INDUSTRY UPDATE: Energy

Introduction

The increasing frequency of extreme weather events seems to be focusing public attention at last on the accelerating climate change humanity has inflicted on the planet for more than 100 years. Finally, a few important steps were undertaken at the latest COP28 meeting in 2023, the global body charged with avoiding climate catastrophe.

“Negotiations at COP28 concluded with the “UAE Consensus”. One notable element of which was the agreement on a global “transition away from fossil fuels in energy systems, in a just, orderly, and equitable manner, accelerating action in this critical decade, to achieve net zero by 2050 in keeping with the science.” This is the first time that fossil fuels have been collectively mentioned in a COP agreement…” [See source.]

Another hopeful sign in 2023 was that greenhouse gas (GHG) emissions allegedly dropped (by 3%) for the first time in the US—the second largest emitter nation after China. [See source.]

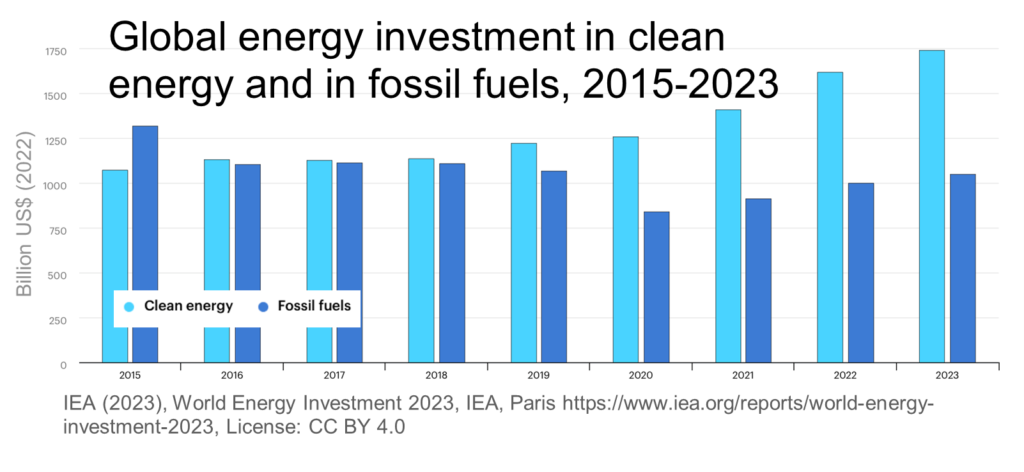

In fact, worldwide investment in “clean energy” has significantly outpaced investment in fossil fuels now for five years running according to the International Energy Administration (IEA) [See chart above and source.] who issued the following statement:

““The transition to clean energy is happening worldwide and it’s unstoppable. It’s not a question of ‘if’, it’s just a matter of ‘how soon’ – and the sooner the better for all of us,” said IEA Executive Director Fatih Birol.” [See source.]

Unfortunately, total carbon dioxide emissions from energy increased in 2023 to a record level of 34.4 billion metric tons. “Despite further strong growth in wind and solar in the power sector, overall global energy-related greenhouse gas emissions increased again,” said EI [Energy Institute] President Juliet Davenport. “We are still heading in the opposite direction to that required by the Paris Agreement.”

Expanding on this theme, Forbes provides these sobering insights:

“While renewable power expanded at record rates, fossil fuels maintained an 82% share of total primary energy consumption. Natural gas and coal demand stayed nearly flat with oil rebounding close to pre-pandemic levels. For reference, this is down from an 87% share in 2010. At that rate of decline, it would be nearly 200 years before fossil fuel consumption reached zero.” [See source.]

Oil and gas companies clearly expect demand to continue, too, as M&A activity in the industry heated up in 2023. “The value of U.S. oil and gas mergers and acquisitions in the Permian basin this year has reached a record of more than $100 billion after several multi-billion dollar deals[…]” [See source.] Specifically, Exxon Mobil, Chevron, Permian Resources, Civitas Resources, and Occidental all invested in firms active in the shale-oil rich region of Texas.

Even so as the recently enacted infrastructure investments roll out in the US, the Department of Energy points to a number of important climate change mitigation steps in 2023 including the launching of the first clean hydrogen hubs, historic investment in the electricity distribution grid, and progress in building a national electric vehicle (EV) charging network among others. [See source.]

Indeed, renewables continue to take share.

