INDUSTRY UPDATE: Financial Services

Introduction

Financial Services, according to LinkedIn, encompass four major industries and numerous smaller segments. The four largest, Banking, Investment/Wealth Management, Insurance, and Capital Markets comprise 68% of all executives in the broader industry. Therefore, let us focus on these four major segments in this introduction.

Banking

According to the Federal Reserve, US banking assets exceeded $23 billion at the end of 2024. That is up 33% or $6 billion since the end of 2020. [See source.] Indeed, the US industry had a good year in 2024. Here are just a few of the top players’ results to illustrate:

- JPMorgan Chase &Co. reached a 2024 return of 40.92%;

- Citigroup Inc returned 36.84%;

- Goldman Sachs Group Inc achieved a return of 48.44%; and

- Wells Fargo & Co posted a return of 42.71%. [See source.]

Despite some doom and gloom on the continent, European banking stocks showed strong performance in 2024 as well. “The STOXX® Europe 600 Banks index climbed 26% […], its best performance since the 34% logged in 2021.” [See source.] The ECB says total assets held by banks in the EU climbed 4.5% through mid-2024 to €32.7 trillion. [See source.]

| 2025 is a critical year for banks to differentiate—or risk falling behind. |

Top banks in the EU and the UK include:

- HSBC (UK), $3.0 trillion in assets, 2024;

- BNP Paribas (F), €2.6 trillion;

- Crédit Agricole Group (F), €2.5 trillion; and

- Banco Santander (ES), €1.8 trillion.

State banks predominate in the Middle East and are critical to the financing of a vast array of infrastructure and other projects across the region. Here are the top regional banks as of mid-2024:

- Qatar National Bank (Qatar), $330.2 billion in assets;

- First Abu Dhabi Bank (UAE), $312.3 billion;

- Saudi National Bank (Saudi Arabia), $265.6 billion; and

- Al Rajhi Bank (Saudi Arabia), $209.2 billion. [See source.]

Whether private or state-owned, banks around the world are in the middle of a huge transition. “As interest rates decline, the banks that have invested in modernized technology and delivery models are poised to lead. 2024 brought economic uncertainty, stricter regulations, and accelerated advances from non-bank competitors, making 2025 a critical year for banks to differentiate—or risk falling behind as M&A activity heats up.” [See source.]

The same source summarizes some of the major challenges the sector is facing as it makes that rapid transition.

“Three forces are shaping this urgency: customer demand for personalization, rising competition from fintechs and non-traditional institutions, and intensified regulatory scrutiny of digital practices. Meeting these challenges requires bold investments in digital and data capabilities that enable banks to engage customers more effectively and operate more efficiently.” [See source.]

More specifically, it seems that banks wishing to ride the next wave of innovation and flourish must keep up with the following key trend predictions:

- AI in the back office becomes increasingly sophisticated;

- Chatbots and AI assistants take larger roles in customer service;

- Generative financial planning and advice make their debut;

- Sustainable finance products and ethical investment grow their share of the pie;

- Central banks are increasingly launching their own digital currencies;

- Quantum computing may soon enhance risk analysis, fraud detection, automated trading, credit scoring, cybersecurity and the development of future-proof encryption;

- AI regulation, oversight and transparency take on new importance; [see source].

Clearly, banking will need new skills going forward to manage all of these increasingly exotic technological challenges. According to McKinsey, the banking sector must up its game substantially as it is routinely punished by capital markets with the lowest price-to-book value ratio among major industries. [See source.] As the margin benefit of higher interest rates fades, many banks may have limited abilities to improve margin by cutting costs.

However, one optimization opportunity includes the widespread adoption of intelligent agents in banking. These AI-driven actors will take over more and more of the activities traditionally performed by people in banking as the technology evolves, ultimately linking banks’ disparate legacy systems effortlessly. “Intelligent agents transform our tech interactions by functioning independently, driven by goals instead of prompts. These autonomous problem solvers adjust to new information and environments like sentiment or word choice, continually evolving to reach their objectives efficiently. The agents start with goals and defined roles of what it is trying to accomplish before it goes out and locates the required data from multiple sources. The agent then creates its own action workflow to accomplish the task.” [See source.]

Meanwhile, a host of new competitors is nibbling at banks’ lucrative operating segments. Collectively known as FinTech, these competitors have already gobbled up 5% of the global financial transaction market. And they are expected to grow by 15% p.a. (three times faster than the overall banking sector) through 2028. Moreover, they have raised phenomenal amounts of capital to drive their development and expansion.

As of July 2023, publicly traded fintechs represented a market capitalization of $550 billion, a two-times increase versus 2019. In addition, as of the same period, there were more than 272 fintech unicorns, with a combined valuation of $936 billion, a sevenfold increase from 39 firms valued at $1 billion or more five years ago. [See source.]

Casual observers might tend to relegate FinTech activity to payments and perhaps lending. But their sphere of activity is actually much broader in the meantime, encompassing embedded finance, investment and wealth management, daily banking, and banking operations, too. FinTech enthusiasts see further innovation on the horizon in the form of

- hyper-personalized financial services through AI,

- further evolution of embedded finance,

- maturation of the buy now, pay later phenomenon, and

- climate-conscious financial products. [See source.]

