INDUSTRY UPDATE: A World of Executive Opportunity

Introduction:

The Barrett Group principally covers the three regional markets noted below with some exceptions. But there is truly a world of executive opportunity out there if you know where to look. More than 450,000 executive positions were filled in the past year in these markets. To be sure, the rates of growth and change vary considerably. And that is exactly why we publish this Industry Update now.

Macroeconomically, the US exhibits positive data. The GDP is up 2.4% in Q2 reflecting “…increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending that were partly offset by decreases in exports and residential fixed investment.” [See source.] Personal income rose by $236 billion vs. the first quarter. Disposable income increased by $248 billion. Personal savings also added almost $20 billion to reach $869 billion in Q2. Overall, the economy may well avoid a recession, in spite of rising interest rates and wages, coupled with persistently low unemployment.

Canada has a different dynamic:

“Real GDP growth will decline to 1.4% in 2023. Higher borrowing costs will weigh on activity. Lower commodity prices have unwound last year’s terms of trade gains. Demand will strengthen through 2024, but annual output growth will remain below the economy’s long-run potential rate at 1.4%. Exports will benefit from improved global conditions, while immigration boosts private spending and labour supply. Price pressures will ebb as the jobless rate rises from recent lows.” [See source.]

In the UK:

GDP growth is still muted at an expected 1%. Wages have grown by about 4%, but disposable income has shrunk in the latest data [See source], and inflation remains stubbornly high. As a result, the “…Bank of England raised interest rates to 5.25% on Thursday 3 August, up from 5%. It’s the 14th consecutive rise since December 2021, when Bank Rate stood at just 0.1% and puts Bank Rate at its highest level since 2008.” [See source.]

In the EU:

Headline inflation is expected to decrease from an average of 5.4% in 2023 toward 2.2% in 2025. GDP is expected to decelerate to 0.9% in 2023 before picking up speed in 2024 and 2025. “As inflation falls, household income recovers and foreign demand strengthens, real GDP growth will pick up in the coming quarters.” [See source.] Employment remains tight. “Growth in compensation per employee is projected to decline from 5.3% in 2023 to 4.5% in 2024 and 3.9% in 2025, with wage increases expected to be well above historical averages in both the public and private sectors.” [See source.]

So this slice of the world presents a mixed picture—even more complicated, of course, at the country or local level. However, on balance, the macro-economy is a far cry from the disastrous outlook predicted by some in late 2022.

Let us now turn to the market for executives.

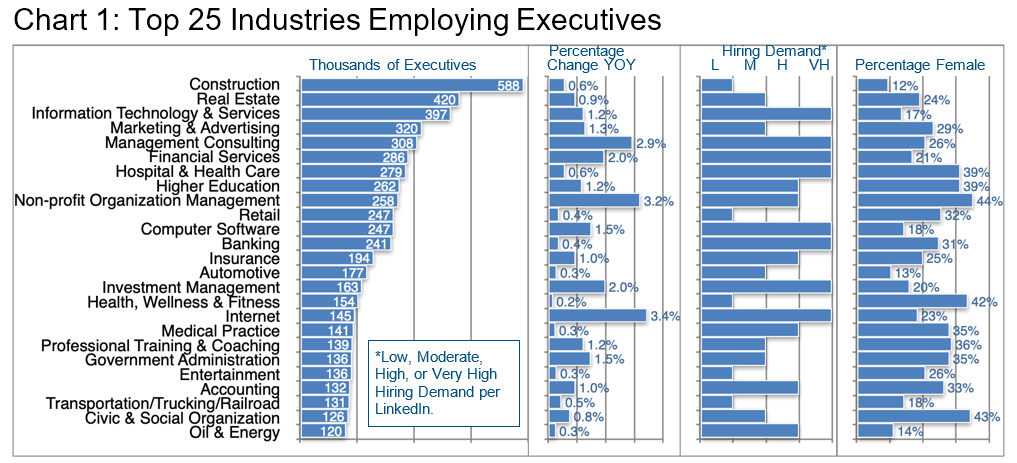

Chart 1 presents the top 25 industries employing executives whereby the strongest YOY growth is evident in the Internet, Non-profit Organization Management, and Management Consulting areas that also show high or very high hiring demand. The Non-profit segment also demonstrates a very high share of female executives as do Civic & Social Organization, and Health, Wellness & Fitness.

