INDUSTRY UPDATE: Management Consulting

Introduction to Management Consulting

Companies engage management consultants for many reasons, for example, to examine organizational structures while considering adjustments so as to enhance efficiency or effectiveness, to bring in specialist skills not available in the organization itself, and to execute limited-term specific projects. Over the decades, this practice has become well entrenched, and the number of management consulting companies continues to grow.

In the US, management consulting reached a market value of $320 billion in 2022 having grown on average by slightly more than 5% per year over the last five years. This rate of growth is forecast to increase at 8.6% (CAGR) through 2029, bringing the expected market value to about $570 billion. [See source.] In Europe the management consulting market is also expected to grow strongly (+5.6% p.a.) through 2030 reaching $254 billion from its current $173 billion valuation. [See source.] The Middle East management consulting market is still quite small at about $9 billion, but is also expected to grow strongly (+4.2% CAGR) to circa $12 billion by 2028. [See source.]

[Editor’s note: the reader will also encounter other numbers for market size and growth from other sources. We believe that it is difficult to really establish an “apples to apples” comparison in this amorphous business segment and that the reader should be cautious in making cross-market comparisons.]

In any case, there seems to be much demand for management consulting worldwide. Why is that so?

Certainly artificial intelligence (AI) is one reason. When one thinks about specialized skills with a huge potential impact, this is one obvious area and management consultants have been quick to pounce on it. Almost 6,000 executives claim AI skills in this cohort—up 117% vs. prior year. “The hype around ChatGPT at the beginning of the year is a solid indication of the direction that many industries are taking. AI-driven technologies are being used to automate mundane tasks, reduce manual labour and provide more detailed insights into data.

In management consulting, this equates to automated big data processing and analysis for more accurate forecasting and decision-making with less effort.” [See source.]

On-going digitization and automation of business processes, migration to cloud-based systems, enhancing hiring and employee development systems when qualified candidates are hard to come by— these are all important areas of focus in the current environment.

More generally, management consultants can be classified into broad specializations including the following [See source.] though very few only play in one segment:

- strategy

- financial risk management

- technology

- sales & marketing

- economic & government policy

- human resources

- regulatory compliance

- process management

- procurement

- operations

Forbes’ latest ranking of the Best Management Consulting firms cites a number of areas of specific emphasis including “multi-disciplinary” capabilities (integrating technology, deep sector insight, human resources, etc. into one package of improvements), sustainability and digital enhancement, and, of course, AI. [See source.] While size, scale, and breadth of experience seem to be a winning formula for many of the larger firms in this area, there is apparently a countervailing trend toward freelancing under an umbrella such as that practiced by Catalant, one of several firms benefiting from the virtualization of business in the post-pandemic world to gather allegedly 100,000 consultants under its umbrella and make them available virtually and at a lower cost—searchable by expertise. [See source.]

Whether working for the largest industry behemoths or providing their expertise independently via new industry platforms, who are the men and women who manage this industry? Let’s take a look.

The Market for Executives

Some 316,000 executives list management consulting as their primary industry according to LinkedIn in the US, Canada, UK, EU and Middle East. (See Editor’s Note for complete parameters.) This group grew by an impressive 3% in the past year while another almost 11,000 changed jobs, bringing the total executive opportunity to about 20,000 positions. The industry remains predominantly male at the executive level (26% female), boasts a 3.6 years average tenure, and rates an overall “high” hiring demand from LinkedIn.

In total 157,000 of these execs are based in the US and Canada (+3% growth, and 29% female), 144,000 in the UK and EU (+2% growth, 23% female), and the balance of 15,000 are based in the Middle East (+4% growth, 20% female).

