Cherry-picking Your Career

As an executive, you may feel that your career options are limited by your industry, your role, your location, your income requirements, and, of course, personal concerns.

We might like to politely disagree with this assessment, excluding the personal concerns parameter, of course.

You see, many of our clients either come to us wanting to change some of those parameters (particularly their industries or roles) or are unsure of what the best career move might be. So we guide them through our Clarity Program© to evaluate who they are (behaviorally), where they are in their current life, and where they might like to be a few years hence.

Clients typically appreciate this personal attention very much because it requires them to review and often reconsider their basic career assumptions.

Our Chairman is also personally convinced that most of the obstacles to change are in the client executive’s head—not in the outside world—and he has moved fluidly from the advertising industry to amusement parks, food manufacturing and marketing, hygienic products, POS and packaging, business coaching, and more recently, career management. Living proof, you might call it.

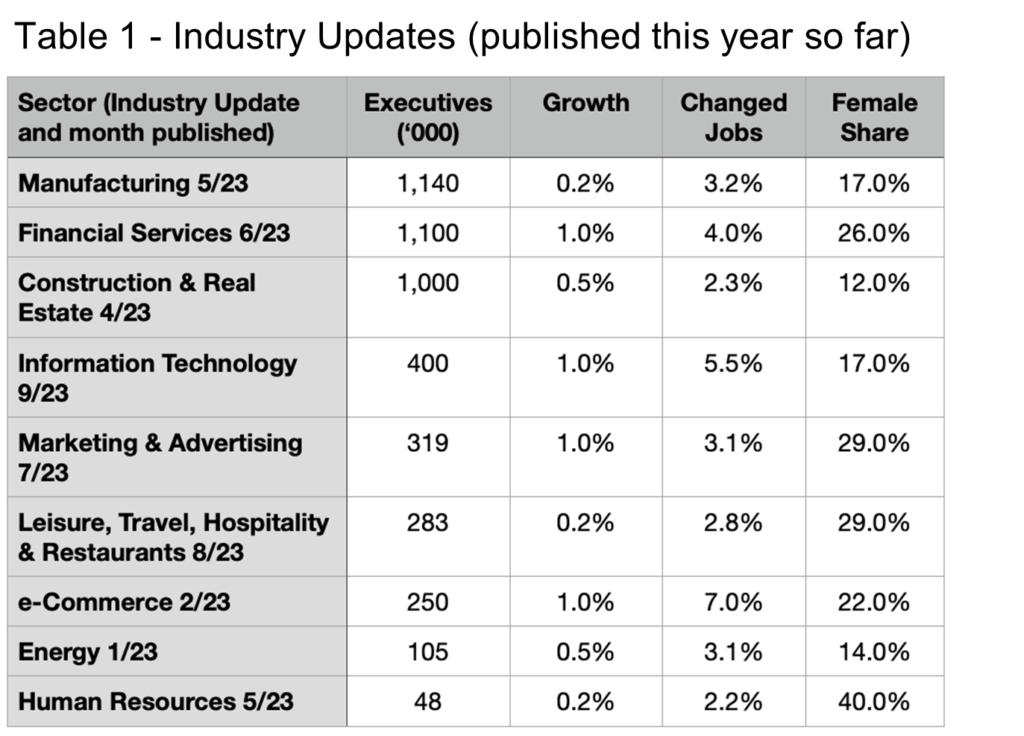

So, let’s consider what “cherry-picking” a career might look like. We publish regular Industry Updates that provide insights useful in this context. [Please find the Updates and their Editor’s Notes under this link.] In Table 1 you will find a simple overview of industries we have profiled so far this year. (Note, we have millions of data points available to our clients, so consider this just a sample.)

One obvious parameter is the choice of industry itself. You may feel you have relevant background in more than one of these already, and we think your horizons will actually expand as you keep reading.

Another parameter is, of course, the relative size of the executive pool if you follow the big fish, small pond logic, or the other way around. From this perspective, Manufacturing is 24 times larger than Human Resources, for example.

