INDUSTRY UPDATE: Big Tech

Introduction:

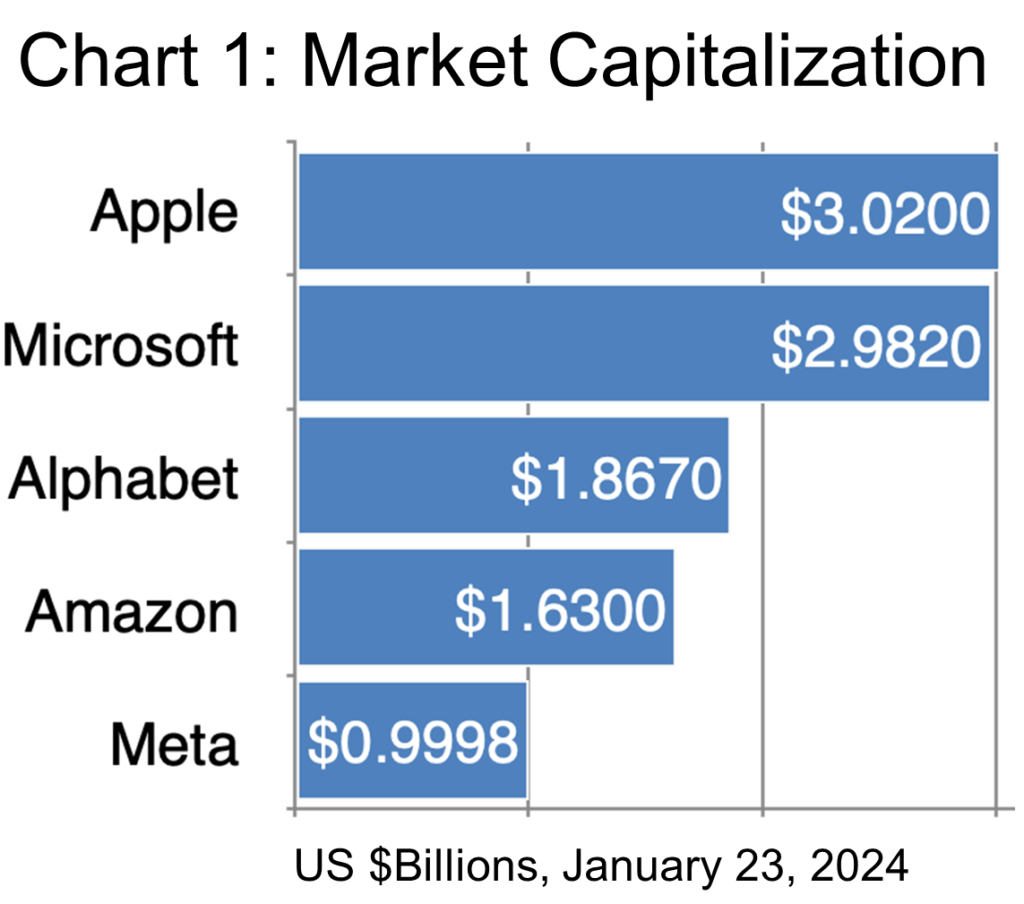

One could philosophize about what constitutes “Big Tech” or perhaps simply refer to the global market capitalization (share price x shares) of the tech companies and arrive at a pretty solid list. Admittedly, Chart 1 excludes the chip maker Nividia (rank 5, Market Capitalization of $1.484 Billion) because of its very specific manufacturing focus while the others are all focused on delivering B2C services and equipment for the most part. [See source.]

These companies (along with Nividia and Tesla) are so important in various stock indices, that the Economist recently mused that we should perhaps differentiate between the published S&P 500 index and the derivative “S&P 493,” i.e., without the “magnificent seven,” because in total these seven stocks account for almost 30% of the S&P 500 market capitalization [Economist, November 8, 2023, “Forget the S&P 500. Pay attention to the S&P 493”]. The risk is that the out-sized impacts of these behemoths in any given index masks the underlying performance of the other stocks.