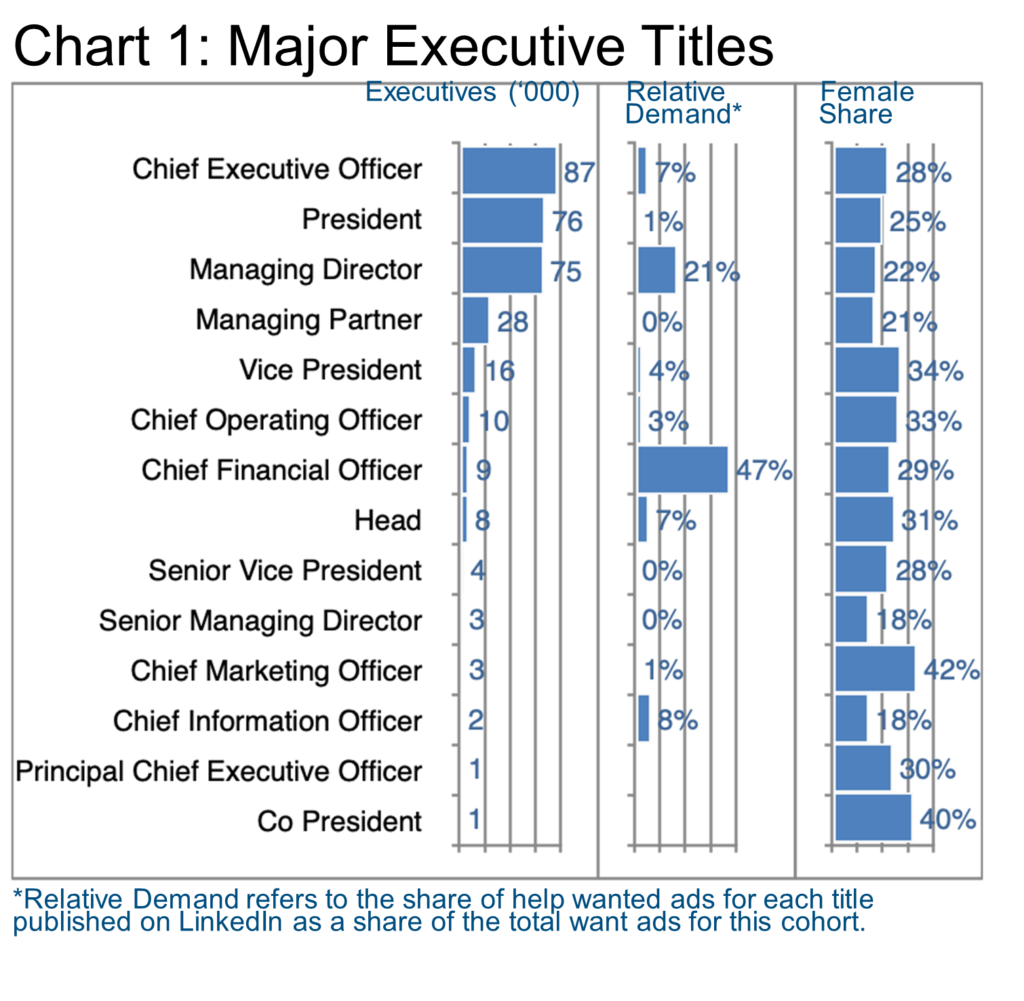

Chart 1 suggests that there are many smaller firms active in this segment as why else would there be 87,000 CEOs? In terms of relative demand, apparently MDs and CFOs have been in hot demand followed by the CIO, Head, and CEO titles. Female executives so far fill the CMO and Co-President roles most frequently.

