INDUSTRY UPDATE: Energy

INDUSTRY UPDATE: Energy

Energy Perspective: Change is in the Air

If change represents opportunity, then this is a great time to be in the energy industry. Let us highlight some of the key challenges driving these transformations. To summarize:

Climate change has mutated from a threat to a reality. Policymakers are actively wrangling to keep the global temperature from rising even more disastrously, though agreeing on the particulars and following through are far from a done deal. Carbon sequestration or geoengineering are wonderful ideas but not yet ready for prime time. So the focus must be on generating fewer emissions in the short term.

Most governments and western public opinion support a shift away from fossil fuels and toward renewables. But the investments required for this are not even understood let alone conceived, planned, or financed. “All this will require capital spending on energy to more than double to $4trn-$5trn a year.” (The Economist, October 16-22, 2021).

Oil, gas, and coal are all under supply constraints and bottlenecks at the moment as the world recovers somewhat from the impacts of the pandemic and reduced consumption but finds itself in thrall to suppliers such as Opec and Russia. “Oil inventories are only 94% of their usual level. European gas storage 86%. And Indian and Chinese coal below 50%.” (The Economist, October 16-22, 2021).

Natural gas enjoys a reputation as a cleaner transitional strategy. However, extraction also unlocks methane and “…the global shortfall in LNG [liquid natural gas] capacity could rise from 2% of demand now to 14% by 2030.” (The Economist, October 16-22, 2021).

While rapidly gaining share, alternative energy is often intermittent (dependent on wind or the sun). The solutions include more efficient and open markets. And also better batteries and/or the coming of age of hydrogen-based technologies unless opinions about nuclear power radically change in the short term.

Deloitte adds detail to the lingering impacts of the drop in demand during 2020. “Mass layoffs and heightened cyclicality in employment continue to challenge the industry’s reputation as a reliable employer. US O&G [Oil and Gas] companies laid off about 14% of permanent employees in 2020, and our research shows that 70% of jobs lost during the pandemic may not come back by the end of 2021.” [See source.] The same source sees digitalization and the resulting efficiencies as one of the key strategies available to companies in the energy industry. This implies new skills requirements. It includes the engineering and analytical experience required to capture data, turn it into information, interpret it, and then act on it.

McKinsey weighs in on European specifics with a number of key assumptions that in themselves are earth-shaking (see source):

- Power demand grows by 40 percent until 2050

- Renewables and possibly nuclear replace coal and gas over time

- Supply and demand regions decouple

- Current power market pricing mechanisms [are] likely to fail

Among many interesting conclusions in the McKinsey study are insights into the most capital-efficient pathways for achieving the “20-20-20 targets” set by the EU. (See source.)

The US Energy Information Administration (EIA) also contributes to the somber portrait with a number of key statements (see source):