“Europe’s power producers generated more electricity from wind than from coal for the first time in the last quarter of 2023, marking a key milestone for regional energy transition efforts[…] Europe’s utilities generated a record 193 terawatt hours (TWh) of electricity from wind sites in the October to December window in 2023 compared to 184 TWh from coal-fired power plants…” [See source.]

This is all the more remarkable as wind generation suffered severe setbacks in 2023 due to labor, material, and financing hurdles [See source], going so far as to cause the German government to provide support to Siemens in the form of an $8 billion loan guarantee due to enormous losses at the wind-power unit Gamesa. [See source.] Another major player in wind, Ørsted, canceled a mega-project off the New Jersey, US shore saying, “Macroeconomic factors have changed dramatically over a short period of time, with high inflation, rising interest rates, and supply chain bottlenecks impacting our long-term capital investments…” [See source.]

However, solar capacity in the EU continues to grow, too. “EU capacity additions in 2023 totalled 56 GW [GigaWatts], representing a 40% increase over the additions seen in 2022 and a new record number for the third year running…” This effectively expanded the region’s solar capacity by 27% to 263 GW in 2023 against a target of 600 GW by 2030. [See source.]

So what role do renewables play in Europe’s energy supply economy and what is the trend?

In Europe as of 2021, the EU reports the following energy source breakdown: “petroleum products (34%), natural gas (23%), renewable energy (17%), nuclear energy (13%) and solid fossil fuels (12%).” [See source.] Europe has also agreed to ambitious goals to change this mix: “The share of renewables in Europe is expected to keep growing. However, meeting the new target of 42.5% for 2030 will demand more than doubling the rates of renewables deployment seen over the past decade, and requires a deep transformation of the European energy system.” [See source.]

McKinsey suggests that the best way to accomplish this transition is to undertake these five steps:

- creating resilient, at-scale supply chains for key decarbonization technologies;

- building out the energy grid infrastructure to support resilience and reduce barriers to in-region renewables;

- reexamining land use, societal, and regulatory constraints to accelerate the development of renewables;

- redesigning power markets in line with decarbonization and affordability objectives; and

- ensuring the affordability of clean technologies to foster their adoption and accelerate the energy transition. [See source.]

Herculean? You bet, but the benefit of getting it right, of course, is enormous—as is the risk of getting it wrong. However it happens, think of the executive change implied by this transformation! The energy industry will require a very different set of executive skills to succeed and that implies executive opportunity.

Before we examine the market for executive talent in this industry, let us briefly discuss another key region. While the Middle East will continue to be a major exporter of oil and gas for the foreseeable future, the region is not neglecting renewables.

“Owing to changing policies and increased support for sustainable energy, the Middle East plans to further increase renewable energy by 2024, with the goal of having 15% of the region’s electricity coming from renewable sources by 2030.” Saudi Arabia, for example, is investing $18 billion into the Sudair Solar Power Plant. [See source.]

“Between 2010 and 2020, the region’s clean energy capacity increased to 40GW, doubling in size, and it is expected to double once more by 2024. With significant investments in wind energy projects in Oman, Egypt, and Saudi Arabia, solar power—fueled by an abundance of sunlight in the desert—takes center stage.” [See source.]

So what does our energy future look like?