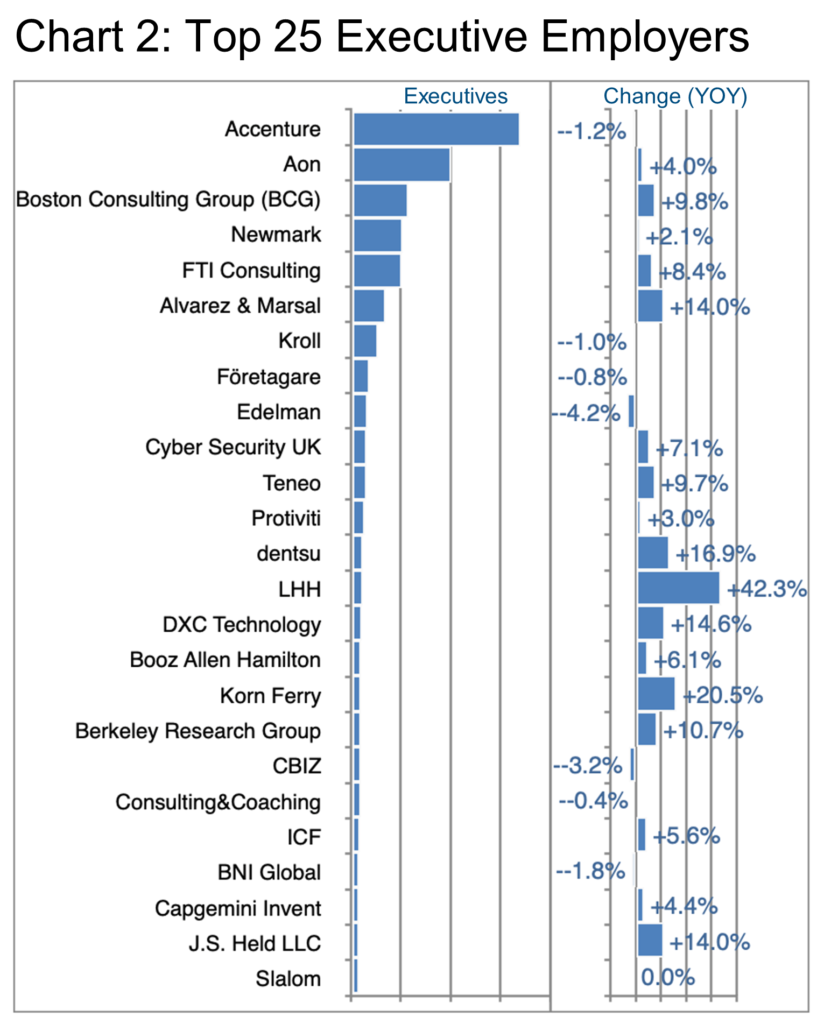

Because the data is only accurate to the nearest thousand, we are not at liberty to detail the executive headcount at each firm, however, in Chart 2 the reader can certainly see the ranking of the top 25 management consulting firms in our focus, where Accenture stands out with more than 6,000 execs worldwide.

As one might expect from such a giant, a review of recent business news involving Accenture includes acquisitions (Flutura, AI; OnProcess Technology, supply chain; Shelby Group, procurement; Nautilus, digital health), significant IT projects with SAP and Salesforce among others, but also an increasingly negative net acquisitions/divestiture balance. “Accenture’s clients comprise the Fortune Global 100 and the Fortune Global 500. The ability to anticipate large, transformative technology trends and capitalization through mergers and acquisitions, are the keys to the company’s success. Accenture reports under five segments: Communications, Media & Technology, Financial Services, Health & Public Service, Products, and Resources.” [See source.]

At number 2 in Chart 2’s ranking, “Aon plc is a multinational corporation that offers risk management services, insurance and reinsurance brokerage, human resource consulting and outsourcing services worldwide. […] Currently, following a major realignment of principal service lines the company reports through four revenue lines, namely, Commercial Risk Solutions, Reinsurance Solutions, Wealth Solutions, and Health Solutions.” [See source.]

In the latest year AON saw departures of executive talent to WTW and Alliant Insurance Services but also gained net talent from Guy Carpenter and from Marsh.

Number 3, Boston Consulting Group (BCG) added to its executive ranks in the latest year, hiring from Accenture, Bain & Company, EY, and Deloitte among other firms. New York, London, Chicago, Munich, UAE, and Singapore all saw double-digit group in their executive teams.

Looking at some of the faster growing participants in this sector, LHH (+42.3%) added significantly in Los Angeles, San Francisco, Atlanta, Denver, and London. Korn Ferry (+20%) added an interim specialist group (Patina) in 2022 and this has helped them grow. Their additions occurred in London, Los Angeles, New York, Chicago, Singapore, Boston, Washington DC and Sao Paulo among other locations. Dentsu (+16.9%) grew strongly by acquiring sales and marketing talent in New York, Paris, Tokyo, Milan and Bangkok.

We cannot afford the space here to delve into all of the fascinating details in this industry, of course, but clients of the Barrett Group have access to significantly more granular information in the early stages of their career change, for example, in screening an entire industry, as well as later, for in-depth profiles of companies and even detailed briefings on individual executives who may be involved in interview processes.

