INDUSTRY UPDATE: Manufacturing

Introduction

In recent decades service employment has expanded rapidly while manufacturing employment has fallen. In the US, for example, manufacturing employment has fallen from 19.6 million employees (22% of nonfarm employment in 1979) to 12.8 million (9% of nonfarm employment in 2019).

Durable goods manufacturing showed the largest decline (down 4.3 million) while nondurable goods fell by 2.4 million. [See source.] In 2020, “[a]bout 1.4 million U.S. manufacturing jobs were lost during the early days of the pandemic, […] setting back the manufacturing labor force by more than a decade. However, the industry has largely recovered those lost jobs and is now urgently seeking more workers.” [See source.] By February 2024, manufacturing in the US again employed almost 13 million workers. [See source.] In fact, the total value of manufacturing output rose to $2.9 trillion on an annualized basis in Q4 2023. That is an all-time high. However, while overall business productivity has continued to rise over the last decades, manufacturing productivity in the US has declined about 5% since 2011. [See source.]

“The majority of manufacturing firms in the United States are quite small. In 2021, there were 238,851 firms in the manufacturing sector, with all but 3,920 firms considered to be small (i.e., having fewer than 500 employees). In fact, three-quarters of these firms have fewer than 20 employees, and 93.4% have fewer than 100 employees. With that said, the bulk of employment comes from larger firms, with 59.0% of all employees in the sector working for firms with 500 or more employees.” [See source.]

In the EU, 2.1 million enterprises employed some 30 million persons in manufacturing in 2021.

“The manufacturing sector contributed to one quarter of EU’s business economy net turnover, with [€]8.3 trillion, an increase of 16% compared to 2020. This strong increase can partly be attributed to the exceptional[ly] low value in 2020 due to the Covid19 pandemic.” [See source.] Nevertheless, “[a]n analysis of Eurostat data by the European Trade Union Institute has found that the number of people employed in manufacturing has fallen by 853,000 since the third quarter of 2019.” [See source.]

The value of manufacturing activity in the EU declined almost 3% in 2023 to €2.5 trillion after its stiff 14.5% increase in 2022 from the depths of the pandemic. [See source.]

The UK has also seen a significant drop in manufacturing employment from 6.7 million in 1978 to 2.6 million today. [See source.] Output of the UK manufacturing sector is projected to amount to US$737.30 billion in 2024. [See source.] Nevertheless, the relative strength of the UK in manufacturing (ranking 8th biggest worldwide just ahead of France) surprising.

British manufacturing has been remarkably successful. According to the oecd, a club mostly of rich economies, its productivity growth comfortably outstripped that of any other g7 country in the 14 years after the onset of the financial crisis in 2007 […] Gross value added (a measure of output) per manufacturing employee rose by 37.3% between 2007 and 2021, against an average of 12.1% among Britain’s peers. [Economist, October 19, 2023]

The same source goes on to report that the broad spectrum of manufacturing in the UK, from high tech components to packaged foods, helps to explain this resilience.

In the Middle East, the trajectory is also quite positive.

The Gulf’s strategic location between Europe, Asia and Africa means it has become an increasingly important global hub for manufacturing. […] Leading local firms like BFG International in Bahrain and the UAE’s AquaChemie are becoming increasingly important global players and global companies like Mondelez and Honeywell are investing heavily in the region. As a result of this progress, Bahrain’s manufacturing sector expanded by 4.9% in 2022, the UAE’s manufacturing production increased by 8.7% and Saudi Arabia’s manufacturing activity increased by 18.5% in December 2022 compared to the previous year. [See source.]

Industrial policy in the Gulf Cooperation Council (GCC) countries underpins this dynamism.

The United Arab Emirates’ (UAE) Operation 300bn is one of several ambitious government plans in the region which aim to boost manufacturing in the region. The Emirati government hopes to increase the industrial sector’s contribution to GDP from $36 billion to $82 billion by 2031 by promoting Industry 4.0 technologies and establishing the country as a global hub for future industries.

