out high in the overall Energy industry ranking but are not relevant in the R&E segment.

Engineering and New Business Development make the top five in both cases, but there the divergence becomes even more pronounced with Solar Energy and Sustainability in the top five in R&E but only ranking in the 20s overall.

Still, via this overview of specializations, it seems there are clear transferability options from within overall Energy sector or even from outside Energy into R&E—the fast-growing segment.

One would, of course, expect the major oil companies to come out on top in the overall Energy market, and they do (Chart 5), and as we mentioned earlier, they are all showing much higher growth in executive headcount than the industry as a whole, leading us to believe that smaller companies must have actually contracted.

TotalEnergies, for example, acquired the commercial and industrial business of Sun Power Corp. in February 2022, adding 133 staff in the process. Otherwise, Total Energies brought in talent from most of its direct competitors as well as a smattering of consultants from EY, Deloitte, and Accenture.

Shell sold off its interest in a refinery to PEMEX (Mexico) in January 2022, shedding 95 staff in the process, moved employees to Raizen as part of a deal involving ethanol production in Brazil, and also added significantly from direct Energy rivals as well as Accenture, IBM, Deloitte, and Capgemini among others.

BP has hired from major competitors, too, but also brought in resources from Amazon, EY, and Baker Hughes. The company also apparently shifted staff to its JV partner in Angola, Azule Energy during the past year.

ExxonMobil hired significantly from its major competitors (mainly Shell, Total, and Chevron) in addition to XTO Energy, as well as consulting firms including Accenture (Argentina), EY, Deloitte, and a small number from Amazon.

Aramco brought in staff mainly from King Fahd University, SABIC, and Maaden in the region, as well as Wood (Scotland), Saipem (Italy), and Amazon.