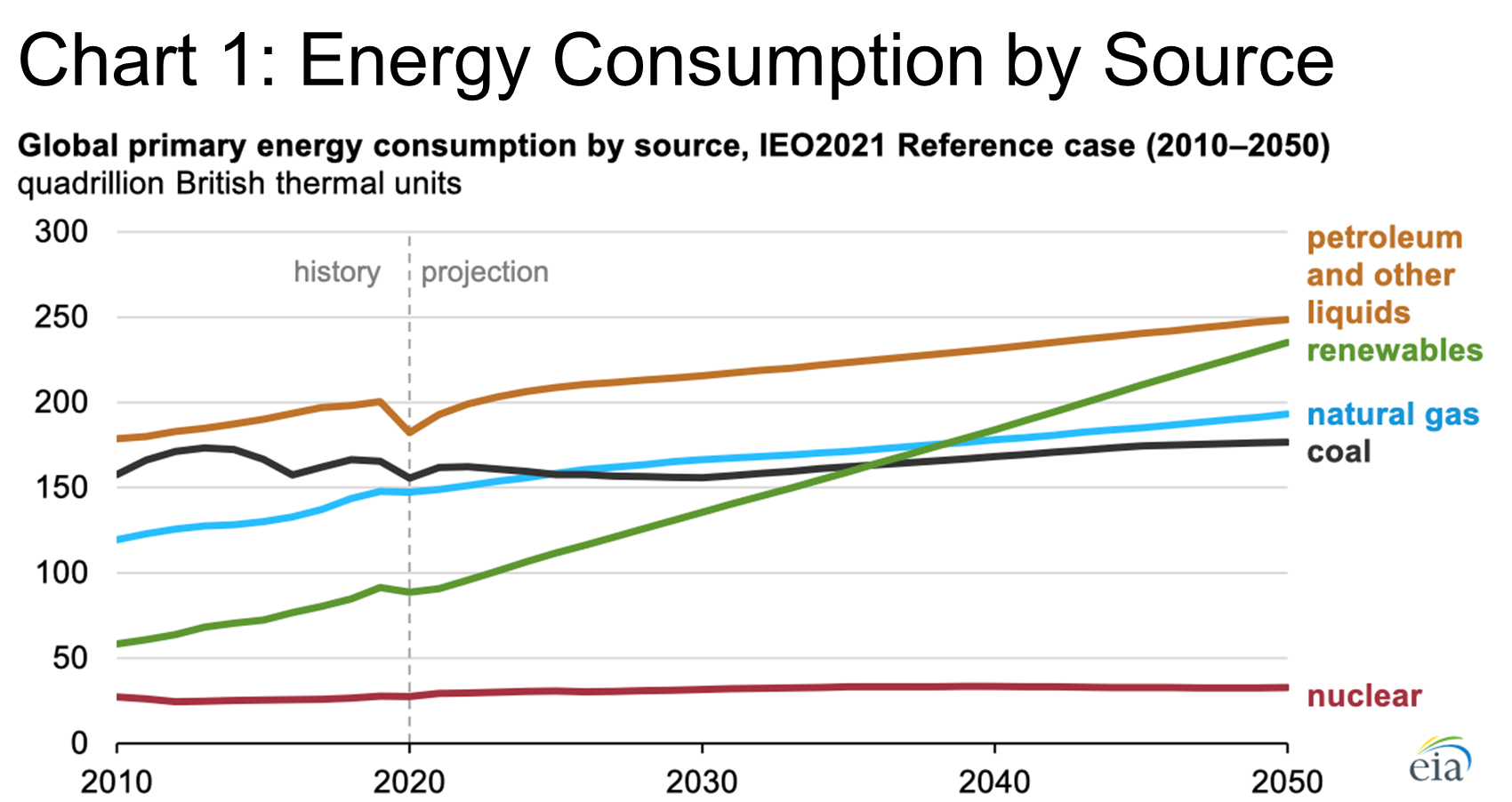

- If current policy and technology trends continue, global energy consumption and energy-related carbon dioxide emissions will increase through 2050. This is a result of population and economic growth.

- The industrial and transportation sectors will largely drive the increase in energy consumption. Electric vehicle sales will grow through 2050, causing the internal combustion engine fleet to peak in 2023…[ ].

- Renewables will be the primary source for new electricity generation. Natural gas, coal, and increasingly batteries will be used to help meet load and support grid reliability.

- Electricity generation will almost double in the developing non-OECD countries between 2020 and 2050. This generation will come largely from renewable resources, which are adopted because of falling technology costs and favorable laws and regulations.

- Oil and natural gas production will continue to grow. This is mainly to support increasing energy consumption in developing Asian economies.

- Driven by increasing populations and fast-growing economies, consumption of liquid fuels will grow the most in non-OECD Asia. This is where total consumption nearly doubles by 2050 from 2020 levels…[ ]. [See source.]

In summary, if the EIA projection is directionally correct, renewables will rival petroleum. They will exceed gas within the next three decades in terms of global consumption even as oil and gas continue to grow. Vast amounts of investment capital will be needed to fund these changes. Electric vehicles, battery, and hydrogen technology will evolve rapidly, as will demands on executive skills.

Editor Note:

In this Industry Update “executives” will generally refer to the CEO, CFO, COO, CTO, CIO, CMO, and Vice President titles only. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research. Is LinkedIn truly representative? Here’s a little data: LinkedIn has approximately 722 million users, 174 million in the US, and 163 million in Europe. (See Source) It is by far the largest and most robust business database in the world, now in its 18th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year. “Attrition” is defined as the departures in the last 12 months divided by the average headcount over the last year.

