INDUSTRY UPDATE: Procurement – February 2022

INDUSTRY UPDATE: Procurement – February 2022

Introduction to Procurement

Imagine for a moment that someone forgot to buy food… tea, coffee, water, sugar, vegetables, rice, beans… toilet paper… Anything that you consume regularly in your household. What would happen? You would probably experience something between dissatisfaction and total disfunction, right?

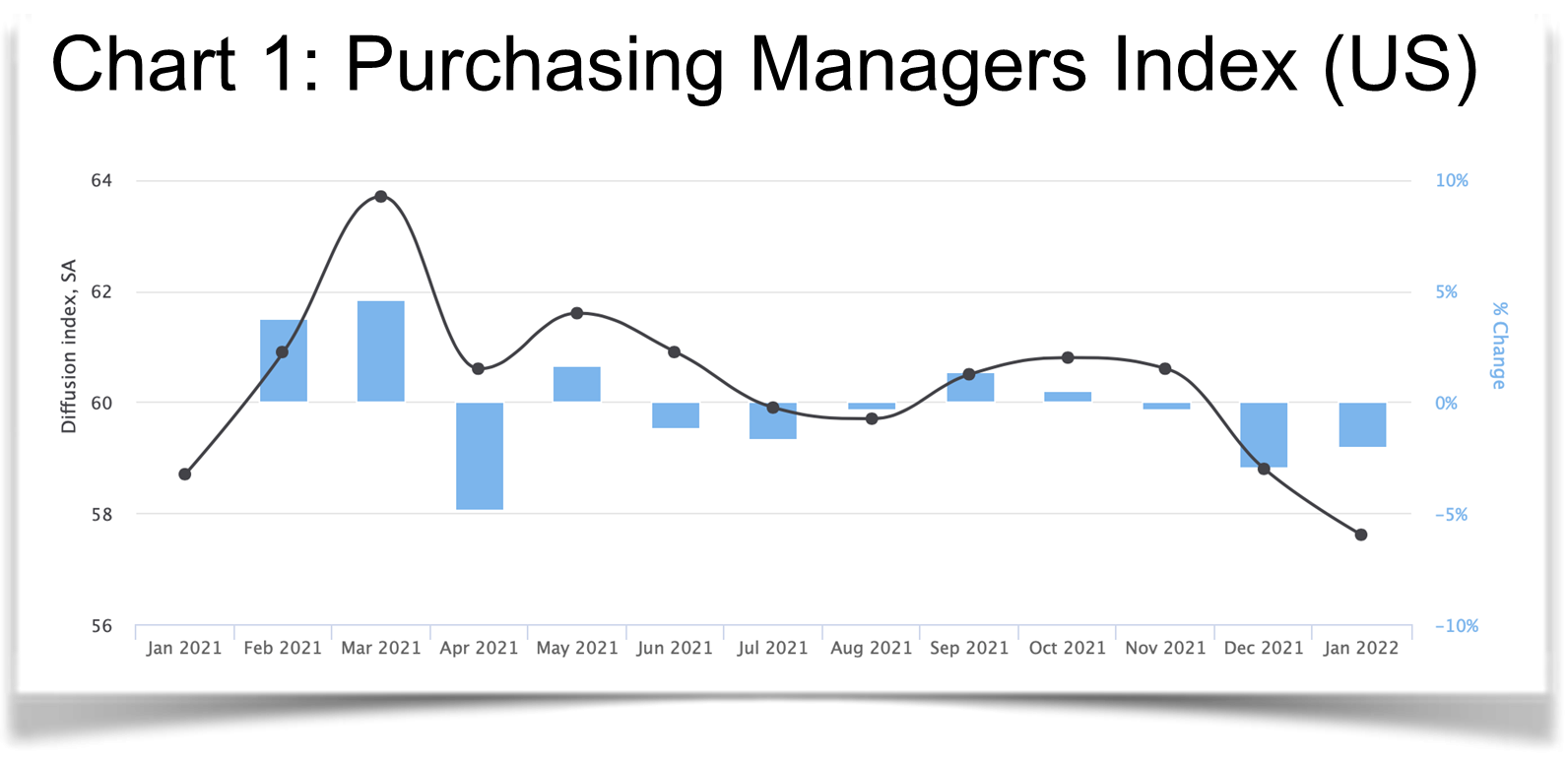

Perhaps this brings home the critical role that procurement plays. Many companies would literally stop working without the supply of raw materials, labor, or services. These are items that their procurement managers regularly purchase. Procurement is so important to the overall economy that we regularly hear about the PMI (Purchasing Managers Index) in the US as an important indicator of macroeconomic trends. (See Source, Chart 1.)

A similar index describes the European area…

“National data are included for Germany, France, Italy, Spain, the Netherlands, Austria, the Republic of Ireland and Greece. These countries together account for an estimated 90% of Eurozone manufacturing activity. The Manufacturing Purchasing Managers Index is based on five individual indexes with the following weights: New Orders (30 percent), Output (25 percent), Employment (20 percent), Suppliers’ Delivery Times (15 percent) and Stock of Items Purchased (10 percent), with the Delivery Times index inverted so that it moves in a comparable direction. A reading above 50 indicates an expansion of the manufacturing sector compared to the previous month; below 50 represents a contraction; while 50 indicates no change.” (See Source.)

“The IHS Markit Eurozone Manufacturing PMI was revised lower to 58.7 in January of 2022 from a preliminary of 59 but still pointed to the strongest growth in factory activity in five months, with production, new orders and employment all registering faster increases. 2022-02-01” (See Source.)

This uptick may well presage a significant increase in inflation. Or, perhaps it’s just the restocking of supply chains.

