INDUSTRY UPDATE: Human Resources

Introduction

What’s up with human resources (HR)? Forbes suggests the function was hit hard by downsizing in 2023 but that the future is bright. In the UK a recent study saw a surge of interest in HR careers. The US Bureau of Labor Statistics predicts stable 6% per annum growth in the number of positions through 2032. LinkedIn says the number of HR executives increased by 17% in the past year.

What’s going on?

The Barrett Group (TBG) believes that there has been an increase in the underlying HR executive population as a response to the post-pandemic economic resurgence. This trend may have been interrupted slightly in 2023 as some positions were trimmed—adjusting the post-pandemic overcorrection. But the future need for HR executives is clear.

According to a recent survey cited by Forbes: “Over the next year, 61% of companies expect to increase investment in this function. The investment outlook for 2024 shows that more than half of the budget increase will be allocated toward AI-powered recruiting tools, followed by DEI initiatives, candidate relationship management, applicant tracking systems, career sites, sourcing technologies, job boards, and offers.”

Indeed, multiple sources agree [example source] that some of the opportunities and challenges ahead will require agile, open-minded HR executives to help companies navigate complicated and interactive issues in the workplace including:

- Balancing remote vs. hybrid vs. office-based employment

- Supporting employees’ work-life-health balance

- Integrating AI-supported processes

- Continuing to advance diversity, equity, and inclusion (DEI) oriented policies

- Driving climate change adaptation

- Creating effective re-skilling programs

Wait a minute. Some people seem to think that DEI is dead. Is it?

While the term DEI may have become a political football in some cultures, the subject remains front and center for most larger companies. Fortune’s CEO concludes as follows: “Of course, the answer to past racism is not reverse racism. The answer to past gender-based discrimination, for example, is not to promote women simply because they are women. But that was never the point of DEI to begin with. It was quite simply to do what its acronym says: to promote diversity, equity, and inclusion. We still support that. DEI may be dead. But its supporters should resuscitate it. Long live DEI.” [Peter Varnham, Executive Editor, Fortune.]

More nebulous but possibly more far-reaching is the question of how to motivate employees given varying generational trends. Gen X, Gen Z, and millennials all behave differently than baby boomers, requiring different incentives and working conditions. Ongoing digitization and redesign of business processes mean roles are continuously changing so that key performance indicators must also adapt or become obsolete—all the more so as AI takes over more and more of the drudgery. Increasingly businesses are becoming untethered to a specific location, so employee policies and practices must reflect this new reality. In a recent report, Deloitte provides some intriguing insights into how human capital can be rendered more sustainable against the background of these challenges, including countering AI’s threatening dehumanization.

Still, effectively juggling different cultures, values, geographies, time zones, process evolution stages, digitization steps, etc. all sounds a bit daunting for the mere mortals working in HR.

Accenture sees AI as an upside and game-changer in the HR space: “Gen[erative] AI offers a trio of opportunities: it can accelerate economic value and drive business growth while also fostering more creative and meaningful work for people[.]” The same source goes on to quote research that indicates most organizations feel ill-equipped to really grasp the opportunity AI presents, but those that do seem to be actively involving the affected employees along the way, creating a creative co-dependency between the employees and how AI is implemented. According to Accenture, this fosters trust, a rare but invaluable commodity in the organizational change space.

Will AI eliminate HR jobs?

Most sources seem to agree that the focus, at least initially will be on reducing repetitive tasks so that HR professionals can focus on more value-adding activities. Nevertheless, the “AI market is growing at a rate of approximately 40 percent each year and is expected to be worth $1 trillion in the US alone by 2028, according to Statista. […] HR is certainly not immune to AI’s workplace growth. According to Gartner, 76 percent of HR leaders believe that if their company does not start using AI solutions in the next 12 to 24 months, it will not be as successful as companies that do. Overall, HR professionals feel hopeful about AI, and many are already using it to complete everyday tasks and maximize productivity, Gartner reported.” [See source.]

As usual then, the answer is that executives in this space must remain agile and vigilant to stay on top of their games. Let’s see how they are succeeding.