Even the industry players may be very different in the coming decades. For example, who would have predicted ten years ago that Tesla, an upstart electric vehicle maker, today would possess a larger market capitalization than the other top seven vehicle manufacturers combined? Attentive market observers should keep a close eye on the venture capital and private equity markets who will likely help fund the next generation of energy market titans.

Portrait of the Energy Industry Today

With the caveat that this industry will likely look very different in the intermediate future, this update describes a pool of executives as we define them (see Editor’s Note) in the US, EU, UK, and Middle East (ME). They are numbering some 46,750. They show less than 1% growth in the last year. And per LinkedIn, only 1,728 claim to have changed jobs in the last year. The industry is 85% male as far as its executive ranks are concerned. And sufficiently “global” that, other than the location we will not segment the information into geographic regions.

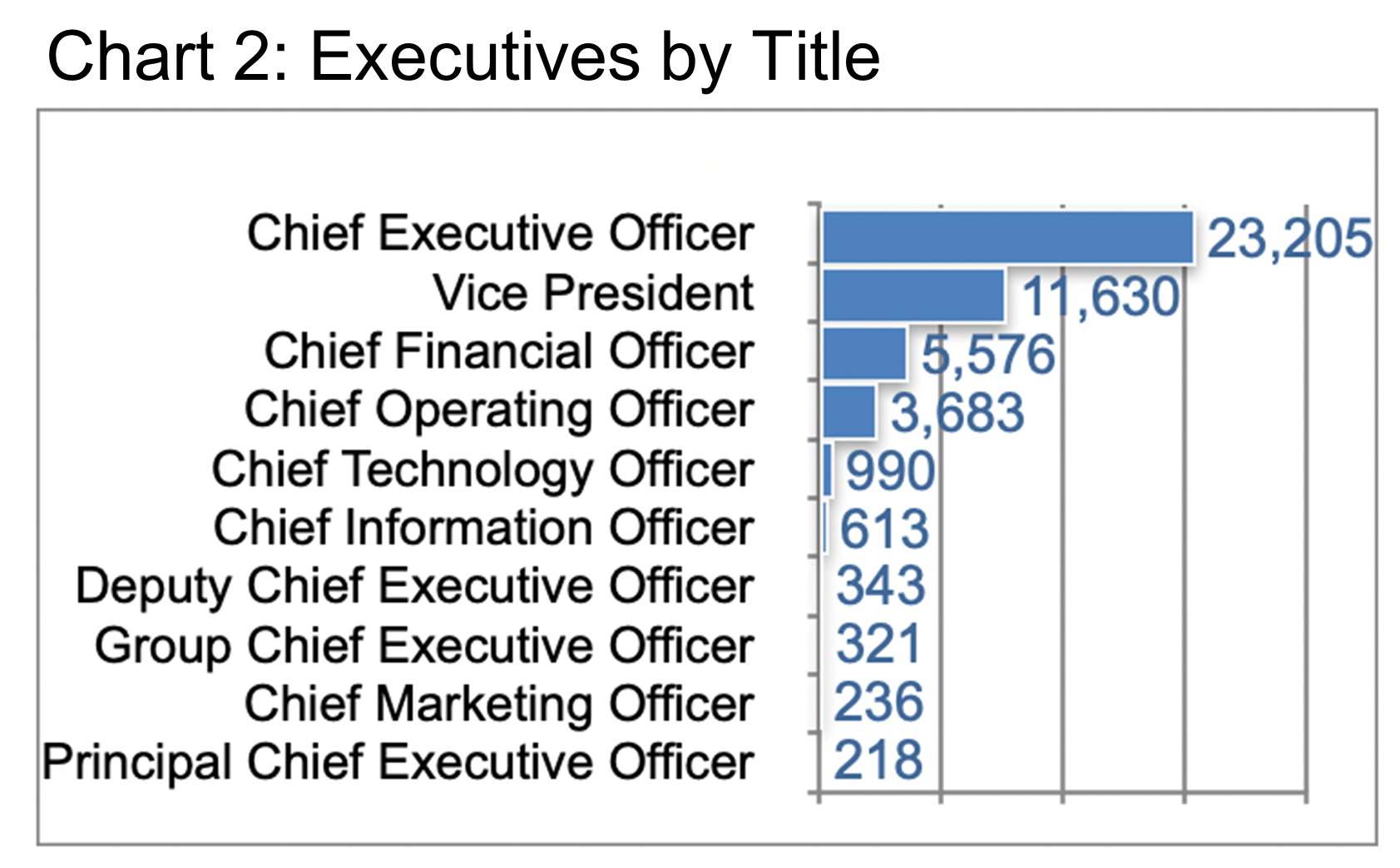

Like other industries we have recently portrayed, this one also shows a preponderance of CEOs (Chart 2) that indicates a rather unconcentrated range of smaller companies as we descend the rankings.