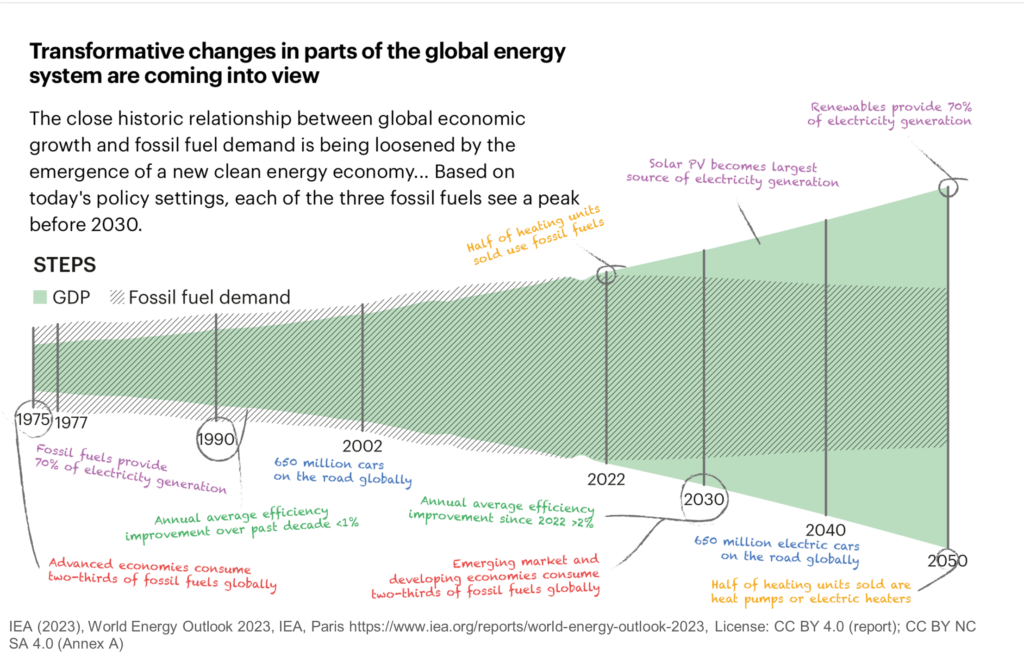

The IEA has a concise graphic we can share at this point (see graphic below) that highlights a number of key stages on our collective journey toward net zero emissions in 2050. [See source.]

Energy generation and consumption both play key roles behind this ambitious plan, including renewables reaching a 70% share of electricity generation, the scaled use of heat pumps instead of the burning of fossil fuels for heat, and a mass migration toward electric vehicles.

Most likely, it will take even more than these measures to achieve net zero which is why other more radical ideas are coming under serious consideration, including carbon capture and geoengineering.

According to Wood Mackenzie, “Energy efficiencies, renewables and alternative fuels will not be enough to meet net zero by 2050 […] We need a huge amount of carbon to be captured out of our industries and the power sector to decarbonise the last miles that can’t be easily reached by green electrification or alternatives.” Intriguingly, there are already numerous active projects utilizing various carbon capture and storage approaches, particularly in the US due to the recent Inflation Reduction Act. “Currently, Wood Mackenzie is tracking globally planned CCUS capacity at 1,400 Mt CO2 Pa, across all types of projects – capture, transport and storage. The US leads in this activity with 33% of all projects.” [See source.] Apparently still more investment will be required though to achieve net zero.

Happily, it appears that not only governments are investing in emissions reduction, but private equity is active as well.

PitchBook reports, “VC funding for companies in the voluntary carbon markets sector has accelerated at a rapid clip—from $100 million in 2017 to around $1.5 billion last year. Businesses that build infrastructure and services for the space, like Xpansiv and Aspiration, have been some of the biggest winners, along with certain credit producers like Climeworks.” [Source: PitchBook’s Daily Pitch, January 17, 2024.]

Other possible approaches offer alluring if still largely theoretical options including mitigating solar radiation in the atmosphere or even in space as well as a surprising array of more or less radical alternatives. [See source.] Whether these strategies ever see the light of day remains open, but they have already spawned new industries such as the budding and fast-growing discipline of carbon accounting that will create an entirely new cadre of professionals who will help us know if we are making any progress toward our climate goals or not. [See source.]

However this climate drama evolves, one thing is clear: there will be enormous change in this industry and that means opportunity for the executives willing to take on these new challenges. Let us now turn our attention to the people making this happen.

The Market for Executives

This year we have decided to include Director titles in the Industry Update series. Please see the Editor’s Note for further details on our definition of “executive.” In this Update, unless otherwise noted, the executive energy market includes the Oil & Gas segment as well as the Environmental Services and Renewables & Environment industry specifications.

