INDUSTRY UPDATE: Health Care

Introduction to Health Care

Health Care is certainly one of the fastest-growing major markets worldwide, despite the gradual abatement of the Covid-19 threat. In 2020, “[s]harp increases in government spending on health at all country income levels underpinned the rise in health spending to a new high of US $9 trillion (approximately 11% of global GDP).” [See source.] “Health spending is projected to return to an annual growth rate of 4.8% between 2022 and 2031, as the consumption of health care services (utilization) rebounds and health sector prices grow due to inflation.” [See source.]

In the US, the market generated revenue of about $1.27 trillion (2020). It was valued at $808 billion and represented almost 20% of GDP. [See source.] In the EU, the spending represented €1.46 billion (2020) or just 11% of GDP. Of course in the EU, “…government schemes and compulsory contributory health insurance schemes and compulsory medical saving accounts […] collectively accounted for 61.8–87.7 % of all financing in 2020. Hospitals accounted for about 37.4% of this spending in the period. [See source.] The UK spent a similar 12% of GDP or about €205 billion through its NHS in 2020. [See source.] In the Gulf Cooperation Countries (GCC) “…healthcare expenditures were projected to reach US$104.6 billion in 2022, according to the UAE Ministry of Economy…” [See source.]

As in most other industries, finding enough qualified Health Care personnel remains a key challenge, particularly in nurses and support functions where the gap is especially acute.

“The World Health Organization predicts a shortfall of 15 million health care workers worldwide in 2030. The International Centre on Nurse Migration projects there will be a shortage of 13 million nurses alone by 2030, up from a shortage of 6 million before the pandemic.” [See source.] On the supply side, migrating nurses from one location to another, raising wages to attract new entrants, and providing support services such as daycare are all being employed to ease the shortage.

Alternatively or in parallel, many companies are looking at other ways of addressing these issues. This is particularly through remote (telehealth) services that offer consultative. And also to some extent diagnostic services via the internet, including increased use of “wearables” to monitor patients at home. In the extreme case, remote, robotic surgery and even a virtual hospital ward are being trialed in some specific areas. [See source.] Telehealth can also encompass support groups for individuals suffering or recovering from specific ailments, such as “Patients Like Me.”

Another response is to deliver services outside of the traditional health care system.

Those for example, through retailers such as CVS, Walgreens, Target, and Walmart. Such services already routinely include drug tests, vaccinations, and simple medical check-ups. “In 2023, patients will choose retail health for their primary care needs as health systems, constrained by inadequate resources, fail to match retail’s elevated patient experiences.” [See source.] This trend could also expand the footprint of health care providers into less affluent communities. For example, in 2023 “Dollar General, the nation’s largest retailer by number of stores, with more than 19,000 locations, partnered with a New York-based mobile medical services company called DocGo to test whether it could draw more customers and tackle persistent health inequities.” [See source.]

Some regions are also investing heavily in basic infrastructure, especially the Middle East.: “The region has over 742 hospitals with more than 106,693 beds. In addition, they have a large number of primary healthcare centers, clinics, and laboratories and there is no end to the expansion in sight […] With a massive pipeline of an estimated 161 healthcare projects across the GCC with a combined value of U.S. $53.2 billion, the scale of the region’s healthcare services is going to expand even further…” [See source.]

Another method of expanding health care infrastructure at a relatively low cost is the use of wearable technology. “The global wearable medical device market size was valued at USD 26.8 billion in 2022. It is expected to grow at a compound annual growth rate (CAGR) of 25.7% from 2023 to 2030. The growth of industries such as home healthcare and remote patient monitoring devices is anticipated to influence market growth.” [See source.] This approach fulfills two main roles: diagnosis (for example, by monitoring heart parameters or blood sugar) and therapy (for example, by actually administering insulin or other drugs as required).

Wearable devices may also promote privacy if the data never has to be stored externally and certainly accelerate care by delivering results and/or medicine in real-time.

The acceptance of such devices piggybacks on the broadening use of fitness tracking wristbands or clips that were worn by 21% of US adults as of 2019 [See source.]. Women (25%) are more likely to use such devices than men (18%). The same survey revealed that about 41% of those US adults surveyed felt it was acceptable for device manufacturers to share fitness data with primary care physicians or other authorized providers.

