INDUSTRY UPDATE: Human Resources – February 2022

INDUSTRY UPDATE: Human Resources

Introduction

- Is there a mass resignation underway and if so, what can be done to retain talent?

- How does a company sensitively roll out an improved focus on valuing diversity without seeming boorish or arbitrary?

- How does a company really decide whether to ask employees to come back to the office or continue to work remotely when there are so many variables to take into account?

- And how do managers and colleagues of differing ages and backgrounds relate to each other and maintain motivation if they do not necessarily share values?

These are just a few of the key challenges facing companies worldwide at the moment. Some are related to the pandemic, to be sure. But others are inherent in underlying societal changes, demographic shifts, and even the ebb and flow of specific industrial segments over time.

To quote a popular movie, “Who you gonna call?”

Human Resources, of course.

And that probably accounts for the huge hiring boom that we are seeing among HR executives across the markets we will cover in this Update i.e., the US, EU, UK, and Middle East (ME).

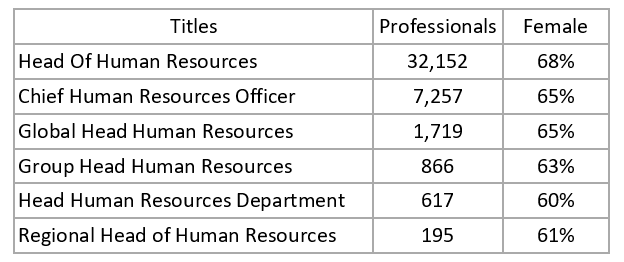

Frankly, we have not yet seen a population so large growing at such a rapid rate so far in our Industry Update series. Nor another one with so much opportunity for women. As we define executives (see Editor’s Note), there are some 45,900 active in these regions. 33,000 in the EU, UK, and ME and another 12,900 in the US. This population has grown about 11% YOY with a whopping 17% having changed jobs and companies in the past year. Meaning there have been something on the order of 11,000 or more executive opportunities in this space in the last 12 months. This population is about two-thirds female, and is, according to LinkedIn, in very high demand. As far as titles are concerned, here are the major titles and their respective gender balance:

No one knows how long this demand will continue. But considering the underlying changes we mentioned earlier, it seems that the demand will continue to be relatively high for some time. On the other hand, if we were to add the major Director level titles (e.g., Director of Human Resources) the total number triples to 135,000 in the regions under discussion. So there is also likely to be competition ahead for would-be HR leadership roles.