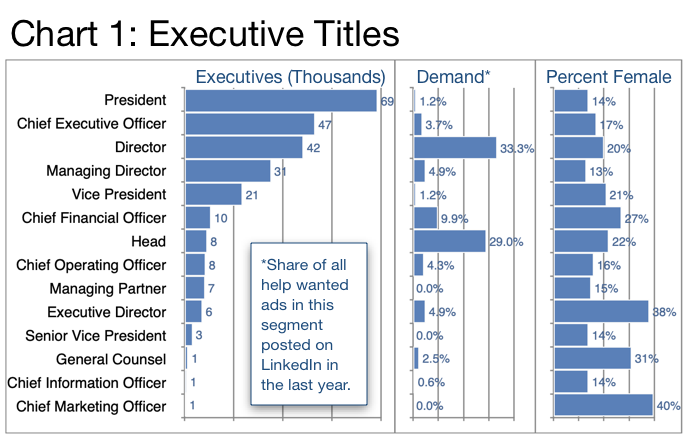

In our target geographies, some 251 thousand executives are active in this industry according to LinkedIn, a cohort that grew by 10% in the past year and saw another 3% change positions, implying that the total executive change in 2023 numbered approximately 32 thousand opportunities. This market is overwhelmingly male—just 18% of the executives are female—and the average tenure was relatively long at four years.

Comparing regional markets, the US and Canada accounted for about 144 thousand positions, up 11% YOY, the EU and UK another 85 thousand, up 8%, and the Middle East, 21 thousand, up 6%. Overall, LinkedIn rates hiring demand for this segment as high.

Even as M&A activity accelerates, there continues to be a proliferation of smaller companies in this industry as demonstrated by Chart 1 where President and CEO titles dominate the ranking (a feature of a relatively unconcentrated industrial segment). Still, the hottest growth was not at the tip of the organization but in the Director (+33.3%) and Head (+29%) roles. Female executives in this industry continue to appear mainly in the Chief Marketing Officer, General Counsel, and Executive Director roles.

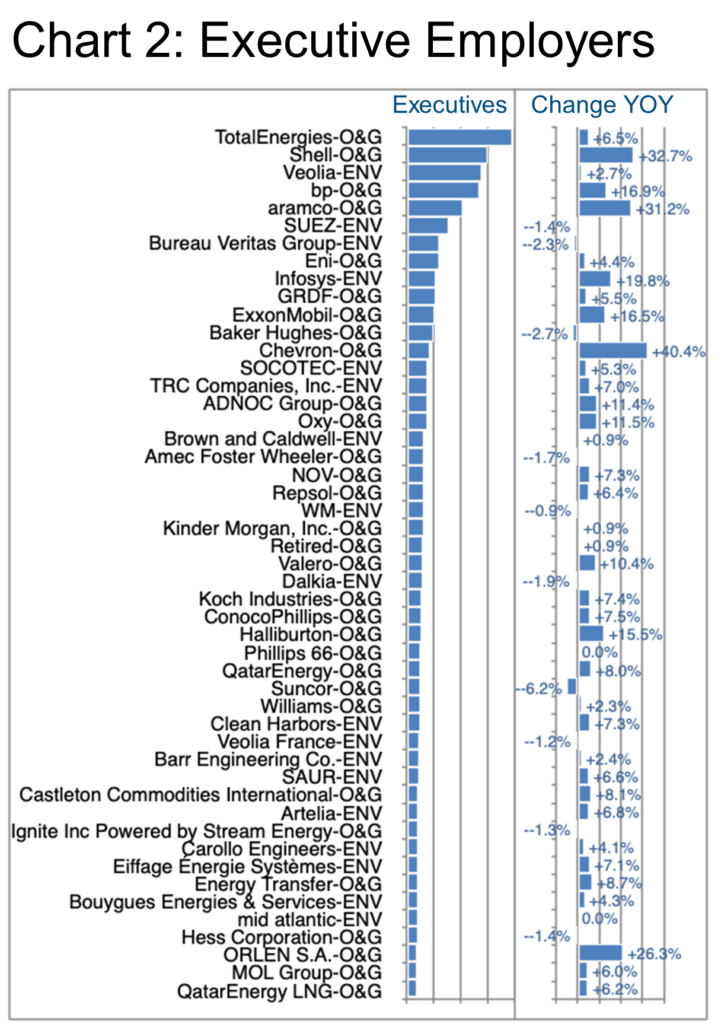

As far as employers are concerned, Chart 2 provides an overview of the largest employers of executives in this space. Please note please the “O&G” or “ENV” designations appended to the employer name in the chart representing the principle focus of the firm in either oil and gas or environment and renewables.

Fossil fuel heavyweights Shell, Aramco, and Chevron all stand out with exceptional growth in the period due in part to acquisitions.