Intriguingly, the executives who run these enormous companies comprise a minute share—just 0.08%, in fact—of the entire 11-million-strong executive population that the Barrett Group (TBG) follows (see Editor’s Note). Frankly, they are not even comparable among themselves with the effect that any comparison is of very unlike business propositions as readers will see in this Update.

For example, Apple competes with Netflix, Disney, and many others on content. Apple competes with Samsung on mobile phone hardware and systems. They compete with Lenovo, HP, and Dell among others on computers and laptops. Apple competes with Microsoft and Alphabet on software. Amazon competes with Microsoft, Alphabet, Alibaba, IBM, and others in the cloud infrastructure market. And also competes with Walmart, Target, and others in the online retail market. Alphabet, Meta, Amazon, Microsoft, and Alibaba all compete for online advertising revenue. Apple and Microsoft also compete in the online gaming market, along with Tencent and Sony.

In short, what may most connect these diverse companies is their need for talent, specifically, executive talent. But before we delve into that subject, let us take a quick look at these competitors’ recent results.

In spite of a significant improvement in its stock value (circa +49%), Apple suffered lower sales in its fiscal 2023 period due to lower iPad (-3.4%) and PC/Laptop (-11%) unit sales, followed by a hiccup on its Apple Watch when new models were removed from stores in the US days before Christmas.

Apple also found itself having to diversify its supply chain away from China even as unstable and politically fraught Chinese demand may yet cause further turbulence. Still, Apple’s $383 billion in revenue and $97 billion in net income in 2023 indicate the company’s underlying rude health. [See source.]

Microsoft’s stock has risen 63% since the beginning of 2023 according to Forbes (See source) driven by improved performance in its productivity and business processes unit as well as its intelligent cloud unit. Expenses overall declined, improving margins. Microsoft released its latest quarterly results on January 30, 2024: “Revenue was $62 billion in the three months that ended in December, up 18 percent from a year earlier. Profit hit $21.9 billion, up 33 percent.” [See source.] AI and gaming underpinned the improved performance. ChatGPT gives Microsoft a very strong leg up to lead this fast-growing market segment, not to mention how AI may improve Microsoft products going forward. [See source.]

Alphabet’s share price soared 58% in 2023, albeit after plunging 39% in 2022, rising in part due to an improving economy that increased ad spending and partly buoyed by general enthusiasm as AI drives investors’ behavior. Alphabet introduced its latest “Gemini” generative AI product in late 2023. “Gemini was tested on various skills, including audio and video understanding, natural image, and mathematical reasoning, “exceeding current state-of-the-art results on 30 of the 32 widely used academic benchmarks […] in large language model (LLM) research and development.”” [See source.] Alphabet seems well poised to leverage advances in AI on its Google search, Google Suite, and other platforms, but it disappointed in ad revenues in its latest results [see source]. Could its dominance in search be in jeopardy?

Amazon stock gained 81% in 2023, its best performance since 2015. Analysts expect an 11% increase in sales and very strong (+2,500%) earnings per share. While most advisors are rating the stock as a “buy” in 2024, there are a few concerns brewing.

Can the AWS unit return to significant growth, for example, or is Amazon lagging in AI versus key competitors? In 2023 Amazon launched Bedrock, a software allowing developers to build AI in several language models, acquired Anthropic, a ChatGPT rival, launched a new improved chatbot for businesses, and generally evinced every ambition not to lag competitors. Holiday sales in its online retail division appear to have been strong, too, as overall industry sales surged 5% versus the prior year during the holiday season. [See source.] The future may also hold significant regulatory hurdles for the company due to 17 US state attorneys general filing a major antitrust suit against Amazon.

Meta, parent of Facebook, saw its stock on track for a record performance (+178% as of December 18, 2023) for the year as its cost-cutting of nearly 20,000 positions improved results markedly. [See source.] Even while Meta continued to invest in its future-oriented “metaverse” virtual reality offering (which lost an estimated $3.7 billion in the latest year), digital ad sales that had been plummeting turned positive. “[…] analysts estimate that e-commerce companies Temu and Shein, which both have roots in China, spent about $600 million and $200 million, respectively, on ads with Meta in the third quarter, leading to year-over-year growth of 44% from Asian advertisers.” [See source.]