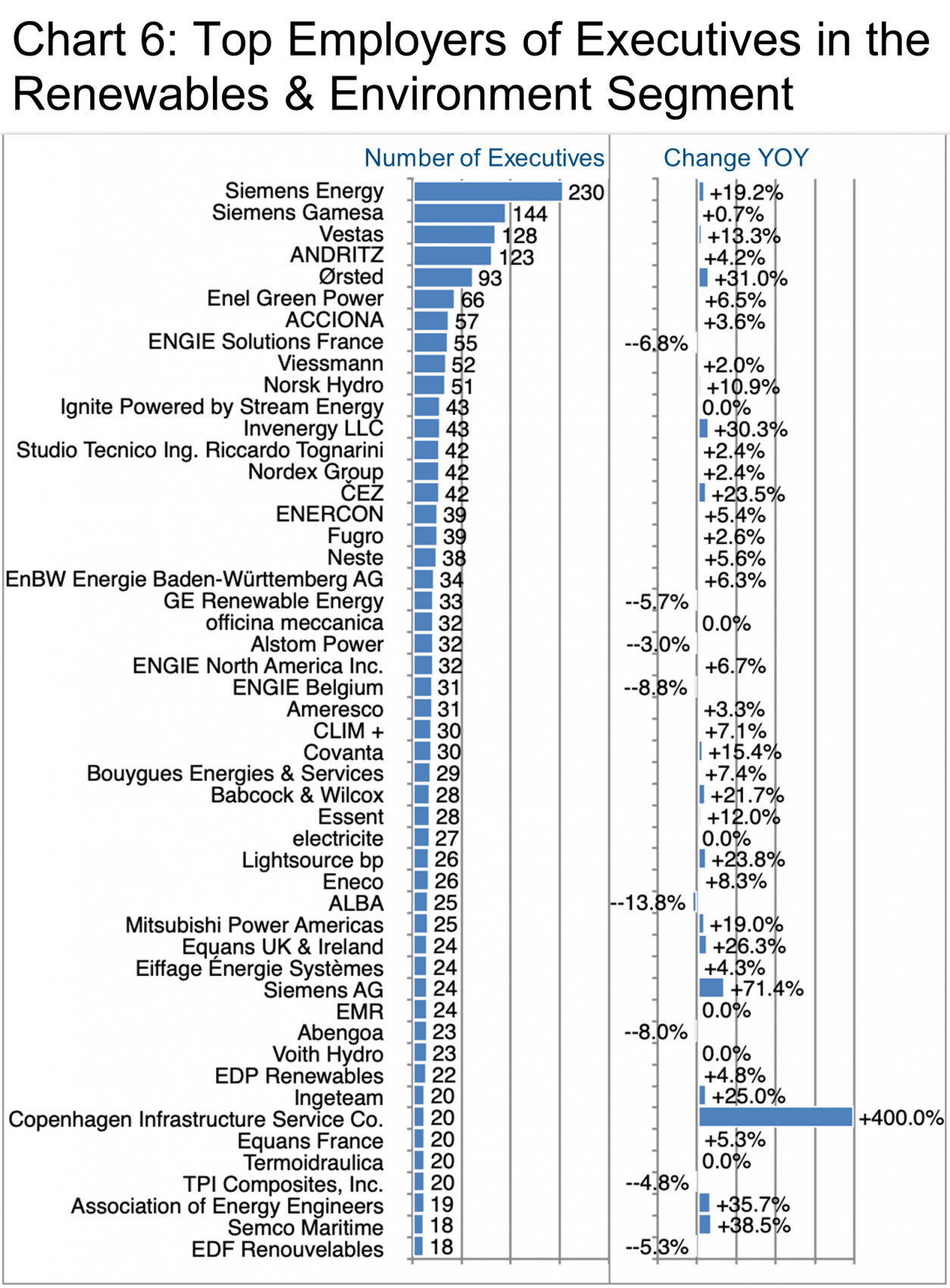

It is interesting that Siemens Energy actually shows up on both Charts 5 and 6 in the top ranking—the only firm to achieve that. “Siemens Energy AG is an energy company formed by the spin-off of the former Gas and Power division of Siemens Group and includes a 67% share of Siemens Gamesa.” (See source.) Headquartered in Munich, the firm has acquired talent mainly from its mother company, Siemens, as well as Hitachi Energy, Siemens Gamesa, ABB, GE Power, Honeywell, and Tata Consultancy Services.

So let us shift over to the top players on Chart 6, Vestas who has this to say about their services: “Vestas now service more than 55,000 wind turbines and more than 10,000 dedicated service technicians across 74 countries work committedly to maintain and support the biggest wind turbine fleet in the world.”

Vestas has hired mainly from Siemens Gamesea, GE Renewable Energy, Nordex Group, Orsted, Accenture, REVTECH, and Global Wind Service. The company’s staff is distributed quite broadly across Denmark, Colorado, Oregon, Spain, Portugal, Italy, India, the Philippines and has additional outposts in China, Brazil, and other locations.

Headquartered in Austria, Andritz manufactures equipment for a number of industries, some of them, such as hydroelectricity, highly relevant to renewable energy. Andritz has hired from its own competitors such as Valmet (Finland), Bühler Group (Switzerland), and Voith Hydro (Germany), as well as GE Power and GE Renewables, Klabin (Brazil), and FL Smith (Denmark).

Based in Denmark, Orsted, also participates in the wind and solar power generation segment with operations in Denmark, the UK, Poland, Kuala Lumpur, the US, Germany, Ireland and other countries including China. In 2022 the company acquired staff from Siemens Gamesa, Vestas, Vattenfall, Ramboll, and TotalEnergies among others.

Forbes highlights the prospects and the challenges for renewables as follows:

“Over the past decade, global renewable energy consumption has grown exponentially, at an average annual rate of 12.6%. Renewables were the only category of energy that grew globally at double digits over the year and the past decade.”

