Industry Update: Information Technology

Introduction

Before we look at this industry in detail let us first rise to the 30,000-foot altitude and look at the landscape for a moment. Many sources offer such perspectives but one interesting source took the abstraction to an unusual level. They focused mainly on emotional motivation. Paraphrasing this source:

- Turmoil and insecurity are the new norm. But most people will adapt and find ways to cope.

- In an unstable world, many people will seek security by joining communities linked by affinities and offering economic and/or emotional benefits. These communities may be either physical or virtual.

- Where we work will continue to evolve and so far a stampede back to the office seems unlikely.

- In fact, working virtually may well slowly evolve into living virtually in some form of metaverse at least part of the time. Artificial intelligence (AI) may accelerate this process.

- This quasi-virtual life will be further facilitated by the expansion of digital wallets. This will be not only as payment devices but also as repositories of identity, serving the purpose today fulfilled by a passport or driver’s license. [See source.]

This need to insulate from insecurity, find community, create safe, comfortable, interesting spaces, and fortify them with cyber defenses seems likely to pervade the coming years for both consumers and businesses.

Underpinning these developments is the steady march of technology driving economics. [See source.] Labor remains in short supply. In turn, the demand for digitization, automation, and robotics (including drones) will continue to expand. This means that certain skills and whole industries will eventually be replaced by machines and algorithms. However, technology typically also breeds new opportunities for which employees will need to be re-skilled. Digitization means that the value of data increases constantly as it can be tapped more efficiently. This will improve decision-making so that data analysis as a skill set already experiences hot demand across virtually all industries.

Should 3D printing become more cost-effective and versatile, whole manufacturing processes will no longer be needed. Capital can be deployed in other ways and supply chains will be ruthlessly upended. Digital wallets will similarly affect the structure of the banking and payments industries as new intermediary roles will be created while others evaporate.

“Generative AI alone could increase global GDP by 7% in the next decade…” proclaims one source [See source.]. The same source continues, “As with any other paradigm shift, new opportunities and challenges abound. Though AI and other technologies are expected to create millions of new jobs, even more are at risk of being displaced—and roughly a quarter of companies are turning to AI to address labor shortages. Cybersecurity risks will only deepen with the deployment of generative AI, which could be harnessed by bad actors. New regulatory requirements are expected to pick up worldwide, too.”

AI today already creates new jobs for “taggers” (people who help AI systems learn). But it also has the potential to eliminate many customer service jobs. In customer service, there is a tireless interface between a business and its clients, for example. It will also affect those such as managing coding, writing, accounting, and countless other tasks. The “creative” potential of AI is hotly disputed at the moment. Actors and artists protest what they see as the shameless exploitation and repurposing of their work.

Nevertheless, many creative tasks have already been relegated to AI and many more will follow.

So what are the short-term trends that we should be looking for in Information Technology?

Precipitated by the collapse of Silicon Valley Bank last year, funding has dried up considerably in the PE/VC space. Therefore shorter-term profitability and access to capital have suddenly come heavily into focus. [See source.] The CFO role is most likely strengthened by this trend even in technology businesses as is the emphasis on data analysis and cost control.

The digitization of business is progressing. “According to Gartner, 91% of businesses are engaged in some form of digital initiative, and 87% of senior business leaders say digitalization is a priority. [See source.]

Cloud computing has also apparently already gained critical mass: “…94% of enterprises use cloud services. 67% of enterprise infrastructure is now cloud-based. 92% of businesses have a multi-cloud strategy in place or in the works.” [See source.]

Cybersecurity deserves new attention, too. AI disrupts old arrangements and IT rediscovers the importance of having a human-centric security architecture in place. According to a senior analyst at Gartner, “CISOs must review past cybersecurity incidents to identify major sources of cybersecurity-induced friction and determine where they can ease the burden for employees through more human-centric controls…” [See source.]