Shell, for example, completed its acquisition of Volta, an electric vehicle charging network, as well as MIDEL, MIVOLT, BYD, all contributing to efficiency improvements or electric vehicle manufacturing. Saudi Arabia’s Aramco acquired Valvoline (lubricants) in February and also took a stake in a Pakistani company “GO, a diversified downstream fuels, lubricants and convenience stores operator, […] one of the largest retail and storage companies in Pakistan.” [See source.] Chevron acquired Hess Corporation in October, adding significantly to its oil businesses in the western hemisphere.

Polish filling station operator Orlen S.A. also grew strongly in 2023 apparently through organic means.

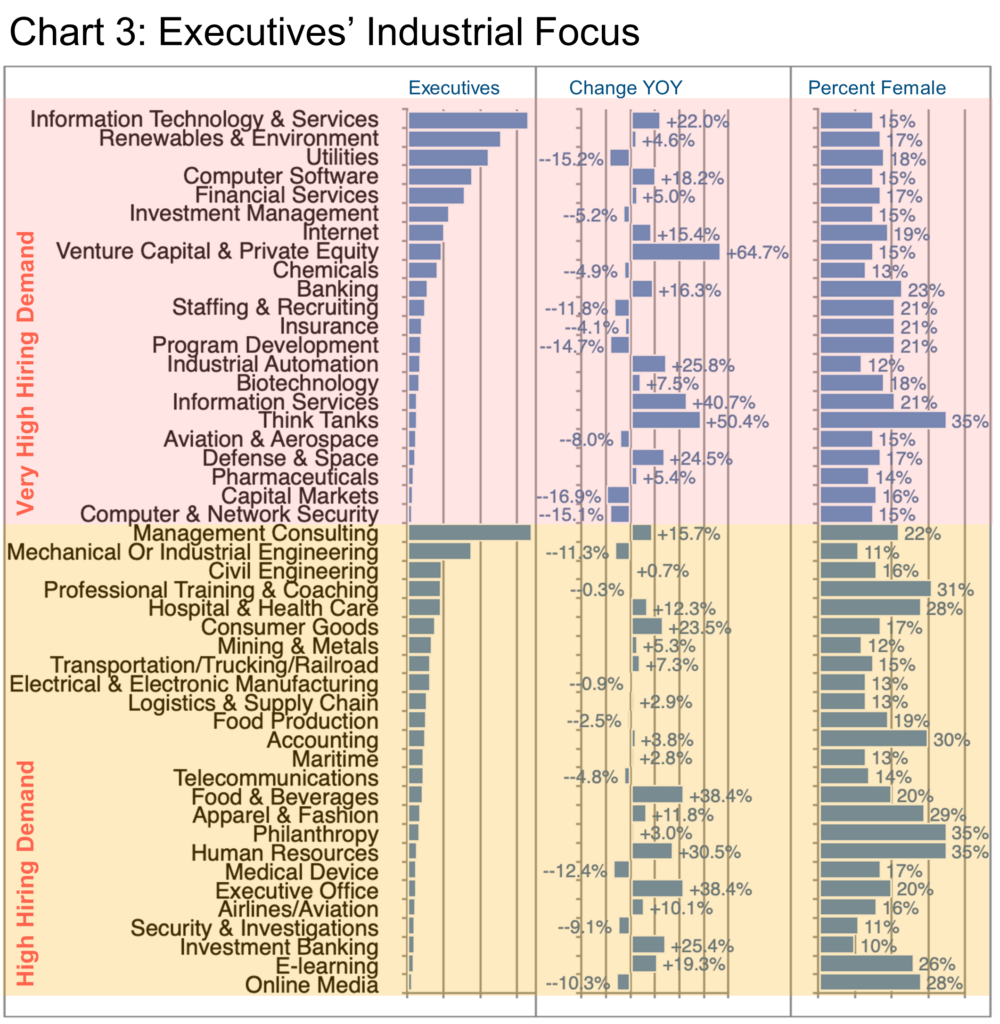

Excluding the general industry designations (Oil & Gas, Renewables, etc.), Chart 3 examines the specific industry focus of these executives highlighting those that LinkedIn designates as having very high hiring demand (in the top half of the chart) versus those with a high hiring demand (in the bottom half of the chart). The actual number of executives is relatively modest so that rounding to the nearest thousand would render the data meaningless, however the bars at least illustrate the relative size of each specific industry’s executive cohort.