Investment in AI has helped Meta improve ad targeting, data centers, and other processes, but competition from TikTok and YouTube is fierce, and Meta is also facing several lawsuits alleging the company’s products are harmful and addictive to children.

Now let us examine the executives who make all of these results a reality.

The Market for Executives: Big Tech

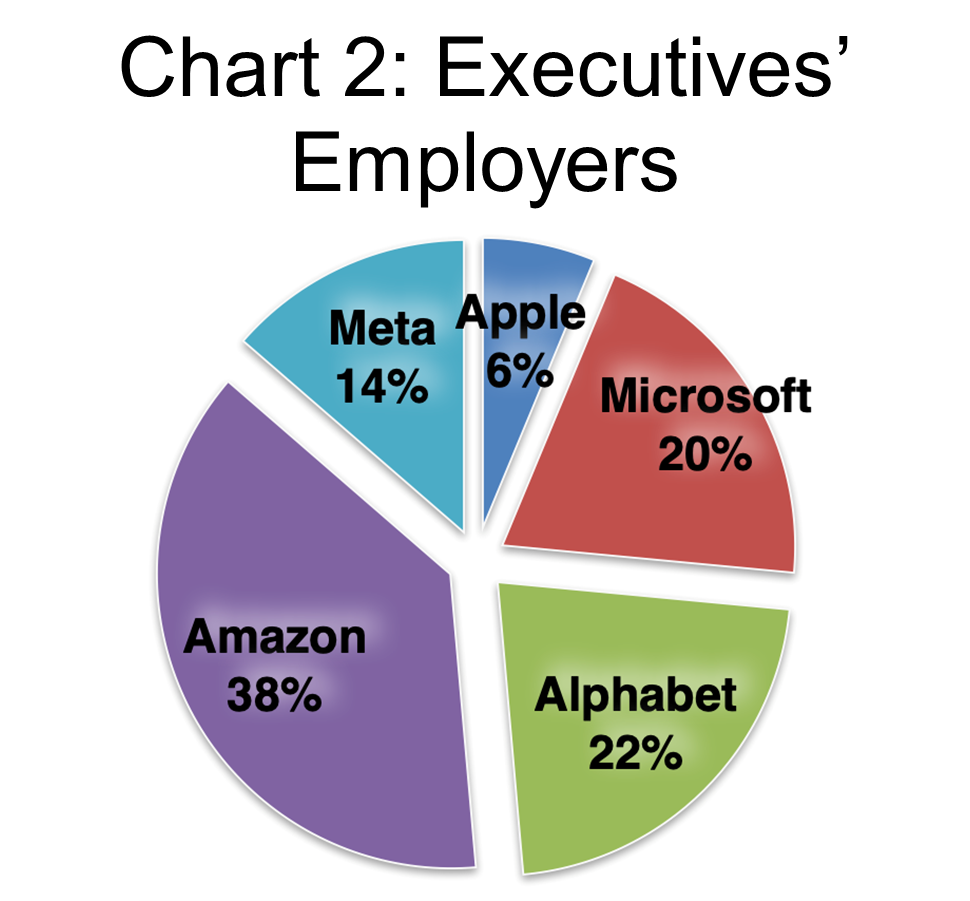

Almost 9,000 executives as TBG defines them (see Editor’s Note) list these companies as their employers on LinkedIn.

Keep in mind that we reported significant staffing reductions in our last Big Tech Industry Update (February 2023) as follows: Amazon (18,000; 1.2% of the workforce), Alphabet (12,000, 6.4%), Meta (11,000, 12.6%), and Microsoft (10,000, 4.5%), although these reductions were across the board and not only the executive level. Apple had not announced any significant restructuring at that time.

From that lower net level 12 months ago this executive cohort apparently grew very differently at the various companies, ranging from a low of 0.7% at Microsoft to a high of 31% at Amazon. The average for the cohort was 15% growth YOY. Chart 2 explains what share of this group each company employs.

