INDUSTRY UPDATE: Marketing & Advertising

Introduction

Advertising and marketing used to be so simple. Broadcast, print, point of sale… the options were limited and there were relatively few outlets. It seemed at least as if access to any given audience was highly controlled by a small cadre of media outlets. However, the proliferation of “outlets” over the last decades is astounding. Speaking only of “newsrooms”, one source says, “…we have over 3,000 outlets that call themselves newsrooms in America.” (See source.)

Indeed, all media have undergone a rapid transformation. Here is a summarized example from the US Census Bureau:

- “Total estimated weekday circulation of U.S. daily newspapers was 55.8 million in 2000 and dropped to 24.2 million by 2020…”

- “Newspaper publishers’ revenue in 2020 was less than half what it was in 2002, dropping from $46.2 billion to $22.1 billion…”

- “Periodical publishing dropped from $40.2 billion in 2002 to $23.9 billion in 2020.”

- “In 2020, Video Tape and Disc Rental revenue was $1.1 billion. That is about one-ninth of what it was in 2002 ($9.4 billion).” (See source.)

Similar trends are visible worldwide.

The major beneficiaries have been digital media. Those are particularly internet-based outlets, social media platforms, search engines (e.g., Google), and omni-channel players such as Amazon. As a result, the “…market for digital advertising is anticipated to surpass $700 billion by 2025 and reach $835.8 billion by 2026. This amounts to a 60% increase from 2021 and will account for 72.5% of all media advertising spending. In other words, by 2026, over $0.73 of every $1 spent on advertising will be for digital ads.” (See source.)

“The United States remains the indisputably largest advertising market in the world, with an expenditure that often surpasses most of the other countries in the top 10 combined. The sector forecast[s] that the U.S. ad industry revenue will grow by 2.6 percent in 2023, reaching a record-high 352 billion U.S. dollars. As a multifaceted and dynamic business, advertising and its many moving parts have marched in various directions. According to the latest projections, the digital segment’s hegemony is far from reaching its limits. In 2022, the Internet accounted for an estimated 63 percent of the U.S. ad expenditure. The share is expected to surpass 68 percent by 2026. Yesterday’s flagship, television, may see its stake decline from almost 21 to less than 18 percent in the same period…” (See source.)

However, Europe is also a large and attractive advertising market.

“According to 2023 forecasts, the continent alone will account for almost one-fifth of ad spending worldwide […] Its robust revenues are expected to continue to expand, albeit at a relatively slow pace. In 2023, Europe’s ad expenditure will reach an estimated 143 billion U.S. dollars, up two percent from the previous year. And not only the entire region is projected to see that annual figure rise, but also each of the main European markets will likely raise their respective ad revenues. Of those sub-regions, 2023 predictions indicate that Central and Eastern Europe (CEE) will top the ranking of the fastest-growing advertising territories in Europe, with an increase rate of 3.5 percent. The only other market expected to follow a similar pace is the United Kingdom, at 3.1 percent.” (See source.)

As far as the Middle East is concerned, the consumption of media is growing rapidly.

“The Middle East Media and Entertainment Market size is expected to grow from USD [39 Billion] in 2023 to USD [61 Billion] by 2028, at a CAGR of 9.41%…” (See source.) Yet the trend toward digital media is clear even here. “The Middle East and North Africa (MENA) region is no exception to the growing investment in digital ads. In 2020, internet ad spend in MENA amounted to around 4.4 billion U.S. dollars and it is expected to increase to 7.9 billion U.S. dollars by 2024.” (See source.)

Deloitte conducted an interesting survey of CMO’s priorities recently. Here is one comment on their findings in the Middle East: “This survey provides valuable insights into the current state of marketing in the Middle East and the priorities for brands as they look to the future. We are encouraged to see a strong focus on sustainability, creative transformations, and the adoption of emerging technologies to drive growth and customer engagement.” (See source.)

These trends are also visible in other regions, of course.