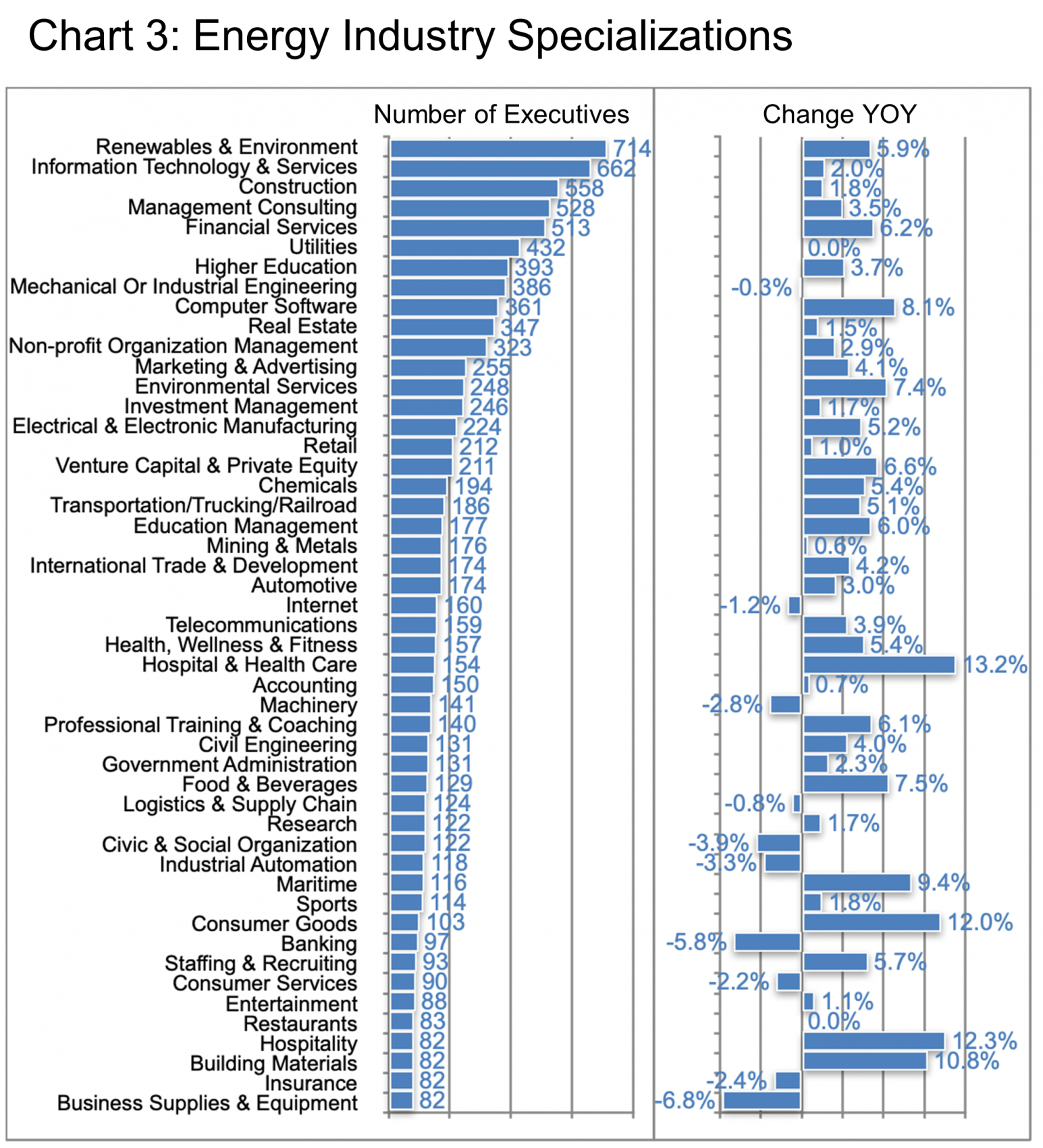

Within the energy field, executives cited numerous specializations (Chart 3).