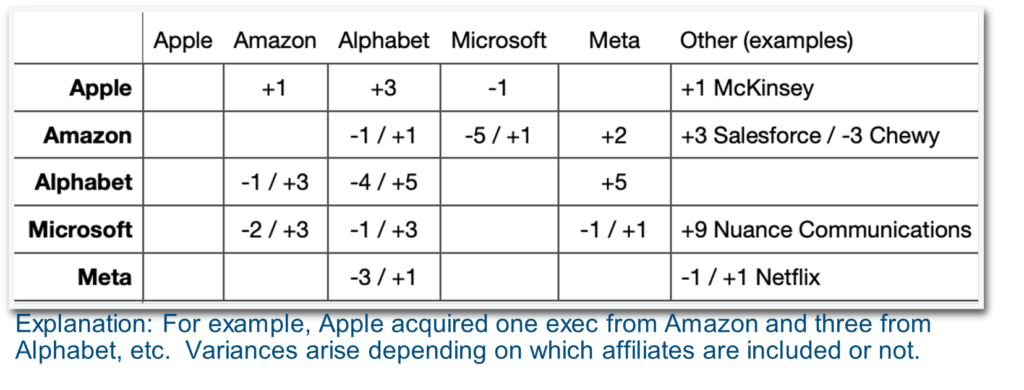

LinkedIn reports frequent, if not voluminous executive transfers between these players (and a few key others). This data changes continually, but here is a snapshot to illustrate the point:

Restructuring in the tech industry is also likely to continue in 2024, though bear in mind that many of these adjustments will not be at the executive level. So far Microsoft, Alphabet, Amazon, and many others have already announced downsizing initiatives. [See source.] Some of these may well be attributable to efficiencies through artificial intelligence (AI) as the business press has speculated, but others are more related to ongoing adjustments after over-hiring in the post-pandemic era and specific segment dynamics such as video content management and gaming.

Let us take a quick look at some of the key sector dynamics affecting this playing field:

Search

Search may well be the number one way in which consumers interact with the web. One source lists 10 ways in which search is likely to evolve in 2024 including drivers such as “AI and Machine Learning enhancements,” “Voice Search and Natural Language Processing,” and “Site Search will support users through chatbots and conversational widgets.” [See source.]

Another source predicts the predominance of “social search,” i.e., the use of social media to search instead of using the traditional web browser. Younger users’ search habits are distinctly different than baby boomers’, for example, focusing mainly on mobile search and utilizing TikTok, Instagram, Facebook, etc. far more intensively. [See source.] In fact, Forbes reports “Last year, the top search engine in the world, Google, reported that roughly 40% of Gen-Z is using TikTok and Instagram for search instead of Google.” [See source.] Clearly, these trends could indeed shift the search landscape going forward.

Advertising

Advertising: “Ad spending in the Digital Advertising market is projected to reach US$740.3bn in 2024. The largest market is Search Advertising with a market volume of US$306.7bn in 2024. In global comparison, most ad spending will be generated in the United States (US$298bn in 2024). […] In the Digital Advertising market, 70% of total ad spending will be generated through mobile in 2028.” [See source.]

PWC goes on to provide this succinct compilation:

- “The world of retail media—advertising on e-commerce sites and at retailers’ owned real-world assets—is growing rapidly. In the fourth quarter, Amazon reported US$11.6 billion in advertising revenues, up 19% from the previous year’s quarter, while Walmart’s Connect business generated US$2.7 billion in 2022.

- The platforms that capture the attention of the youth are seeing revenues explode. In late 2022, TikTok projected its ad revenues for the year to more than double, from US$4 billion in 2021 to US$10 billion.

- As gaming continues to grow as a medium, it is becoming the locus for a heightened level of advertising. In the 2021 Outlook, we charted for the first time the size of the in-app games advertising market. Coming in at US$54 billion in 2021, it is expected to more than double by 2026 to US$118.6 billion.

- According to the Outlook, connected TV advertising will rise from US$16.6 billion in 2022 to US$27.7 billion in 2026.

- As streaming companies encounter headwinds to subscriber growth, they are also starting to focus on advertising as a potential growth area. Netflix, for example, has launched an advertising business, centered around a cheaper, ad-supported tier that offers a lower monthly subscription price aimed at expanding the potential universe of subscribers.” [See source.]