Whatever happens, clearly there will continue to be strong demand for talented and agile executives as the evolution of the overall banking sector accelerates.

Investment/Wealth Management

According to one recent source, “The global wealth management market reached a value of nearly $1.8 trillion in 2023, having grown at a compound annual growth rate (CAGR) of 11.69% since 2018. The market is expected to grow […] and reach $3.5 trillion in 2033.” [See source.]

The same source goes on to explain some of the factors driving this growth. They include:

- rising demand for alternative investments,

- growth in emerging markets,

- accelerating digitization,

- burgeoning retiree populations,

- urbanization, and

- rapid increase of high net-worth individuals’ portfolios.

The major cloud on the horizon for this segment is the risk of increasing regulation, though certainly political trends in the US at least seem to be tending in the short term toward less government intervention rather than more. The EU now seems to be more aggressive at least as far as the regulation of AI is concerned. [See source.]

Lastly, the same source expands on who will provide these wealth management services including private banks, investment managers, full-service wealth managers, stockbrokers, and other smaller niche actors.

The private banks market was the largest segment of the wealth management market segmented by type of wealth manager, accounting for 38.94% or $707.13 billion of the total in 2023. Going forward, the investment managers segment is expected to be the fastest growing segment in the wealth management market segmented by type of wealth manager, at a CAGR of 7.77% during 2023-2028. [See source.]

The wealth management market is apparently still fairly fragmented according to the same source. The top ten players controlled just 12.9% of the total market in 2023. This may not change quickly: “The declining trend in mergers and acquisitions gained more momentum stepping into 2024 as there was a 27% decline in deal count to 234 in the first half of 2024 compared to 321 in the same period last year.” [See source.]

| The bottom line seems to be that standing still in the Investment/Wealth Management market is not an option. It’s “move or die.” |

But the past may not be a good indicator of the future in the Investment/Wealth Management segment. The global rotation out of high-interest into low-expense investment products can be a treacherous path for the unwary according to Deloitte who says that “Traditional investment managers [are] bracing for a low-expense ratio environment.” [See source.]

ETFs [exchange-traded funds] have continued to attract investors and cumulatively received a net inflow of more than US$3.0 trillion in the last five years in the United States. Investor preference for low-cost funds is evident from the fact that across mutual funds and ETFs, the majority of AUM [assets under management] is invested in funds with lower expense ratios. [See source.]

Beyond the ubiquitous call to focus on AI-driven strategies which we will address shortly, there are other innovations apparently coming to this segment, including the expansion of private credit.

Globally, private credit assets continue to experience double-digit annual growth, reaching more than US$2.1 trillion in 2023. There is little to suggest that a slowdown in growth is on the horizon. In fact, some investment management firms are exploring partnerships with banks that were once deemed unlikely to expand their reach into the private credit arena. [See source.]

Additionally, the evolution of so-called evergreen fund structures that minimize reporting requirements and maximize investor liquidity continues. “In 2023, assets that fall under the evergreen fund umbrella globally grew to a record US$350 billion as the number of funds reached 520, double the amount from five years ago.” [See source.]

And then there is artificial intelligence (AI).

According to Deloitte, 2024 did not deliver the expected boom in AI-driven Investment/Wealth Management innovations, though this may just be the calm before the storm. AI has the power to analyze market trends and investor behavior in real time so as to deliver customized investment proposals faster and more accurately than any human being.

Imagine the impact the output generated by the AI model could have when it is fed inputs from a variety of sources—current news, financial statements, earnings call transcripts, historical pricing data, and proprietary valuation models. The output has the potential to revolutionize the role of securities analysts and portfolio managers. [See source.]

Still, effective use of AI requires the right sort of system and data architecture in the first place, systems that can talk to one another, and a certain appetite for risk. These factors have likely hampered the expected revolution so far:

About 60% of surveyed investment management firms are using AI in their data-related distribution undertakings to a modest degree, but just 11% describe the usage as “heavy,” despite an increase in use cases. [See source.]

The bottom line seems to be that standing still in the Investment/Wealth Management market is not an option. “Move or die” might sound a bit dramatic, but it is not particularly hyperbolic.

Insurance

Perhaps it is best to begin by understanding that insurance is not evenly present worldwide. “While premiums written exceeded 10% of GDP in France, the United Kingdom, the United States and some other European and Asian jurisdictions, premiums accounted for a much lower proportion of GDP in many Latin American countries and some European countries.” [See source.] Overall, non-life insurance predominates in part because it is mandatory (such as motor vehicle insurance) in most jurisdictions whereas life insurance is by and large voluntary and more prevalent as affluence increases.

|

The insurance industry saw surprisingly robust results in 2024. However, stormy weather is likely to rain on this parade. |

The global insurance market was valued at around $8 trillion in 2024 and is expected to grow to $10.8 trillion by 2029 at a CAGR of 6.9%. A number of factors are driving this increase including aging populations that are more risk averse and more willing to invest in health insurance. Reportedly, worldwide one in six people will be 60 or older by 2030, and the number of people aged 80 years or older will increase by 426 million between 2020 and 2050 according to the World Health Organization. [See source.]