Human Resources-Broad Growth in Demand

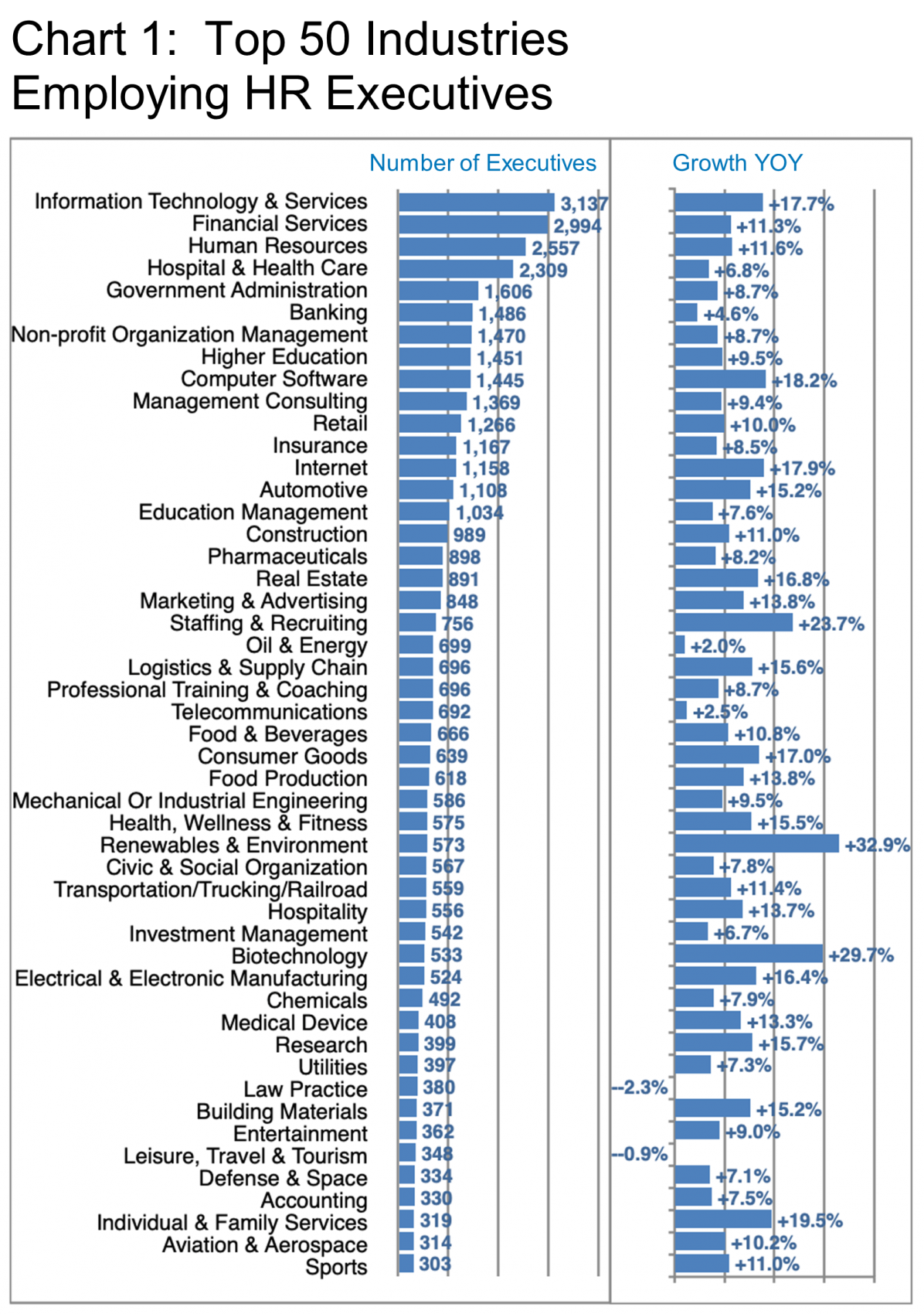

As far as which industries are hiring HR executives, Chart 1 explores the top 50 business areas whereby Information Technology, Financial Services, and Hospital & Health Care come out on top in terms of the numbers employed. However, perhaps predictably Renewables & Environment (+32.9%), Biotechnology (+29.7%), and Staffing & Recruiting (+23.7%) demonstrate the highest growth in the number of executives employed while only Law Practice and Leisure show declines.

Readers might very reasonably ask, what do Human Resource executives actually do? What are their specializations?

LinkedIn reflects this by analyzing the “skills” that each executive cites on his or her profile. LinkedIn also provides the following portrait of how these resources are employed at their respective companies.

