INDUSTRY UPDATE: Venture Capital and Private Equity – October 2021

Industry Update: Venture Capital and Private Equity

It is a fact that the current business environment has been difficult for some industrial sectors while allowing others to flourish. Clearly, venture capital (VC) and private equity (PE) belong to the latter group.

“Global venture capital investments hit record high” read one recent headline from Reuters. (See source.) The article went on to cite capital inflows of $268.7 billion through July—$17.5 billion more than prior year to date. The article went on to explain, “The bulk of these deals were in software, e-commerce, digital healthcare and fin-tech companies, whose products and services have seen strong demand during the pandemic…”

Bloomberg reported that by mid-2021 the PE sector had “amassed a record $3.3 trillion of unspent capital” creating a war chest for continuing growth in M&A activity. (See source.)

So who are these mysterious VC and PE companies? What do they do? And more importantly, are there executive opportunities in the sector?

Recently one long-time industry insider, Fabiano Aguilar, Managing Director of Parabellum RE, Miami, gave an interview to The Barrett Group. He laid out a simple explanation to help readers differentiate between these two important subsectors.

“VC and PE are loosely thrown acronyms but there is a very clear distinction. Venture Capital is when you create or develop an idea, a product or a service… you create a beta version of that service. Then you hire the initial staff. You test different business models… and once you find something that works… I tend to call it the “trinity”… the right product or service, the right clients or channels, and the best pricing… then you go for capital—for growth capital. Most entrepreneurs don’t get to the trinity. They die on the beach as they are trying to develop those products and make their companies relevant.”

“Private equity is usually for companies that need growth… companies that have been around for some time… Either they need growth to increase their market penetration or sometimes there is consolidation… you get companies from different geographies so you consolidate and build a larger play, or you are trying to prepare them for a strategic or IPO exit.” [Fabiano Aguilar, Managing Director of Parabellum RE, Miami, Listen to the whole interview.]

So who works in these related sectors?

In the United States, EU, UK and Middle East, approximately 24,600 executives as we define them are employed in this sector. It’s a cohort that grew by 8% in the past year. It has seen 1,370 job changes in the same period. These executives are overwhelmingly male (82%) and LinkedIn cites the hiring demand in general as “very high.”

Please remember that this is just the tip of the iceberg. Every one of these firms has a portfolio of companies in which they are invested. And every one of those companies employs further executives. For example and chosen purely at random, let’s look at Battery Ventures. It is a US-based, mid-level company in terms of the number of executives directly employed, lists 590 companies in which they are invested. If the same relation were to hold true for all VC and PE companies (which we cannot verify), then just the companies we cite later in this update would cover more than 60,000 portfolio companies.