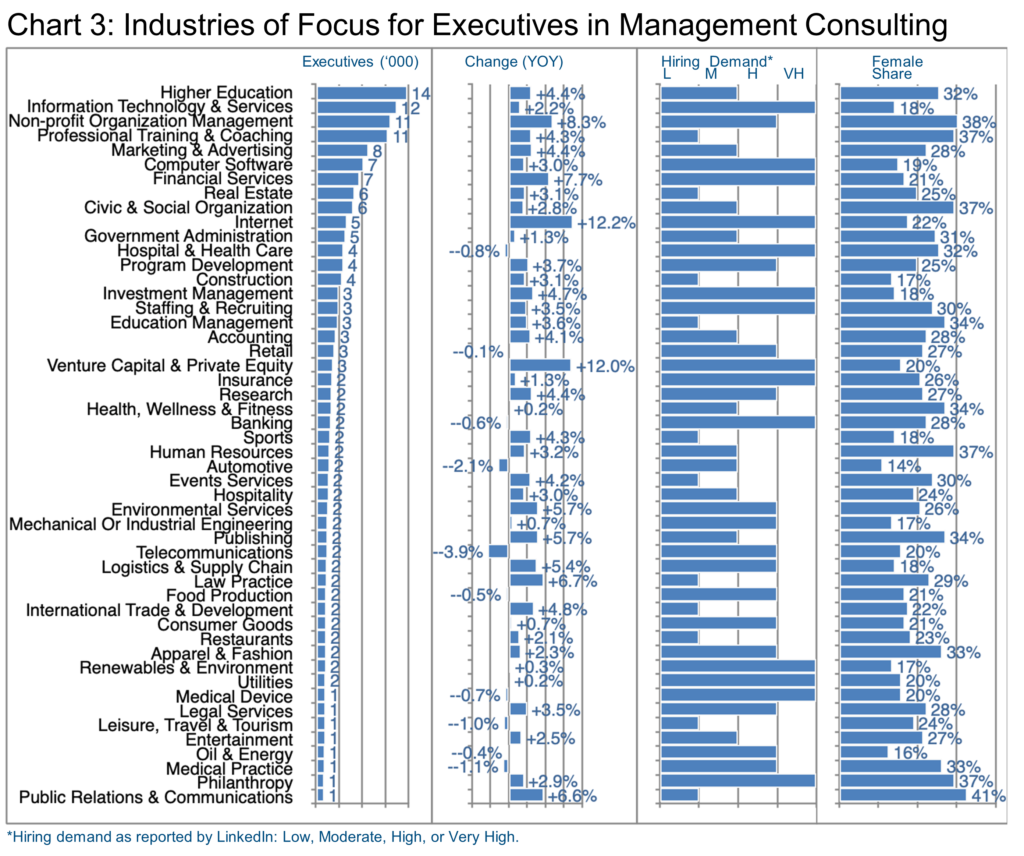

In Chart 3 we explore the specific industries of focus that executives in Management Consulting list in their LinkedIn profiles. For a change, let us start with the laggards. We expect to see Telecommunications (-3.9%) shrinking as it has for years, Automotive (-2.1%) is somewhat surprising given how much innovation is going on in that segment as the conversion from internal combustion to electric power ramps up. Hospital & Health Care and Medical Devices both come in at -0.7% to -0.8% in industries that are otherwise showing very modest growth [Read more.], however, note the very high demand for executives in both of those latter segments. This suggests there is a supply issue—not enough talent available to address even the shrinking demand.

In fact, numerous areas show high or very high hiring demand in Chart 3 regardless of their historical recent percentage change: Information Technology & Services (+2.2%), for example, or Computer Software (+3.0%), Financial Services (+7.7%), and Internet (+12.2%), etc. There are quite a few pockets of higher growth in this field, especially if one focuses on the near term (hiring demand) rather than history.

As is usual in most segments we study, there are pockets requiring deep competence (e.g., Construction, Legal Services, Oil & Energy) but plenty of areas where experience can be transferred from other disciplines, particularly Professional Training & Coaching, Marketing & Advertising, Program Development, etc.

Many Barrett Group clients want to change industries or roles, and we help them highlight and promote their transferable skills or experience in ways that often surprise and delight them. This happens for many reasons.

Here is one example:

“I just wasn’t in the right head space to continue. I was drained and burned out from fundraising, and I just wanted things to be easier. When I realized I had to extend myself, I just checked out mentally. I wasn’t ready to do the work… The TBG team gave me confidence that, despite being underemployed for three years, I could bounce back and get a job that I really enjoy.” [Jennifer Eager – Read more.]