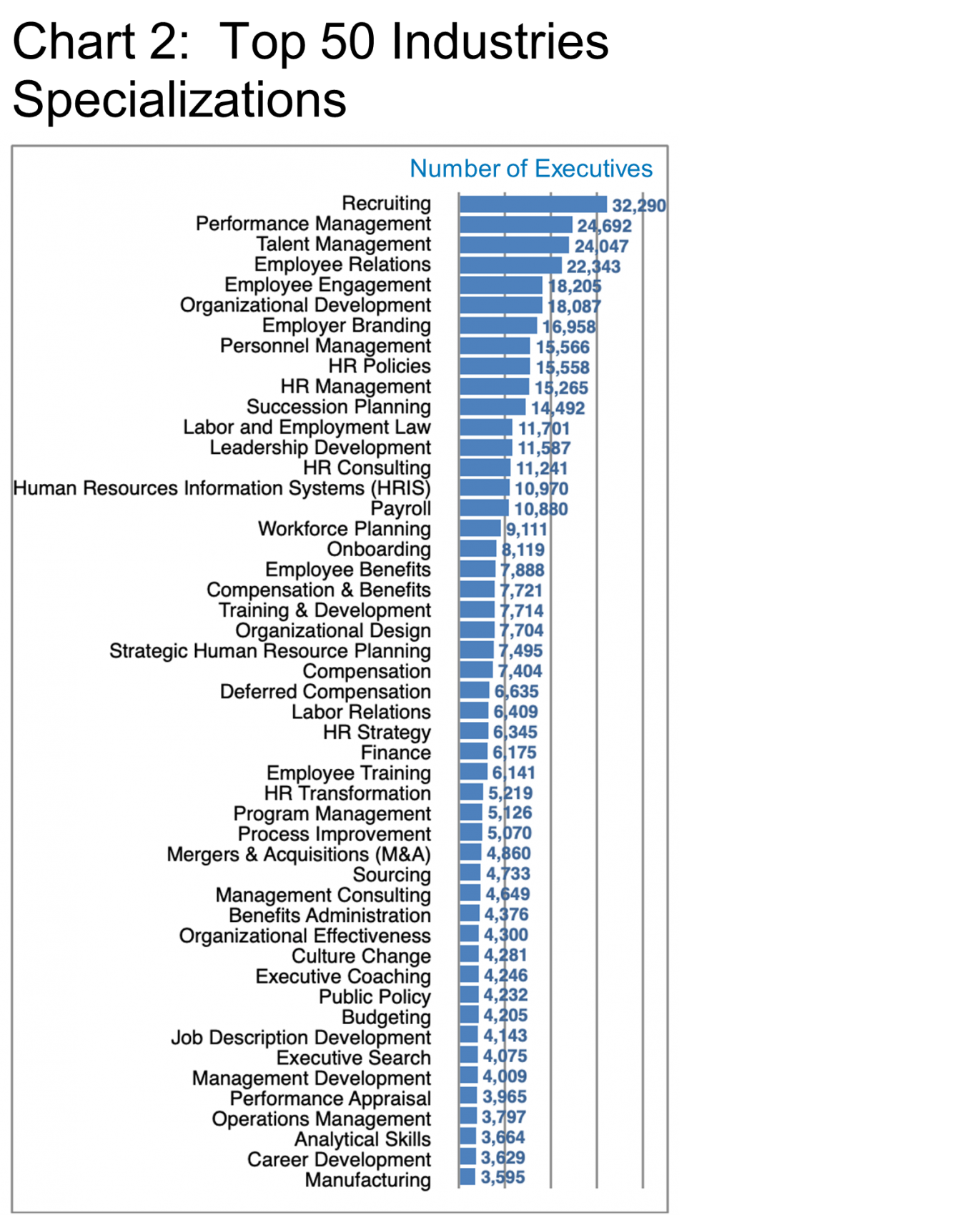

Chart 2 provides some insight into these questions with some fairly predictable emphases such as Recruiting and Performance Management being at the top of the list. The critical role of HR in managing company image and how the company is perceived by employees (among other constituencies) seems quite evident. This is because subjects such as Employee Relations, Employer Branding, HR Transformation, Organizational Effectiveness, and Culture Change all appear quite prominently. We will see Diversity and Inclusion a little later in this Update. But for some reason, these topics have not yet made it onto the top 50 specializations. However, it is interesting that niche subjects such as Executive Coaching now make the list.

From the outset, we have wondered about why there are proportionally more HR executives in the EU, UK, and ME regions than in the US (See page 1). We can only speculate that the need to manage diverse cultures, languages, and national laws including social and health benefit regimes that are not yet completely coherent. All of this complexity increases the need for HR professionals. The US has a certain scale benefit in that respect with relatively coherent national laws simplifying employee management. At least that is the theory.