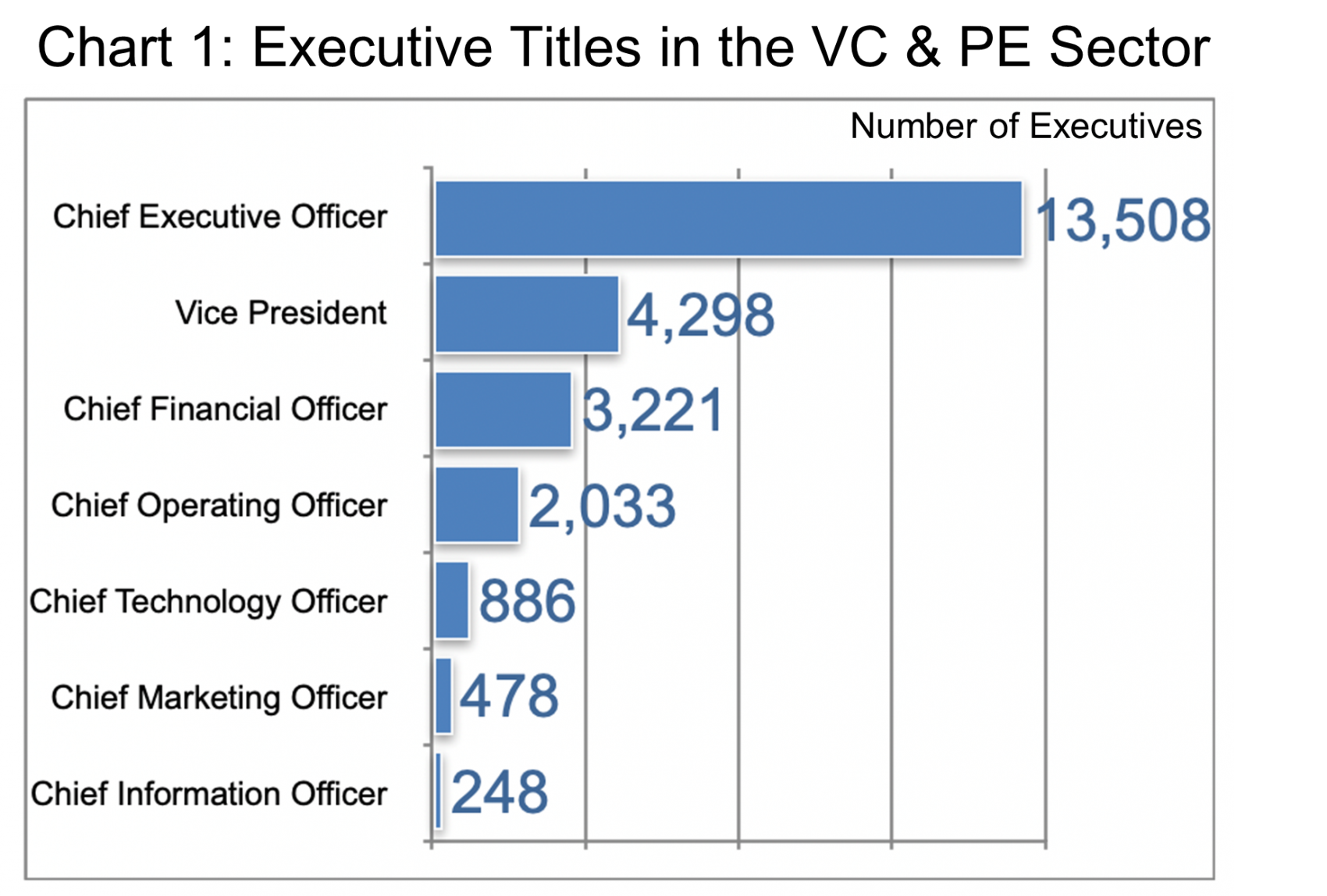

In any case, the directly employed executives in this sector are naturally somewhat top-heavy in terms of titles. This is because they are generally not involved in the operational work of their portfolio companies, at least not full-time. As a result, there are far more CEOs than any other executive title. (See Chart 1.)