Certainly, the pandemic has brought plenty of supply shocks sometimes due to hoarding and sometimes supply constraints. (Think about computer chips and the impact the current shortage is having on car manufacturing). All of these were or will be resolved by someone in procurement.

Interestingly, the Bureau of Labor Statistics in the US predicts a decline in the long term in the total number of procurement jobs. It also still highlights the need to fill approximately 45,800 purchasing jobs per year in the US (at all levels). And reports the median salary as a relatively high $125,940. (See Source.) Both in the European area and in the US, LinkedIn cites procurement executives as generally very highly in demand. And we can understand why.

Procurement in Demand

“Success has many fathers…” goes the saying. It means that if things are generally going well everyone wants to claim responsibility for that success. And so it is with procurement. Certainly, at a high level, a CEO is also responsible for procurement. But that does not mean that the CEO actually buys anything. So it is a little complicated to sort out who is really operationally involved in purchasing and who is just taking credit.

The broadest measure suggests that there are some 182,000 procurement executives as we define them in the US, EU, UK, and Middle East (ME). There has been approximately a 3% increase in this number over the last year. About 10,000 of them have changed companies and jobs during that period. As reported above, LinkedIn cites hiring demand for this function as “very high.” These procurement professionals are largely male (84%) and have a median tenure of about 3.3 years.

Approximately 104,000 of these positions are located in the EU, UK, and ME. This is a pool that grew by about 4% in the past year and experienced a churn of 6% (executives who changed companies and jobs). The remaining 78,000 were in the US where the market grew by about 2%. The US experienced a similar rate of churn. Between growth and churn, that means there were approximately 15,000 executive opportunities in this market in the past year.