Between the advent of wearable health care technology, a broader provider footprint, and telehealth, the prospect of relatively personalized health care now seems more achievable. This is especially true when artificial intelligence is brought to bear in the interpretation of masses of health data as its pattern recognition capabilities come fully into focus.

Pharmaceuticals certainly face the talent shortage too, but also additional challenges. Just as the promise of “new modalities” such as cell and gene therapy and mRNA vaccine technology have increased the speed and precision of potential drug therapies, supply chain interruptions, the increased cost of investment in R&D due to inflation, rising protectionism requiring more regionalization, and state intervention—all of these are greatly complicating the lives of the major pharma providers. [See source.]

One positive development though is the increasing application of big data models to the development and perfection of new drug therapies: “Digital tools, robots, and sensors are becoming cheaper and easier to access, and they can be used to capture all manner of raw data. In addition, edge computing and cloud analytics are providing real-time optimization and transparency.” [See source.]

Of course, there is so much more to say about Health Care in 2023. But our focus is on the men and women who act as executives in this field.

The Market for Executives

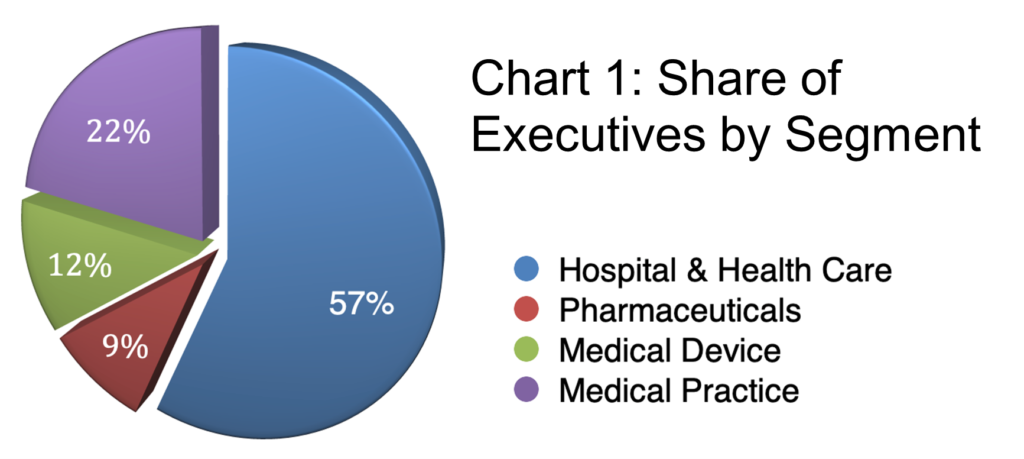

LinkedIn reports 534 thousand executives in the four specific segments included in this Update as reflected in Chart 1.

Overall the market is hardly growing (+0.3%) but the demand is very high, reflecting a scarcity of appropriate talent. At 35% the female executive share is relatively high. That number varies considerably by region and segment. The US and Canada account for 366 thousand of these executives. This is a cohort that has grown by +0.4% which 3.3% have changed jobs in the past year. Some 36% of these executives are female.

The EU and UK number another 141 thousand executives in these fields, a group that has grown by +0.3% with another 4% having changed jobs in the last year. One-third (33%) of these executives are female. And the Middle East accounts for a further 27 thousand executives, a pool that grew by 1% and comprises 21% female participants.

The gender parameters also vary by segment: Hospitals & Health Care boast 39% female executives, Medical Practice, 35%, Pharmaceuticals, 27%, and Medical Devices just 20%.

Chart 2 explores the titles this group of executives reports. Qt first glance, the titles look surprisingly top-heavy given the organizational size of some of the players. This suggests that there are also many smaller organizations in the mix, otherwise, there would not be so many CEOs and Presidents. In any case, the highest relative demand seems to be for “Heads” followed by Managing Directors.

As noted earlier, the female executive share is relatively high in general within the cohort. But particularly high for titles such as Chief Human Resources Officer (67%), Associate General Counsel (58%), CoPresident (49%), Vice President (43%), Chief Marketing Officer (42%), Chief Operating Officer (41%), General Counsel (39%), and Head (39%).