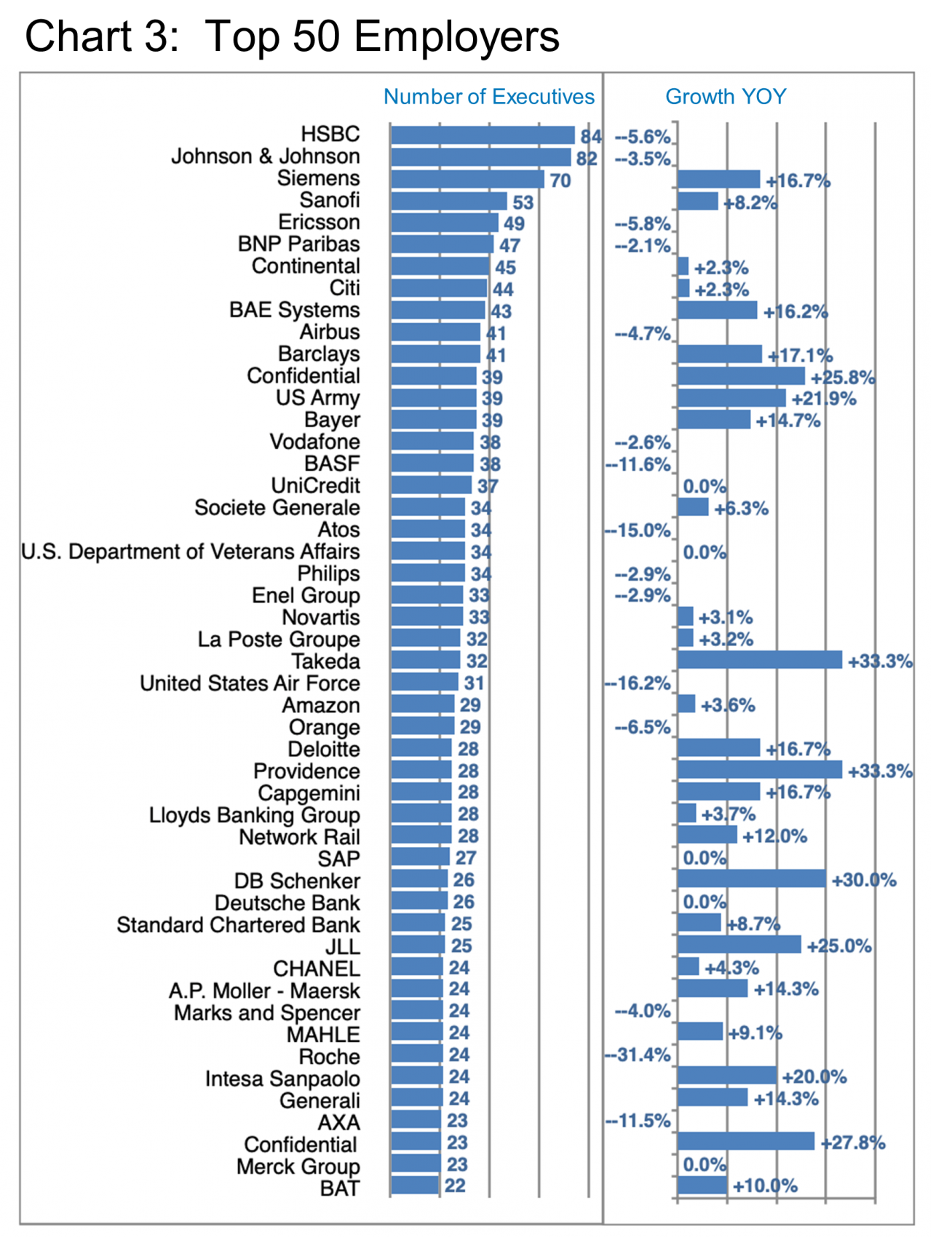

In any case, that explains why so many of the top employers of HR executives (Chart 3) are European. Though, increasingly it is difficult to really pinpoint a “global” company to a specific, overriding culture or location. In the days of virtual meetings, the world seems smaller.