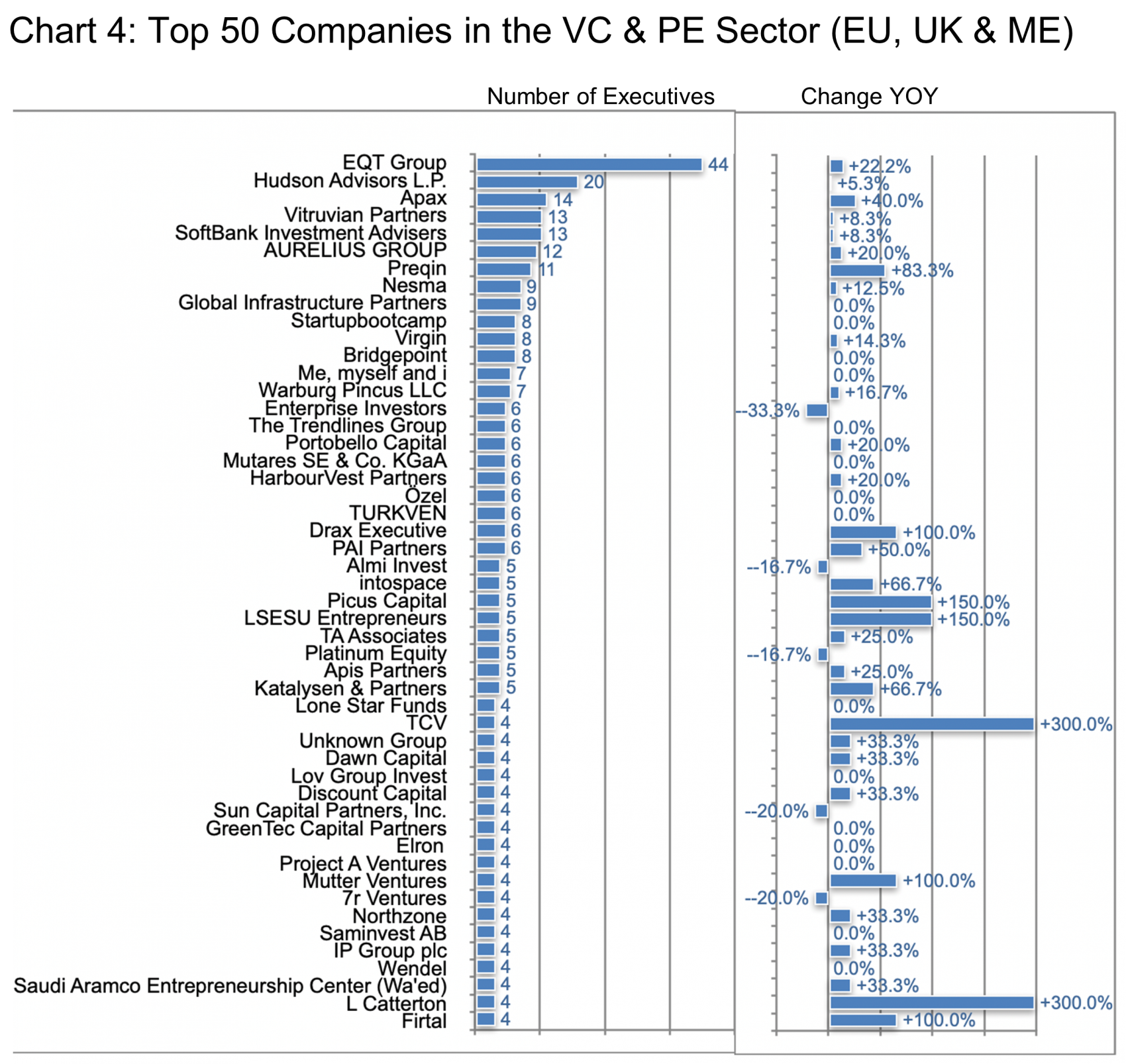

In Charts 3 (US) and 4 (EU, UK & ME), the largest companies (in terms of executives employed in the sector as well as their relative growth rates YOY) are listed. Attrition data is spotty for this sector so we will not report it in this update, but clearly there is a lot of movement.

The Barrett Group (TBG) clients, of course, can have detailed insights into any of these companies, but let us investigate a few of them here to better understand the movement of talent.

In the US, HarbourVest Partners, for example, grew by about 35% in terms of its executive team during the past 12 months. Our data shows about 151 hires vs. 60 departures. It has the pace of hiring increasing in the second half of 2021. The hires came from PWC, Cambridge Associates, Fidelity Investments, BlackRock, CVS Health, Brown Brothers Harriman, State Street, Credit Suisse, Advisor 360, and Citi to name just the top sources.

Apax, on the other hand, which employs the bulk of their executive talent in London. They also saw a 40% increase with 78 hires and 39 departures in the period. The hiring trend in this case has been pretty steady over the course of 2021. The talent influx came from Boston Consulting Group, Bain Capital, Mezocliq LLC, McKinsey & Company, and Morgan Stanley. Also Evercore, Goldman Sachs, 3i Group plc, MSD Capital L.P., and J.P. Morgan to name just the larger talent donors.