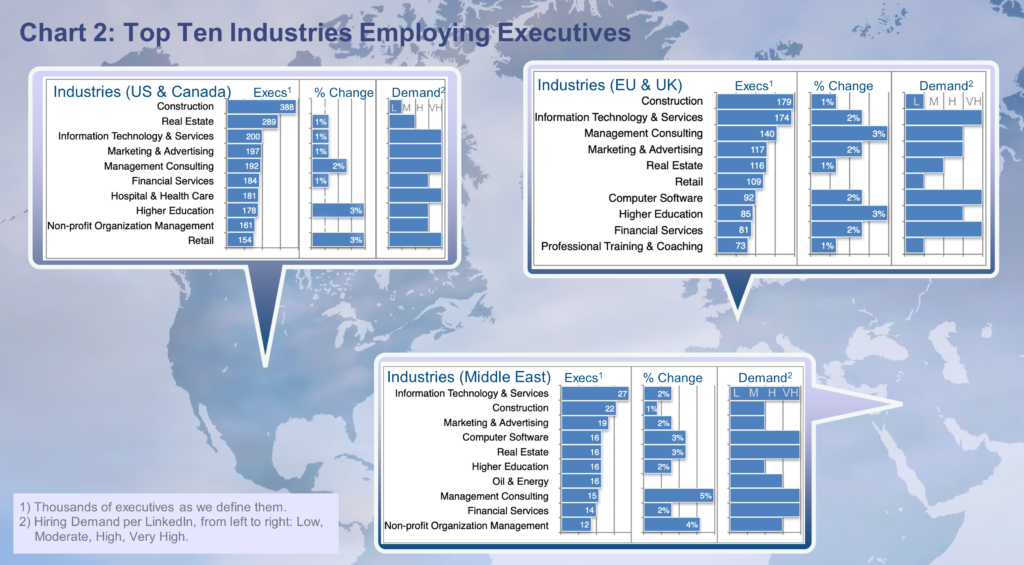

Chart 2 provides an overview of the relative importance of different industries as employers of executives in three major geographic regions. For executives desirous of finding a new role, Demand2 may be the most important indicator of all, as it reflects the near-term desire of employers to find executives in that segment.

In that context, Information Technology & Services occupies the unique position of exhibiting very high demand in all three regions. In the US & Canada, Retail demonstrates both high growth and very high demand whereas Hospital & Health Care show only very high demand with no growth, indicating the relative difficulty of finding relevant executives in the latter segment. By contrast, Retail seems to be flagging in the EU & UK with neither growth nor demand.

Perhaps some execs in that sector might want to contemplate a change of industry.

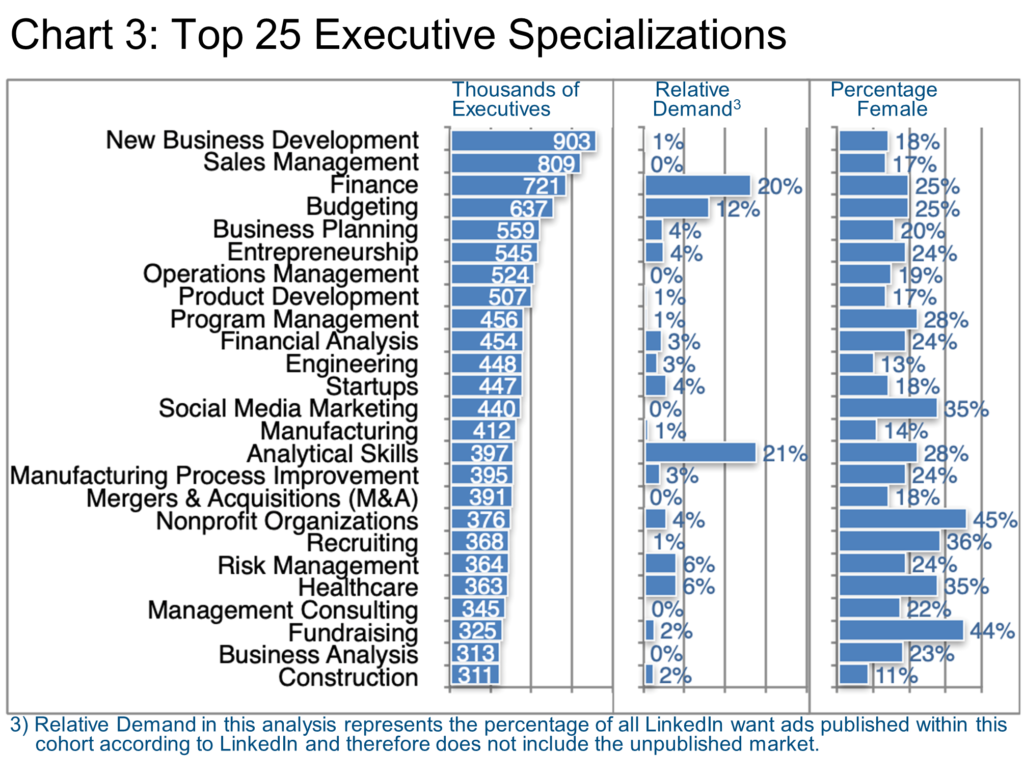

Chart 3 reviews executives’ stated specializations. Typically New Business Development and Sales Management come out high on this list, as is the case here, too, however, the relative demand for these skills appears weak at the moment. On the other hand, these two are among the most transferable of skills from one industry to another, as are Finance and Budgeting, which both appear to also be in relatively high demand. Analytical Skills also stand out in the relative demand dimension while also being highly transferable.