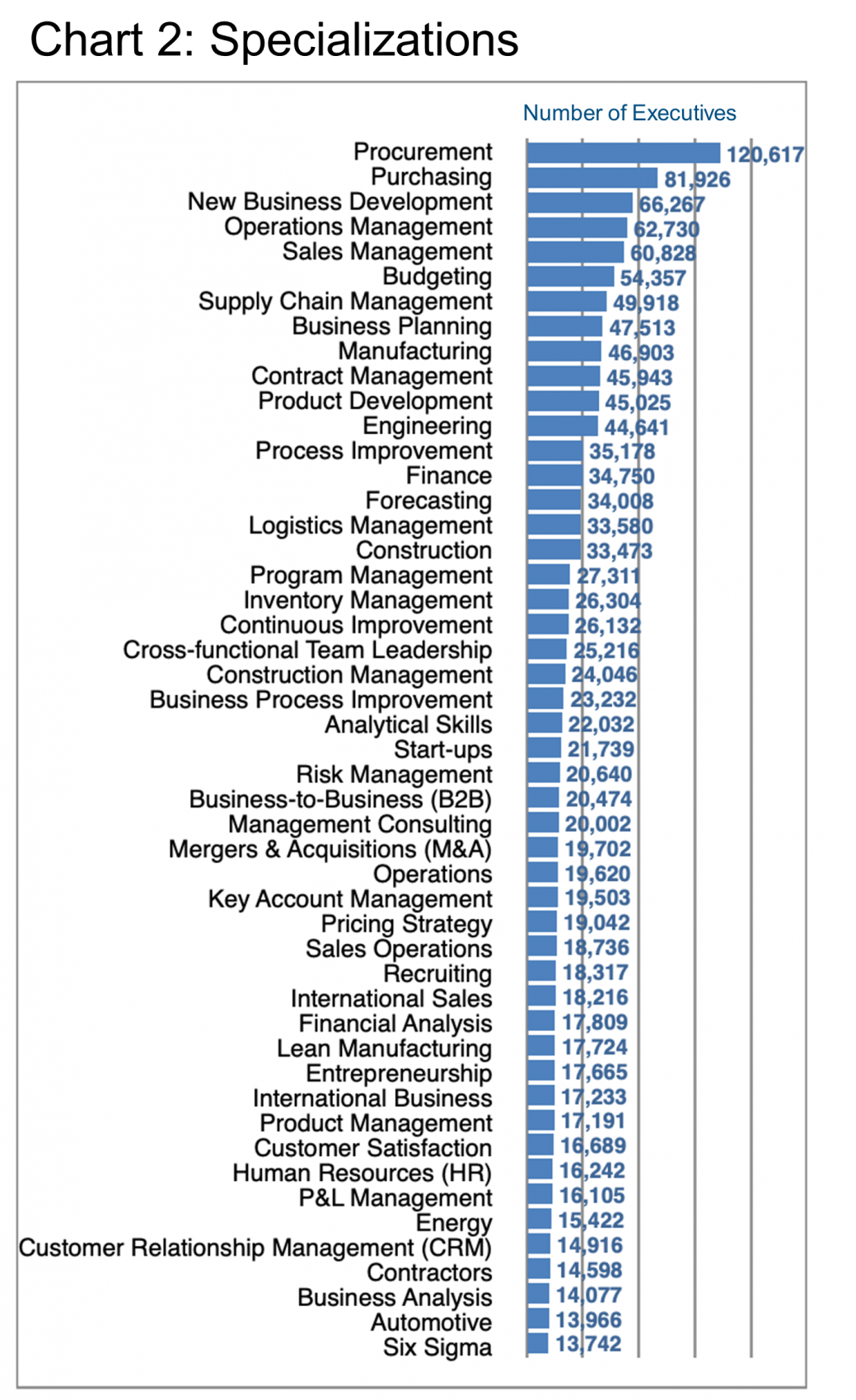

Chart 2 examines the relative specializations within this pool. It is no surprise that Procurement and Purchasing come out on top, of course. And these numbers may be more reflective of the operational procurement function. The broad range of other specializations suggests that, organizationally, procurement has different homes in different industries. Or indeed, the function may well be distributed with specific organizational units being responsible for procuring specific goods or services.

At a high level, the total number of procurement executives per organization seems relatively modest.

Globally, Accenture tops the bill with 334 (up 14% YOY). It is followed by Citi (170, +8%), JP Morgan Chase & Co. 147, +13%), Bank of America (127, +3%), and AlixPartners (115, -7%). To drill down a little bit more at Accenture, this company seems to be somewhat focused on this function at the moment. This executive specialization at Accenture has grown about 18% worldwide in the past year. Accenture has about 558 executives following hires from IBM, Capgemini, Deloitte, Cognizant, and Kearney.