The importance of the shift toward streaming content cannot be ignored though as an overall tectonic change in the media landscape: “The global video streaming market size is expected to reach USD 416.84 billion by 2030, registering a CAGR of 21.5% from 2023 to 2030…” (See source.) Even as the major players battle for subscriptions, the real challenge is “catching eyes.” And in that regard, a number of innovations are likely to have an outsized effect.

Among the numerous “trends in marketing” lists available on the internet, here is one we found more valuable than most:

- Increased use of automation and AI.

- Growth of mobile advertising.

- Focus on privacy and protection.

- Shift toward video advertising.

- The emergence of new technologies (e.g., virtual reality, see source.).

The potential of virtual reality is yet to be truly demonstrated.

But there are new buzzwords. Words such as “connected TV” and “programmatic technology” already allude to the growing ability of consumers to purchase a service or product directly from the video link they may be watching (most likely on a mobile device). Or the ability of marketeers to identify a viewer’s current interests and immediately show relevant ads or advertorials. This latter approach, of course, may well encounter some limitations due to privacy concerns.

Inevitably social media will play a larger and larger role as new arrivals such as TikTok capture particularly younger audiences. (See source.) Several other key trends include the fact that even while their frequency explodes, mobile video ads are ever shorter and now often muted so as not to irritate their audiences. Building on the popularity of mobile gaming, advertising increasingly exploits potential synergies with game characters, icons, and references.

In any case, it is clear that advertising and marketing is a very rapidly evolving field. It requires talented and experienced executives to generate the best possible returns. Let us now explore this disparate cohort and see how it is evolving.

The Market for Executives

As defined in the Editor’s Note, this population counts about 319,000. This group has grown by 1% in the past year. Some 10,500 changed jobs which means the total executive opportunity lay in the 13,000 range. Overall, executives in this field have a median tenure of 3.3 years. Only 29% of the executives are female. LinkedIn also says they are generally in “high demand” though that varies by specialization and location, of course.

The US and Canada comprise circa 58% (184,000) of this cohort. But only 40% of the executive opportunities in the past year. The EU and UK on the other hand show higher overall growth (+2%). EU/UK is totaling some 116,000 execs and circa 50% of the overall opportunities. The Middle East group also grew by approximately 2% to 19,000. The Middle East generates 10% of the open opportunities in the period. The size of these organizations is noticeably smaller than many other industries we have studied.

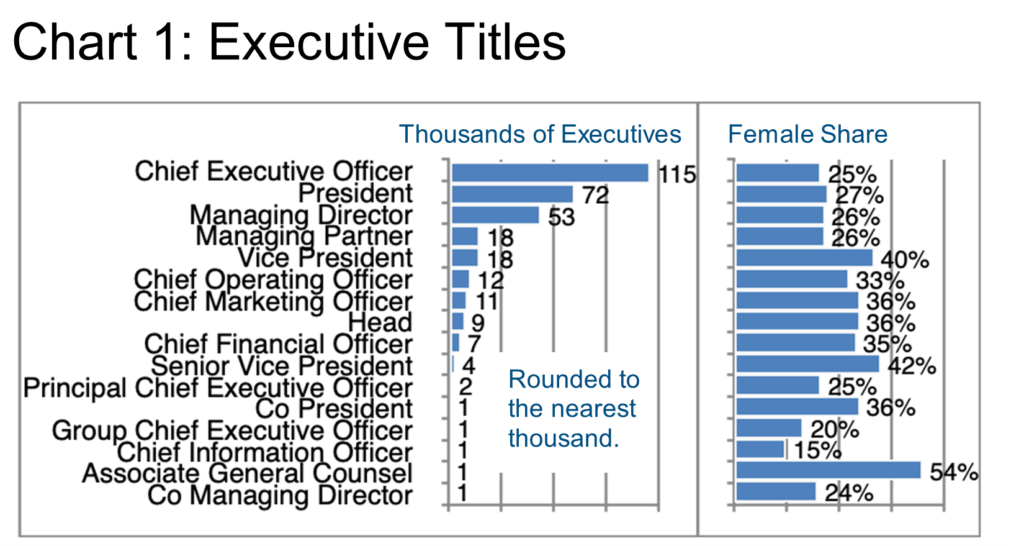

This becomes clear in Chart 1 due to the very high number of CEOs and Presidents in the mix. The inequitable distribution of roles by gender is gradually changing, however. As of the time of this Update, marketing and advertising still relegates women predominantly to various Vice President and Associate General Counsel roles in this industry.