The Market for Executives

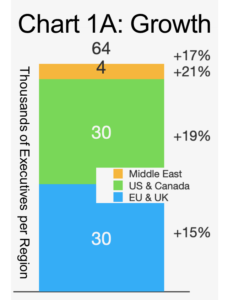

As TBG defines executives (see Editor’s Note), this market numbers about 64,000 individuals, having grown an astonishing 17% over the last year. With job-changers, that means the total executive opportunity in the space was about 12,000 positions in the last 12 months. This market is much more balanced gender-wise than most (43% female) with an average tenure of slightly more than 3 years.

Chart 1A; Growth

Geographically, the population is similar in the US and Canada vis à vis the EU and UK at about 30,000 executives though the former grew faster and has a higher female share (47%). The Middle East grew the fastest but from a modest base of just 4,000 with a lower share of female execs. Nevertheless, LinkedIn reports hiring demand for the whole cohort is high.

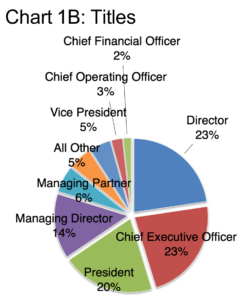

Chart 1B reveals the share of executives by major title category, where, as usual, there are many Directors, but also surprisingly many CEOs, Presidents, and Managing Directors. Remember, these are the titles that are principally associated with the Human Resources responsibility. This suggests to TBG that the structure of the sample includes numerous smaller companies as larger firms are more likely to have more Vice Presidents.

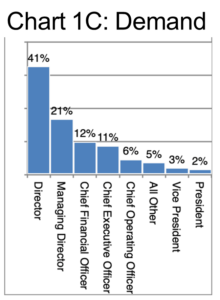

Chart 1C explores the relative demand for each title based on the share of online job postings per position. The Director title was clearly the most sought after followed by Managing Directors, CFOs, and CEOs. Of course, this would ignore the unpublished opportunities.