We mentioned the implications of digital wallets above. Gen Z is having a profound effect (as did Covid-19 and remote working) on the adoption of digital payments. “As digital natives immersed in the latest technologies, there’s also an expectation that every business they [Gen Z] buy from or work for takes a similar digital-first approach. This is an expectation that has carried over to payments, where digital wallets and instant transactions have become the norm.” [See source.]

Also in the payments and digital currency sphere, while crypto currencies had a rough ride in 2022 BitCoin and Ethereum are both well up in 2023, and even governments now seem to be preparing digital currencies of their own. In fact, allegedly, “…130 countries representing 98% of the global economy are now exploring digital versions of their currencies, with almost half in advanced development, pilot or launch stages.” [See source.]

Managing the HR function has also moved significantly into the digital age in recent years. “A human resources information system [HRIS] primarily functions as a central database for many of the administrative responsibilities of HR. That includes absence management, benefits administration, and compensation management.” According to a recent “Human Resource Executive survey of 500 human resources (HR) professionals, respondents think that the most important workforce/HR technology they use is their HRIS (44%). That places it above even core HR technology, such as payroll, time, and attendance (42%).” [See source.]

We could continue this list. But these highlighted trends in Information Technology probably suffice to get us started. Let us now turn our attention to the executives who bring these subjects to life.

The Market for Executives

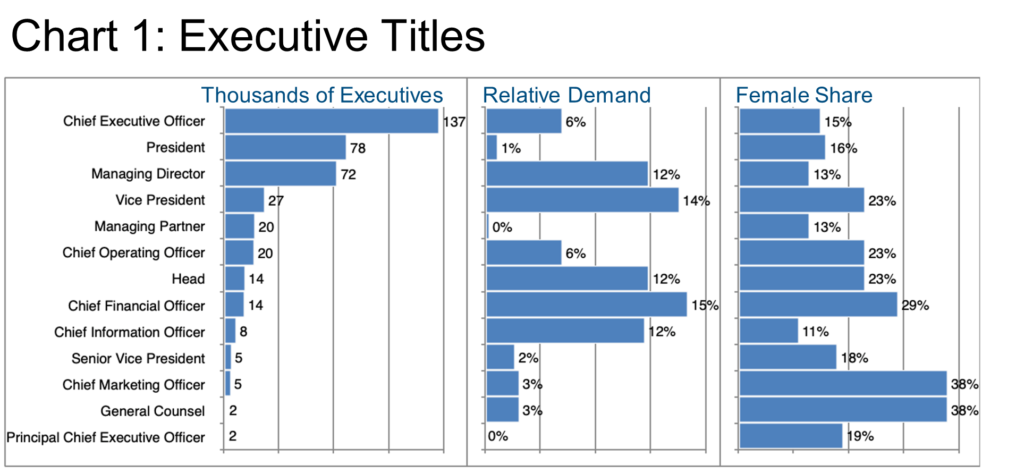

Approximately 400,000 executives participate in this industry in our core geography according to our source (see Editor’s Note). 22,000 or so changed jobs in the past year. Overall, the female executive share was just 17% with pockets of higher integration (See Chart 1). Approximately 198,000 of these positions are in the US and Canada. 175,000 in the EU and UK. 27,000 in the Middle East. The latter two markets are growing faster (+2% versus 1% in the US) but also fewer females at 15% and 13% versus 19% in the US and Canada.

Per Chart 1, the industry remains relatively unconcentrated (i.e., there are a lot of CEOs), indicating that there are numerous, smaller organizations in this list. LinkedIn says that overall the hiring demand for Information Technology talent is “very high.” The relative demand chart refers to the percentage of want ad listings per specific job title as a share of total want ads in the industry (on LinkedIn). Bear in mind that most of the executive positions are never advertised. This data still provides a glimpse of the relatively strong demand for the CFO, CIO, VP, and MD titles as well as certain functional Head positions.

The gender share data bears out a pattern that we see in many industries, though not all, that female executives seem to populate certain positions more frequently. In this case, the CMO and GC roles as well as the CFO roles represent the highest shares of female executives.