Streaming

Streaming represents a whole universe of competition as the OTT (“over the top media,” i.e., services bypassing cable and broadcast to deliver services directly via the internet) seems on track to deliver CAGRs of 29% through 2027 even as SVOD (“subscription video on demand”) will likely remain the largest segment for the time being while penetration continues to grow. Higher transmission speeds through 5G will further enable streaming growth. Over time access to quality content will increasingly drive consumer behavior. [See source.]

Gaming

Gaming brings content generation, streaming, AI, and virtual reality together under one roof, making Meta’s investment in the metaverse or the pricey Apple Vision Pro headset, for example, more understandable. “The projected revenue in the Online Games market worldwide is expected to reach US$27.97bn in 2024. It is projected to have an annual growth rate (CAGR 2024-2027) of 5.20%, resulting in a projected market volume of US$32.56bn by 2027. By 2027, the number of users in the Online Games market is expected to amount to 1.2bn users.” [See source.]

In short, competition will heat up in 2024. Let’s look at the players.

Executive Locations: Big Tech

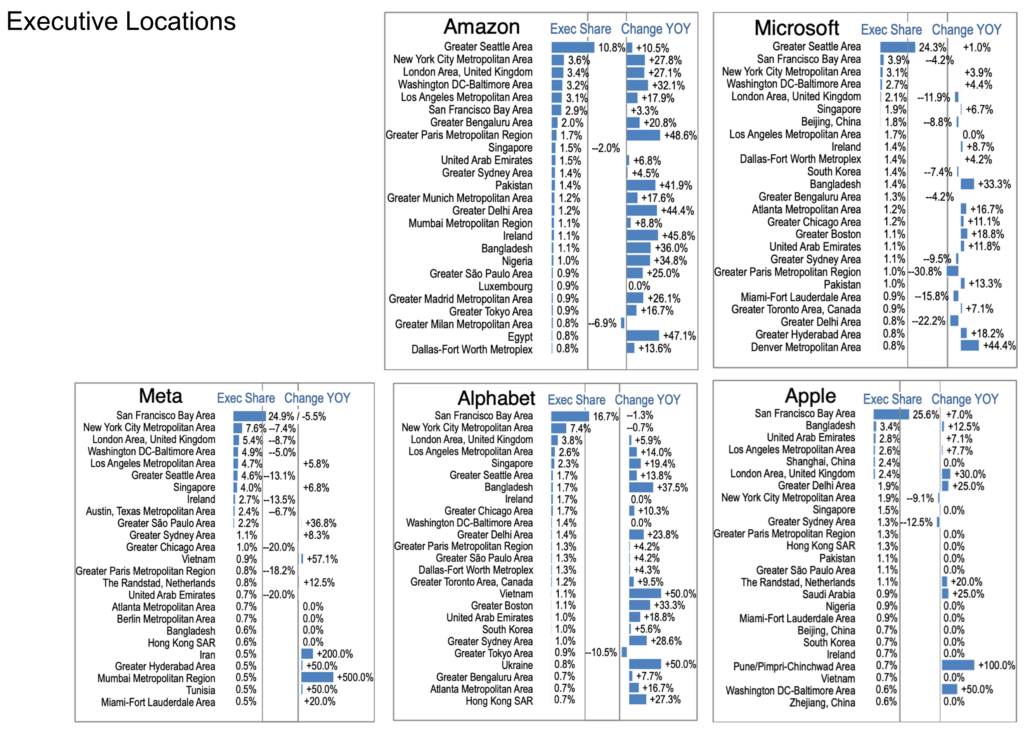

Given the relatively small numbers of execs involved, TBG is not at liberty to publish specific head counts, however, we can note the share of total executives per location and the relative change of that population according to LinkedIn. Remember, too, that the downsizing at many of these companies took place early in 2023, so that the variation over the last year may well be against a reduced baseline. Overall, it does seem as if the most developed locations (New York, London, Paris, etc.) are tending to decline while other regions benefit. San Francisco took quite a drubbing in 2023 and remains a mixed picture. Los Angeles seems to be growing in all cases. Note that these high-level summaries are just that—high-level, but that TBG’s clients have access to significantly more granular data as their career change programs progress.