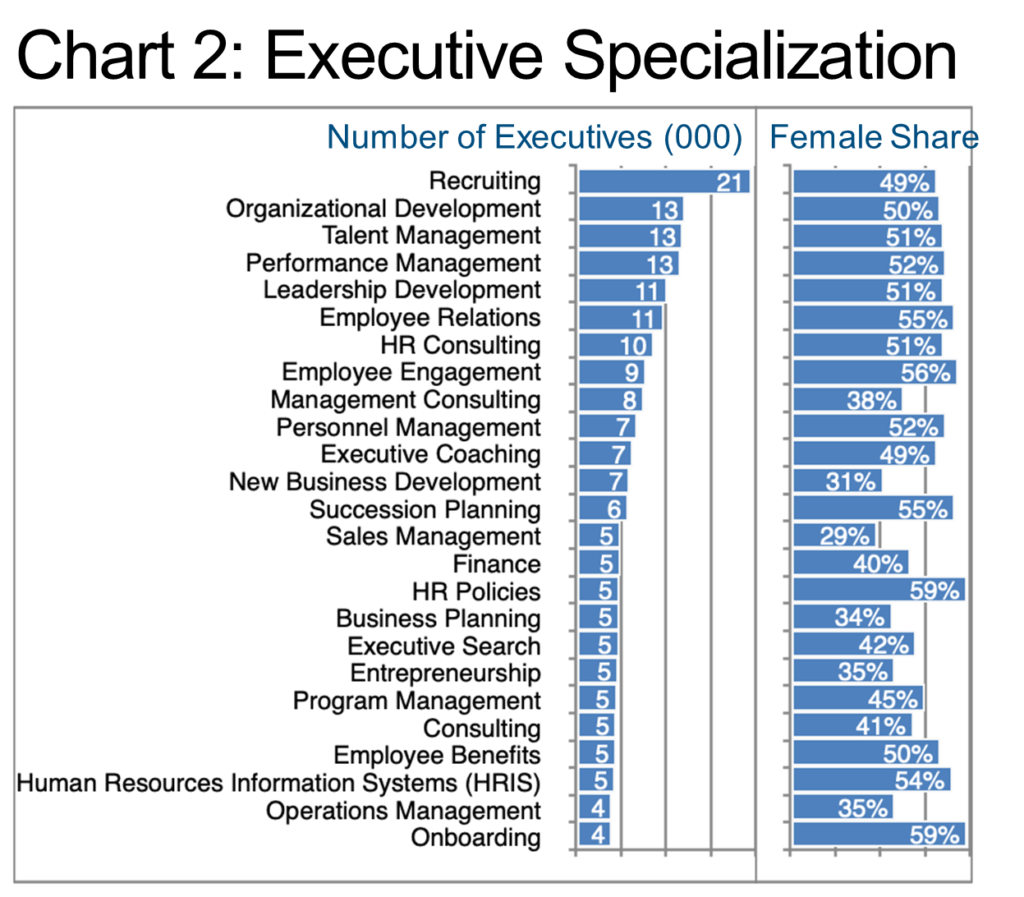

Most executives cite more than one specialization on their LinkedIn profiles so that by listing these an overview of the skills in the HR space emerges. Chart 2 provides this perspective. Clearly, recruiting predominates in the rankings, followed by skills requiring subject matter expertise such as Organizational Development, Talent Management, Performance Management and Leadership Development. In fact, the more generic specializations such as Management Consulting or New Business Development do not occur until further down the ranking. This may be important to note for would-be career changers who might wish to transfer into this industry by leveraging their relevant experience from other verticals.

TBG routinely helps executives rethink their professional trajectories, inventory their options, and then repackage themselves accordingly—with stunning results as highlighted in numerous Success Studies. Increasingly, executives are coming to understand that they are not necessarily trapped in a particular industry even if that is where they have spent their professional lives so far.

Regular readers of TBG Industry Updates will recognize from Chart 2 that the share of female executives in this industry is exceedingly high in comparison to many other industries TBG has studied. TBG believes this is more a result of cultural forces and has little to do with inherent capabilities. Fortunately, companies are generally trying to improve gender equity across the board, though progress remains slow so far.