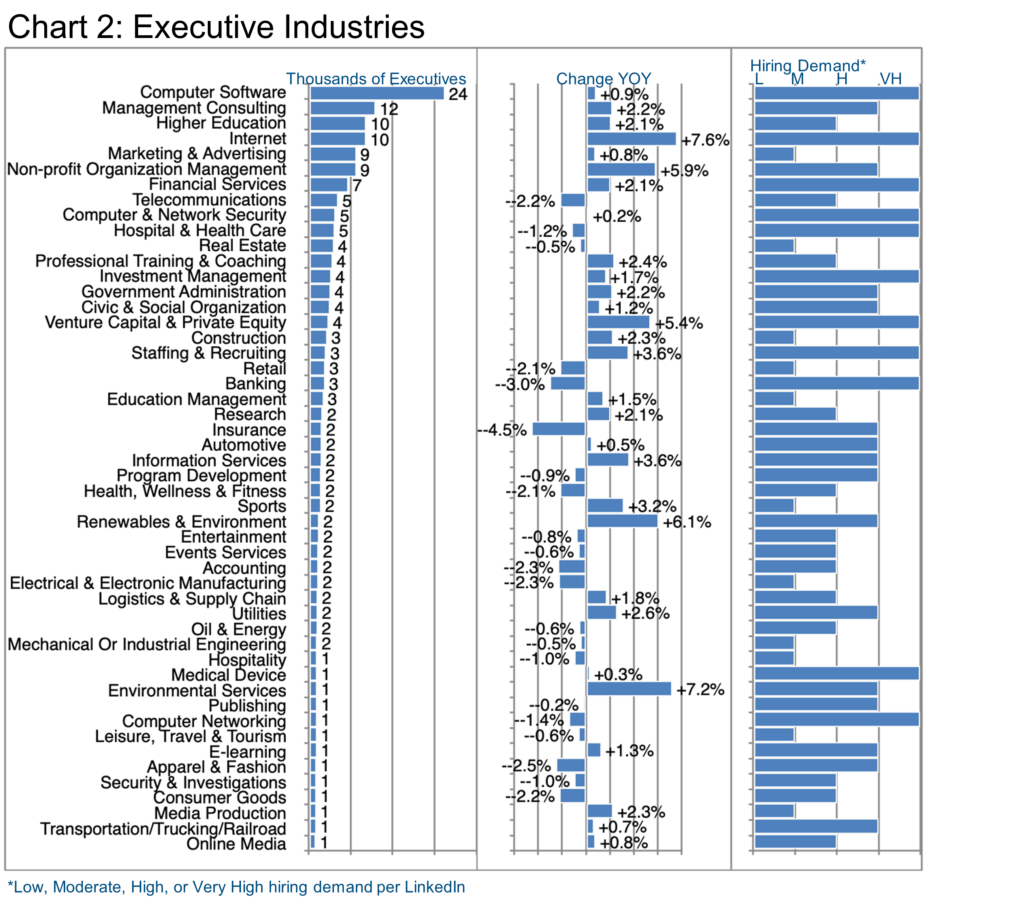

Chart 2 dives into the specifics by industry as to IT executives’ focus, and where the historical growth has been over the last year. It also shares where the current hiring demand is trending per LinkedIn.

Growth rates that stand out are several. They include Internet, Environmental Services, Renewables & Environment, Non-profit Organization Management, and Venture Capital & Private Equity. Numerous industries also show high hiring demand in the above chart. Some have demand because of growth and others possibly due to a lack of supply. Take Computer Networking, for example. The specific segment shows negative growth (-1.4%) and yet very high hiring demand. This probably indicates that fewer IT executives are interested in entering this focus area for various reasons.