But there are also negative factors in play, for example, the increasing incidence of major weather events.

…high inflation and increasingly erratic climate-related losses put pressure on non-life insurance lines’ profitability over the past few years. Many insurers responded by hiking premium pricing and even pulling back coverage for certain high risks. Moreover, as interest rates rose, life insurance and annuity carriers jockeyed for position in a crowded field to take advantage of the surge in consumer interest in savings-linked products. [See source.]

This led to surprisingly robust results for the insurance industry in 2024. However, stormy weather is likely to rain on this parade:

For the first time in six years, worldwide insured losses from natural catastrophes surpassed US$100 billion without a single event causing over US$10billion in damages. […] Economic losses from natural catastrophes reached US$357 billion in 2023 globally. Yet only 35% of these losses were insured, leaving a protection gap of 65% or US$234 billion. [See source.]

Nevertheless, “At a global level, estimates suggest that insurers’ return on equity could improve to about 10% in 2024 and 10.7% in 2025. […] Profitability is expected to improve in the United States as well. […] The sector is expected to continue to benefit from deceleration in claims costs because of lower inflation, which decreased to 3% in June 2024 after reaching a peak of 9.1% in June 2022.” [See source.]

One source suggests there are five key strategic perspectives relevant to the insurance market in 2025 and beyond:

- a widening trust gap in an uncertain world,

- rapidly evolving customer needs and preferences,

- an increasingly digital and AI-driven world,

- climate risk and a focus on sustainability, and

- convergence, collaboration, and competition. [See source.]

Additionally, there remain huge opportunities to increase the penetration of insurance services in many markets, not to mention constantly optimizing the portfolio strategies between the various product families within the insurance space. In all the uncertainty, one fact remains clear: guiding any insurance enterprise through this maze requires superior executive management talent.

Capital Markets

Let’s begin with a definition. What is the difference between a financial market and a capital market?

A financial market having a group of financial institutions trades short-term financial instruments, for typically less than a year. The capital market is a financial market where companies and governments issue and trade securities to raise long-term funds needed for their capital requirements. [See source.]

Essentially, financial markets tend to have a shorter return horizon and thus favor instruments such as CDs, Treasury Bills, Interest Rate Swaps, etc. Capital markets on the other hand are intended to finance longer term requirements such as capital investments and therefore trade in financial assets such as stocks, bonds, exchange-traded funds (ETFs), mutual funds, etc. There are usually two levels to the overall capital market, a primary market for new issuance (for example, bonds, stocks, including IPOs) and a secondary market where previously issued securities may be bundled and traded between investors.

| All in all, conditions appear to be relatively positive for continued growth in the overall Financial Services sector. |

One trusted source on this subject summarized the key trends affecting this market as follows:

- inflation is decreasing toward central bank targets,

- interest rates are declining in response, making borrowing less expensive,

- government bonds are offering lower yields,

- investors are more optimistic about future economic prospects based on the (US Treasury) yield curve,

- credit spreads hit multi-year lows in 2024, reflecting investor confidence in economic stability and corporate earnings growth amid moderating recession risks,

- the bull market in equities has continued into 2024, with U.S. stock indices posting double-digit returns and closing at record highs multiple times throughout the year, and

- the price of oil has declined well below a multi-year high of around $120 per barrel in June 2022 to approximately $69 per barrel mid-December—relatively unchanged from a year prior. [See source.]

All in all, this is a relatively benevolent climate for economic activity, though clearly geopolitical risks could easily spoil the picnic. There are also specific areas of concern, such as Germany, whose export-driven economic strategy is suffering from an over-reliance on exports and a perhaps overly conservative attitude toward borrowing.

We may therefore expect to see more investment flowing to businesses and continued economic growth overall. Here is how one major consultancy summarizes the outlook for 2025:

“The 2025 IPO market is poised for a resurgence, driven by favorable policy changes, renewed investor confidence and a strong pipeline of companies ready to go public. While challenges such as economic uncertainties and potential regulatory shifts remain, we expect a dynamic year ahead, marked by increased activity and opportunities for growth. PwC is optimistic about the role of innovation and resilience in shaping a vibrant capital markets landscape in 2025.” [See source.]

All in all, the conditions appear to be relatively positive for continued growth in the overall Financial Services sector, whether due to increasing penetration in an increasingly wealthy population, lower inflation, improving access to capital, almost unlimited innovation, the potential benefits of harnessing AI more widely… the list goes on.

Political upheaval, geopolitical tensions, regulation, and global warming on the other hand certainly represent challenges to all of this positive momentum.

Let us now turn our attention to the women and men who will help the industry navigate this obstacle course and deliver on-going returns for consumers, businesses, and, of course, for themselves.