Clearly, advertising and marketing executives may well work in an agency providing services to client companies. Or they may provide in-house support within a company or corporation. Chart 2 reveals the principal industries of these employers. It also shares their growth and demand dynamics per LinkedIn.

On a percentage basis, Venture Capital & Private Equity (+5.4%), Management Consulting (+4.9%), Non-profit Organization Management (+4.5%), and Staffing & Recruiting (+4.3%) have grown the fastest. On the other end of the spectrum, Banking (-4.0%), Consumer Goods (-3.8%), and Restaurants (-3.1%) have declined most rapidly.

Perhaps more important than the historical growth is the current hiring demand according to LinkedIn. The LinkedIn rates shown in the right-hand column are of an unusually high 33% of the Specializations rate as having a “very high” hiring demand. This bodes well for professionals seeking opportunity and having those particular industrial backgrounds—regardless of the historical development.

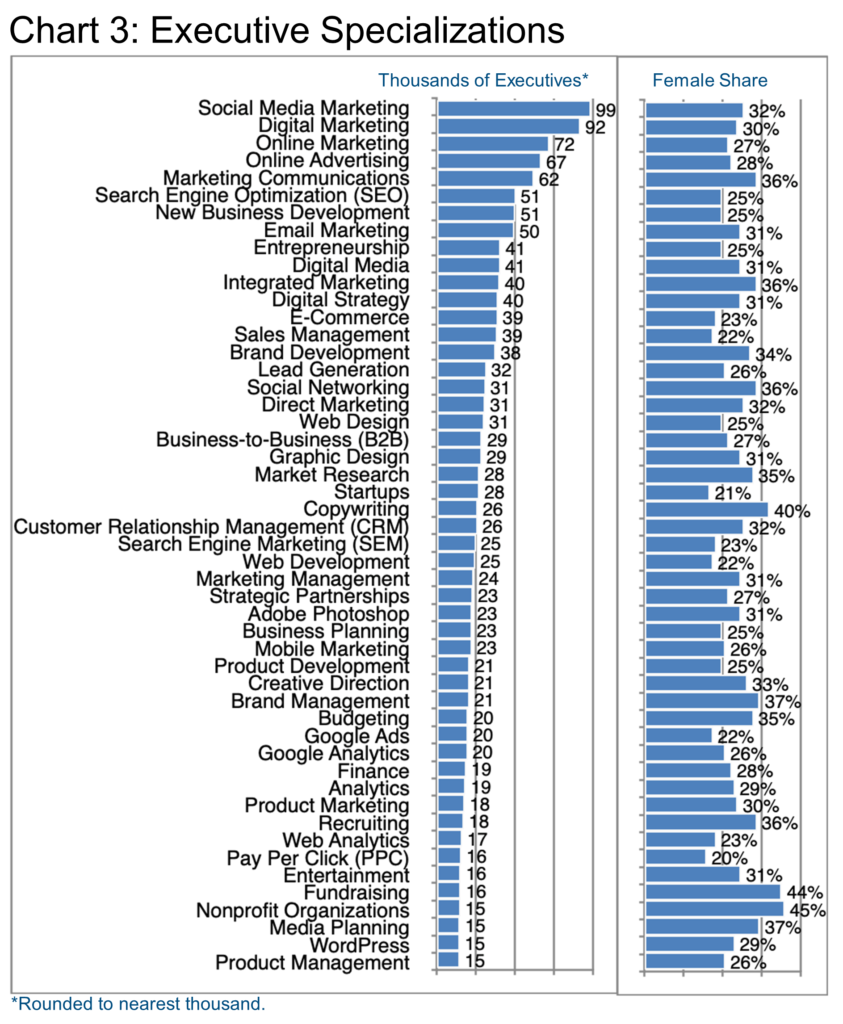

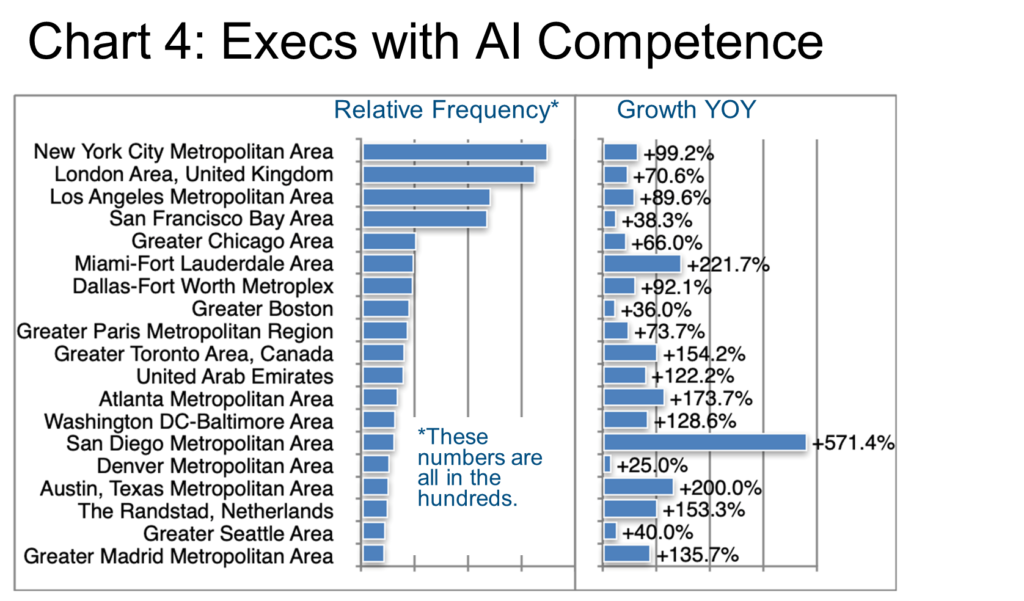

We cannot identify specific growth rates for the Specializations (Chart 3) unfortunately. But it is perfectly clear that Social Media, Digital Marketing, and Online Marketing/Advertising are the top four fields of endeavor—as alluded to in our introduction. More specifically, Artificial Intelligence and Machine Learning as specializations are, of course, running hot at the moment. They are up 103% at something over 3,000 executives claiming AI as one of their specializations. (Remember, we are not talking about programmers here. But rather executives as we define them.) This alleged competence in AI is well distributed geographically. Chart 4 shows New York, San Francisco, and Los Angeles. It also shares London, Paris, and Toronto all showing up in the top ten locations where execs claim this capability.

Why focus on AI?

Here’s what one recent survey of marketing professionals discovered: “Some 82% of respondents say content writers face a high risk of disruption from AI, 43% say email marketers face a high risk, and 34% say social media managers face a high risk. Just over half (50.6%) of digital marketers say they are concerned about AI threatening their job.” [See source.]

Now it is certainly true that over time technology has actually created jobs, possibly more than it has destroyed. However, it is always prudent to keep one eye on the horizon speaking metaphorically and to be prepared for change. That is exactly what the Barrett Group does for hundreds of executives every year (now for over three decades). We help them proactively chart a new course and pursue a change on their own before it is imposed on them. [Read more.]