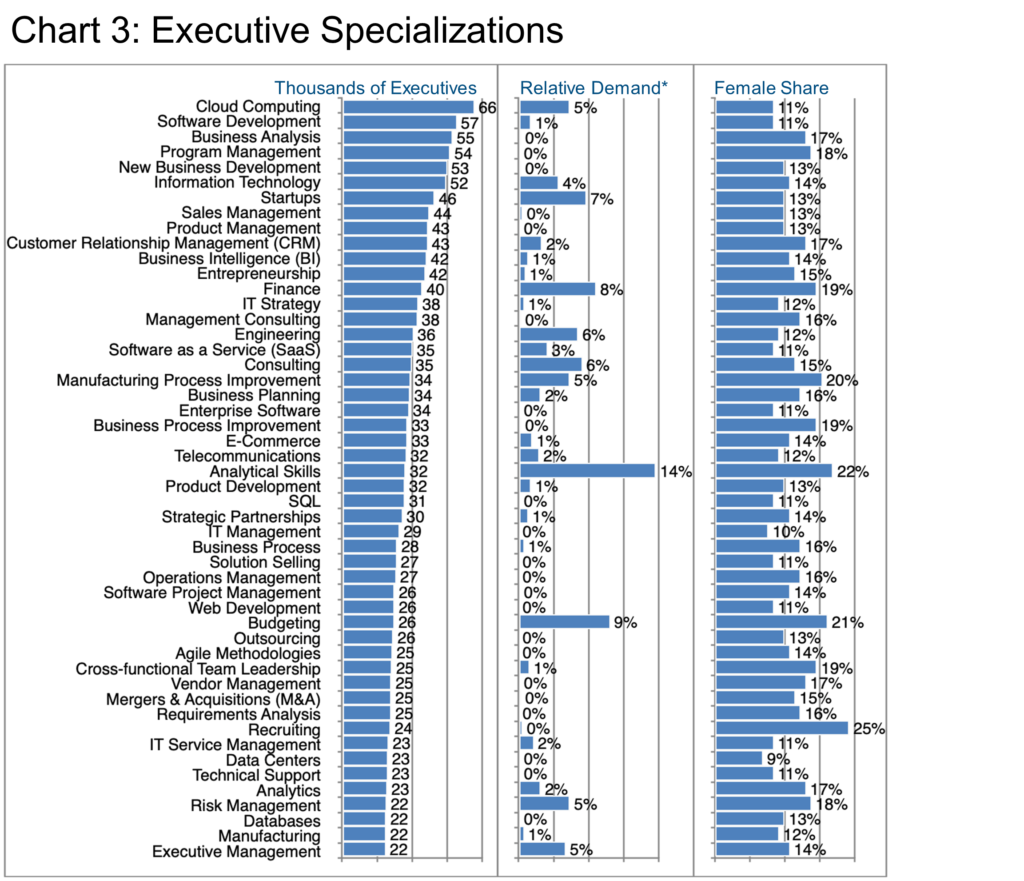

Chart 3 explores the skills or specializations of executives in this industry, their relative frequency, apparent demand, and the female share. Highly consistent with the trends cited in the Introduction, Cloud Computing has reached a fairly significant penetration. It is still attracting significant relative demand as are Analytical Skills, Budgeting, Finance, and Startups.

Overall, the female executive share in this industry is rather low. There are a few peaks in Recruiting, Analytical Skills, Budgeting, Manufacturing Process Improvement, Finance, Business Process Improvement, and Cross-functional Team Leadership. The Barrett Group believes that this in no way represents the best use of female executives’ skills. Rather this shows prevailing gender biases in staffing that, while in part cultural, are nevertheless slowly receding.

Where is artificial intelligence (AI) on this list, you might ask? It is apparently not yet sufficiently mainstream to make the top 50 specializations. LinkedIn reports about 12 thousand executives in the Information Technology industry who list AI as a specialization, up 2% over the past year, of which about 6% changed jobs in the past year. They work for IBM, GenPact, Tata Consultancy Services, Kyndryl, Tech Mahindra, Accenture, Virtusa, Samsung, and Dell (among others), principally in New York, London, San Francisco, Washington DC, the UAE, Paris, Los Angeles, Toronto, The Randstad, and Boston (to name only the top ten locations).