Saudi Arabia’s Advanced Manufacturing Hub Strategy has identified more than 800 investment opportunities totalling $273 billion, all of which are aimed at diversifying the industrial sector. By 2035, Saudi Arabia aims to increase the number of factories from around 10,000 currently to 36,000, including 4,000 of which will be fully automated.

In Bahrain, the government’s Economic Recovery Plan and Industrial Sector Strategy aims to achieve a $6.6 billion GDP contribution from the industrial sector by 2026. The strategy focuses on embracing Industry 4.0 capabilities, investing in a circular carbon economy, encouraging digital and technological product investments and strengthening industrial infrastructure and local value chains. [See source.]

Undoubtedly, the GCC offers some unique challenges and opportunities. But the lack of qualified talent is universal and some of the solutions are also gaining traction worldwide.

A recent Deloitte study indicated that a striking 86% of surveyed manufacturing executives believe that smart factory solutions will be the primary drivers of competitiveness in the next five years. [See source.]

Some call it “smart factory solutions” while others refer to “industry 4.0.” Either way, the recipe is similar:

Simply put, modern and advanced manufacturing uses smart technology to expedite and improve production quality. Some common examples of this include:

-

- Additive manufacturing (3D printing)

- Artificial intelligence (AI)

- Laser machining

- Machine learning

- Nanotechnology

- Robotics and automation

- Data analytics

- Cloud computing [See source.]

Diversity initiatives (DEI) and sustainability strategies have also become crucial in the manufacturing sector. They expand the potential labor pool while attracting talent that might otherwise go elsewhere. On diversity, one source from Canada has this to say:

One of the most effective ways for manufacturing companies to promote DEI is by showcasing diversity in their leadership teams. When potential candidates see diverse leadership, they are more likely to believe that the company values inclusion and equity. Recruiters should actively seek out diverse candidates for leadership positions and provide opportunities for advancement to employees from underrepresented groups. [See source.]

Nevertheless, “[w]omen currently account for less than one-third of the total manufacturing workforce, and the proportion of Black, Asian, and Latinx employees is only slightly higher at 36%, according to 2022 data from the US Bureau of Labor Statistics.” Why is diversity important to the manufacturing industry?

It’s simple demographic arithmetic: Organizations cannot have a robust talent strategy without a robust DEI strategy. The manufacturing industry is already aware of this, as DEI has made its way to the top of the industry’s list of priorities. In fact, manufacturing companies of all sizes are taking the National Association of Manufacturers’ Pledge for Action in the industry by 2030: a commitment to taking 50,000 tangible actions to increase equity and parity for underrepresented communities, creating 300,000 pathways to job opportunities for Black people and all people of color. [See source.]

Sustainable technology has also experienced growing support through industrial policy in many countries. In the US, for example, record investment in infrastructure and green technology is facilitating a significant retooling of manufacturing processes.

[…] investments in semiconductor and clean technology manufacturing are nearly double the commitments made for these sectors throughout 2021, and nearly 20 times the amount allocated in 2019. Since passage of the IRA, close to 200 new clean technology manufacturing facilities have been announced—representing US$88B in investment—which are expected to create over 75,000 new jobs. There has been a significant increase in construction spending in the manufacturing industry after the passage of the IIJA, CHIPS Act, and IRA. As of July 2023, annual construction spending in manufacturing stands at US$201 billion, representing a 70% year-over-year increase and setting the stage for further industry growth in 2024. [See source.]

Such investment in sustainability is certainly welcome and needed because “[a]ccording to a 2023 US Environmental Protection Agency report, the manufacturing and raw materials industries were responsible for 23% of greenhouse gas emissions in the US.” With respect to industry commitment, “[a] 2022 study by consultancy Climate Impact Partners notes that 42% of the companies in the Fortune Global 500 have delivered on a significant climate milestone or have committed to do so by 2030.” Altruism is not the only motivator: “…40% expect to generate value in the next five years [through sustainability]. That value includes cost savings related to decreased energy usage and more-engaged customers.” [See source.]