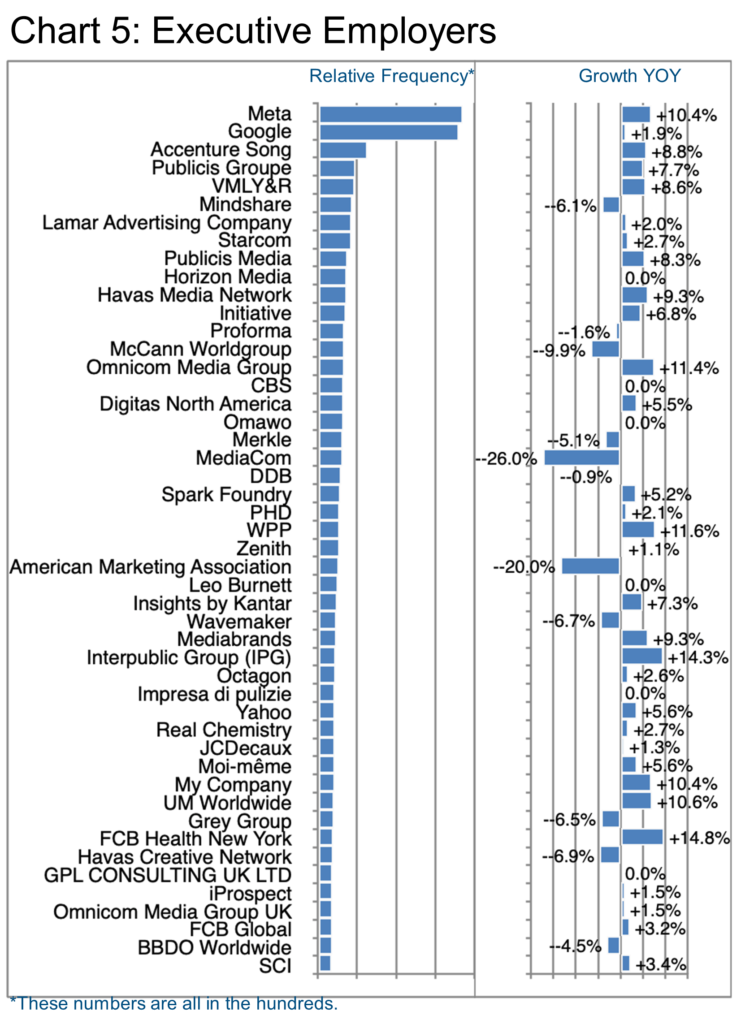

Chart 5 summarizes the largest employers of executives in this field. Because of the highly distributed nature of this market, the numbers are small enough that rounding to the nearest thousand would render them absurd, hence the reference to “relative frequency.”

Of course, clients of the Barrett Group receive far more granular research support, for example, at the initial industry or geographic screening stage, in-depth company snapshots when preparing for interviews, and even profiles of hiring managers as may be required to prepare for offer negotiations.

Per Chart 5, Meta has hired mainly from competitors in the past twelve months. These include Microsoft, Google, Amazon (AWS), and TikTok, but also from banks and, intriguingly, the US Department of Justice. This latter emphasis is hardly surprising when we look at the specializations of the executive staff at Meta which heavily favor litigation, law, legal writing, legal research, intellectual property, and corporate law—the top six skills listed by their executives. Ireland saw the highest percentage of executive hires at this company (+47%), but San Francisco, New York, London, Washington DC, Los Angeles and Singapore comprise their top six hiring locations.

Google’s executive team did not grow very much in the most recent period. But the company still hired executive talent from Meta, Microsoft, and American Express as well as apparently transferring individuals from Mandiant (now part of Google Cloud) and YouTube. Hiring focused on Online Advertising, Strategic Partnerships, E-commerce, Analytics, and Cloud Computing. Sao Paulo apparently had the highest percentage growth (+42%) followed by Toronto (+21%), Seattle (+13%), Chicago (+5%), Ireland (+4%), and Singapore (+3%).