Take HSBC, number 1 on the list, for example. Some 9% of their HR employees are in London. 6% in Hong Kong. 4% in Hyderabad. 3% in Paris. 3% in Egypt, etc. Or what about Johnson & Johnson, number 2 on this list. Their HR employees are scattered all over the globe with some 17% in New York. 5% in Manilla. 4% in Colombia. 4% in Tampa. 3% in Philadelphia. Another 3% in Sao Paulo.

Let us also look at the fastest-growing companies on this list: Takeda (Pharmaceuticals, Japan; growth in HR executives +33.3%). Providence at (Hospitals & Health Care, US; +33.3%). And DB Schenker (Logistics, Germany; +30%). The largest concentrations of Takeda’s HR team are located in Boston, Chicago, and Philadelphia followed by Zurich. Providence is heavily-focused apparently on the US West Coast (Oregon and Los Angeles). And DB Schenker lists Romania, Singapore, and Sao Paulo as its largest concentrations of HR personnel.

Where does a fast-growing company recruit HR employees? Takeda obtained talent from Bristol Myers Squibb, Biogen, IBM, Philips, Baxter International, and Pfizer within the last year. Providence hired mainly from IBM and Kaiser Permanente. DB Schenker hired from a range of local competitors.

Of course, we cannot go into all the details here. But our clients can have tremendous insights into movements at the company, location, and industry level through our extensive research capabilities.