Bottom line, the manufacturing industry is in steep competition with other industries for talent at all organizational levels. Strategies to expand the pool of potential employees are all critical to success in the future. These include DEI initiatives, upskilling current employees, retaining associates, and enhancing the efficiency of available human talent.

Increased automation, though, is probably the key to survival. The internet of things (IoT) crops up significantly in this area, as companies seek to link their assets digitally, digitize their processes, update their software automatically, introduce remote piloting, and even explore UAM (unmanned autonomous machine) operations.

Industrial manufacturers use IoT location data to track assets in their supply chains. And they monitor the temperature, humidity, and vibration frequencies of their machines, alerting users to potential failures or uploading software fixes directly to those machines. [See source.]

Deloitte suggests that “over 70% of surveyed manufacturers have woven technologies such as data analytics and cloud computing into their processes, and nearly half are already harnessing the power of IoT sensors, devices, and systems.”

These technologies are also foundational to the industrial metaverse. In addition, the majority of surveyed manufacturers have made significant investments in digital twins, 3D modeling, and 3D scanning, which can serve as key building blocks of the immersive 3D environments that make up the industrial metaverse. [See source.]

Clearly, the required skill profiles of executives in the manufacturing space are evolving rapidly. They now include understanding “the industrial metaverse”, artificial intelligence, IoT, process digitization, 3D printing, drone operations, electrification, sustainability, and DEI. The relevance of all these topics has risen dramatically since the pandemic. As noted above, industrial policy is helping to power part of this transition. But the rest will have to come from other sources.

Apparently, private equity (PE) has provided $1.4 trillion to more than 11,000 manufacturers in the US over the last decade. In fact, “[e]ach year, nearly 1,000 manufacturers take on new PE investments, and it is not uncommon to see at least $100 billion channeled into these companies in any given year.” [See source.]

But PE is not only providing capital. One source suggests their impact is far broader. “Focusing on the triple bottom line—people, planet, and profit—PE firms increasingly align their pursuits with the broader community’s welfare. PE-backed manufacturers are taking on the mantle of community stewardship by investing in sustainable practices, fostering local employment, and contributing to the socioeconomic fabric of the community.” [See source.]

Now that we have sketched manufacturing’s major challenges and potential solutions, let us turn our attention to the executives whose energy and skill will guide the course of this critical industrial sector for decades to come.

The Market for Executives

At over 1.5 million executives as we define them (See Editor’s Note), this is undeniably a large executive market, even though it has shrunk by 1% over the past year. More than 46,000 also changed jobs, a “churn” rate of 3%. While the overall decline is understandable given the industry dynamics laid out in the introduction, the rapid changes in the hiring demand profile and the relatively high churn rate suggest there is still plenty of executive opportunity in this industry.

The US and Canada account for about 746,000 executives (-0.7% change YOY) and more than 18,000 job changes. The EU and UK add another 692,000 execs (-1.0%) and a further 24,000 career changers. The Middle East comprises additionally 98,000 executives (-1.0%) and over 3,000 job changes. LinkedIn suggests that the hiring demand remains high overall. Currently, female executives constitute no more than 19% of the total executive population in this industry.

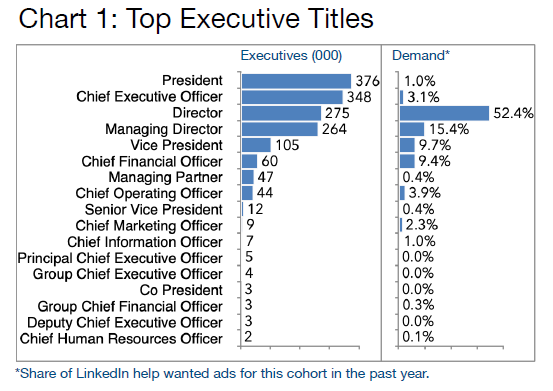

Chart 1 reviews the share of titles across this industrial grouping. As mentioned earlier, the vast majority of manufacturing companies are small which explains the large number of Presidents and CEOs. However, the recent demand was clearly for the Director title—more than 50% of all help wanted ads. Note, too, that these ads represent the published market. At The Barrett Group (TBG), however, the vast majority of clients—some 75%—land via the unpublished market. These latter opportunities are generally so new that they have not been formalized as position descriptions. In many cases they do not even have compensation parameters. This means that TBG’s clients have more latitude to help define their roles and pay packages with little competition since the position typically has not been advertised.