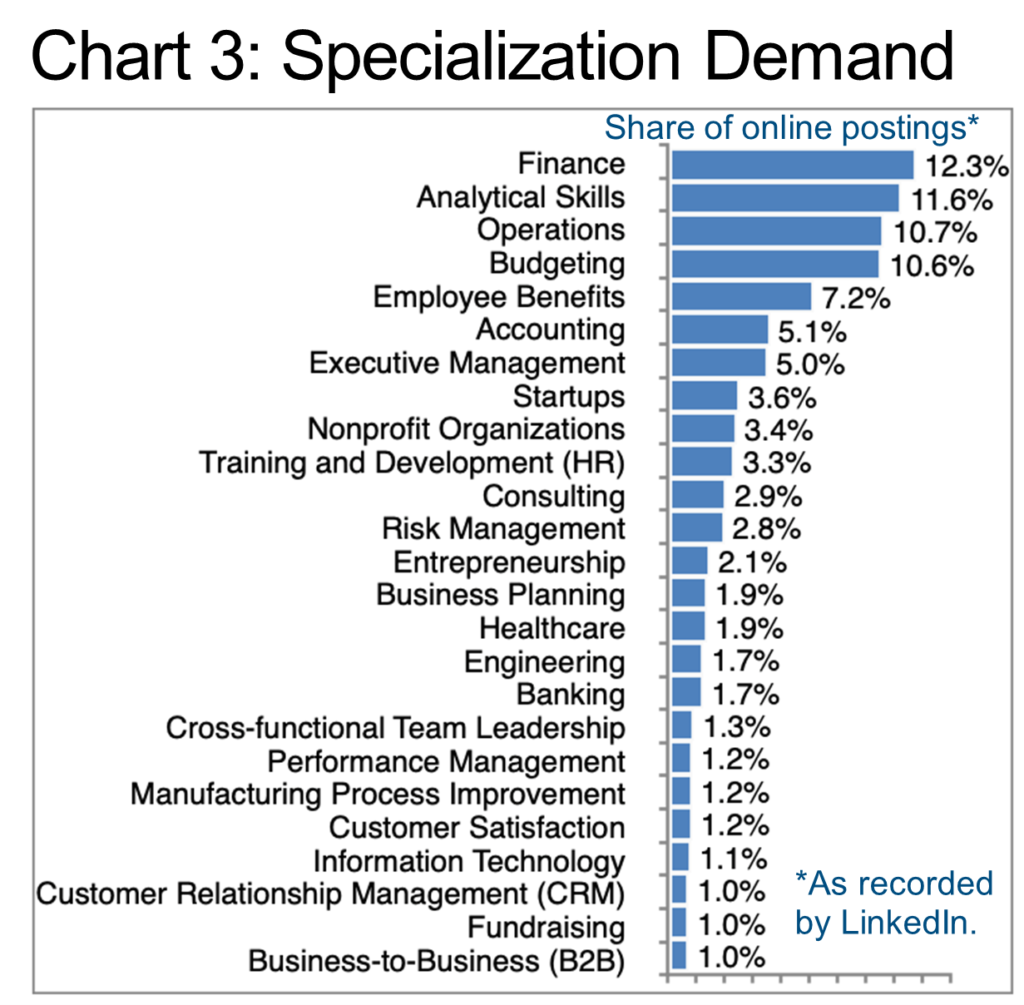

Chart 3 again utilizes the available indicator of the share of online job postings to reflect relative demand. Executives should note that the online market encompasses only about 15% of client landings at TBG while 75% land via the unpublished market. However, based on Chart 3, this industry is very similar to others in that quantitative disciplines such as Finance, Analytical Skills and Budgeting occupy three of the top four positions—all generic skills, by the way, affording interested executives ingress or egress to or from this industry as they consider possible career changes.

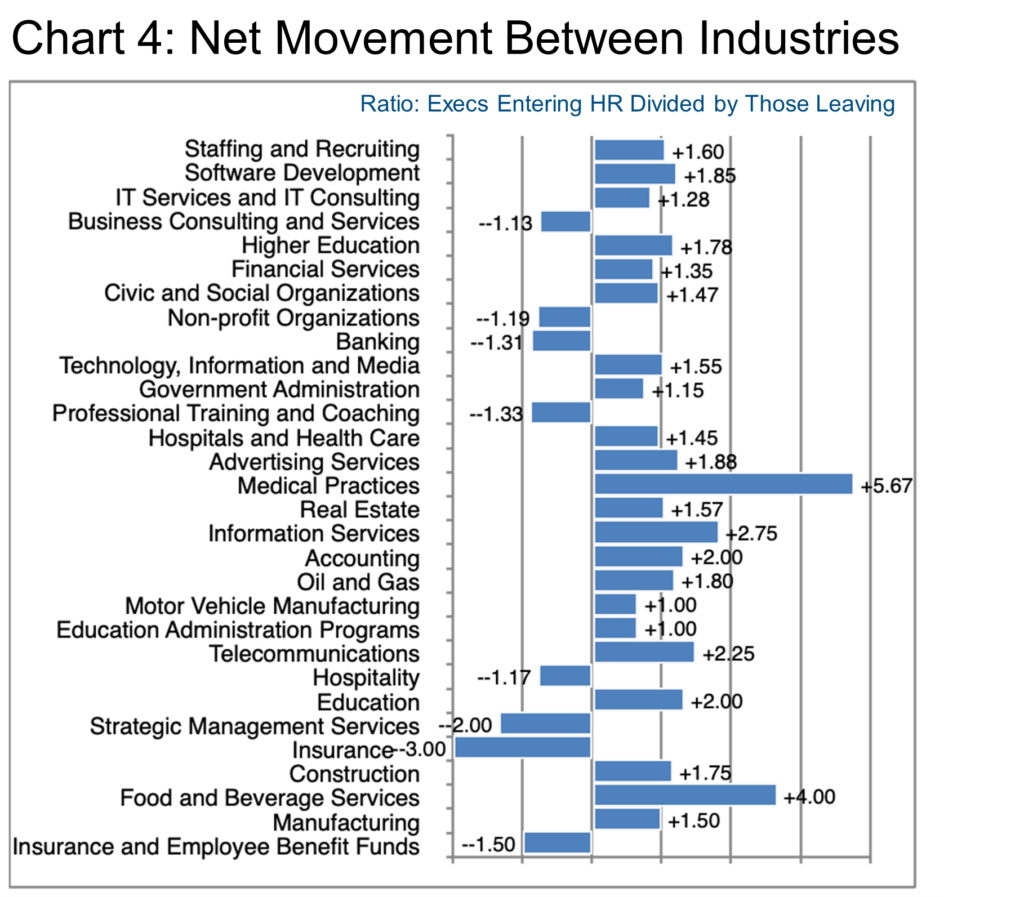

Chart 4 offers an interesting portrait of how HR executives are shifting industries according to LinkedIn by summarizing the ratio of execs who have moved from or to HR over the last 12 months from the various other sectors listed on the vertical axis. Essentially, this chart tells us, for example, that 60% more executives entered the HR industry via the Staffing and Recruiting sub-sector than those that departed. Another 85% more joined in Software Development, etc.