Accenture Song grew mainly via internal transfers from other parts of Accenture and prior acquisitions (Fjord, for example). Analytics, Management Consulting, Customer Experience, CRM, Digital Media, Digital Marketing and related fields comprised their principal areas of growth, specifically in Atlanta (+100%), Chicago and Copenhagen (+40%), Sydney (+33%), and Sao Paulo and Milan (+13%).

Publicis Groupe may be more representative of what we think of as an ad agency though here too transformation is in full swing. Their hiring focused on Digitas North America, MediaCom, and a broad array of smaller, specialist firms. Mobile marketing, Online Advertising, Digital Media, and Digital Marketing seem to have been their talent acquisition focus, specifically in New York, Hong Kong, Mumbai, London, and The Randstad. In contrast, their executive teams in Paris, Chicago, Shanghai, and Singapore all shrank.

In fact, MediaCom (-26%) contributed executive talent to competitors in many of the specializations highlighted above though most of the reduction is apparently an internal move to their affiliate EssenceMediacom. Their executive teams in New York, London, Düsseldorf, Warsaw, and Mumbai are the most affected.

VMLY&R on the other hand continued to grow, adding talent from Red Fuse Communications, FCB Health, TBWA\Istanbul, WPP and a range of other industry sources. Creative Strategy, Marketing Communications, and Online Advertising seem to have been their principal targets as far as specializations are concerned while their ranks grew in Chicago, Miami, Kansas City, and New York in the US and Sydney, Istanbul, Warsaw and Johannesburg internationally.

Mindshare’s executive team declined somewhat with departures for GroupM and Amazon. Sydney and Paris showed growth but other markets such as New York, London, Chicago, Singapore, Frankfurt and Shanghai all showed significant attrition.

Researching mergers and acquisitions (M&A) activity in this field is truly a labor of love because there is a more or less constant fluctuation as agencies acquire, spin off, merge or downsize in the on-going experiment we all know as the Marketing and Advertising industry. Apparently we should expect more of the same going forward due to a number of developments that are driving this high rate of activity including:

- geopolitical realignment between China and the West,

- widespread (marketing) re-skilling requirements,

- the impact of AI,

- the imperative of agencies having enough scale to survive,

- client business and brand portfolio simplification,

- a new crop of incoming CEOs demanding change, and

- a log jam of pent-up M&A activity due to Covid and other factors that are now no longer impediments. [See source.]