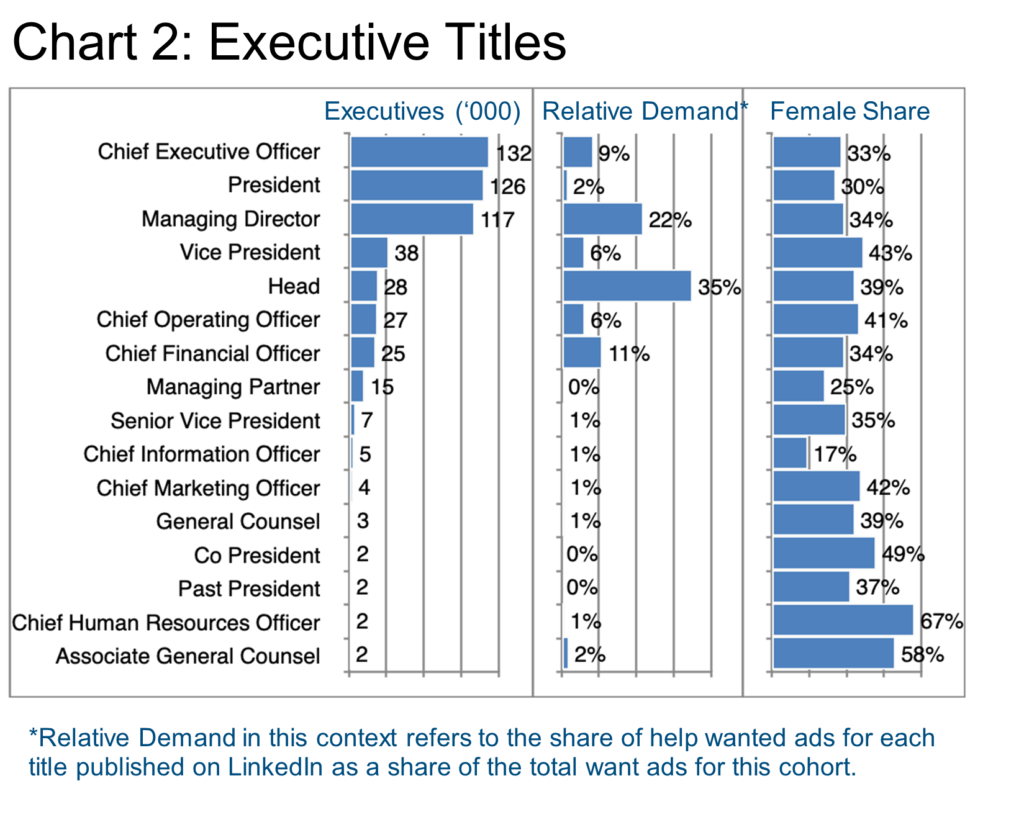

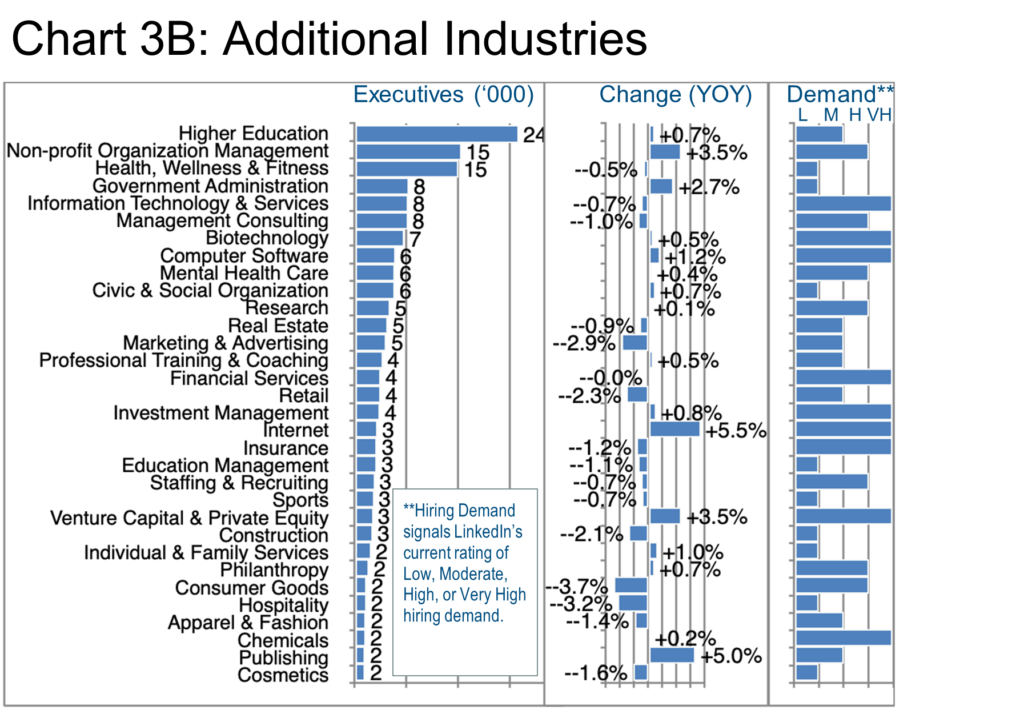

Charts 3A and 3B provide insight into major and additional industrial segments. These charts give respect to size of the executive population, change in that population year-over-year (YOY), and the current hiring demand in that segment according to LinkedIn. Low growth with high demand typically means there is a lack of supply