The Barrett Group helps clients cope when they see the need to change industries, roles, or, indeed, locations—or when they are forced to make a change due to unexpected interruptions in their careers. Our initial “targeting step” (the Clarity Program©) guarantees that clients do not simply rinse and repeat their previous career experiences without at least considering and quite often redirecting their professional trajectories toward an alternative career path.

Here is how one landed client summarized his Clarity experience: “Engaging The Barrett Group has been well worth it. I wanted to find the exact job I wanted but I didn’t even know what the exact job might be. I certainly never considered that it would be in a completely different industry!” said Kia. “How much you put behind your slogan ‘We are here to help’ is not just lip service – the value you give back to clients is probably more than clients anticipate they will get.” [Kia Banisadre, Read more.]

Female executives also feature in Chart 3 in Non-profit Organizations but also in Fundraising, Recruiting, Social Media Marketing, and Healthcare.

At the Barrett Group. we see any specialization’s lower female shares as opportunities for enterprising women to challenge the status quo—not accept it. [Read more.]

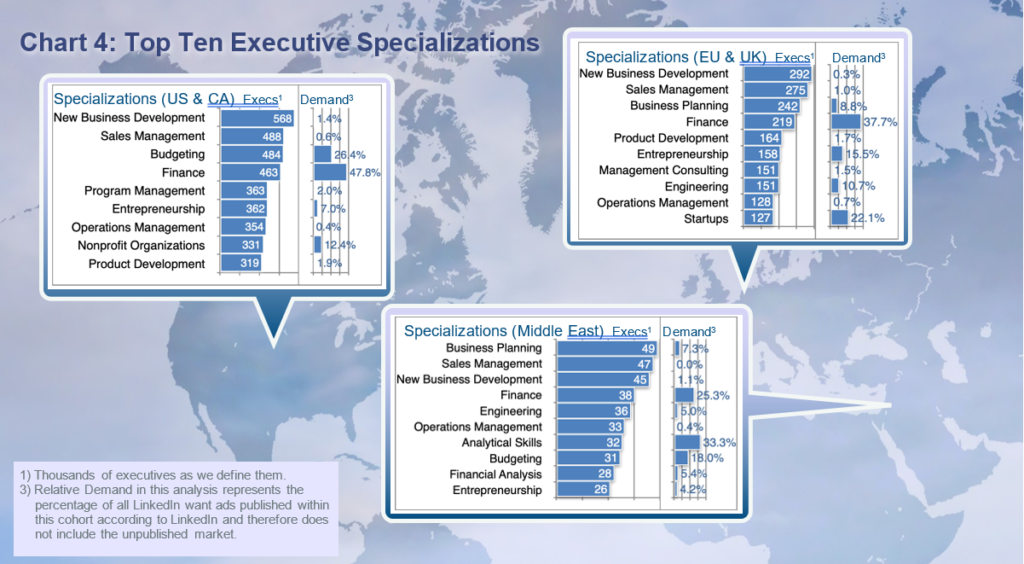

In Chart 4 we begin to examine the specializations at the regional level, noting that there is much similarity, but also there are some key differences such as the strong demand for Nonprofit Organizations experience in the US & Canada versus a need for Engineering in the EU & UK. Finance seems to be universally in strong demand, and Budgeting, too, at least in the US/Canada and Middle East. Analytical Skills really stand out, too, in the Middle East. Please note, as per footnote 3, the demand figures here cover only published want ads that typically represent just 15-25% of the market in our experience.

The US economy comprises circa 33 million companies [See source.] The EU, 30 million [See source]. In the UK, there are more than 5 million private businesses [See source.]