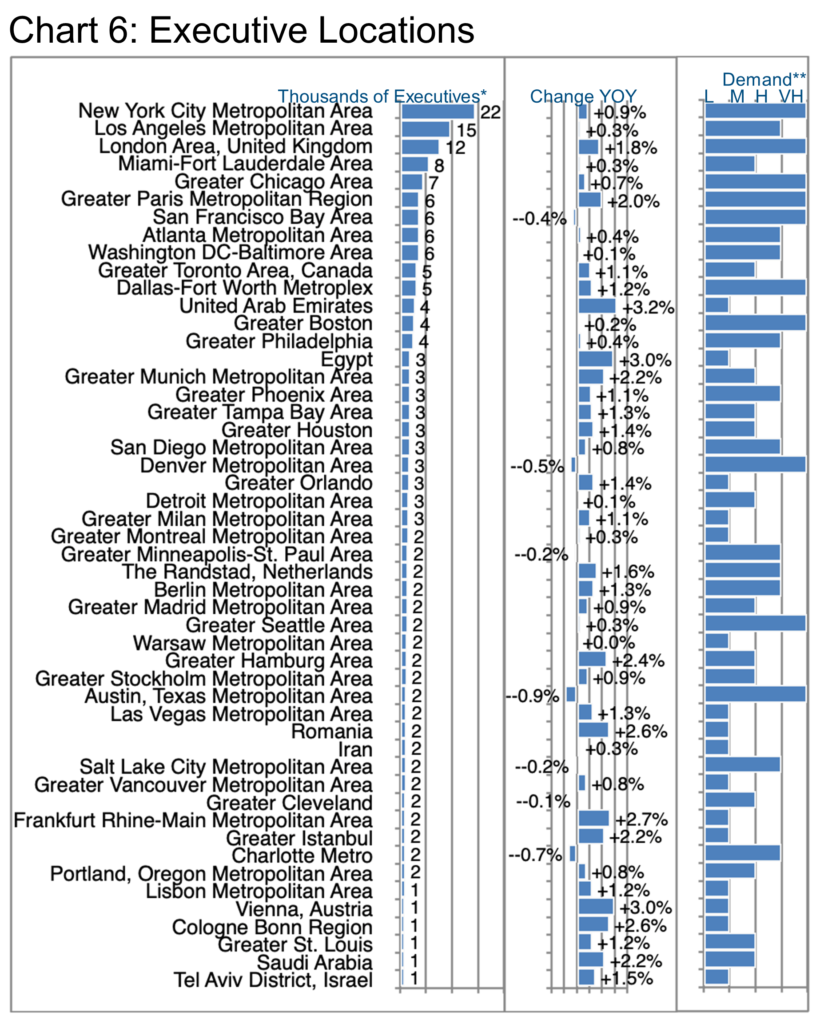

As usual, New York stands at the top of the list.

Horizon Media, Google and Meta ranks as the largest employers of execs in this area based in New York. We have already addressed the latter two in this Update. Horizon Media remains independent while providing the following services: “We provide a full-service digital offering for our clients and have specialized units for search marketing, digital strategy, display, social, mobile, AR/VR/MR, campaign management and analytics, technology strategy, and a dedicated division for creative media solutions.” [See source.] Their overall ranks grew by 5% in the past year while the executive suite did not.

In London, Meta and Google appear again in the top three along with Accenture Song—all of whom have already been addressed in this Update. Paris offers new contestants: Omawo (UK, a specialist in online marketing for business website owners), BETC (France, an agency emphasizing brand communication) and Publicis Groupe (France, per their LinkedIn profile: “Publicis Groupe is the second largest communications group in the world and a leader in marketing, communication, and digital business transformation…”).

Beyond the percentage change also note LinkedIn’s rating of the hiring demand in each market in the right-hand column of Chart 6.

As usual, it is possible that negative growth coincides with high hiring demand—see Denver for example. SRG (a “strategic growth consultancy”), Booyah Advertising (an independent, full-service ad agency), and Core Consulting (Mexico, a “Licensing & Brand Management agency focused on maximizing the potential of consumer products in America”) reign as the largest employers in this sector although only Booyah seems to be growing its executive ranks significantly in the most recent period (+40% YOY).

Austin is also showing negative growth (-0.9%) while experiencing high demand. Meta has added 16% to its ranks in that location but others are relatively stable at the moment with a few notable declines in service organizations providing copywriting and marketing insights. San Francisco is similar, also in that Meta shows executive growth while many others do not.

Peter Irish, CEO

The Barrett Group

Click here for a printable version of Industry Update – Marketing & Advertising 2023

Acting Up Against AI

Imagine you are an actor, perhaps an extra, who hopes to get a few lines in a movie, a commercial, or a series. The risk of AI is that this actor can be filmed (and paid for one day) and then reproduced endlessly by digital means and versioned with AI. This effectively eliminates most of the actor’s livelihood.

“You know it’s bad when the cocreator of The Matrix thinks your artificial intelligence plan stinks. In June, as the Directors Guild of America was about to sign its union contract with Hollywood studios, Lilly Wachowski sent out a series of tweets explaining why she was voting no. The contact’s AI clause, which stipulates that generative AI can’t be considered a “person” or perform duties normally done by DGA members, didn’t go far enough. “We need to change the language to imply that we won’t use AI in any department, on any show we work on,” Wachowski wrote. “I strongly believe the fight we [are] in right now in our industry is a microcosm of a much larger and critical crisis.”” [See source.]

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.