Note that Barrett Group career consultants and research teams can typically provide significant background data and details about most companies a client may choose to target, including insights into current management.

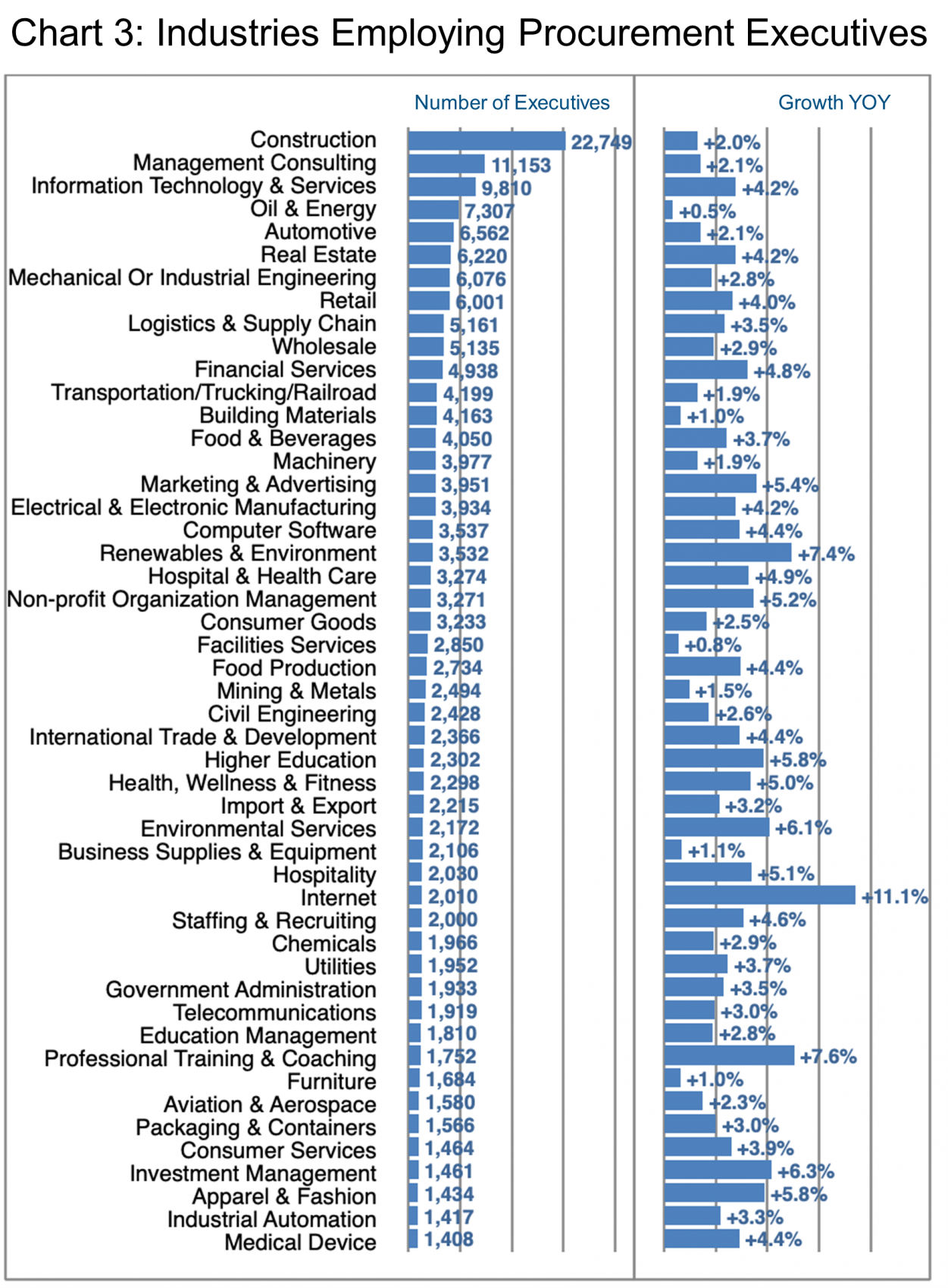

As far as industries employing procurement executives are concerned (Chart 3), Construction stands out as twice as big as the next contender. Major employers in this space include Skanska (Stockholm), MGAC (Washington, DC), and PSI construction (Memphis, TN). However, the expected growth in this sector is slow to moderate versus some of the hotter business areas.

