Are You Ready for The Recovery?

Recently, I was trolling through government statistics. I wanted to understand the recovery and where we really are. I researched numbers from the US Department of Commerce. Then, I looked to the Federal Reserve (Richmond) (Fed). And next, I researched the Congressional Budget Office (CBO). There are some pretty dire numbers out there. No matter where I looked, the details are concerning. The table of US Economic Indicators below summarizes some of these results.

None of this is really news. But, it is important to understand how deep we are before speculating on an eventual recovery.

I looked for a bright spot in the data. It might be that the personal savings rate jumped by 33% in April. Consumers held on to their money and spent less across the board.

The Fed also alludes to the underlying expansionary monetary policy in the US. They show a vast increase in the M2. For example, this is one measure of money supply. It is also the reduction in personal consumption inflation (-4.6%, April vs. March). And a negative Real Federal Funds Rate of -1.6% in April.

This is also evident as the PPP, EIDL, and other programs succeed in pumping money into the economy. This increase is even though the programs are less than perfect.

As we have all seen, the economic impacts have been very uneven.

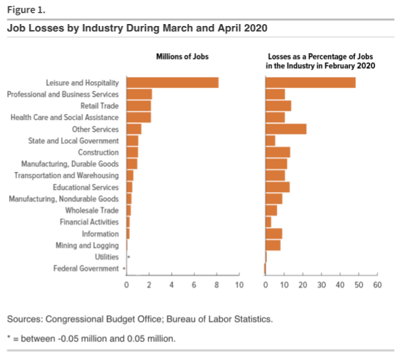

Some industries have been hit much harder than others. See the chart from the CBO below on the subject of Job Losses by Industry. The chart was accompanied by this grim summary:

“The more than 20 million confirm payroll jobs lost during March and April were concentrated in industries that rely on a high degree of interactions, including leisure and hospitality, retail trade, and educational services. The leisure and hospitality industry was hit particularly hard, losing more than 8 million of its 17 million jobs.”

Concerning me was another snapshot from the Fed. It cited 20 indices of economic activity. Only 3 showed improving trends from March to April.

So, what about the recovery? Where is it? When will it start?

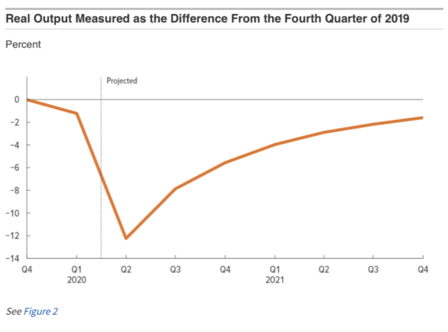

The Congressional Budget Office has an interesting perspective on this that is quite specific. See the Real Output graphic at right.

The accompanying text states:

“Although economic conditions are projected to improve following their sudden drop, real output is expected to be 1.6 percent lower in the fourth quarter of 2021 than it was in the fourth quarter of last year.”

The Fed also cites statistics revealing an expected recovery. This is portrayed through the optic of an increasing Federal Funds Rate (midpoint) forecast to rise toward 1.5% end of 2020, 2% of 2021, 2.2% of 2022.

The CBO goes on to predict a resumption of economic activity:

“The economy is expected to begin recovering during the second half of 2020 as concerns about the pandemic diminish and as state and local governments ease stay-at-home orders, bans on public gatherings, and other measures. The labor market is projected to materially improve after the third quarter; hiring will rebound and job losses will drop significantly as the degree of social distancing diminishes.”

So, a recovery does seem to be in the cards.

At the Barrett Group, we have seen the Covid-19 crisis having relatively little impact on the executive hiring market. In the most recent eight weeks, we have helped 30 executives land jobs or field attractive offers. Read about their experiences on our Hiring Line website.

So, why not get started on a career change and be farther ahead in the hiring process? From our perspective, we see no reason for executive job changers to sit on the sidelines.

For those who are considering a career change but have not yet started, why are you waiting? You should start now. Don’t be left behind. The economy will stabilize, even if it is a “new normal.”

The Barrett Group gives our clients a significant leg up. We have a unique five-stage Career Change Process. We add the support of a six-member team of professionals. This group helps you set up the framework of your job search. We help to ensure you get into the job market effectively. And help you to be faster than you ever could on your own, regardless of industry or geography.

Are you ready for the recovery? Let’s talk and find out!

Peter Irish

CEO

The Barrett Group