INDUSTRY UPDATE: e-Commerce

Introduction e-Commerce

As a definition of e-commerce “commercial transactions taking place over the internet” seems a bit general. Virtually every business has this characteristic in the meantime. In fact, in this context, we usually think of the big firms that have evolved to be largely internet-based sellers of goods. Here, for example, are allegedly the largest e-commerce firms by sales (See source: NOTE: This list excludes players based outside the US, UK, EU, and Middle East; four out of the top five worldwide are actually based in China):

How is the sector evolving? “In 2021, total US ecommerce sales reached $959.5 billion, an 18.3 percent year-over-year increase from $811.6 billion in 2020.” (See source.)

More recently the US Commerce Department reports, “The third quarter 2022 e-commerce estimate increased 10.8 percent (±1.2%) from the third quarter of 2021 while total retail sales increased 9.1 percent (±0.4%) in the same period. E-commerce sales in the third quarter of 2022 accounted for 14.8 percent of total sales.” (See source.)

Beyond the e-commerce specialists, bricks and mortar firms have been catching up fast too, notably Walmart, Target, Home Depot among many others in the US. For example, “According to recent data, Walmart’s online sales […] hit $67.39 billion in 2021, the highest ever recorded. This also makes up 7.2% of the total US ecommerce sales in 2021.” (See source.) “Globally, ecommerce sales penetration continues to climb, Walmart CEO Doug McMillon said during a Nov. 15 [2022] conference call. “So far this year, 13% of our total sales as a company now start in a digital fashion,” McMillon said, […]. Online penetration for Walmart International, which encompasses Walmart’s non-U.S. operations, is 20%, he added.” (See source.)

Morgan Stanley sounds rather upbeat on the prospects for further e-commerce growth, too, saying, “Over the long term, the e-commerce market has plenty of room to grow and could increase from $3.3 trillion today to $5.4 trillion in 2026. “We believe that the Covid-driven bump will not flatten future e-commerce growth,” says Brian Nowak, an equity analyst covering the U.S. internet industry. He sees e-commerce reaching 27% of retail sales by 2026. “Across the world, we have yet to see a ceiling for e-commerce penetration.”” (See source.)

Europe continues to see growth in e-commerce as well with 91% of consumers now having access to the internet and 75% claiming to have purchased goods on line (See source). McKinsey reports, “while e-commerce penetration is slightly lower in some EMEA markets than in the United States (online represented 14.4 percent of total sales in Western Europe in 2021 versus 15.3 percent in the United States). In others, it is significantly higher. Online sales comprise 28.3 percent of retailer revenue in the United Kingdom and 18.1 percent in Germany…” (See source.)

In the Middle East, the forecast is also for significant growth: “…the share of online retail as a percentage of total retail sales in the Middle East stands at little more than 2%. Even in the wealthiest countries of the Gulf Cooperation Council (GCC), e-commerce sales are only 3% of total retail. For comparison, e-commerce in the US reached 2% of total retail sales way back in 2004 and now stands at around 14%. But rapid growth is forecast in the Middle East. E-commerce sales are expected to increase by more than 11% each year.” (See source.)

What then will drive this growth, and what are the hottest trends in e-commerce?

There are numerous lists available on the internet. We think this one is reasonably representative of important trends that will affect the development of e-commerce in the near term:

|

|

It appears then that e-commerce has a lot of running room, and plenty of trends to help power that growth. What does this mean for the executive market? Let’s find out.

The Market for Executives

Approximately 250,000 fit our executives definition (see Editor’s Note) in this industry vertical, some 130,000 in the EU, UK, and Middle East and 120,000 in the US. Overall, this cohort is growing at about 1% per year in the latest period and some 7% have changed positions, meaning there were about 20,000 executive opportunities in this space in the past year.

New York, London, Los Angeles, Paris, and San Francisco are the most frequent locations for these roles which are predominantly held by men (circa 81%). LinkedIn describes these executives as being hard to find and therefore hiring demand is said to be very high while the median tenure is 2.9 years.