Only the CFO and Chief Marketing Officer titles on Chart 1 attract a higher than average share of female executives at 29% and 39% respectively. Predictably, the Chief Human Resources Officer (of which there are only two thousand) comprises 59% female execs.

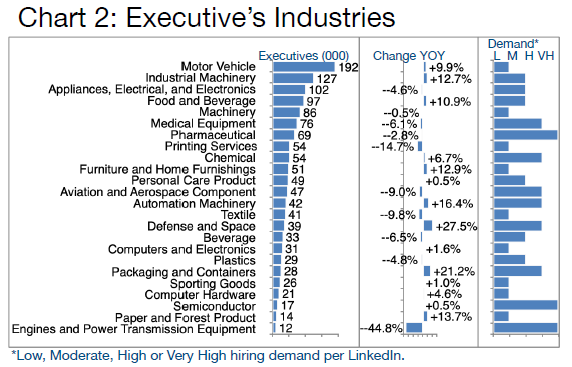

Chart 2 depicts the industries employing the most manufacturing executives, their historical change year-on-year, and the forward-looking demand per LinkedIn. It seems reasonable to assume that the rapid evolution of electric vehicles is negatively affecting the Engines and Power Transmission Equipment industry (-44.8%). But the very high hiring demand indicates a possible supply bottle neck as well. Printing (-14.7%), too, has been in decline longer term as digital media continue to take share. Textiles (-9.8%) are one of the nondurable manufacturing categories that have moved steadily to China and particularly Southeast Asia.

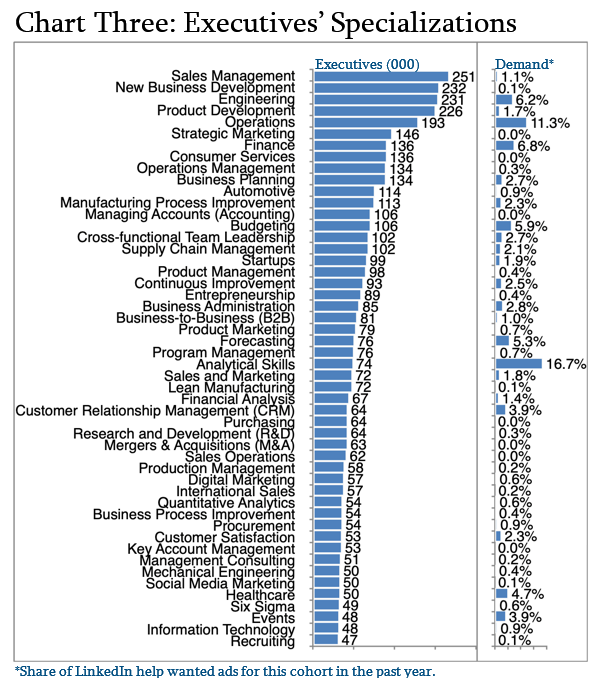

In Chart 3 we highlight the specializations that executives note on their LinkedIn profiles. Interestingly, Sales Management and New Business Development top the list while showing a relatively soft demand profile. Analytical Skills (16.7%), Operations (11.3%), Finance (6.8%), Engineering (6.2%), and Budgeting (5.9%) seem to be the specializations most in demand. But, again, these represent only the demand in the published market. This is the executive market segment in which only about 25% of TBG clients land.

Another dimension of the specializations in Chart 3 is each skill’s transferability or lack thereof. For example, Manufacturing Process Improvement, Lean Manufacturing, and Production Management are all rather specific skills associated with manufacturing. These may not be so easy to transition to alternative industry verticals.