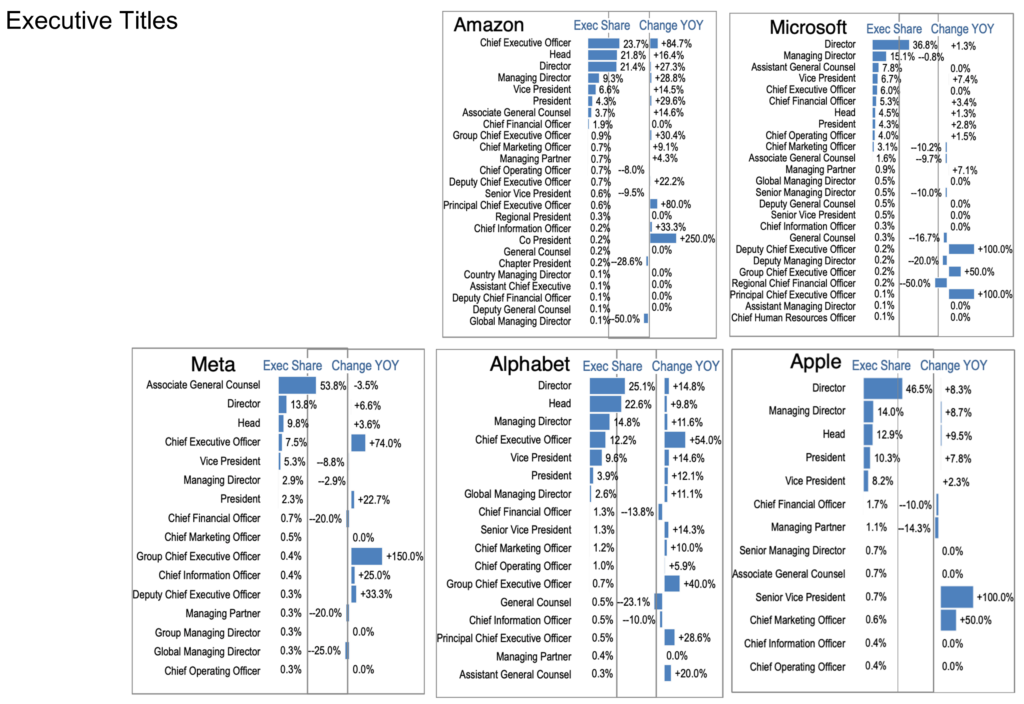

Executive Titles: Big Tech

The same limitation applies here as to the small number of execs per title, however, readers can still recognize the relative importance of each title at each company as well as the relative change per title. Yes, Amazon apparently has a lot of CEOs. According to one source that is because the company empowers General Managers as “CEOs” in their respective business units and therefore has more than one hundred CEOs. [See source.] Otherwise, “Director” is the most widely distributed title.

A curiosity with Meta is the enormous preponderance of legal titles—53.8% of the executives are “Associate General Counsels.” One explanation is that the company is involved in a lot of legal actions. [See source.] The company also apparently posted the majority of its help-wanted ads this past year in support of legal roles according to LinkedIn, so the need is not purely historical.