On the one hand, it is encouraging to see Renewables & Environment and Environmental Services so prominent in that list. Both are growing at a reasonable rate of about 6% or more YOY. However, many of the strongly growing specializations are more generic in nature. They are subject to importation from other industry segments. This is something we at the Barrett Group (TBG) always look for when we are guiding clients who seek to demonstrate the transferability of their skills. Let us focus briefly on the more highly represented, faster-growing, and yet transferable specializations:

- Financial Services

- Computer Software

- Venture Capital & Private Equity

- Education Management

- Hospital & Health Care

- Professional Training & Coaching

- Food & Beverages

- Consumer Goods

All of these show more than 100 executives in place and a growth of 6% or more YOY. Even hospitality shows signs of life at 12% YOY growth, a welcome sign after the decimation in this industry due to the pandemic.

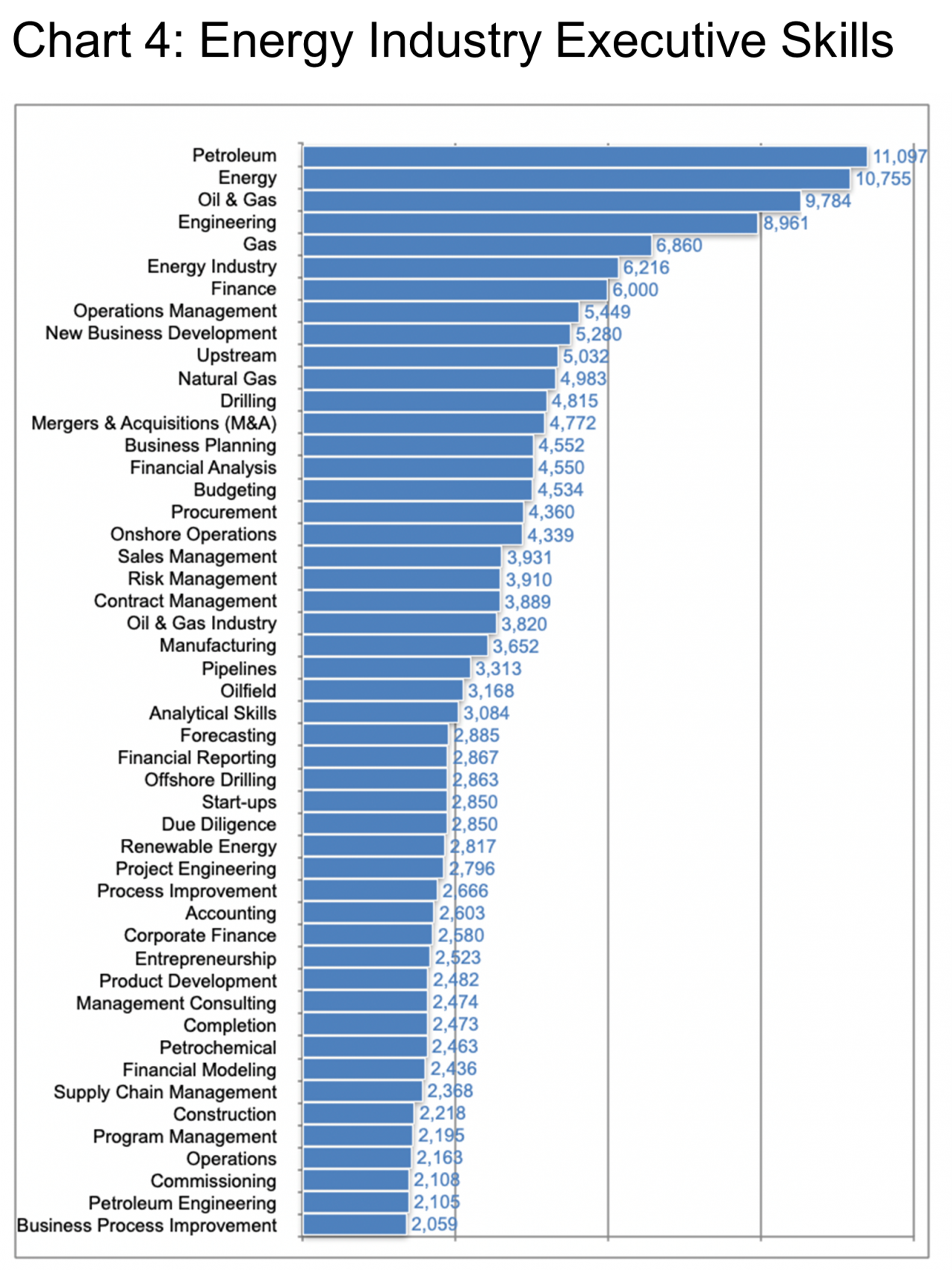

Looking at Chart 4, it focuses on the top skills highlighted by executives in this industry on their LinkedIn profiles. Again, many of these skills are highly industry-specific such as “Drilling” and “Pipelines”. And others are highly generic and given the expected changes in the industry may see increasing demand. For example, Finance, M&A, Business Planning, Financial Analysis, Budgeting, Analytical Skills, etc. are all highly transferable.