Chart 3 also emphasizes female executives’ shares with high points in Public Relations & Communications (41%), Non-profit Organization Management (38%), Professional Training & Coaching, Civic & Social Organization, Human Resources, and Philanthropy (all at 37%).

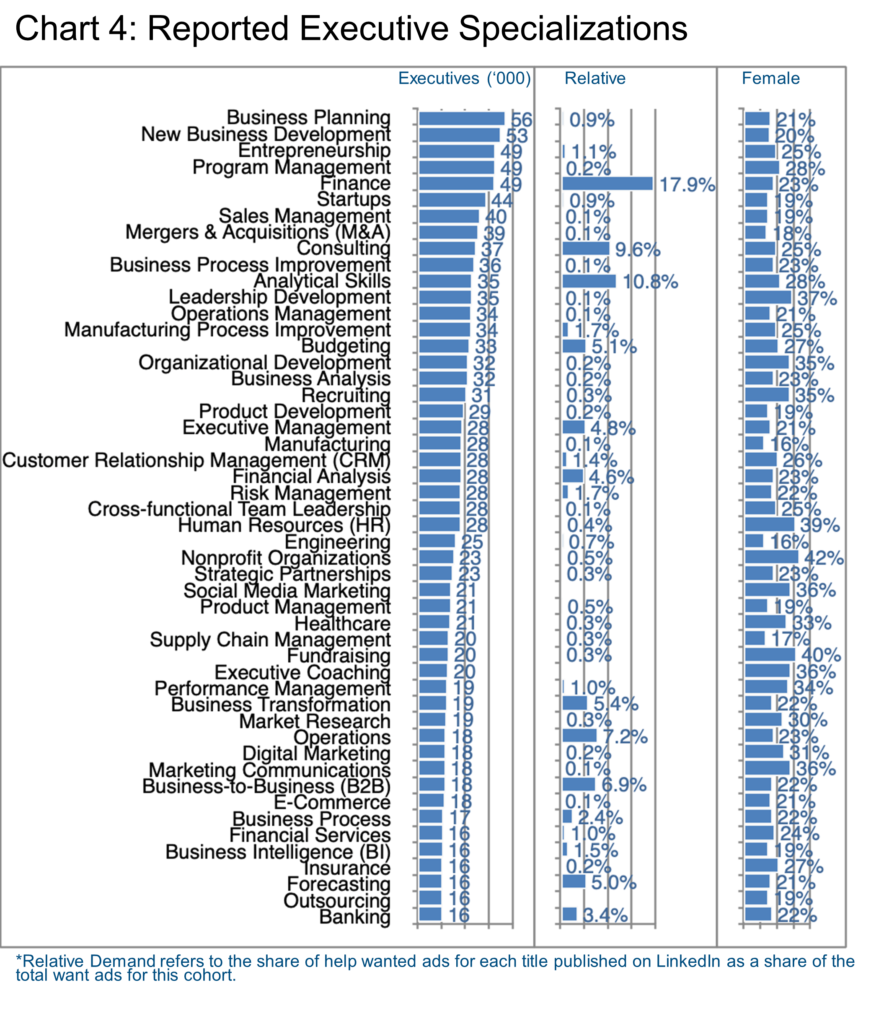

Now let us rotate the data cube and look at the same population from the point of view of skills or specializations as extracted from their LinkedIn profiles in Chart 4.

Here relatively generic disciplines hold the top slots such as Business Planning, New Business Development, Entrepreneurship, and Program Management indicating significant opportunity to enter or exit this industry based on transferable skills and experience.

The relative demand, however, favors Finance, Consulting, and Analytical Skills, followed by Operations and Business-to-Business (B2B) skills. Bear in mind that this relative demand measure addresses only the published market (want ads) and does not indicate demand in the larger unpublished market where approximately 75% of Barrett Group clients land—opportunities so new that they have not been published yet.

The list of specializations with a high female share will seem familiar most likely, including as it does Fundraising (40%), Human Resources (39%), Leadership Development (37%), Executive Coaching, and Marketing Communications (36%), as well as Organizational Development, and Recruiting (35%).