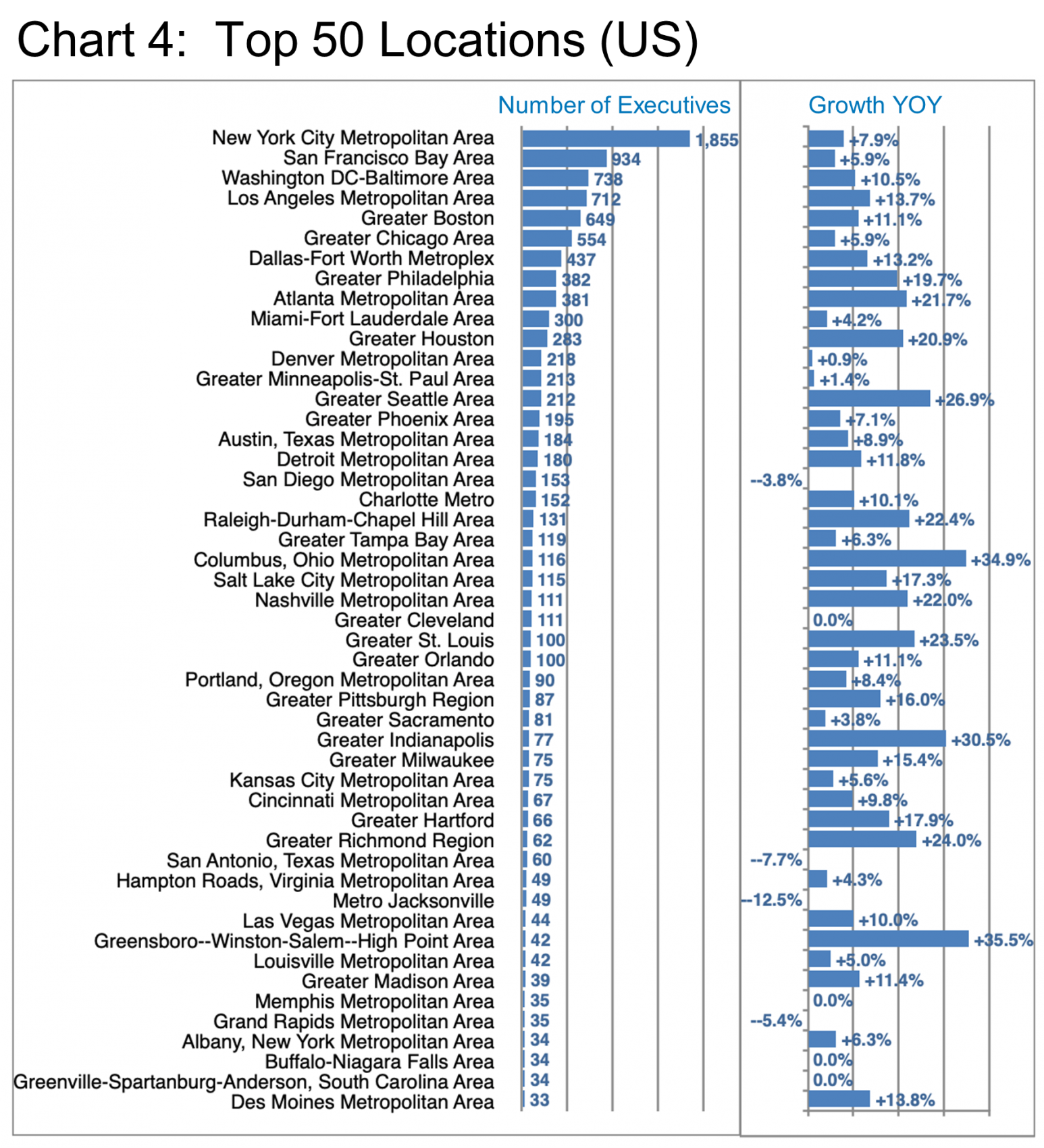

It is fascinating that so much growth is taking place during a time of pandemic and economic turmoil. But clearly larger societal forces are driving these changes and they are unlikely to dissipate quickly. In the US, (Chart 4) New York, as usual, has the highest concentration of HR executives—twice San Francisco, the next largest.