“But here is the challenge the world faces. Against the backdrop of the 5.1 exajoule global increase in renewable energy consumption, global energy demand increased by 31.3 exajoules in 2021 — over six times as much. Based on the current trends it would take over a decade before renewable growth can match global energy demand growth.” (See source.)

In other words, the prognosis for continued rapid growth in the renewables segment is highly favorable.

The geographic distribution of executives in the O&E versus R&E segments varies quite distinctly. While all too often New York houses more executives than any other location, in the O&E market, and therefore in the overall Energy market, Houston has the largest population (Chart 7), albeit with low growth but still high hiring demand. New York comes in second, followed by Dallas, but only London in the top five shows significant growth and very high hiring demand. In Houston, ExxonMobil, OXY, and ConocoPhillips are the largest employers of executives in the sector. The Barrett Group’s research teams help clients identify targeted employers in all major markets, including specific executives who are involved in interview processes.

Certainly the energy sector will see some significant changes going forward that will affect hiring location and in particular the skill sets companies seek, so it behooves candidates to have conducted up-to-date research before entering into any specific discussions with prospective employers.

Regionally, we should expect significant development and divergence in the coming years, particularly as the R&E market takes off.

The Economist, for example, reports on the development of Europe’s North Sea as an energy resource saying, “The North Sea’s strong winds and relative shallowness together make it a huge basin of potential energy. Thanks to taller and more powerful wind turbines, more efficient undersea cables and other technological advances, it is now increasingly being tapped. A group of nine countries near this body of water has plans to install 260gw of offshore wind power by 2050—nearly five times that produced worldwide today, and enough to power all of the European Union’s nearly 200m households.” (See source: The Economist, January 5, 2023, Why the gusty North Sea could give Europe an industrial edge.)

In fact, as we reported in our focus on Private Equity (see links at end of blog), “Green energy and related infrastructure projects are clearly a major focus for the coming years. The US will invest more than $500 billion. The EU plans to invest €584 billion through 2030. And even India also expects to invest $500 billion. These are only three large but hardly unique examples. The same trend continues essentially worldwide. Much of this spending will attract private investments as well. And almost all of it will create executive opportunity.” (See source.)

Even the Middle East is investing heavily in a greener future, as the Economist reports: “Overall, Saudi Arabia aims to build 54GW of renewable capacity by 2032. Not to be outdone, the UAE is eyeing 100GW of renewable energy by 2030, at home and abroad, up from a cumulative investment in 15GW-worth in 2021.” (See source: The Economist, December 24, 2022, When brown meets green.)

As we have mentioned elsewhere, Private Equity is also piling in on the country-level investment trends, supporting electric vehicle, battery, wind, solar, and particularly hydrogen start-ups and early-stage companies as they race to bring their technology to market and scale rapidly.

Indeed, perhaps now is a good time to reconsider your industry of choice.

Peter Irish, CEO, The Barrett Group

Click here for a printable version of Industry Update – Energy 2023

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Human Resources Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 800 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 19th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year. “Attrition” is defined as the departures in the last 12 months divided by the average headcount over the last year.

Private Equity Links

Private Equity is transforming business as we know it— a trend that the Barrett Group explores in a four-part series:

|

Dry Powder introduces the subject, helping readers to understand how pervasive Private Equity has become, as well as the vast sums of cumulative funds raised for future investment—all of which generate executive opportunity. |

|

Who’s Who and What’s What provides an overview of what is going on in this mysterious but fascinating, not to mention, fast-growing business segment. For example, 300 firms raised more than $1.85 billion in the past year—each. Discover who they are and their industrial focuses. |

|

Life After Landing follows up on dozens of Barrett Group clients who have joined Private Equity portfolio companies in a wide range of executive positions, proving that making the transition to new roles and industries is more than just a pipe dream. |

|

Be Part of the Bigger Picture encourages executives to look beyond their own executive trajectories and consider how they may leverage the transferability of their skills and experience to benefit from major business trends—especially green energy. |