The executive job market is changing as industries reshuffle their priorities due to the Covid-19 virus.

We hope you benefitted from the burst in economic activity in Q3 that also saw a substantial jump in employment (though we still have a huge employment deficit (versus the pre-Covid virus era).

Here at the Barrett Group, we keep a close eye on economic and industry developments.

We want to be be able to best advise our executive clients and guide their career searches.

GDP in the US apparently surged 33.1% at an annualized rate after the 31% (annualized) decline in Q2 2020. Europe also saw a pick-up in growth to 12.1% in Q3, up from -11.4% in Q2 with the strongest growth in France, Spain, Italy, Portugal, and Austria. This still leaves the EU on track for a -7.4% GDP decline for 2020 while the Conference Board has recently published an expectation of a meagre 2.2% real growth in the US in 2020.

Looking ahead at 2021, the National Association for Business Economics in the US forecasts 3.6% growth in GDP while Commissioner Gentiloni forecast 4.1% for the EU in remarks on November 5, 2020—after the deepest recession in EU history, cushioned by the highly accommodative monetary policy adopted by the the ECB and others.

That loose money policy has moved to center stage in the recent spat between the US Treasury and the US Federal Reserve as the administration attempts to eliminate several monetary support measures by the end of the year while the Fed wants them to stay in place. We will see how this evolves, but looser money seems likely to win.

Most telling, of course, is the impact of the second wave of the virus infections, hospitalizations, and deaths on both continents that without further mitigation efforts has the potential to derail economic activity severely in the coming weeks and months.

Nevertheless, we look ahead at the impact on industries and sectors from our current economic vantage point.

The Bureau of Labor Statistics in the US recently published a list of industries ranked on their “teleworking friendliness” (from least friendly to most) as a method for predicting impacts on employment:

- Leisure and hospitality

- Retail trade

- Construction

- Transportation and warehousing

- Manufacturing

- Health care

- Management services

- Other services

- Public administration

- Real estate

- Wholesale trade

- Information

- Finance and insurance

- Professional services

- Educational services

Deloitte meanwhile published a survey of various industries in the EU based on inputs from representative companies’ CFOs on the speed of each company’s resumption of normal (pre-Covid virus) activity here sorted from the highest speed to the lowest speed of recovery:

- Retail

- Financial services

- Life science

- Consumer goods

- Technology, media and telecoms

- Energy, utilities, and mining

- Construction

- Industrial products and services

- Automotive

- Transport and logistics

- Tourism and travel

At the Barrett Group, we help our clients reflect during the Targeting stage of their career search.

We help our clients decide whether they are in the right industry, and, increasingly, executives are finding that a change of industry probably makes sense given the vast upheavals currently underway. We also help our clients substantiate the transferability of their skills during the Packaging stage of their career search and articulate these persuasively during the Preparation stage, so that no client needs to go into interviews and offer negotiations unprepared to excel.

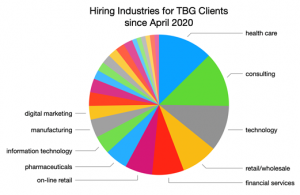

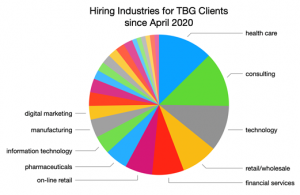

And we are proud of the more than 120 executive clients who have landed great jobs since Covid became serious earlier this year. Here’s where they landed (the top ten named sectors account for 75% of all landings):

Employers also seem to be opening up and becoming more flexible about moves between industries and accepting the transferability of experience (if it is properly presented). We recently interviewed one of the top health care providers in the US for example (Mayo Clinic). Chris Gade, the Chief Public Affairs Officer, told us that from his perspective, health care operators need more general business experience and more data analysis skills. “We have enough data,” he said. “We need the insights from that data!” [Listen to the Interview]

The Barrett Group would never suggest that you treat your most important pre-retirement asset (your career) as a plaything at the whim of the latest market fads, but it is interesting to see in the short term what specific industries are among the fastest growing as an indicator of future trends.

Here is one take on the fastest growing industries in the US during 2020:

- Online grocery sales

- Cough and cold medicine manufacturing

- 3D printing and rapid prototyping

- Online pet food and supplies sales

- Hydraulic fracturing services

- Autonomous underwater vehicle manufacturing

- Stock and commodity exchanges

- Video streaming services

- Thermometer manufacturing

So, the point is that there is a huge amount of activity in the executive job market as industries and players reshuffle their business priorities – in response to the virus.

Read more about it on our Hiring Line where we report on our clients’ success every week. Or, better yet, give us a call and get started yourself on that new and improved career track in an industry with solid growth potential.

Peter Irish

CEO

The Barrett Group

Read next: You think you have stress?