But size is not everything. What about growth? Fast-growing industries offer more new opportunities generally, right? Clearly, the growth in the executive population varies considerably in this overview from 0.2% up to 1%—neither of which in itself is all that exciting, however, the “churn” (the degree to which executives change jobs) may be more interesting as each of those job changes also represents a new opportunity for another executive. Here the variation is considerable, from 2.2% up to 7% (of executives changing jobs in a year).

Some of us will also be curious about the gender mix, and it is certainly true that some industries appear to be more accommodating of female executives than others. Hence the females share data.

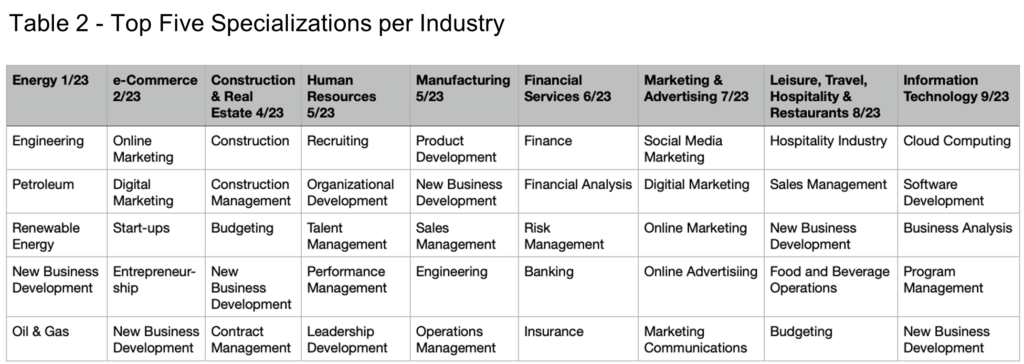

Peeling back a layer, you will find specializations in every industry, in this case, extracted from executive’s LinkedIn profiles. Some are obvious and highly specific such as Petroleum or Oil & Gas in the Energy Field or Cloud Computing in the Information Technology space.

Many other specializations offer lateral movement opportunities from one industry to another. Take New Business Development, for example. This skill set shows up in six different industries. Budgeting, Finance, and related skills are also excellent conduits for movement between sectors. But Table 2 only looks at the Top Five in each segment. Other skills farther down the ranking may be in higher demand.

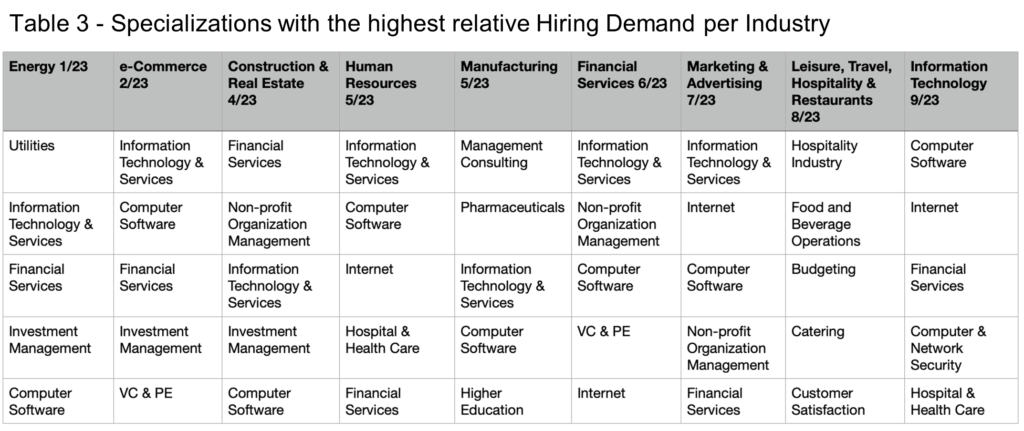

Table 3 examines the same industries but now offers a perspective on which particular specializations or industrial backgrounds are experiencing the highest relative hiring demand per LinkedIn. Now Information Technology shows up in seven and Financial Services appears six times in this selection of industries. Specialization in the Internet also shows up repeatedly (four times) and Investment Management (three times) does as well. Please review our specific Industry Updates for more specifics and a deeper dive.