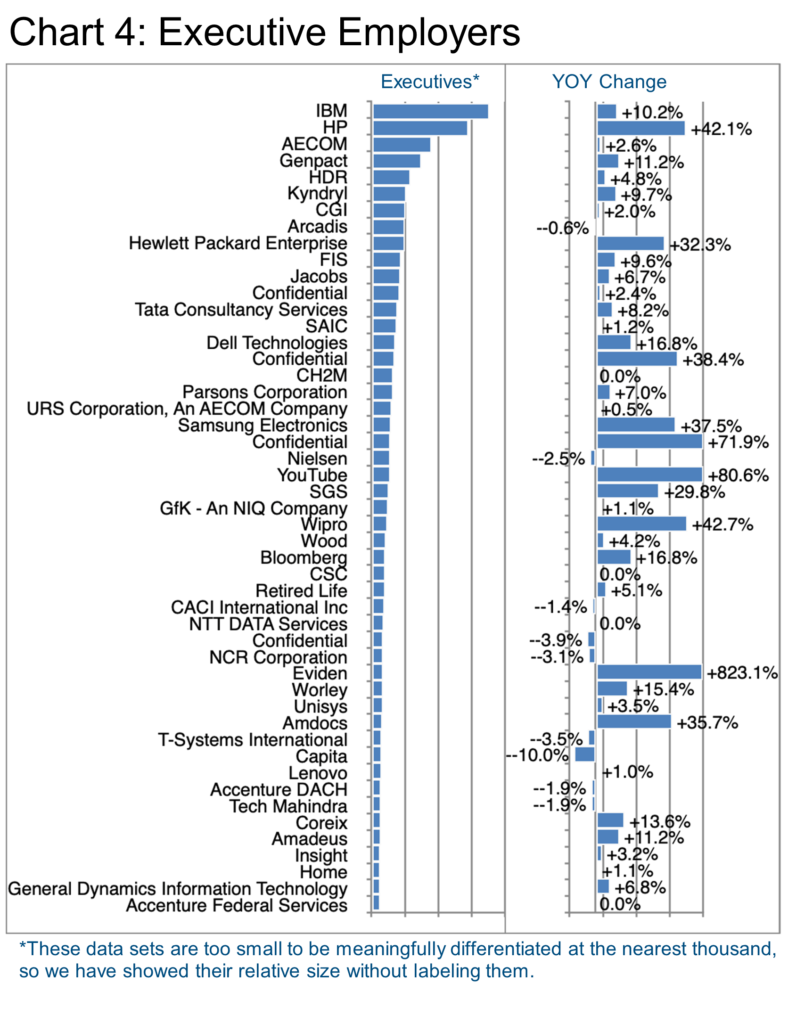

Chart 4 examines the top 50 companies employing the most executives in this industry. IBM has long been a behemoth in this segment and seems now to be adding staff (not only execs) generally from Tata Consultancy Services (perhaps under their long-standing partnership currently focused on driving Cloud computing adoption), Accenture, Capgemini, Infosys, Cognizant, HCL Tech, and Wipro among others.

HP’s massive growth comes from the acquisition of Poly in 2022, a specialist in workplace collaboration solutions. Farther down the list, Eviden’s 823% growth comes more from a carve-out by Atos, creating a “services-oriented spinoff focused on digital transformation, big data, and cybersecurity.” [See source.]

YouTube (a subsidiary of Alphabet) is driving more organic (+80.6%) growth and now claims more than 122 million viewers in 100 countries and 80 languages [See source.] They have hired executives from a long list of competitors in the space during the last year.

Wipro has only a relatively small foothold in our target geography with most of their staff based in India, however, their operations in New York, London Saudi Arabia, and other relevant locations justify their inclusion. They describe themselves as “a leading technology services and consulting company focused on building innovative solutions that address clients’ most complex digital transformation needs.” [See source.]

Samsung Electronic’s 37.5% growth is also nothing to sneeze at. They have acquired staff net of departures from LG Electronics, Huawei, Ericsson, Microsoft, and many other familiar names over the past year.