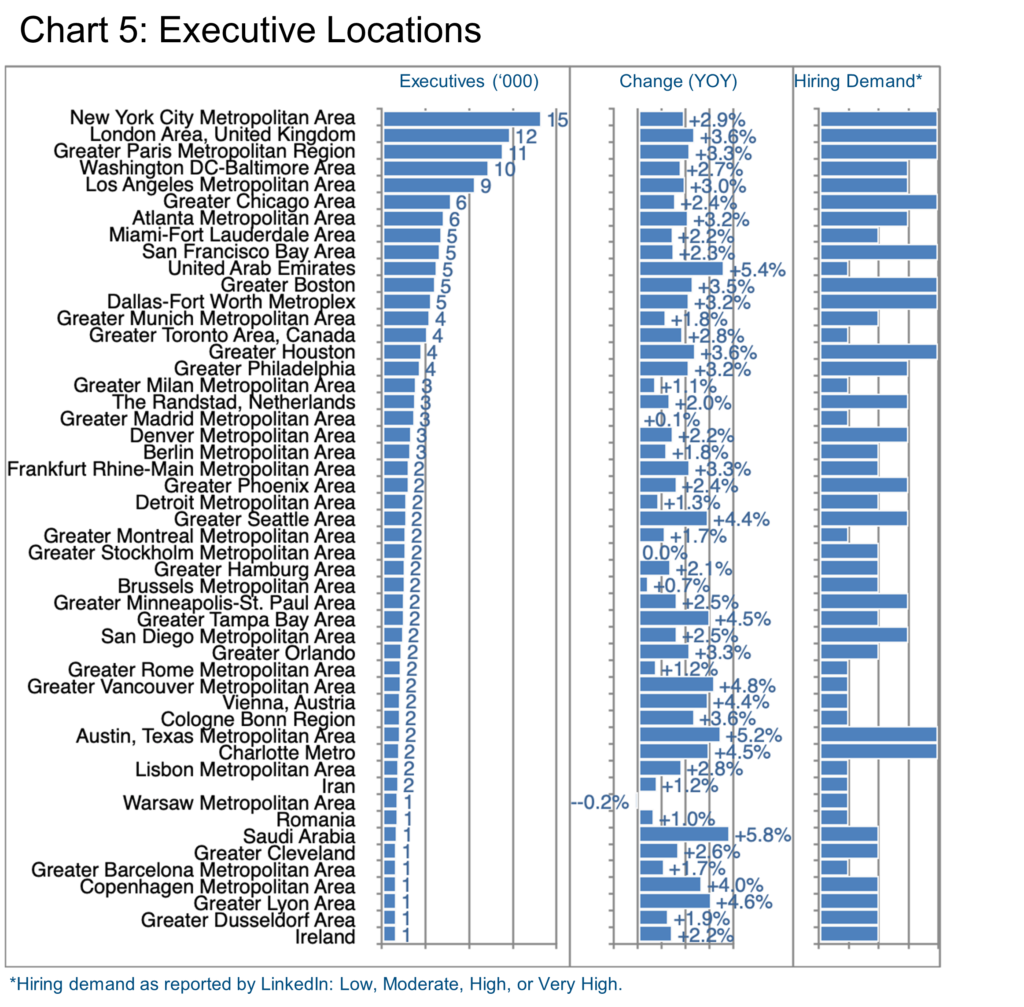

Readers might wonder about the location of these positions, in which case, Chart 5 should help. The usual suspects top the list: New York, London, and Paris, plus Washington DC and Los Angeles constitute the top five, all with high to very high hiring demand and above average growth.

Accenture shows up as a top employer in each of these top five markets, along with Newmark, FTI Consulting and AON, each in two of these markets, while Boston Consulting Group, Teneo, CapGemini Invent, and Booz Allen Hamilton exhibit that status in one each. This list remains relatively consistent all the way down to Munich where KPMG joins the list of top employers, Toronto adds PwC, and Houston introduces Alvarez & Marsal.

As noted earlier, we can hardly cover so much geography in detail in this Update, but Barrett Group clients have access to literally millions of data points via our research capabilities whether at the initial industry screening level or in detailed preparation for an interview.

Peter Irish, CEO, The Barrett Group

Click here for a printable version of INDUSTRY UPDATE: Management Consulting 2023

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.