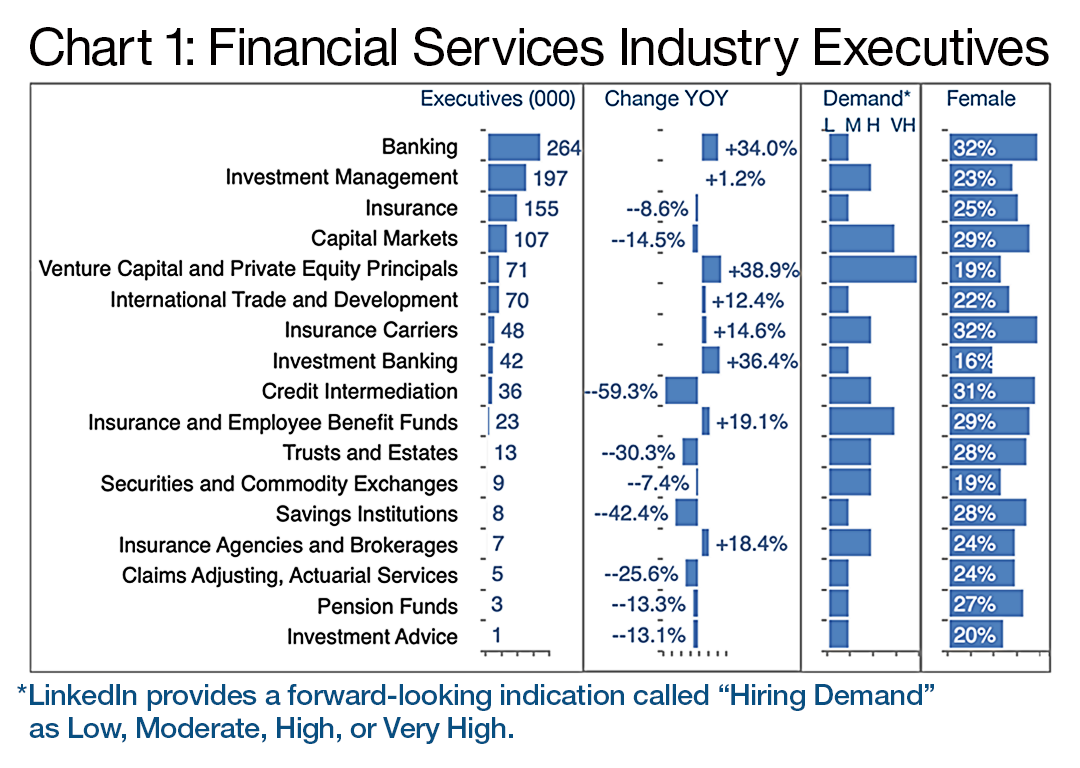

The Market for Executives

Something over 1.3 million executives as we define them (see Editor’s Note) are active in the broader Financial Services market. The US and Canada account for 860,000, the EU and UK another 400,000, and the Middle East, 64,000. This group has grown by 3% in the past year, and another almost 59,000 have changed jobs, so that the total executive opportunity added up to about 100,000 positions. Looking ahead, LinkedIn rates the overall industry hiring demand as very high. However, as in many other industries we study, female executives are under-represented, making up about 26% of this cohort.

Chart 1 breaks down the industry into segments, their respective growth rates over the past year, a forward-looking hiring demand indication, and the specific female executive share per segment.

We have discussed the broad trends in the top four segments in the introduction, so let us examine only the more striking changes further down the list. The Venture Capital and Private Equity sector has been fully reported in our most recent Industry Update on the subject.

The decline in Credit Intermediation is also quite dramatic. Here’s how one source explained what is going on:

“Bank disintermediation continues to gather pace, but new competitive fault lines have emerged. It is one thing to disintermediate loans from bank balance sheets. It’s quite another to disintermediate the banks themselves from their most prized clients and customers. As more credit market assets inevitably gravitate from banks to private portfolios, expect banks to mount a more vigorous defense of the smaller, but more lucrative, remaining territories; willing to cede assets but not the relationships responsible for their most important income streams.” [See source.]

The Trusts and Estates sector has also seen a decline, albeit from a post-pandemic peak.

Caring.com shares that its key finding through the 2024 survey is that estate planning levels have dropped to pre-pandemic levels for the first time. Currently, less than 3 out of 4 Americans have a Will in place. […] — a six percent falloff from 2023. [See source.]

The savings institution segment “continues to lose market share to more dynamic commercial banks as well as financial technology companies.” [See source.]