in any given segment. That could present opportunities to contemplate a career transition if one has treasonable transferable skills and experience.

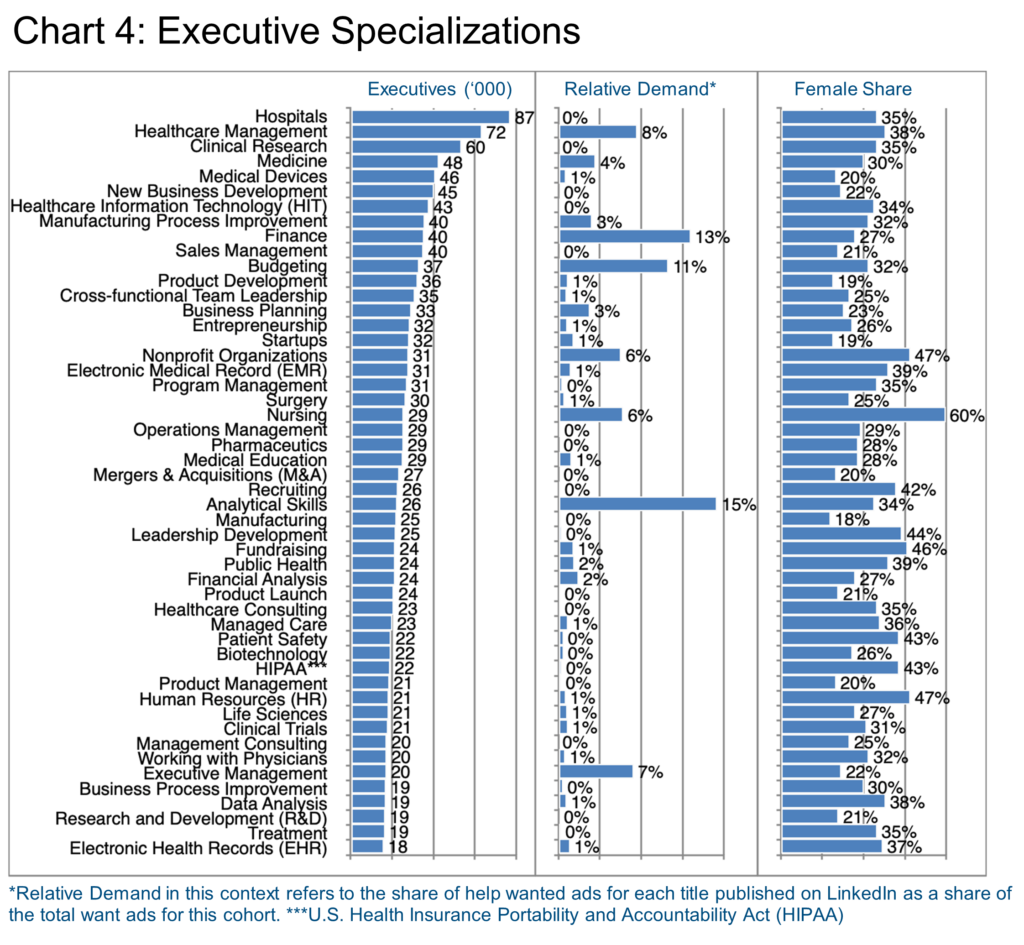

More than 157 thousand executives cited “Healthcare” as their specialization. That also attracted the lion’s share (29.5%) of all want ads on LinkedIn and, at 36%, continued the relatively strong female share trend.