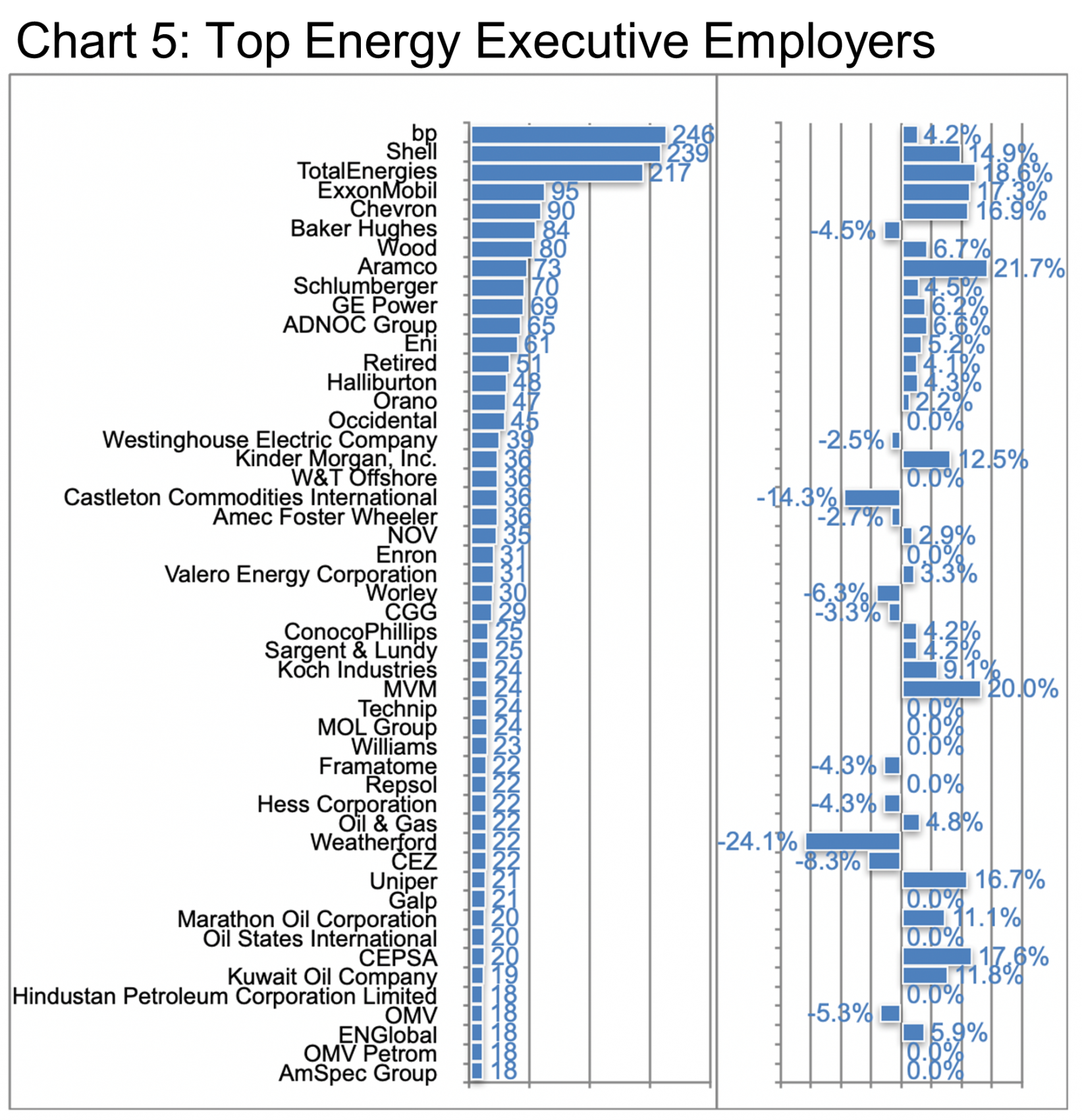

Observers were intrigued as “British Petroleum” rebranded to “Beyond Petroleum” some years back. This was a move that seems highly logical from today’s perspective. As noted above, many of the employers in this industry are relatively small in size. Therefore they have a smaller number of executives (hence the relatively high number of CEOs). Chart 5 makes this plain already within the context of the top 50 employers of executives in this industry.

To understand the movements in this industry, let’s take a more detailed look at several representative companies.

First, let’s review the top of the list. BP shows 258 executives as we define them in the targeted geographies. Per LinkedIn, 15 were new hires in the past 12 months. And there was an 11% attrition rate (regardless of who instigated the changes). London is BP’s prime executive location with 63 officers, up 11% in the past year. London is followed by Houston (48, +2%), Chicago (15, +7%), New York (8, +0%), and Denver (5, +0%). Other European locations include Hamburg (3, +5%) and Frankfurt (3, +0%). BP appears to have had a small spike in departures (-10) in December 2020, and then been relatively steady through the balance of the year.

BP hired from Boots UK, EverSource Capital, AstraZeneca, Schneider Electric, and ENGIE. Also from Shell, MacQuarie Group, and Genpact. BP lost talent to FreeWire Technologies, BKV Corporation, Parsons Corporation, Arnold & Porter Kaye Scholer LLP, INEOS, GeoLogica, Rio Tino, and a number of other companies. Of their hires in the past year, 9 were at the Vice President level. 2 were CFOs. And there were 1 each CEO, COO, and CTO. If one reviews the skills of the newly hired, these are generally not energy-industry-specific skills. Rather they are business process improvement skills, financial modeling, forecasting, and analysis.