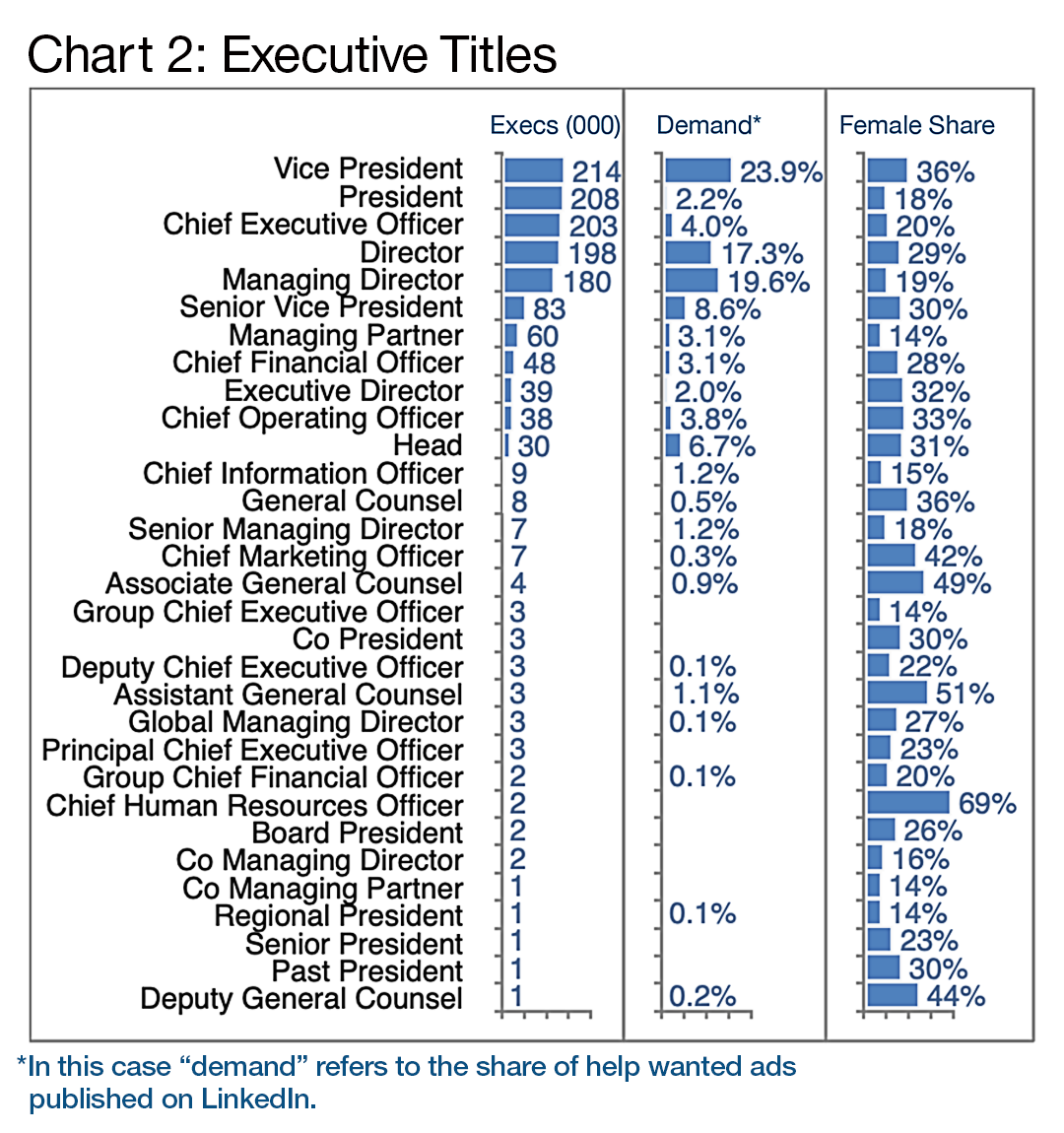

Executive Titles

Chart 2 explores the executives titles in the industry. From the data it is clear that this is an industry that is relatively concentrated, i.e., contains a fairly large share of larger firms. Larger companies tend to have more management levels and therefore require a significant number of Vice Presidents and Managing Directors as a ratio of CEOs.

Clearly the demand has been principally at the Vice President, Managing Director, and Director level in this industry while all other functions exhibit very moderate demand. On the other hand, this specific demand indicator represents only the published market while The Barrett Group finds that 75% of its client executives discover their next step in what we call the unpublished market, i.e., positions so new they have not yet been published, so the demand data in Chart 2 most likely understates the true number of opportunities considerably.

Also clear from Chart 2 is the continued practice of hiring females over-proportionally for the HR, General Counsel, and Marketing portfolios while underrepresenting them in most other titles.