In the other direction, net gainers from the HR sector include the following segments: Business Consulting and Services (-13%), Non-profit Organizations (-19%), Banking (-31%), Professional Training and Coaching (-33%), etc. Strategic Management Services and Insurance seem to have even more extremely negative ratios suggesting that these industries have aggressively hired HR execs in the past year.

However, Medical Practices seem to be adding HR executives (+467%) as are Food and Beverage Services (+300%). Overall, this tends to prove one of TBG’s major tenets: there is always opportunity in the executive market if one knows where to look.

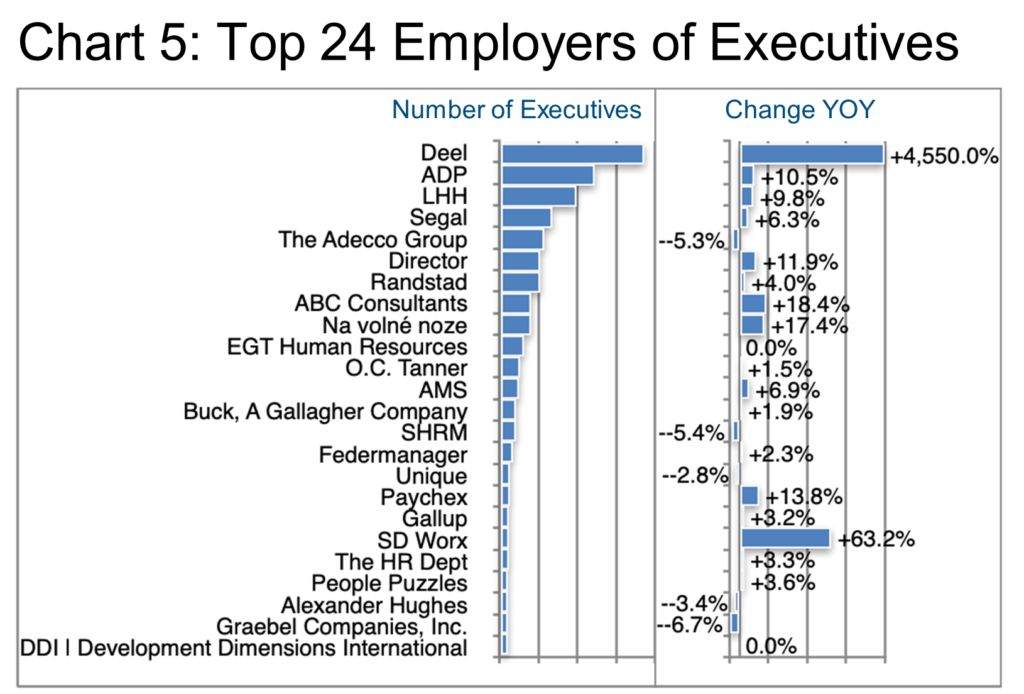

As noted earlier, HR is a rather fragmented executive cohort, spread across a large number of firms—so much so, that the top 24 firms represent just 4% of the total! Chart 5 shows this clearly as the number of execs per firm even at the largest companies lies in the mere hundreds. As a result, rounding to the nearest thousand is meaningless. Deel, for example, a privately held HR services startup based in San Francisco, profited richly by picking up talent from Meta, Salesforce, Rippling, Slack, etc. over the past 12 months. It aims to provide the latest in HR tech offering unique services such as a compliance hub intended to provide insight into HR legal requirements in 150 countries. As evidenced by its recent hiring, Deel’s clear focus in terms of skills has been on Software Development, IT Services and IT Consulting, as well as Financial Services.