Readers can easily pick out those with exceptional historical growth (Private Equity, Think Tanks, etc.). Of course, clients of the Barrett Group receive significantly more detailed data whether at the general industry screening stage, the specific company approach or interviewing stage, or even more granularly, intelligence on the hiring manager as may be helpful in the latter stages of a career change program.

Many of the fast-growing segments in Chart 3 also lend themselves to industrial migration, i.e., executives moving from one industry to another—a specialty of the Barrett Group by helping clients to truly recognize and inventory their transferable skills so as to present themselves as highly qualified even in industries or roles they have never occupied before.

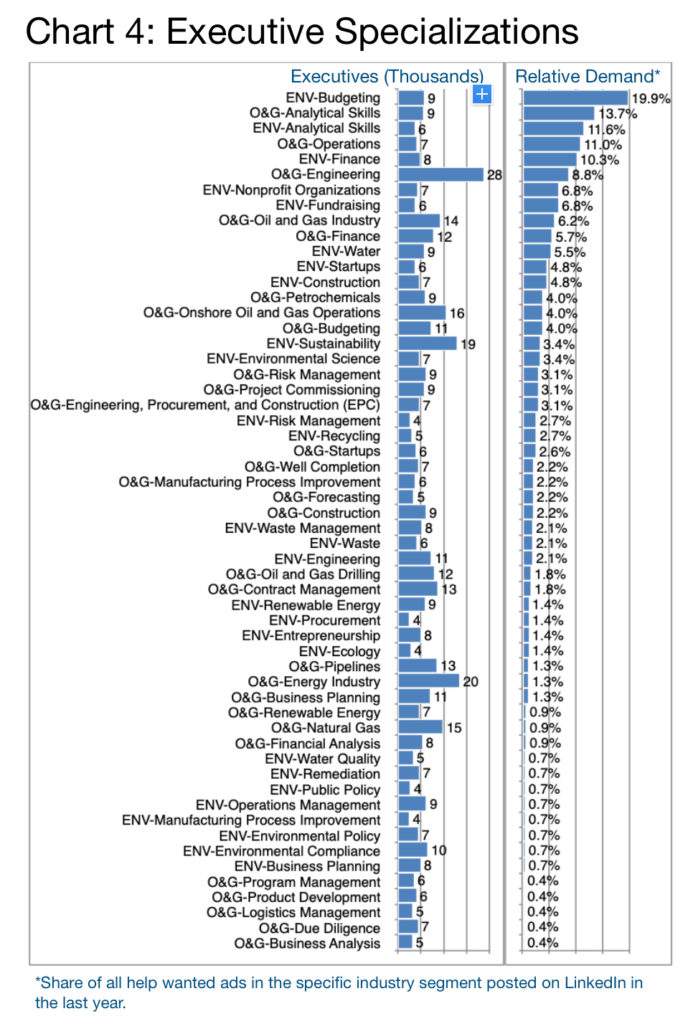

Beyond industry specializations, most executives on LinkedIn list skills or areas of special competence in their LinkedIn profiles. Chart 4 provides an overview of these ranked according to their relative demand within the two specific subsegments Oil & Gas vs. Renewables & Environment.

Clearly the quantitative and analytical skills competency is hotly in demand in this industry (Budgeting, Analytical Skills, and Finance). It seems, though, that there is a certain balance between the two subsegments in terms of demand with neither really dominating this chart.