In the number two spot, Shell lists 240 executives including 49 hires (+16%) and 8% attrition. Their key executive locations are the Randstadt, NL (30, -12%), London (26, +4%), Houston (25, -4%), Los Angeles (9, +80%), and New York (7, +17%). Shell also saw a small peak in departures in December 2020. Shell has continuously hired executives over the last year for a net gain of 32. The departures were generally to energy companies (e.g., Endurant Energy, Sempra LNG, Naftogaz of Ukraine, etc.). Shell’s hires were from non-energy-related enterprises. They hired 16 CEOs, 9 VPs, 5 CFOs, and 3 CIOs in the period.

Rounding out the top three, Total Energies also went on a hiring spree in 2021. Employing 229 executives, 48 new hires, and showing a modest 5% attrition. Their executives are mainly in Paris (90, +7%), Houston (11, +22%), UAE (6, -14%), Lyon (4, +0%), and Barcelona (4, +33%). As others were downsizing, Total hired strongly in December 2020 (+12). They then remained relatively stable until September when they again hired 10 executives. Total hired from a mixture of energy and non-energy companies: LVMH, Aramco, Groupe PSA, Hutchinson, Renault Group, EDF Enouvelables, Shell, Group City One, PWC, and Ingenico, for example. They gave up talent to a similarly eclectic group of firms. Total added 16 CEOs, 12 Vice Presidents, 5 CFOs, and 3 CIOs in the period.

It is perhaps difficult to generalize from these examples. But we believe we see validation of the predicted trends toward the net acquisition of talent from non-energy companies as this industry diversifies and implements the energy transition required to slow global warming.