Per Chart 5, ADP, a New Jersey-based public company, continues to grow (+9%) by providing payroll and many other HR services. Recently the company has lost net talent to Paychex but gained from Amazon, Accenture, Oracle, Tata Consultancy, Salesforce, Deloitte, and others. ADP recruited net talent in IT Services and IT Consultancy, Higher Education, Staffing and Recruiting, Banking, and a number of other specializations.

LHH, a firm known best for providing outsourcing services, also grew by about 11%, adding talent from competitors such as Adecco, Hays, Robert Half, and Korn Ferry. The firm focused its new talent acquisition on specializations in Staffing and Recruiting, Human Resource Services, Business Consulting and Services, IT Services and IT Consulting, and Software Development, among others.

Segal (+6%) is a human resources consulting firm that touts its strong team of 150+ actuarial professionals. The firm provides “a broad range of consulting in addition to actuarial [services], including health benefits, human resources, compensation, organizational effectiveness, technology, investment, communications and specialty insurance to name some others.”

This report cannot explore all of the details of this fascinating industry. However, TBG’s clients receive significant research support during the early, industry-screening phases of their career change campaigns, as well as more detailed analysis as they approach critical interviews with target companies.

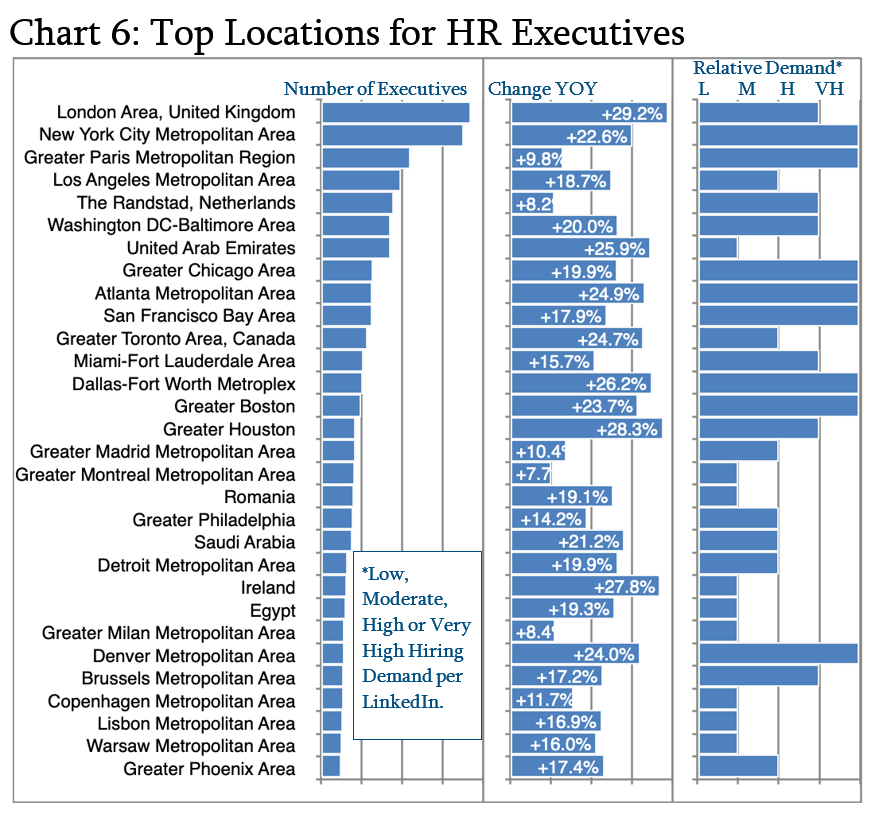

HR executives are also well distributed geographically (Chart 6) with London and New York vying for the most (each rounding to about 3,000 execs). Certainly, the rates of growth are impressive as noted earlier in this update, but the forward-looking hiring demand data may be a more useful indicator of current and future trends. Take the UAE, for example, which grew by 25.9% in the past year but now reveals a low relative hiring demand. Paris might be the counter-example, with a “modest” 9.8% historical growth rate but a very high hiring demand. Bear in mind that a scarcity of qualified executives may also significantly affect the relative hiring demand parameter.

Peter Irish, Chairman

The Barrett Group

Click here for a printable version of INDUSTRY UPDATE: Human Resources, Feb 2024

Editor’s Note:

In this Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represent a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 1 billion users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.