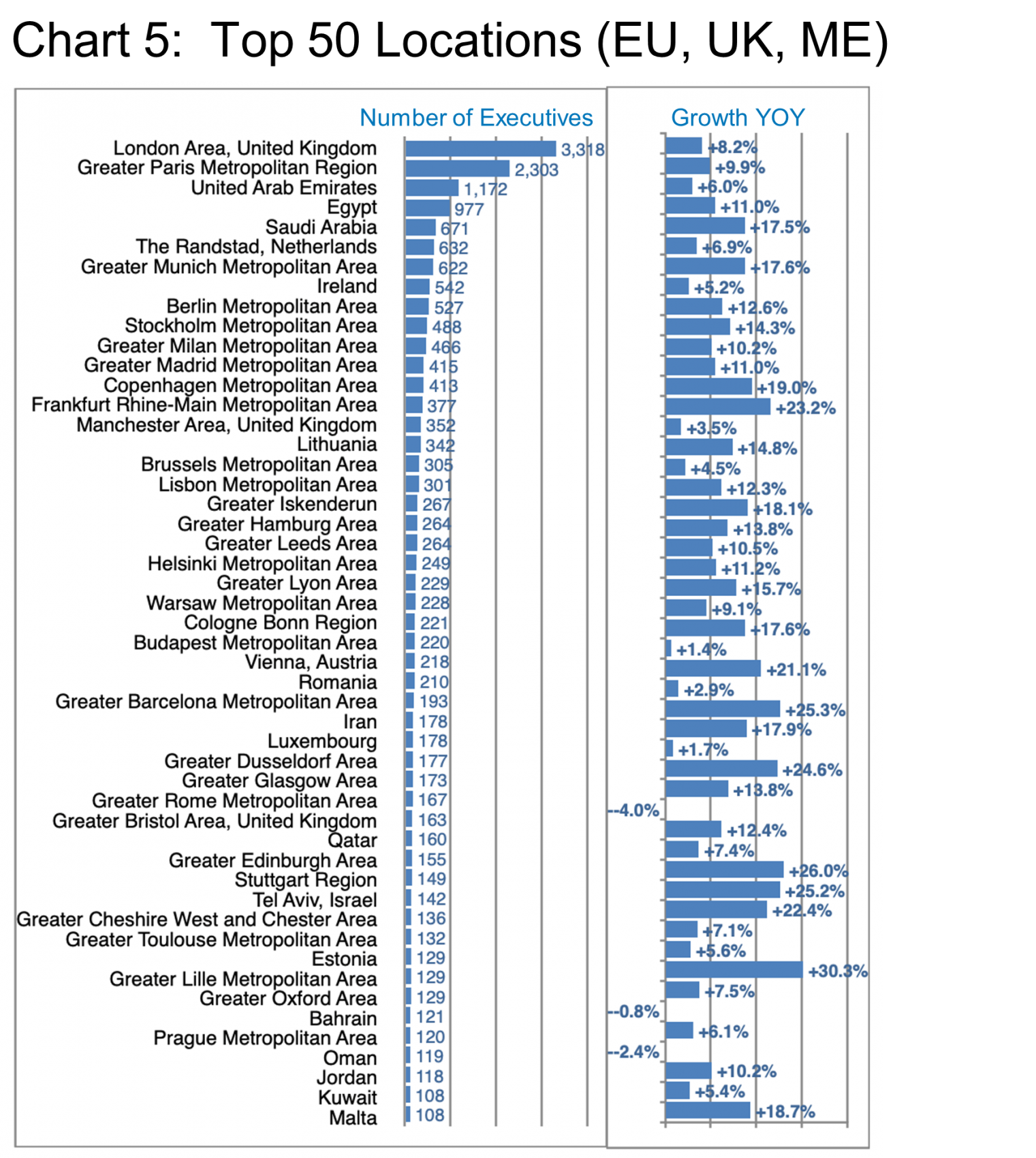

That London and Paris are the top of the charts in Europe is no surprise (Chart 5), but the growth of the Middle East may surprise some readers, with the UAE, Egypt, and Saudi Arabia coming in as numbers 3, 4, and 5 in the ranking respectively.

Diversity and Inclusion

We promised to come back to this subject later in this Update and it is certainly an important one, beyond the moral and philosophical aspects, the growth in this specialization is phenomenal: +26% in the past year. In the target geographies, there are about 3,100 Chief-, VP-, or Director-level positions including “Diversity and Inclusion” in their titles cited on LinkedIn, of which about 87% are Director-level. There was also a lot of movement in this sub-group with about 25% having changed companies in the past year. This cohort is also predominantly female (67%) per LinkedIn.

These roles also appear to be largely a US phenomenon. The first non-US location for such a role appears in London, UK at rank 10 in the top 100 list. New York, Washington DC, Chicago, Boston, and Atlanta are the top five locations. All of the top locations show growth in the +20% to +48% range.