Chart 4 highlights the remaining top specializations in this cohort. The opportunity for transition into this industry via demonstrated competency in Finance, Budgeting, and/or Analytical Skills seems quite opportune given the high relative demand for these specific skill sets. This is especially considering the high technical nature of many of the other specializations in this listing.

At The Barrett Group, we have literally decades of success in helping executives inventory their special skills and achievements. We help them repackage themselves to allow a pivot into new industries, roles, and even countries depending on our client’s objectives. [Read more.]

It is no surprise perhaps that Nursing (60% female) or Human Resources (47%) are largely the terrains of female executives (Chart 4). But fundraising (46%), Leadership Development (44%), Patient Safety, and HIPAA (both 43%) are also hotbeds of female executive activity, too.

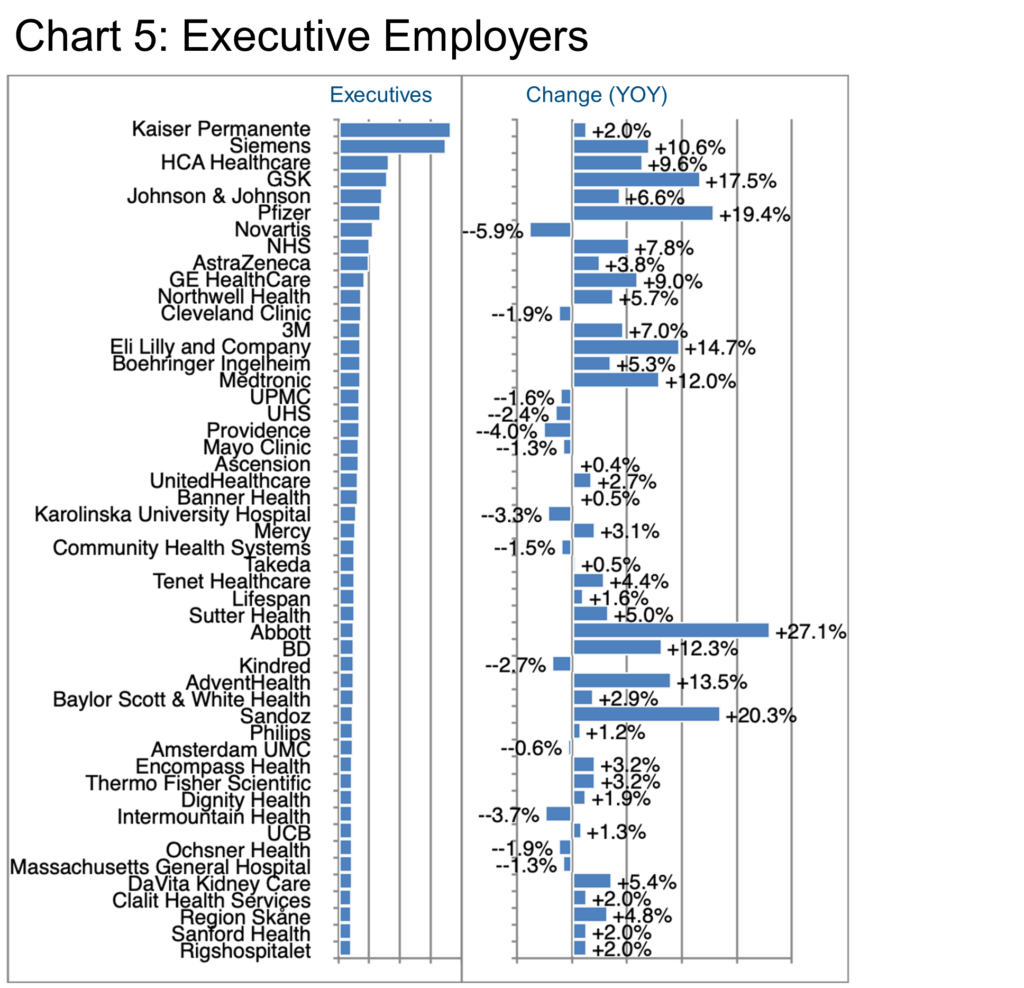

Chart 5 opens the door to the specific players in this market, the executive employers.