Sales Management, New Business Development, Engineering, Operations, Strategic Marketing, etc. on the other hand are potentially more generic in nature. These could be just as valuable in another area of commerce. TBG specializes in helping executives move between industries by leveraging their transferable skills and developing coherent and compelling explanations as to why their experience and achievements are highly relevant to any new targeted area of endeavor. Particularly analytical and financial skills seem to be hotly in demand essentially in every industry vertical that we study.

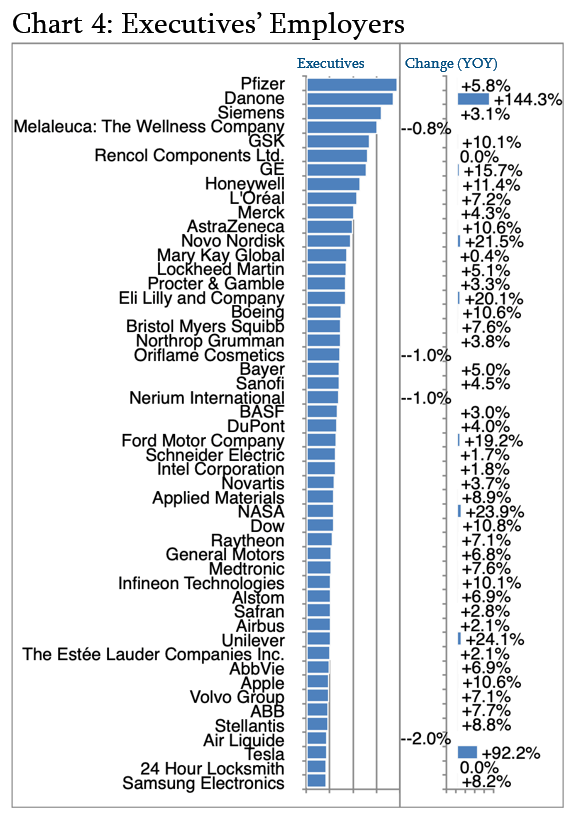

In Chart 4 we turn our attention to the companies that employ executives in this industry.

Because the numbers would be meaningless if rounded to the nearest thousand as required by our data provider (LinkedIn) we leave off the exact numbers, but the top of the chart ranges between 1 and 2 thousand per company and the bottom just a few hundred. In terms of growth, Danone certainly stands out with the kind of change that only acquisitions typically confer. And Danone has indeed been active. One source reports that the French company “has made 22 acquisitions across sectors such as Food & Beverage Products, Nutritional Formula, Consumer Digital – Europe and others”.

In 2023, Danone added a health services business in Poland (ProMedica). It is investing a further $50 million in expanding manufacturing in the same country. [See source.] Danone is also involved in a renewal plan to reassure shareholders and as a result agreed to sell its New Horizon food brand. The winnowing of their portfolio continues. [See source.]

Other than acquisitions, the coming and going of executives at Danone represents a who’s who of food, cosmetics, pharmaceutical, and consumer businesses. These include Unilever, PepsiCo, Mondelez, L’Oreal, Reckitt, Mars, Nutricia, and Abbott among others. According to LinkedIn, Danone’s recent net executive hiring favored the pharmaceutical and manufacturing specializations.

Tesla’s executive ranks also grew an impressive 92.2% in the period (before announcing dramatic changes in early 2024). One of the reasons for growth was yet another acquisition, this time of Wiferion, which “develops and provides contactless inductive wireless energy systems intended for industrial and mobile robotics applications”. [See source.] Net executive hiring at Tesla in the recent period has been mainly from Amazon, Apple, and Meta, suggesting that their immediate focus is less on manufacturing and more on software development.

Several pharmaceutical companies boasted significant increases, including Novo Nordisk (+21.5%), Eli Lily and Company (+20.1%), and GSK (+10.1%). Novo Nordisk added Vice Presidents, functional Heads, CFOs and unit CEOs mainly hiring from competitors in Copenhagen, Madrid, Boston, Stockholm and Oxford (UK). Eli Lily added Vice Presidents, as well as several CTOs and unit CEOs mainly from competitors in US cities (San Francisco, Boston, Washington DC, and San Diego) but also in Frankfurt, Germany.