For example, Internet stands out as the area showing the highest growth in the past year at +11%. Major employers of procurement professionals in this industry include Amazon, Google, and Salesforce. Professional Training & Coaching also stand out. These are at +7.6% growth. Professional Training and Coaching includes Vistage (San Diego, CA), Project Management Institute (Newton Square, PA). And also Germe, le réseau de progrès des managers (Nantes, France). Note that LinkedIn projects growth in this latter area as “moderate” going forward.

On the other hand, LinkedIn projects “very high demand” in the Renewables & Environment industry. These already grew its procurement executive ranks by +7.4% in the past year. It has been driven by top companies such as ENGIE (France), Vestas (Denmark), and Siemens Energy (Germany). Environmental Services (+6.1%) are also performing well propelled by firms such as Veolia or Suez (France) and Combineering A/S (Denmark). LinkedIn also classifies Environmental Services as having “moderate” hiring demand in the immediate future.

It is also good to see “post-pandemic” signs of life such as Investment Management (+6.3%) and Apparel & Fashion (+5.8%). These have added significantly to their procurement executive ranks as well.

We will not pretend that Procurement is as integrated globally as certain other industrial specializations, for example, in the energy industry. However, with the emphasis on remote working these days, it is probably good to know where the action is even if you as a prospective participant do not wish to move to that location. You can at least make an informed decision. On the other hand, some employers might be able to offer a more global platform. Accenture, for example, appears among the top three employers of this specialization in London, Houston, Washington DC, Paris, and Chicago.