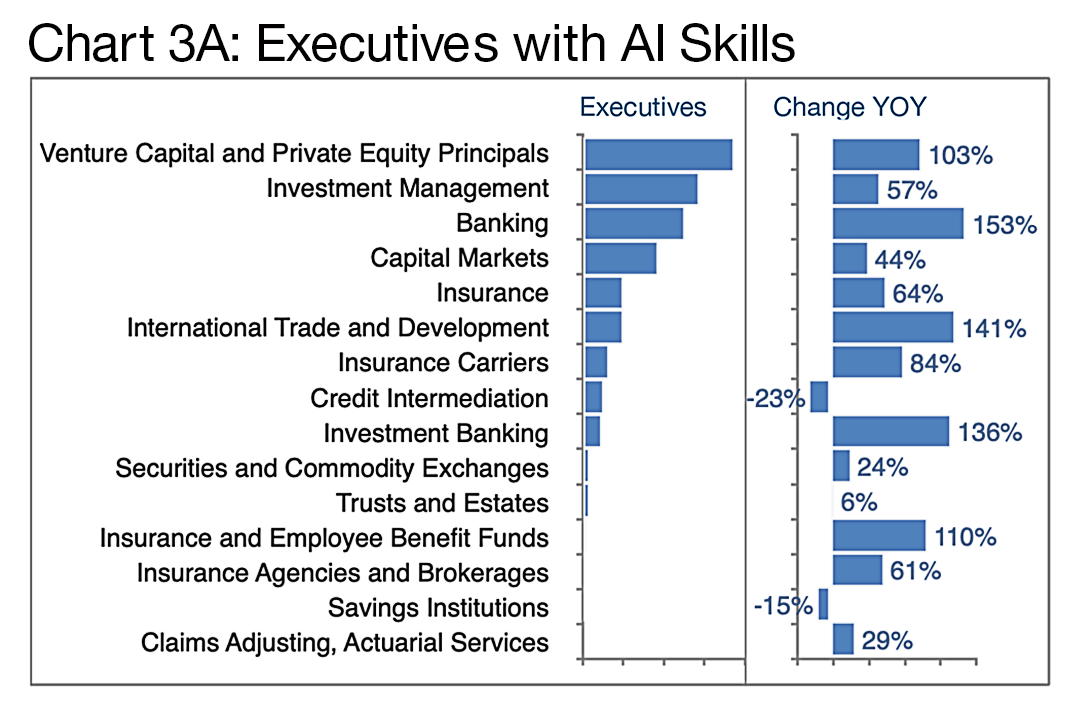

Executives with AI Skills

We have all heard how AI is already a transformative force in this and many other industries. How seriously are executives taking this trend? One indication is the degree to which execs are acquiring AI skills. Chart 3A examines this angle. More than 8,000 Financial Services executives now claim (via their LinkedIn profiles) that they have AI skills—up 80% in the past year, but still only a paltry 0.7% of the total pool. Some 45% are employed in New York, London, San Francisco, Los Angeles, the UAE, Dallas, Paris, Toronto, Boston, and Washington DC, locations that do not differ greatly from the overall geographic distribution of this talent pool. So it seems that firms are still being cautious with the implementation of scaled AI at least so far.