Unilever also added 24.1% to its exec staff. These included Heads of function, unit CEOs, Vice Presidents, CFOs and CTOs mainly drawn from direct competitors such as Diageo, Lipton, and Mondelez with an emphasis on London, India, New York, The Randstadt (Netherlands), Pakistan, Paris, and Jakarta. Skill-wise their focus appeared to be FMCG, Finance, Forecasting, Consumer Insight, Business Planning, and Supply Chain.

Continuing on Chart 4, GE’s executive cohort grew 15.7% in the period driven by Business Development and Information Technology hiring per LinkedIn with significant growth in New York City, Atlanta, Dallas, and Los Angeles as well as Hong Kong, Bangladesh, Delhi, and London.

Ford Motor Company’s executive team grew by 19.2% adding both functionally and geographically with a certain emphasis on Asia (Vietnam, India, Pakistan, and Bangladesh), but also Europe (Cologne, Paris, and London).

Of course, the information in this Industry Update must be kept relatively high level given its general nature. Naturally, TBG clients receive significantly more granular data via their career change consulting teams as they conduct broad industry screenings, and then focus on target employers before diving deeply into companies prior to interviews.

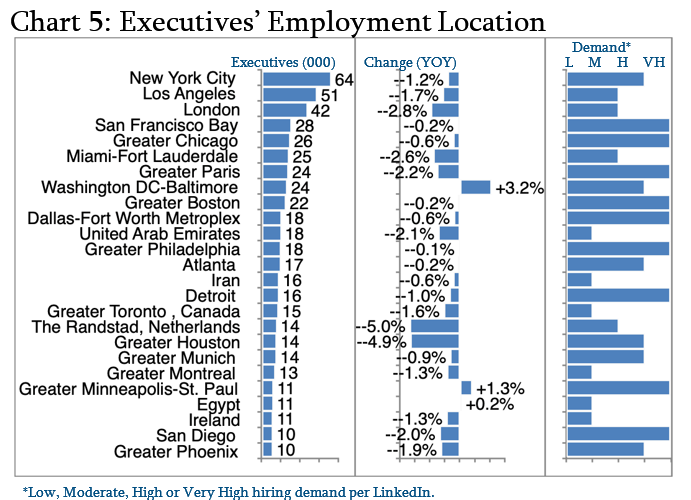

Logically, given the overall industry dynamic, most locations in Chart 5 show a decline in executive employment. Nevertheless, the hiring demand perspective (which is more forward-looking or reflects scarcity of qualified talent) tells a different story with numerous locations showing high or very high hiring demand per LinkedIn.

First among these is San Francisco where Applied Materials, Apple, and Western Digital are the top employers of manufacturing executives. In Chicago, AbbieVie, Motorola Mobility, and MedLine Industries LP hold this honor. In Paris, L’Oreal, Safran, and Renault Group top the bill. Pharma reigns supreme in Boston where Takeda, Pfizer, and Sanofi are the top executive employers in this field.

Lockheed Martin, Alcon, and Texas Instruments hold the top ranks in Dallas. Merck, GSK, and Pfizer top the charts in Philadelphia. While in Detroit, General Motors, Ford Motor Company, and Stellantis employ the most manufacturing executives.

Peter Irish, Chairman

The Barrett Group

Click here for a printable version of INDUSTRY UPDATE: Manufacturing 2024

Editor’s Note:

In this Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 1 billion users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.

Samantha’s Success Story

Here is an example of how TBG helps clients rethink and retell their stories more successfully.

“My consultant, George Schulz, took me through a spreadsheet of potential interview questions and coached me on how to answer them. The biggest takeaway for me was the importance of giving answers that don’t focus so much on the achievements I want to share about myself but what the hiring manager wants to hear. That was mind-blowing to me! That was the first time I’d ever heard that. George taught me how to identify the company’s needs and speak specifically to how I can meet those needs. The goal is to convince them there is no better choice than me.”