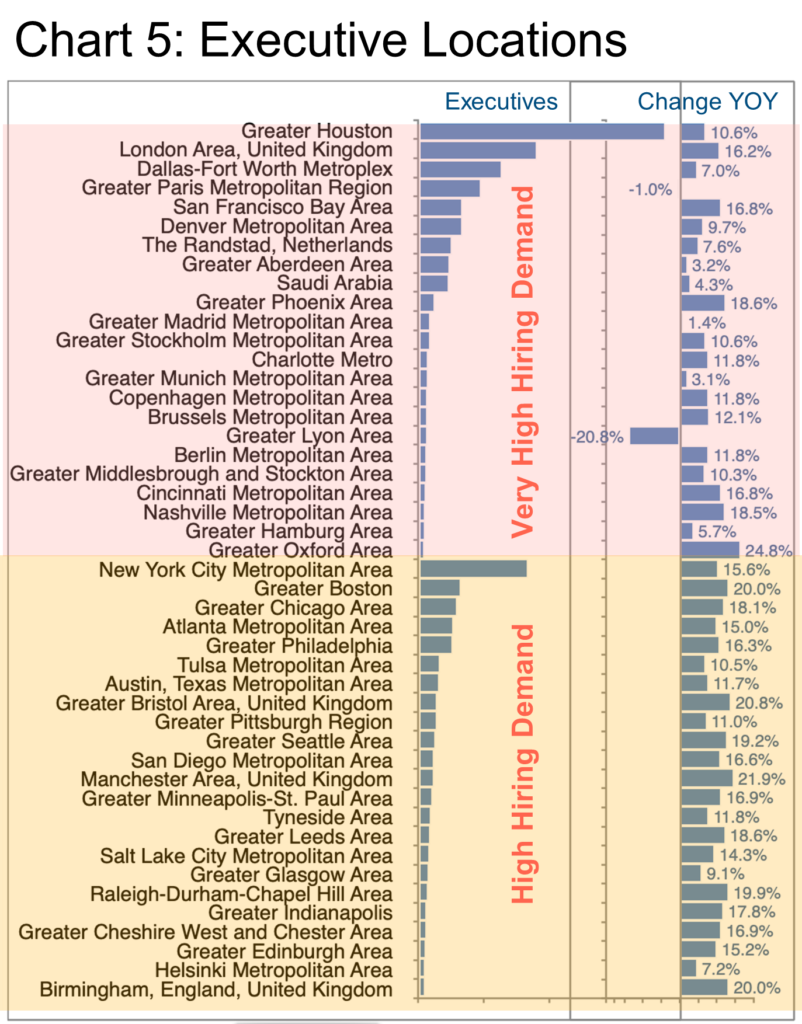

Chart 5 offers an overview of the locations where the most executives in this industry are employed grouped into those with the very high hiring demand per LinkedIn and those with (merely) high hiring demand. Naturally all of these locations show exceptional growth historically in addition to the somewhat predictive “hiring demand” evaluation. Only Paris and Lyon show a decline. In both of these cities Total is the largest employer in the cohort who shrank 7% in Lyon but grew 9% in Paris in 2023.

Peter Irish, Chairman, The Barrett Group

Click here for a printable version of Industry Update: Energy January 2024

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles principally located in the US, Canada, Europe, the UK, and/or the Middle East. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than 900 million users. (See source.) It is by far the largest and most robust business database in the world, now in its 20th year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.

Barrett Group Executive Client Success Studies in the Energy Sector

Kwasi Asare

Kwasi Asare was director of corporate safety at a firm that provides construction, maintenance and engineering support to the energy industry. His job was eliminated during the pandemic. He had been 20 years at the same company and worried about the challenges of job seeking. By the end, though, he said, “Looking back, I should have left my former job a while ago. This whole experience really helped me take inventory of things in my career. For 20 years I never thought about leaving the company. I never tested the landscape. That’s horrible! If I had known years ago what I learned from TBG, it might have set my career path in a very different direction.” [Read more.]

Justin Kinney

Justin Kinney was senior manager of robotics at an American multinational that provides equipment, technologies, and expertise to oil and gas industry customers. He left because he felt management wasn’t providing the professional support he and his team merited. He ended up transitioning to a robotics company within the supply chain industry. [Read more.]

Derek Maxwell

Derek Maxwell was global technical support manager of electrical, mechanical, marine and drilling systems for an industry-leading, offshore drilling company. The pandemic wreaked havoc on his industry and Derek got laid off. He’d spent 30 years in the oil and gas industry and thought he had little prospect of finding similar work. But his consultant had him cast his net wider. He ended up landing as senior manager of engineering and supply chain and site manager for a distribution center of a multinational retail corporation. [Read more.]

Arturo Núñez

Arturo Núñez was in a field that is sort of related to energy. He was a field test engineer at the beginning of his 22-year long stint at a large, East Coast provider of solutions that protect the integrity of critical industrial and civil infrastructure. By the end of it, he was coordinating two divisions and wearing two hats: senior manager of asset monitoring and substation reliability Center of Excellence manager. But he left because he didn’t feel supported or appreciated. After several slow months of job hunting, Arturo got two attractive job offers and a potential third offer – all in the same week. He landed as R&D/Innovation division director for a leading manufacturer of wire and cable used in the transmission and distribution of electricity. [Read more.]