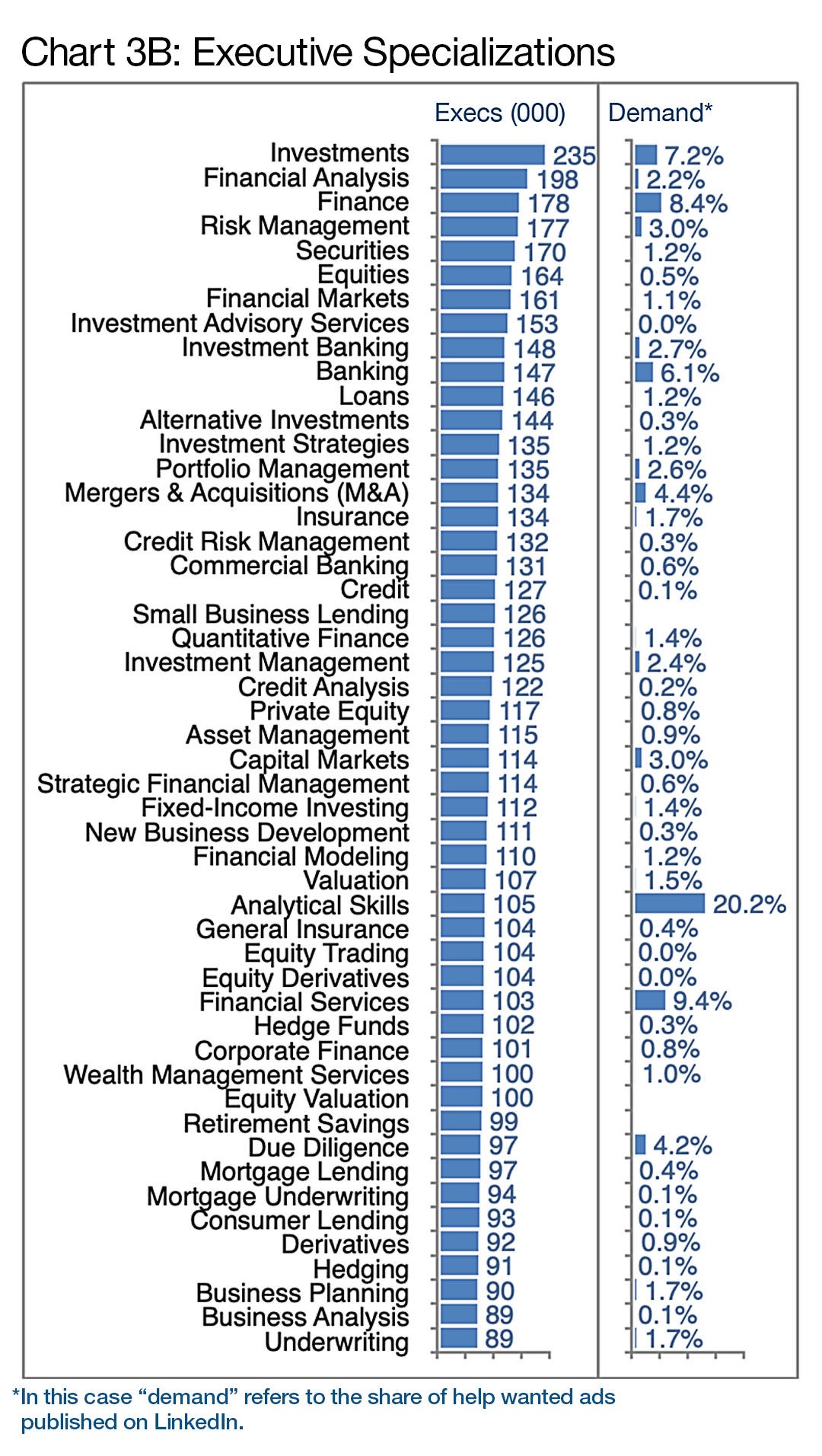

Executive Specializations

Regarding other specializations as visible in Chart 3B, there are few surprises. Based only on the share of want ads and for the time being ignoring the larger potential in the unpublished market, Analytical Skills (20.2%) showed the highest relative demand, followed by industry specific skills such as Financial Services (9.4%), Finance (8.4%), Investments (7.2%), and Banking (6.1%).

Interestingly, a truly generic specialization such as Business Development that often shows up in such assessments ranks a lowly number 29 in the top 50 in this industry, and another evergreen choice, Sales Management, does not make the list at all. This suggests that entering this industry without financial services credentials would require more effort, or, perhaps, the support of a career management firm with massive experience in helping executives transition between industries and roles. The Barrett Group has been proudly providing this service now for more than 30 years, and is pleased to have been recognized for five years by none other than Forbes as one of the best in the business, and incidentally, the top career management firm.

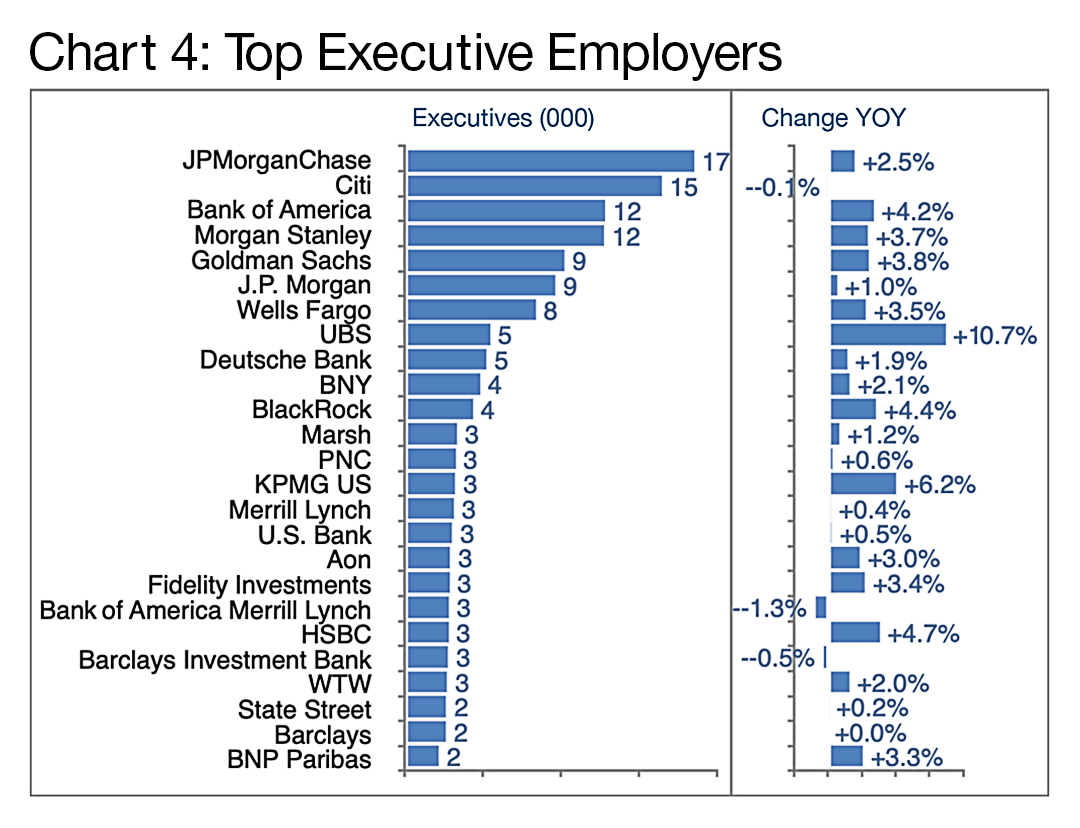

Top Employers

Chart 4 opens the subject of top employers of executives in this sector. While the whole industry has grown strongly in the past year, several firms stand out. Citi, for example, has been engaged for years in an on-going reorganization.

Citigroup Inc. is planning to reserve $600 million for severance payments in 2025 as it continues to trim its workforce and cut expenses, according to Chief Financial Officer Mark Mason. The $600 million figure is down about 14% from last year, when the bank shed more than 10,000 jobs. Typically, Mason said, severance costs would hover around $300 million. The New York-based bank is about halfway through a years-long reorganization that it initially anticipated would cull 20,000 jobs globally. Part of the overhaul includes investments in technology that would, Mason said, “allow us to eliminate manual processes.” [See source.]