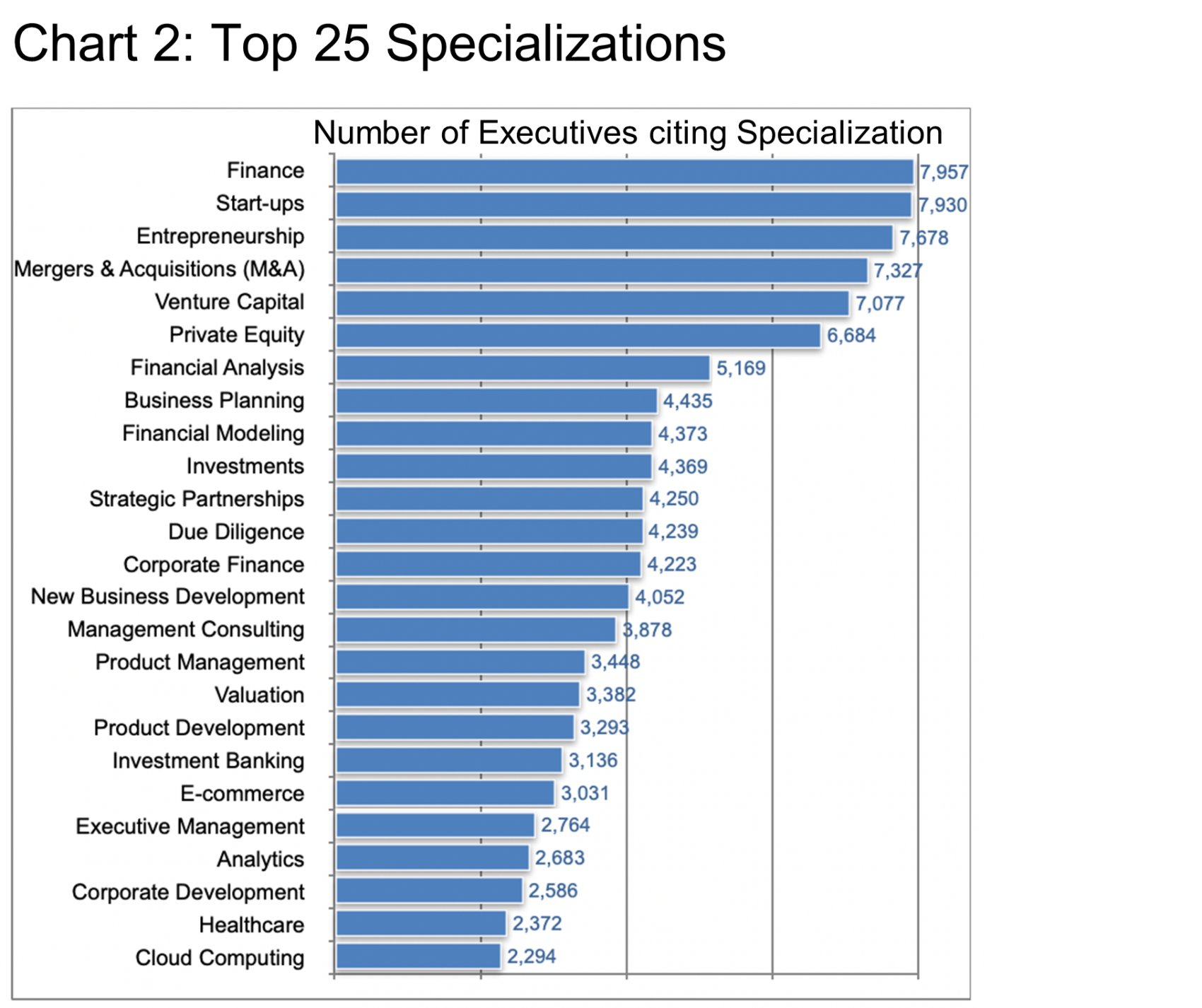

Presumably, each VC and PE company is actively curating its talent to have the right mix of skills and quality of performance at all times. In that context, Chart 2 cites the top 25 specializations claimed by executives employed in the sector as we have defined it regardless of geography.

Why are we seeing so much growth in the VC and PE sector?

Pitchbook, an important marketplace for these industries, cites the changes we summarize below:

In the past, companies needing growth capital beyond what their private investors could provide essentially had to go public to tap capital markets. This has changed because the volume of private capital available has grown enormously. Attractive returns have reinforced this trend. Therefore companies have been less likely to tap public markets. “As a result, we’ve seen a sharp influx in the number of VC-backed startups and PE-backed companies in recent years. In other words, as more money flows into this space and as more companies stay or start up within it, the private markets will continue to grow in value and opportunity.” [Pitchbook, See Source.]