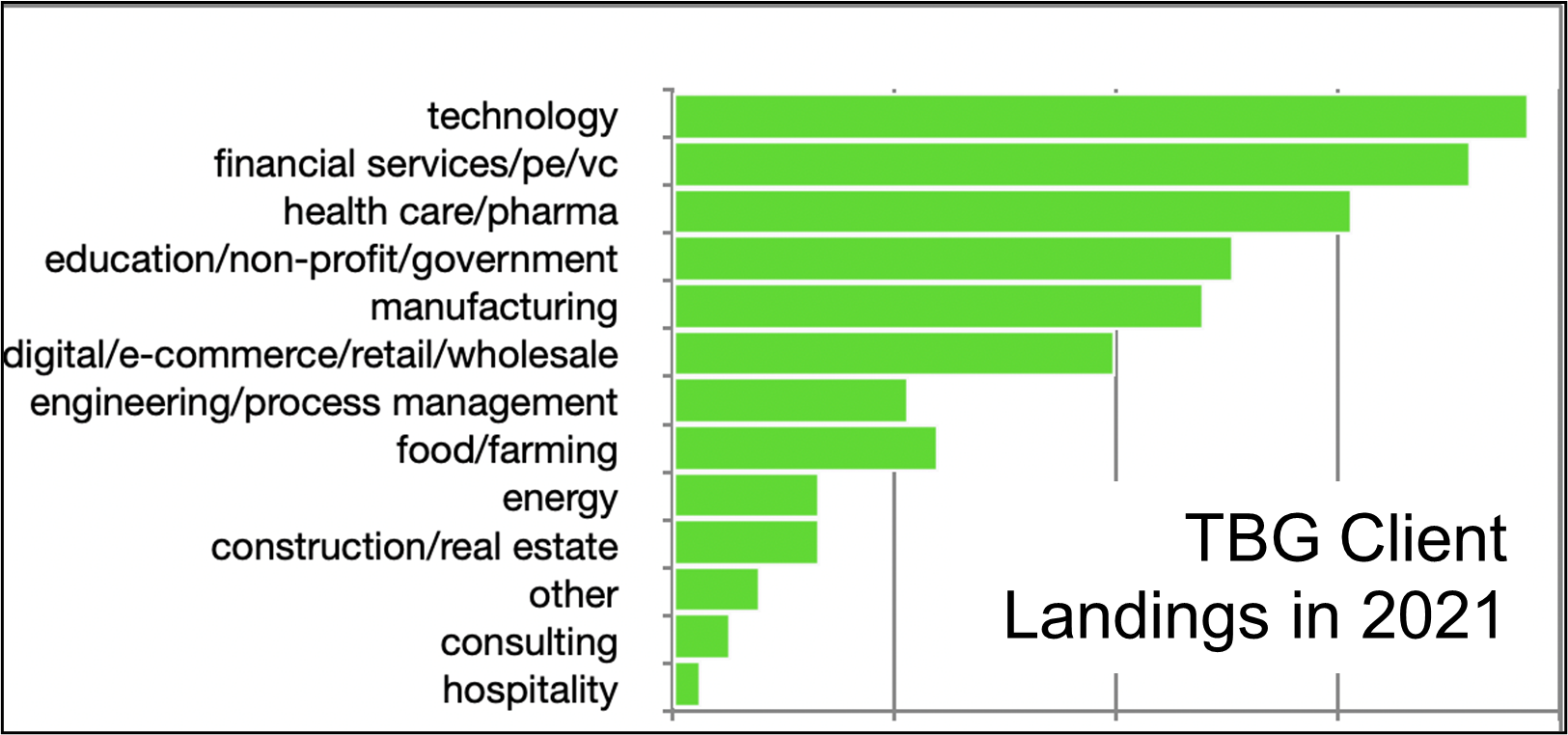

In general, executives seem to welcome these changes and be much more open to changes in the industry, role, and even geography. We at TBG are proud to be facilitating these adjustments by helping executives take matters into their own hands. As part of our five-step career change process developed over the last three decades, TBG helps executives review their career plans in the light of their whole lives and adjust their career trajectories to suit their own objectives. The pandemic has occasioned a lot of reflection, as you can imagine. From an industry perspective, here is where our clients are landing in 2021:

Peter Irish, CEO The Barrett Group

Click here to download a printable version: Industry Update – Energy