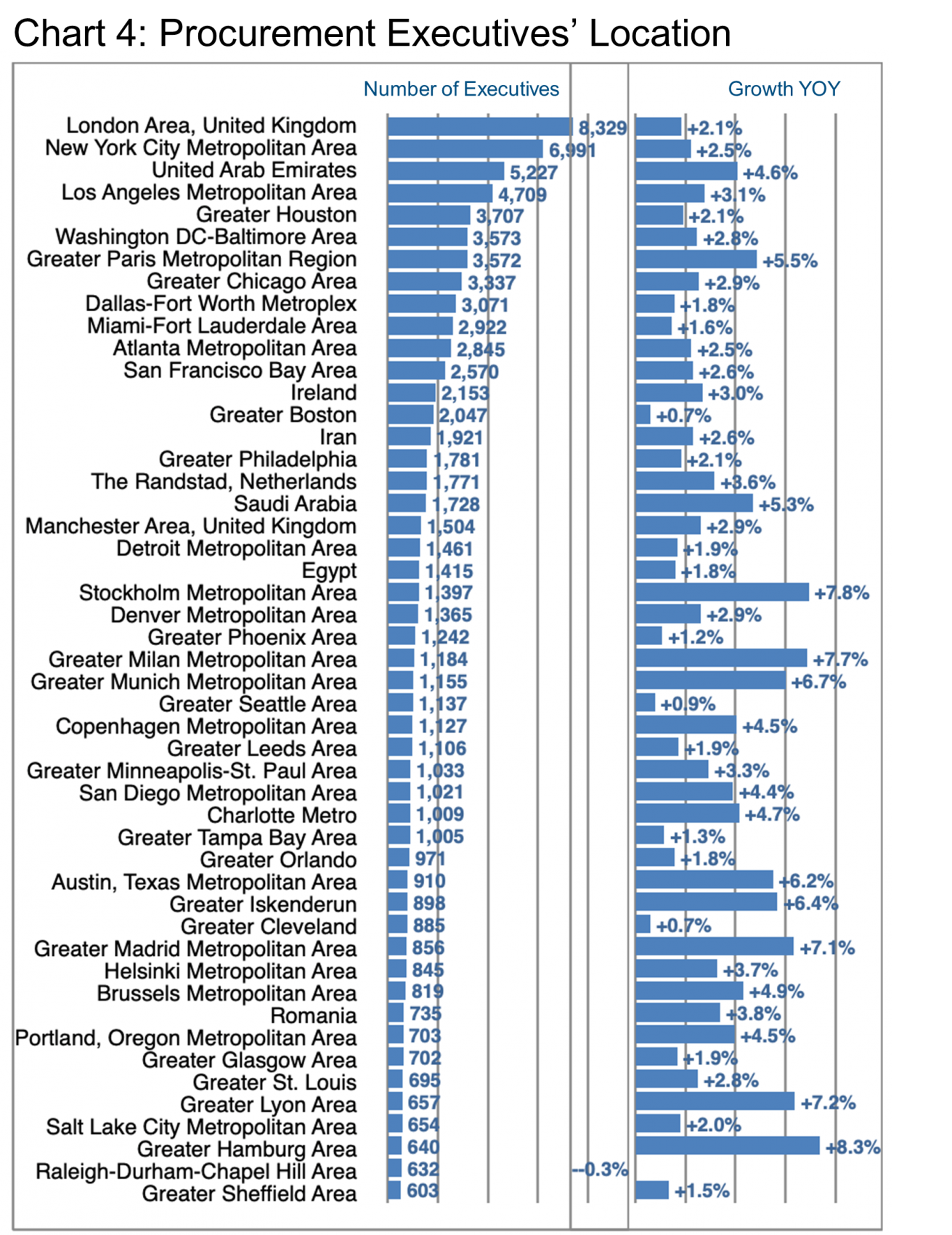

Chart 4 highlights where procurement executives are employed in the targeted regions’ major population hubs. As well it shows the relative growth rates. It is interesting to note that the fastest growth seems to be in European centers. These include Hamburg, Stockholm, Milan, Lyon, and Madrid. All are exceeding 7% YOY growth.

Of course, given their respective size London, New York, and the UAE all offer significantly more opportunity in terms of the actual number of new positions. Looking only at the US for a moment, New York, Los Angeles, Houston, Washington DC, and Chicago are the top five locations. All have procurement executive populations in the 3,000-7,000 range growing by 2-2.9% YOY.

In the EU, UK & ME region, London, UAE, Paris, and Ireland stand out with relatively large procurement executive populations and reasonable growth rates.

Looking ahead, LinkedIn goes on to characterize the hiring demand for procurement executives in the top locations as follows:

- London – high

- New York – very high

- UAE – low

- Los Angeles – high

- Houston – high

- Washington DC – high

- Paris – very high

- Chicago – very high

- Dallas-Fort Worth – very high

- Miami – moderate

- Atlanta – high

- San Francisco – very high

- Ireland – low

- Boston – very high

- Iran – low

- Philadelphia – high

- The Randstad – moderate

- Saudi Arabia – moderate

- Manchester (UK) – low

- Detroit – moderate

Peter Irish, CEO The Barrett Group

Click here to download a printable version: Industry Update – Procurement

For more background on many of the industries listed in this Industry Update, see our Industry Update 2021 that covers executive demand in the following sectors: Financial Services, Information Technology, Manufacturing, Health-Hospitals, Health Care & Medical Devices, Management Consulting, Energy, Hospitality, e-Commerce, Venture Capital and Private Equity, and Big Tech.

Editor Note:

In this particular Industry Update “executives” will generally refer to the Vice President, Chief Financial Officer, CEO, Managing Director and Chief Operating Officer titles with functional responsibility for procurement. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research. Is LinkedIn truly representative? Here’s a little data: LinkedIn has approximately 722 million users, 174 million in the US, and 163 million in Europe. (See Source) It is by far the largest and most robust business database in the world, now in its 18th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year. “Attrition” is defined as the departures in the last 12 months divided by the average headcount over the last year.