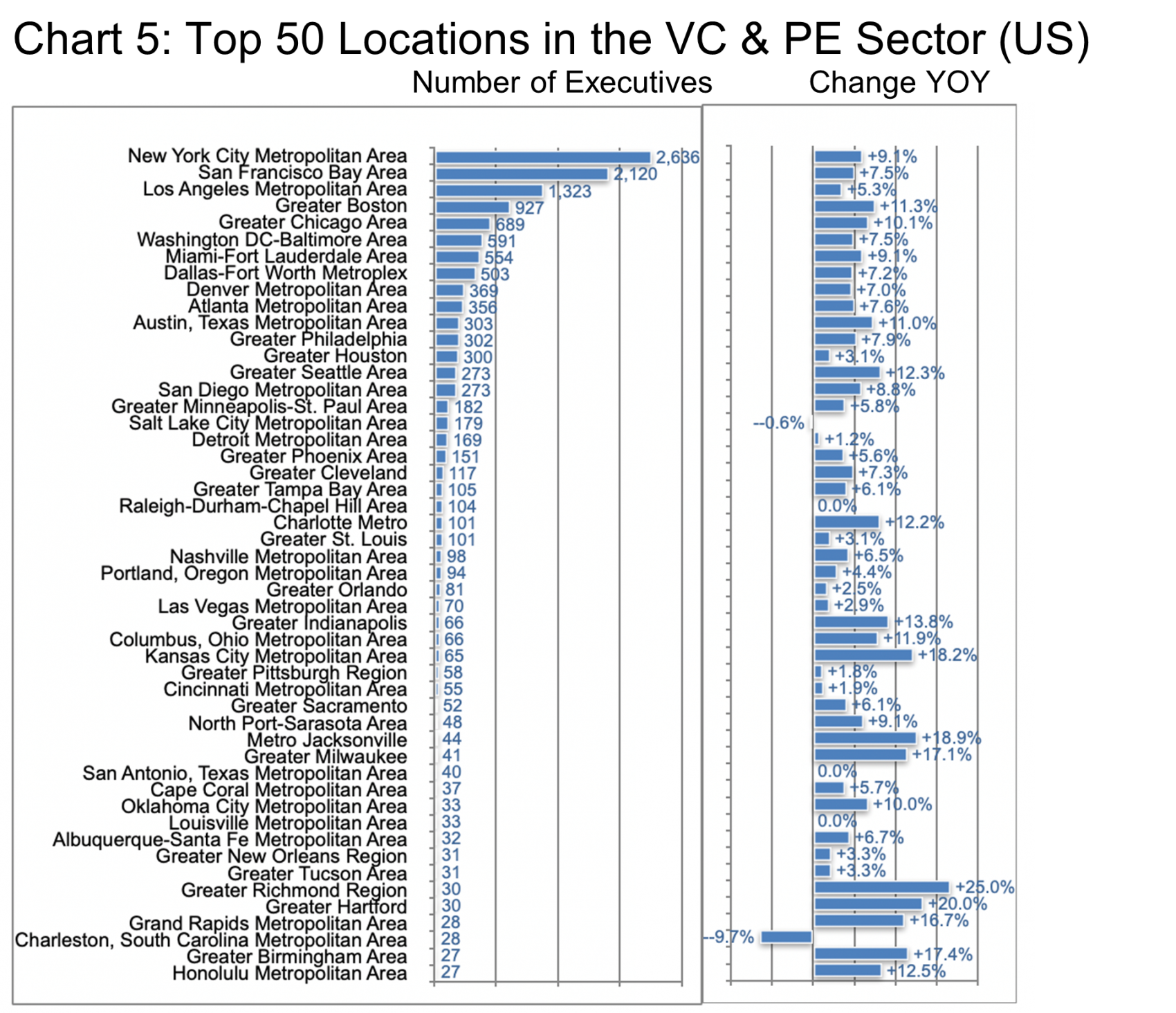

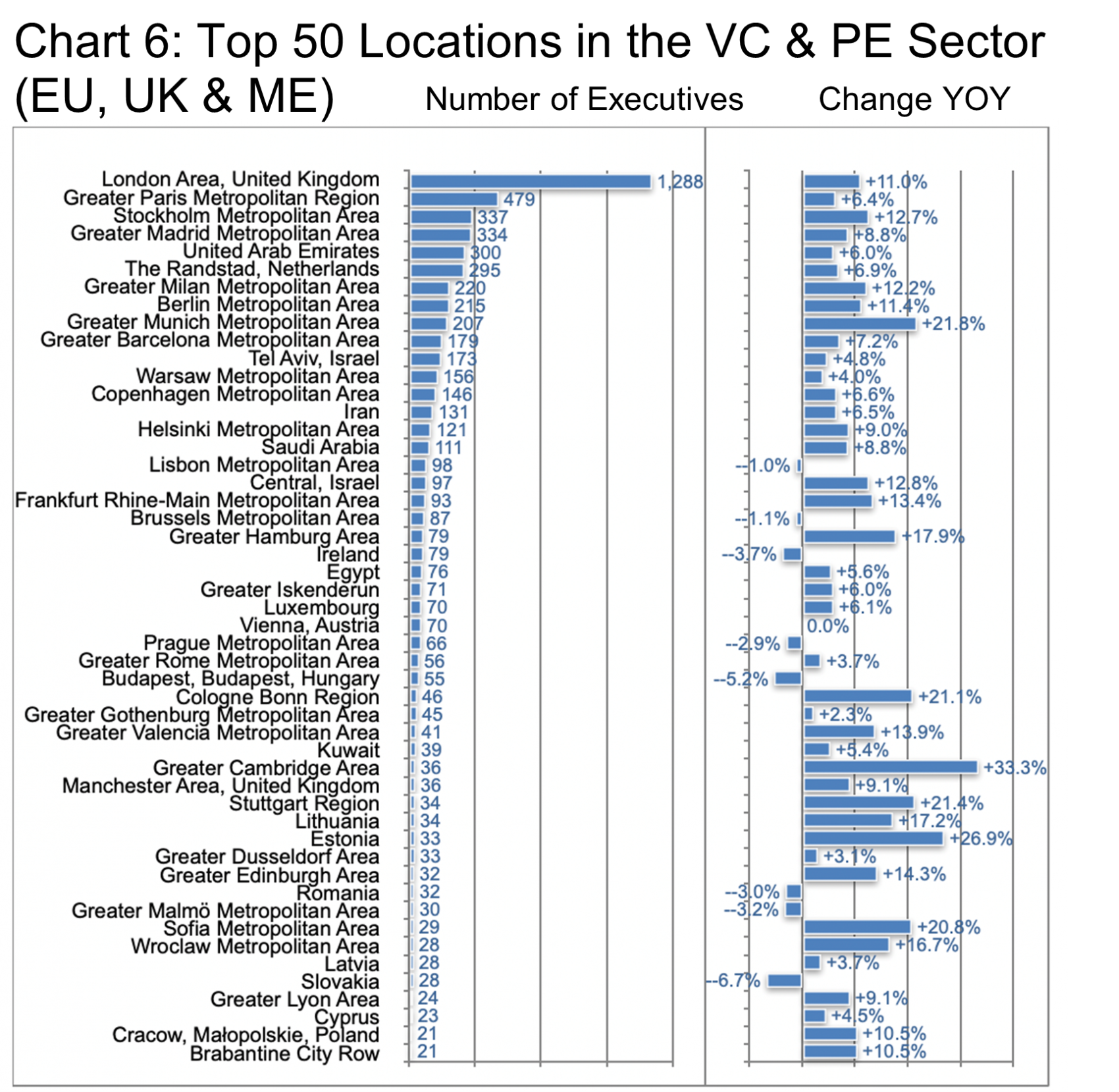

As far as locations are concerned, the executives employed in this sector are somewhat predictable. They are concentrated in the financial centers of their respective geographies per Charts 5 (US) and 6 (EU, UK & ME). Growth in employment is broadly distributed. Even the heavily entrenched cities are still growing strongly, e.g., New York or London.

Editor’s Note:

In this Industry Update “executives” will generally refer to the CEO, CFO, COO, CTO, CIO, CMO and Vice President titles only. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research. Is LinkedIn truly representative? Here’s a little data: LinkedIn has approximately 722 million users, 174 million in the US and 163 million in Europe. (See Source) It is by far the largest and most robust business database in the world, now in its 18th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year. “Attrition” is defined as the departures in the last 12 months divided by the average headcount over the last year.

Peter Irish, CEO The Barrett Group

Click here to download a printable version: Industry Update – Venture Capital and Private Equity