Note, that LinkedIn requires that we round to the nearest thousand in these Updates. The number of executives in each specific enterprise is small enough to become a rounding error. Therefore we are not providing the specific value for each company in Chart 5. However, the reader can still ascertain the relative size of each executive team based on the graph.

Kaiser Permanente and Siemens stand out in this dimension. Both have about twice as many executives as number three or four on this list although they have little in common. Kaiser says this on LinkedIn about its model: “As the nation’s leading not-for-profit health plan, we proudly serve 12.7 million members from 600+ locations in 8 states and Washington, D.C.” Their executives are located largely in California, particularly in San Francisco and Los Angeles. The company has recently reached an agreement regarding a strike by some 75,000 employees for better wages. [See source.]

Siemens seems to be focusing on the engineering side of the equation. Promoting a unit under the “Heathineers” heading that focuses on connecting patient data and treatment data in real time: “The availability of data can lead to significant savings in time and money for new examinations as well as to a massive improvement in response times. This is exactly where our solutions for patient engagement and care collaboration come into play.” [See source.] Siemens executives seem to be based in Nuremberg, Munich, Berlin, New York, Vienna, Beijing, Mumbai, Singapore, the UAE, and Switzerland, among other locations. Siemens’ executive team is growing (+10.6%). But it is shrinking in Germany and growing most significantly in the US according to LinkedIn.

HCA Healthcare describes its business as follows: “As one of the nation’s leading providers of healthcare services, HCA Healthcare is comprised of 182 hospitals and 2,300+ sites of care in 20 states and the United Kingdom.” [See source.] The company signed a deal in May to acquire 41 urgent care facilities in Texas [See source.].

Other fast growers in Chart 5 include multiple pharmaceutical companies. Companies including GSK (+17.5%), Pfizer (+19.4%), Eli Lily (+14.7%), Abbott (+27.1%), and Sandoz (+20.3%). One source explains this growth as follows: “An aging population, the emergence of new treatments and states’ obligations to fund healthcare lead to increasing demand. Through this, the industry should continue growing. Together with other factors, this priority helps the pharmaceutical market grow at more than 5% per year.” [See source.] However, this segment may also see some adverse pricing developments as new legislation in the US empowers Medicare to negotiate certain products’ prices.

Major players in the medical devices segment are also faring pretty strongly. Those companies include Siemens, GE HealthCare (+9%), 3M (+7%), Medtronic (+12%), and BD (+12.3%).

Note that Barrett Group clients receive access to much more granular data during their career change programs. The program goes through the general industry screening, in-depth target company profiling, or interview preparation stage. Barrett Group data resources encompass literally millions of companies and individual executives’ data.

Location is always a key factor in any career change, even if the preference is for working at home. Chart 6 details the location of this executive population which, like so many others, has a very strong New York and Los Angeles presence.

In New York, the largest employers are Northwell Health (+7%), Johnson & Johnson (-3%), and Pfizer (+4%). As far as Los Angeles is concerned, Kaiser Permanente (+1%), Cedars-Sinai (+3%), and UCLA Health (-1%) employ the most executives in this cohort. Miami’s biggest employers of execs include Baptist Health, Memorial Healthcare System, and Jackson Health System. Rounding out the top five, Boston’s are Massachusetts General Hospital, Beth Israel Deaconess Medical Center, and Takeda. Washington DC’s include Inova Health System, MedStar Health, and the Children’s National Hospital.

Internationally, London comes in at rank nine. Here GSK, NHS, and Barts Health NHS Trust represent the major employers of health care execs. Toronto falls in at number 17 headlining Sunnybrook, University Health Network, and HOSA Canada as top employers. Paris is number 18 where Greater Paris University Hospitals – AP-HP, Servier, and Essilor Group top the bill.

Peter Irish, CEO, The Barrett Group

Click here for a printable version of Health Care 2023.

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represent a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.