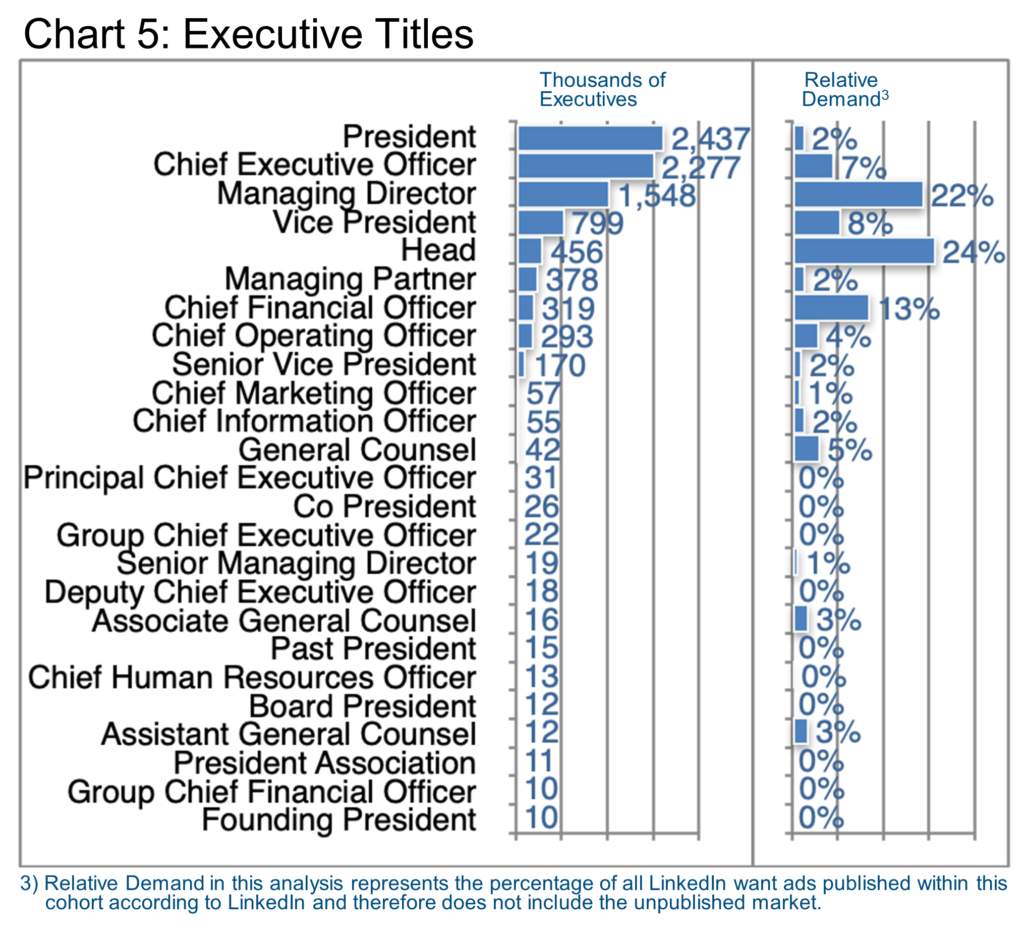

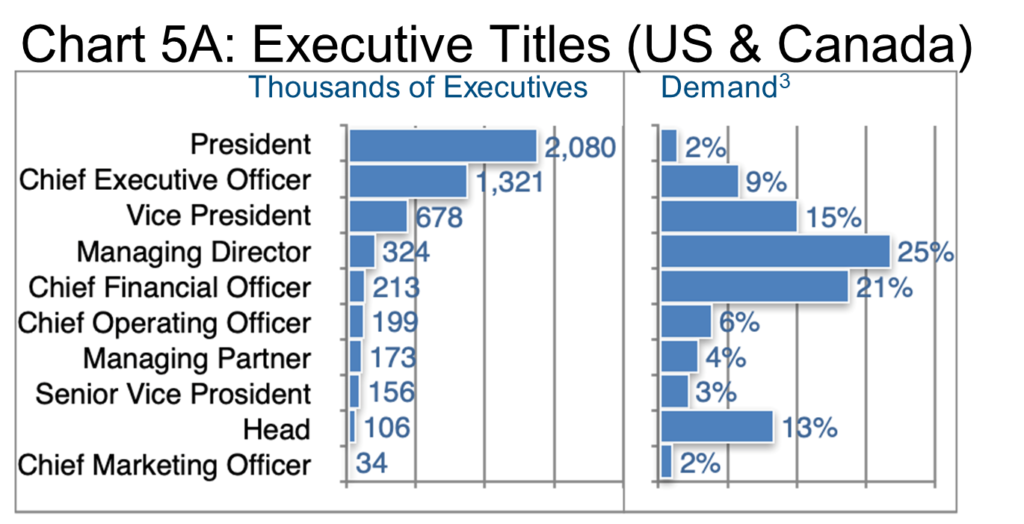

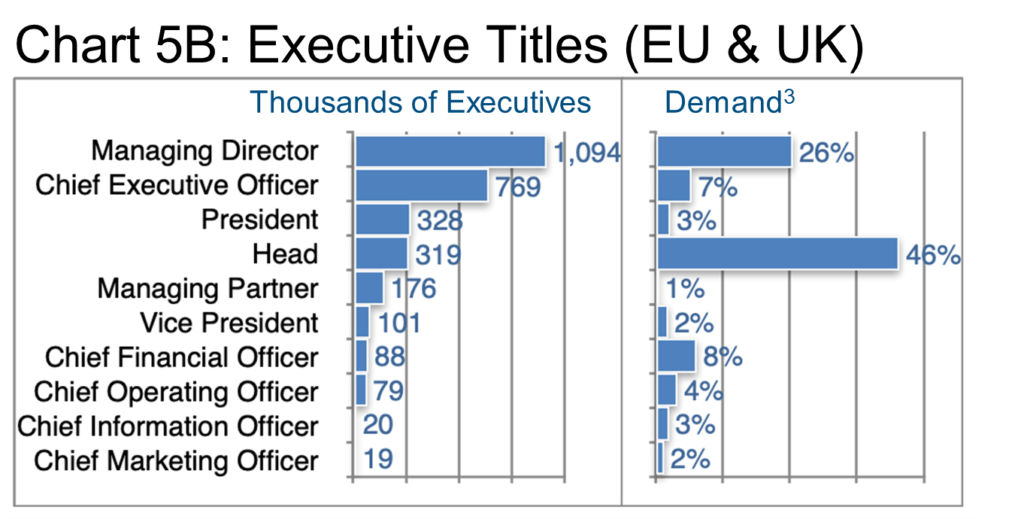

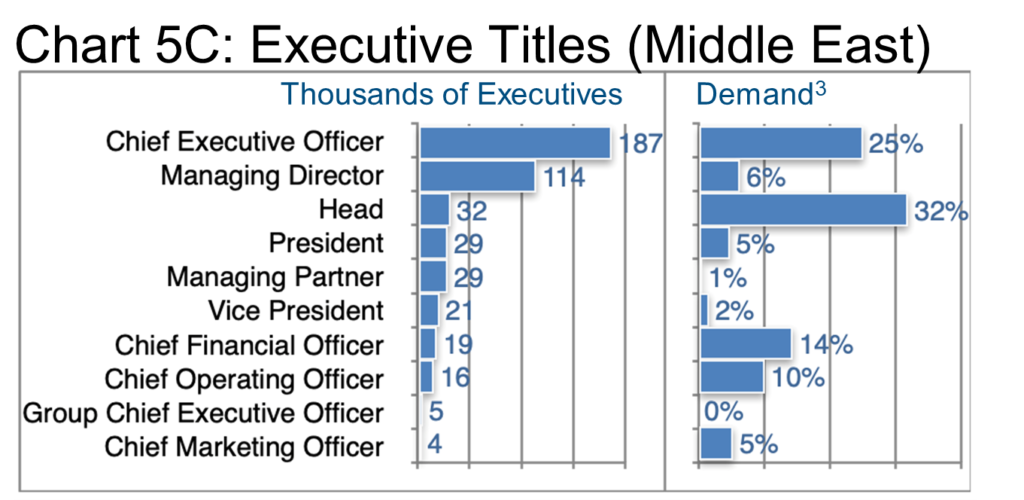

Without going into the Middle East or Canada, we think readers will therefore understand why there are so many Presidents and CEOs in Chart 5: every company has a top position, but many do not have much of a second tier. In any case, across the cohort we are exploring, President and CEO were the most common titles, but there seems to be far more demand for the Managing Director and Head titles, followed by the CFO role. See charts 5A-C for regional variations in the top ten roles.

Generally, demand for executives is local, in spite of the increased incidence of remote work since 2020.

Therefore, Chart 6 looks at the top ten locations for executives in our three macro-regions. The percentage change alone simply does not tell us very much except that Istanbul (+2.5%), the UAE (+2.4%) and Saudi Arabia (+2.1%) have grown the fastest of any of these locations YOY, followed by Paris, London, and Frankfurt (all at +1.8%) and Munich (+1.7%).

Toronto manages 1.2%, but regional growth in the US is generally in the 0-1% range and hardly deserves our attention. However, the hiring demand as forecast by LinkedIn looks far more interesting—see the charts below.

Remember, clients of the Barrett Group have access to significantly more detailed data at multiple stages during their career changes.

Peter Irish, CEO, The Barrett Group

Click here for a printable version of Industry Update: A World of Executive Opportunity

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn. It represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.