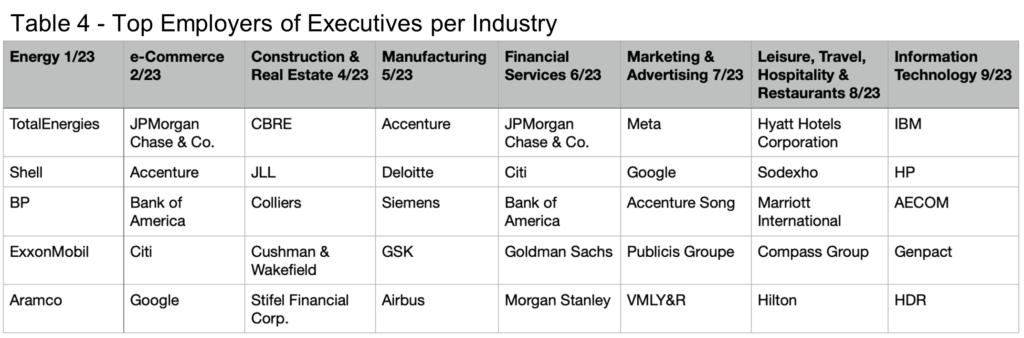

As far as employers are concerned (Table 4), there is not much crossover except between Marketing & Advertising and e-Commerce, because most companies focus on a specific macro-industry. Accenture stands out in this regard, showing three times in total. JPMorgan shows up twice, as do Citi, Bank of America, and Google. Note too, that the company size does not necessarily correspond to the size of their executive teams.

Apple, for example, has a rather small executive team in spite of its significant market capitalization and sales. Again, these are only the top five in each segment. Our Industry Updates go into much more detail.

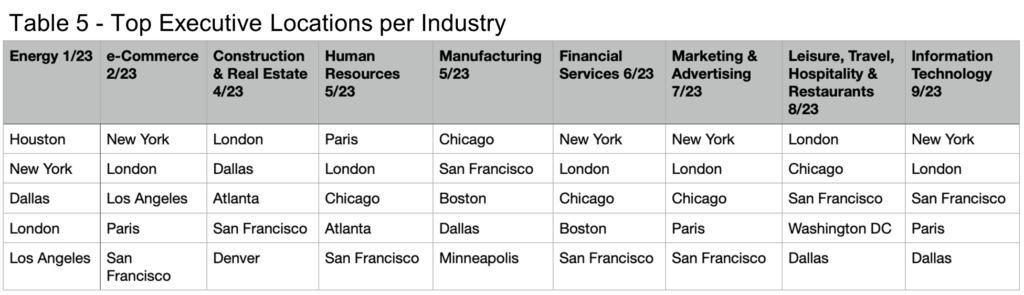

Of course, where you live and/or work is also a rather important decision factor, too.

In Table 5 we examine which locations have the most executives in each industry. New York often comes out on top, but not always. See Construction & Real Estate, Human Resources, Manufacturing, and Leisure, Travel, Hospitality & Restaurants for example. Internationally, London and Paris appear frequently though a little farther down the rankings in each Industry Update you will also see many other European and Middle East locations. One surprise may be to see San Francisco in all but one of the top five locations listed above.

With luck you have now realized that there may well be options to move from industry to industry, changing roles (or not), and locations (or not). That’s why we think of this as cherry-picking.

Fundamentally, our approach makes use of not only the published and recruiter markets for executives (where 25% of the opportunities are available) but of the vast unpublished market as well (the other 75%). You might want to talk with our senior career consultants if you are contemplating a change.

With patience and diligence (and our support) clients generally find the ripest and most succulent opportunities the market has to offer.

Peter Irish, CEO

The Barrett Group