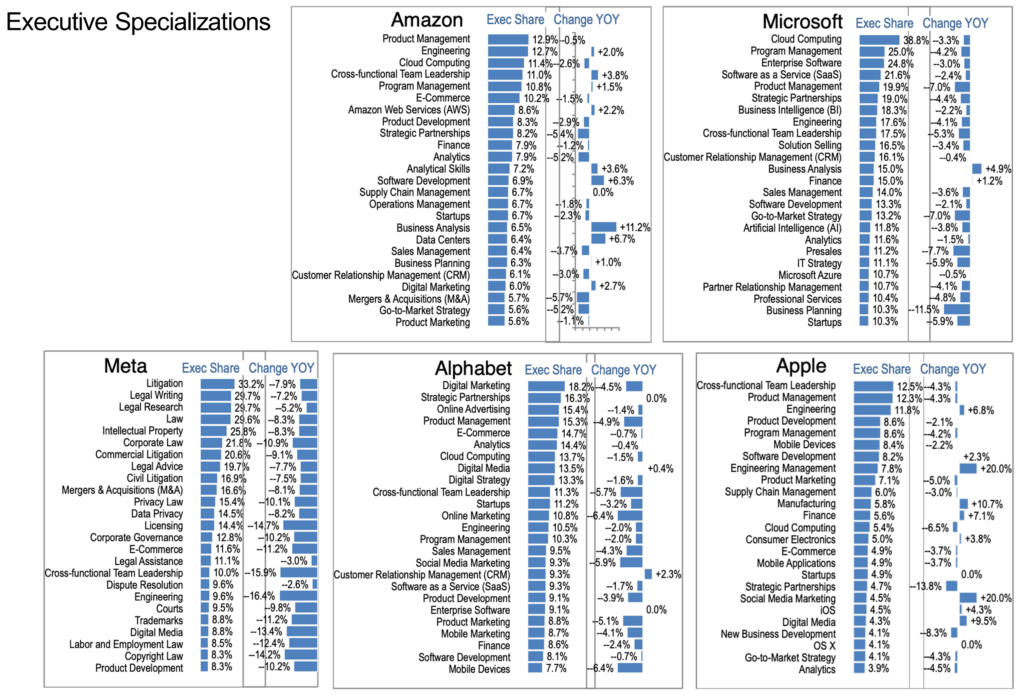

Executive Specializations:Big Tech

While the expected categories such as Cloud Computing and Software Development are present at most of these players, they are not the fastest growing skills. Even Artificial Intelligence at Microsoft shows a reduction in executives according to this data. Business Analysis does well at Amazon and Microsoft, and Apple remains heavily focused on engineering, while the emphasis on legal skills remains clear for Meta. As usual, there are many skills represented here that are relatively generic offering opportunities to transition into or out of these companies for entrepreneurial executives eager for change. Please note that most executives list more than one specialization.

Peter Irish, Chairman, The Barrett Group

Click here for a printable version of Big Tech 2024

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, President and Director titles. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represent a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative? Here’s a little data: LinkedIn has more than one billion users in 200 countries. (See source.) It is by far the largest and most robust business database in the world, now in its 21st year. LinkedIn Talent Insights data is derived by aggregating profile data voluntarily submitted by LinkedIn members. As such, LinkedIn cannot guarantee the accuracy of LinkedIn Talent Insights data.

Affiliates as noted by the company:

Apple’s data does not list any affiliates.

Amazon’s included affiliates:

Amazon, Amazon Web Services (AWS), Whole Foods Market, Twitch, Amazon Business, Amazon Fulfillment Technologies & Robotics, Amazon Lab126, Prime Video & Amazon Studios, Audible, Amazon Development Center Poland, Ring, Zappos Family of Companies, Souq.com, Amazon Music, Amazon Games, IMDb.com, AWS Elemental, an Amazon Web Services Company, Shopbop, CreateSpace, Goodreads, eero, Woot, Inc., A9.com, Annapurna Labs, Brilliance Publishing, Quidsi Inc., a subsidiary of Amazon, AbeBooks, an Amazon company, Veeqo, Comixology, an Amazon company, Curse, AWS for Games, Alexa.com, LOVEFiLM, D. Cloostermans-Huwaert, Audible GmbH, AWS Thinkbox, Amazon | Liquavista, Casa.com, Whole Planet, BeautyBar.com, 2lemetry (Acquired by Amazon), Immedia Semiconductor, CANVAS Technology – Acquired by Amazon, Whole Kids Foundation, CloudEndure, Sell on Amazon, Whole Cities Foundation, Justin.tv, Graphiq Inc., Sqrrl, IGDB.com, Soap.com, Wag.com, INLT, WHOLE FOODS MARKET PACIFIC NORTHWEST INC, Biba Systems, Inc, Rooftop Media, YoYo.com, DataRow, Carrboro Coffee Company, TSO Logic, Instameme, dispatch.ai, LOVEFILM UK LIMITED, and ParcelBright.