A less well-known player has also grown significantly: Amdocs based in Missouri, USA says this about its business purpose: [we are here to] “accelerate our customers’ migration to the cloud, differentiate in the 5G era, digitalize and automate their operations, and provide end users with the next-generation communication and media experiences…” [See source.]

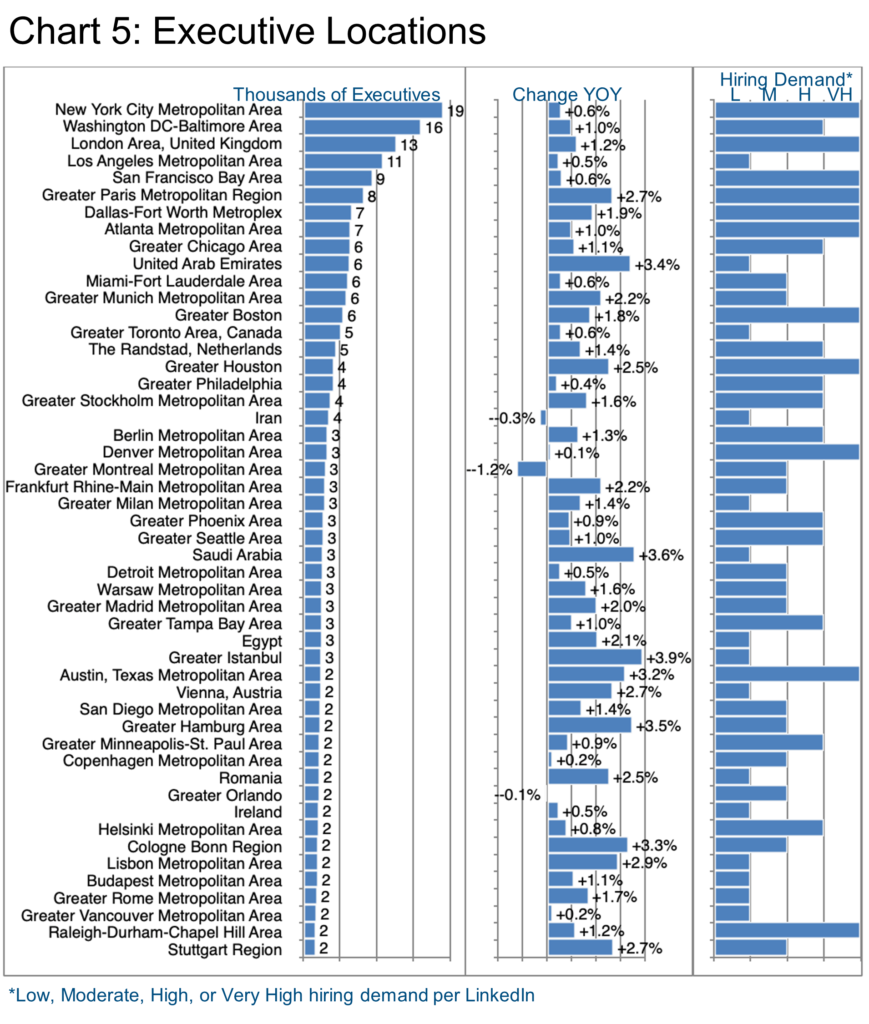

Chart 5 reflects on the locations of Information Technology executives’ employers. As usual, it is important to look at the historical growth, but perhaps even more important to keep the hiring demand in mind as an indicator of near-term activity.

In this context, many locations show high demand in the US with higher or lower historical growth including New York, Washington DC, San Francisco, etc. Europe and the Middle East, with the exception of London and Paris, reveal more moderate growth and demand statistics.

However, Information Technology & Services tops the Barrett Group’s landed clients industry ranking again this year as of September 2023, so it seems that there is plenty of opportunity for enterprising executives with the right (including highly transferable) skills in this industry—almost regardless of location.

Peter Irish, CEO,

The Barrett Group

Click here for a printable version of Industry Update: Information Technology-Sept 2023

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn. It represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.