UBS shed about 10,000 positions in the wake of its acquisition of Credit Suisse in 2023, and now plans “to close the profitability and size gap with larger competitors such as Morgan Stanley and Bank of America’s Merrill Lynch” by restructuring its wealth management function, including the recruitment of more financial advisors as well as investments in technology. [See source.]

Obviously, we can only provide an overview of an industry and its players in a high-level report such as this, but clients of The Barrett Group receive extensive research support as they screen industries, dive deeply into prospective employers, and prepare for interviews and negotiations.

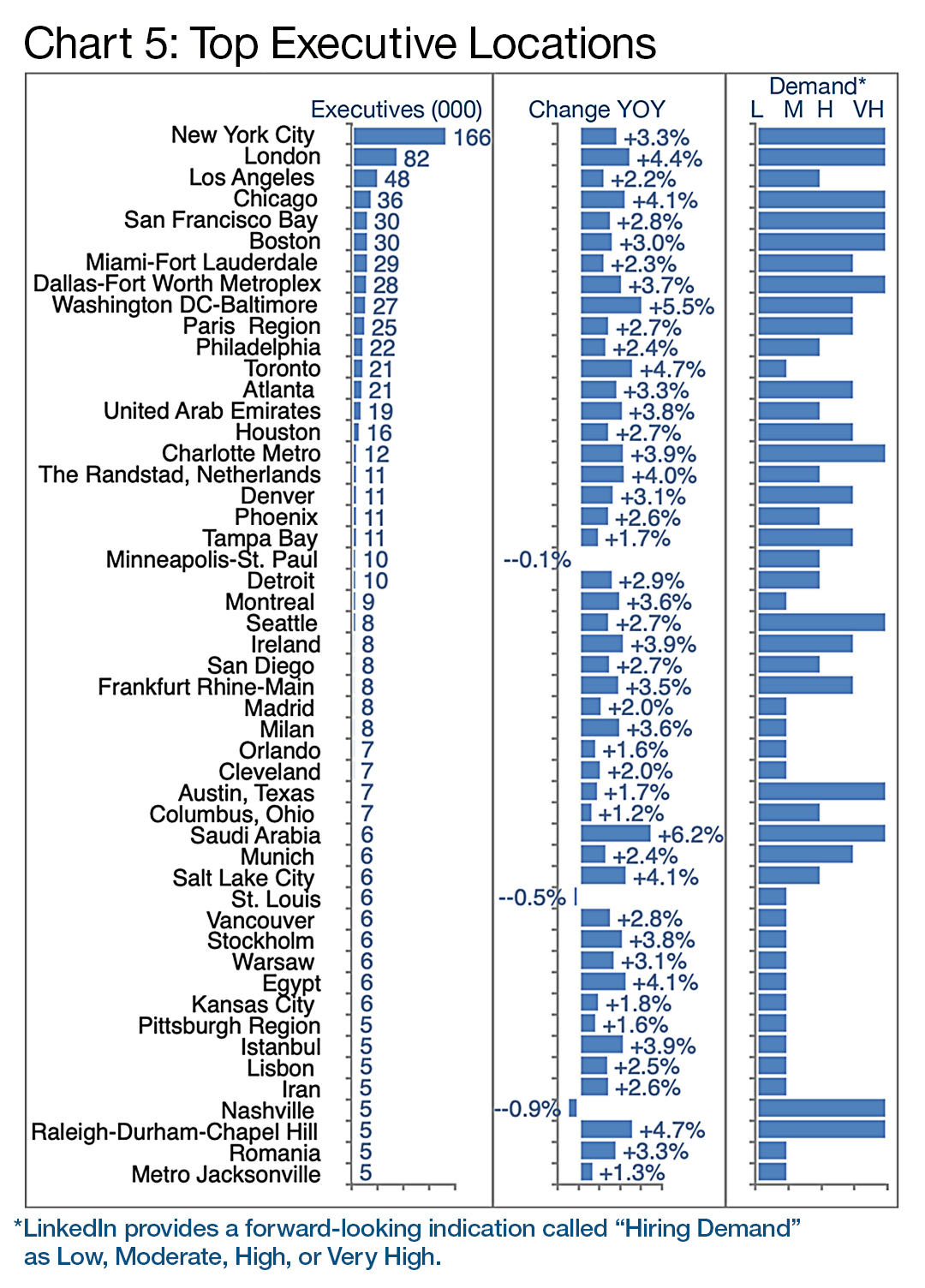

Top Executive Locations

Chart 5 provides an overview of executives’ employment locations which are, of course, largely a result of where their employer is headquartered or has regional offices. Please bear in mind that while the change year-on-year is historical, the hiring demand tends to be forward-looking.

Editor’s Note:In this Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research. Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 1 billion users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data. |

Peter Irish, Chairman

The Barrett Group

Click here for a printable version of INDUSTRY UPDATE: Financial Services