The Reluctant Recovery

Clearly, this is not the vertical lift-off politicians were hoping for. In fact, the recovery, if there is one, is more like a patchwork quilt. Certain areas and industries are performing better while others suffer.

Perhaps you should not wait for the world to catch up. Perhaps you should instead lay plans for your own personal economic recovery. Let’s find out.

Fortune has a great map of the United States, for example. The map illustrates the unemployment rates per state. Kentucky (4.3%) and Utah (5.1%) show a V-shaped recovery in unemployment numbers. Massachusetts is experiencing the highest unemployment at 17.4%. The same article shares a survey of CEOs. Only 9% of CEOs predict a rapid (V-shaped) recovery.

Bloomberg runs a Recovery Tracker. US industries and economic indicators are the tracker’s focus. Active oil rigs show the worst impacts right now followed by same-store (retail) sales. Restaurant bookings and airline passenger traffic shows a slight improvement since the worst ratings in the depths of Q2.

The CBO says this about the recovery (having walked back it’s previously relatively robust predictions):

- CBO projects that if current laws governing federal taxes and spending generally remain in place, the economy will grow rapidly during the third quarter of this year.

- Real (inflation-adjusted) gross domestic product (GDP) is expected to grow at a 12.4 percent annual rate in the second half of 2020. It is expected to recover to its pre-pandemic level by the middle of 2022.

- The unemployment rate is projected to peak at over 14 percent in the third quarter of this year. It is then expected to fall quickly as output increases in the second half of 2020 and throughout 2021.

On August 7th, the New York Federal Reserve reduced its forecast for Q3 GDP growth by two points to 14.6%. It cited weakness in non-farm payroll.

The Economist (August 1, 2020) reported that the German economy contracted by 10.1% in Q2 versus Q1. This was the biggest decline ever recorded. Industrially, the World Tourism Organization reported that worldwide there was a 56% decline in tourist arrivals (through May YOY). This translated to a loss of revenue of about $320 billion.

Meanwhile, both in the US and Europe, governments pump money into the economy at a rate of more than 10% of world GDP. More stimulus is likely to come.

And the virus continues to claim victims, though a vaccine may be available earlier than previously predicted. Whether a vaccine will impart temporary or continuous immunity, however, remains a mystery.

In short, it seems that things are unlikely to go back to normal any time soon.

So waiting is probably not a good strategy.

At the Barrett Group (TBG) we have not been sitting on our hands. Since the beginning of April we have now helped more than 72 executive clients find jobs of their choice. And the rate actually increased in July (the historical “low” season for executive hirings). Our Hiring Line website reports on all the particulars. As an example, one executive followed our negotiating advice and increased his package by $80,000!

There are certainly profound shifts in industrial demand as energy, aviation, hospitality, tourism, and some retail sectors implode. And other businesses explode—particularly health care and technology—where demand dramatically increased.

We mine these opportunities. We help our clients uncover them in the unpublished market (where about 75% of our clients typically land) before they are ever made public.

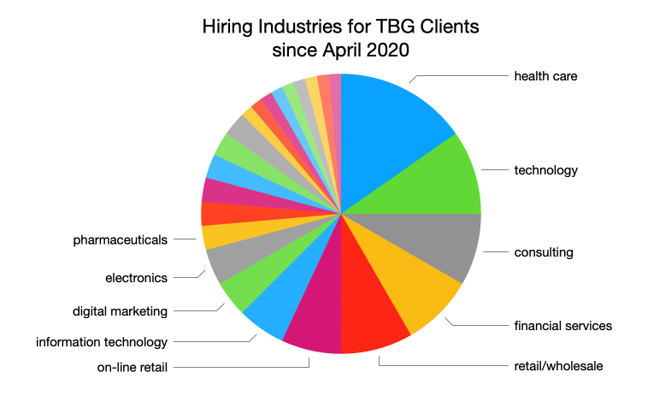

Not surprisingly, health care is on the top of the heap as far as hiring industries are concerned. Based on our clients’ experience, healthcare is followed by technology, consulting, financial services, retail/wholesale, and on-line retail. The top 10 industries constitute 74% of TBG client hirings since April (see the graphic for details).

With our help, executives rethink their career history. They are able to reposition their experience so as to make it demonstrably transferable.

But we also look during the Targeting stage of our five-stage career change program. This is where the client is most comfortable with respect to emotional and quality of life factors as well.

A six-member team supports you as you move through our process. Our clients are vastly more effective in their job searches than their competition because of our support.

So if you are unsure about your career prospects. If you were laid off and need to change industries? Maybe you want to increase your compensation. Maybe you need support after spending frustrating months spinning your wheel. Or maybe you are in a job market you do not understand.

Consider my professional career management advice. I am a thirty-year industry veteran. I am delighted to help executives to implement their own personal economic recoveries, right now, in spite of the the pandemic.

Contact TBG.. Your own personal economic recovery can start today.

Peter Irish

CEO

The Barrett Group