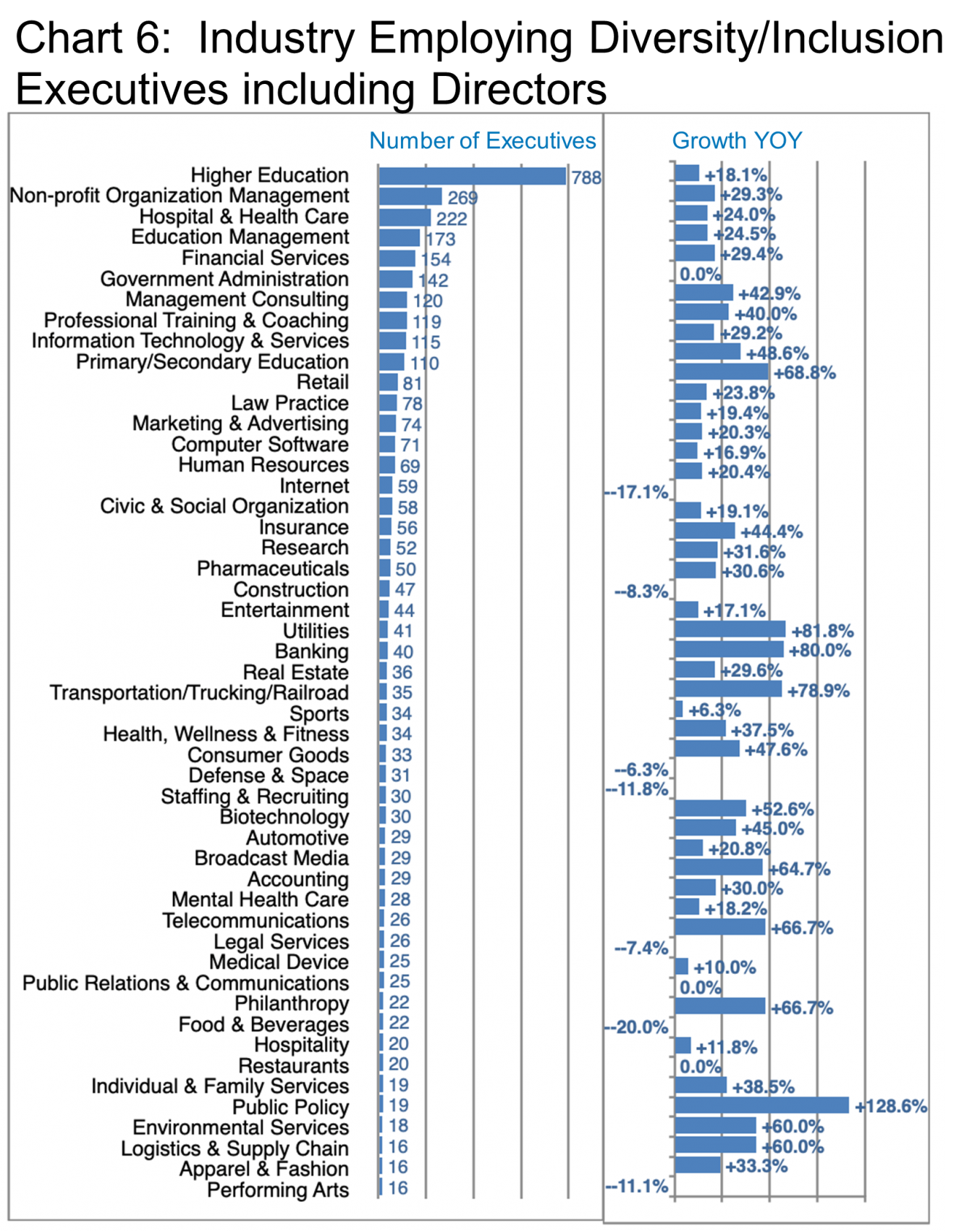

Industrially, Higher Education remains far and away the largest employer of this specialization, approximately three times larger than the number 2 on the list, Non-profit Organization Management or number 3, Hospital & Health Care. Granted the baselines are relatively low, however, the growth rates are significant, indicating that there is a broad wave of adoption underway as various industries take the bit and add these roles to their management teams.

Understandably, when we review the companies employing these executives, the number of roles per company is quite low, ranging between 7 and 14 even within the top ten employers, so these roles are highly dispersed across a wide company base. In other words, the growth is coming from broad adoption not deep pockets of specialization.

Peter Irish, CEO The Barrett Group

Click here to download a printable version: Industry Update – Human Resources

Editor Note:

In this Industry Update “executives” will generally refer to the CEO, CFO, COO, CTO, CIO, CMO, and Vice President titles only. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research. Is LinkedIn truly representative? Here’s a little data: LinkedIn has approximately 722 million users, 174 million in the US, and 163 million in Europe. (See Source) It is by far the largest and most robust business database in the world, now in its 18th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year. “Attrition” is defined as the departures in the last 12 months divided by the average headcount over the last year.