Microsoft’s included affiliates:

Microsoft, LinkedIn, GitHub, LinkedIn China 领英中国, Revolution Analytics, Skype, Playground Games, Lynda.com, Obsidian Entertainment, Metaswitch Networks, Undead Labs, inXile entertainment, LinkedIn Pulse, Compulsion Games, Studios Quality – Xbox Game Studios, M12, Microsoft’s Venture Fund, InMage Systems, Xamarin, Yammer, Inc., Glint, Flip, Bonsai, SMART GLASS, Solair, Parature, Avere Systems, Drawbridge (acquired by LinkedIn), npm, Inc., Bright.com, Colibria, Microsoft Game Dev, Bizo, Advance Technology Solutions, Lumenisity Limited, Event Zero, Semantic Machines.

FieldOne from Microsoft, Softomotive, Citus Data, Lobe, Cycle Computing, Adallom, AÉROPHOTO, AltspaceVR, Careerify (Acquired by LinkedIn), Perceptive Pixel, Prodiance, FSLogix, Inc., Rapportive, Deis, Inc, Beam Interactive, Inc, Newsle, Connectifier, Inc., Netbreeze GmbH, PointDrive, BlueStripe Software (wholly owned subsidiary of Microsoft), Shanghai MSN Network Communications Technology Company Limited, Metanautix, Softmotion Networks, Code Connect Inc., The POS Experts, BI Consultant for Hire, Datazen Software, 6Wunderkinder, We Created It (acq. LinkedIn), Aorato, Incent Games, Inc., RoboVM AB, Chalkup, APIphany, XOXCO, Vidku, VoloMetrix, Regidelta S.A., AlwaysOn IT Consulting, LLC, and Wand Labs, Inc.

Meta’s included affiliates:

Meta, Facebook, Instagram, WhatsApp, Oculus VR, Meta for Work, Hot Studio, Unit 2 Games (a Meta studio), BigBox VR, Sofa B.V., WaveGroup Sound, QuickFire Networks, Onavo, Monoidics Ltd, Carbon Design Group, Ozlo Inc., 13th Lab, InfiniLED, TheFind, Inc., MailRank, Confirm.io (Acq Facebook), spaceport.io Inc., Wit.ai, Gowalla Incorporated, Bloomsbury AI, threadsy, AI at Meta, Mobile Technologies (Acq. by Facebook), SportStream, Inc., osmeta Inc., Acrylic Software, Eyegroove, GrokStyle (acquired by Facebook), rel8tion, and Nascent Objects (now part of Facebook)

Alphabet’s included affiliates:

Alphabet Inc., Google, YouTube, Fossil Group, Inc., Waymo, Google DeepMind, X, the moonshot factory, Verily, Titan, Google Fiber, Kaggle, Wing, Photomath, Waze, Intersection Co., Calico Life Sciences, Qwiklabs, ITA Software by Google, CapitalG, Mineral.ai, Sidewalk Labs (Part of Google), Onduo by Verily, Channel Intelligence, Loon, Adometry (acquired by Google), SignalPath, Global IP Solutions, BeBop Technology, FOSSIL ITALIA SRL, Tenor, Lytro (Acquired by Google), Fossil (East) Limited, Bump Technologies (acquired by Google), Montres Antima SA, Fossil Japan K.K., Fossil UK Ltd., DevOps Research and Assessment (DORA), Social Status, Jibe Mobile, Bot & Dolly, Klipmart, Divide™, Anvato, Fossil France SA, Fossil Switzerland GmbH, Cask Data (acquired by Google).

BandPage, WIMM Labs (acquired by Google), Apportable, Baarzo (acquired by Google), Directr, Appurify, Inc. (Acquired by Google), Panoramio, AppBridge, Athena Wireless Communications Inc., Talaria Technologies, Joyride, Inc, Urban Engines, Moodstocks, BufferBox, Meka Robotics, Clever Sense, Inc., Autofuss, FFlick, Fabric inc., Agawi, RightsFlow, Doubleclick International Internet Advertising Limited, Pittsburgh Pattern Recognition, Inc., Redwood Robotics, drawElements, Emu Messenger, Limes Audio, Quest Visual, Inc., Vidmaker, Incentive Targeting, Inc. (acquired by Google), SlickLogin (acquired by google), Red Hot Labs, GoogleNewsSubmit.com, Fly Labs Inc., Synergyse, Industrial Perception, Inc., Stackdriver, and Green Throttle Games, Inc.