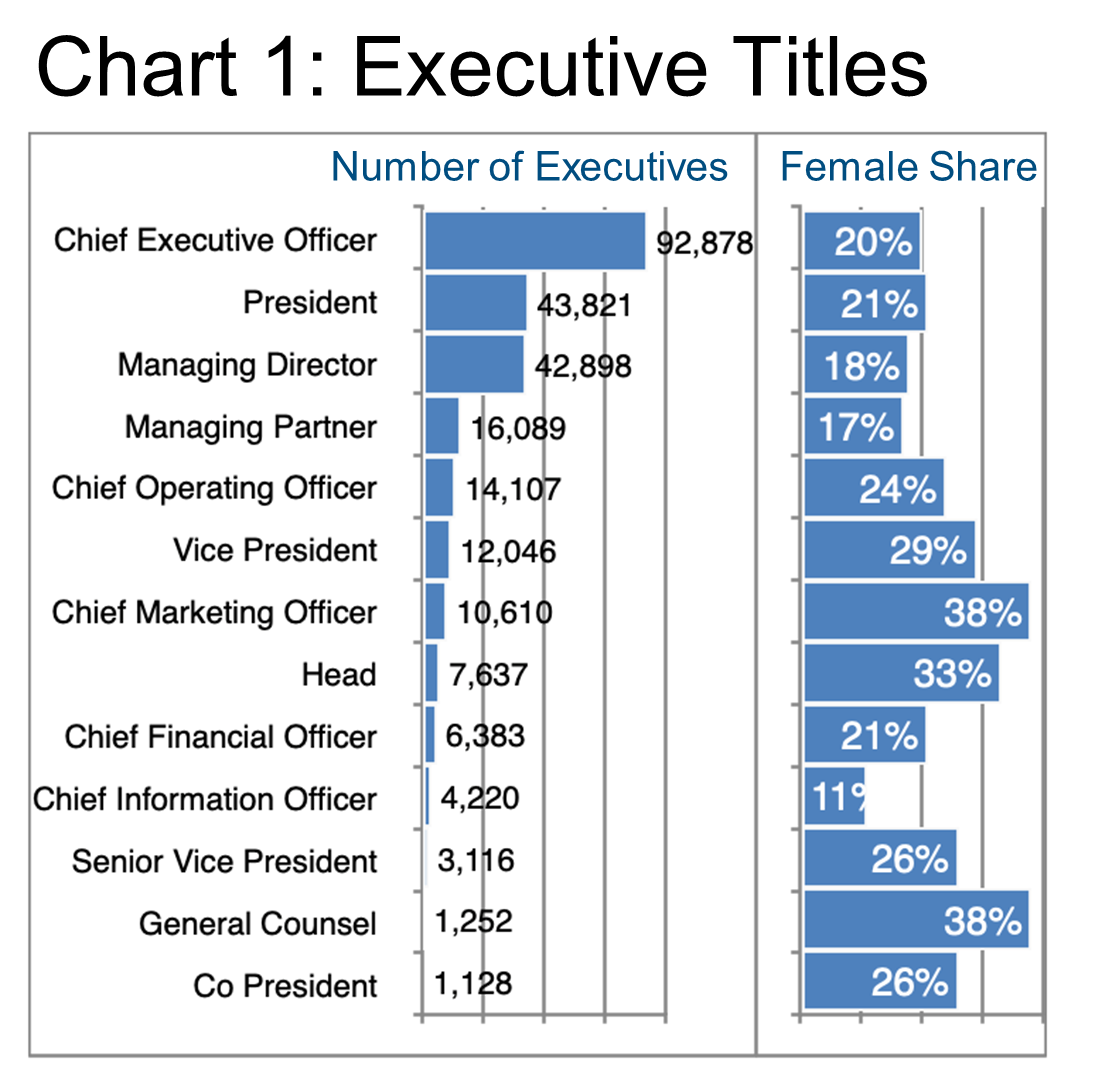

We believe that this industry is relatively unconcentrated, in that the number of CEOs is high relative to the number of Vice Presidents and other titles (see Chart 1).

While the female executive share is relatively low in comparison to some other industries, there are titles that stand out in this respect, notably Chief Marketing Officer and General Counsel.

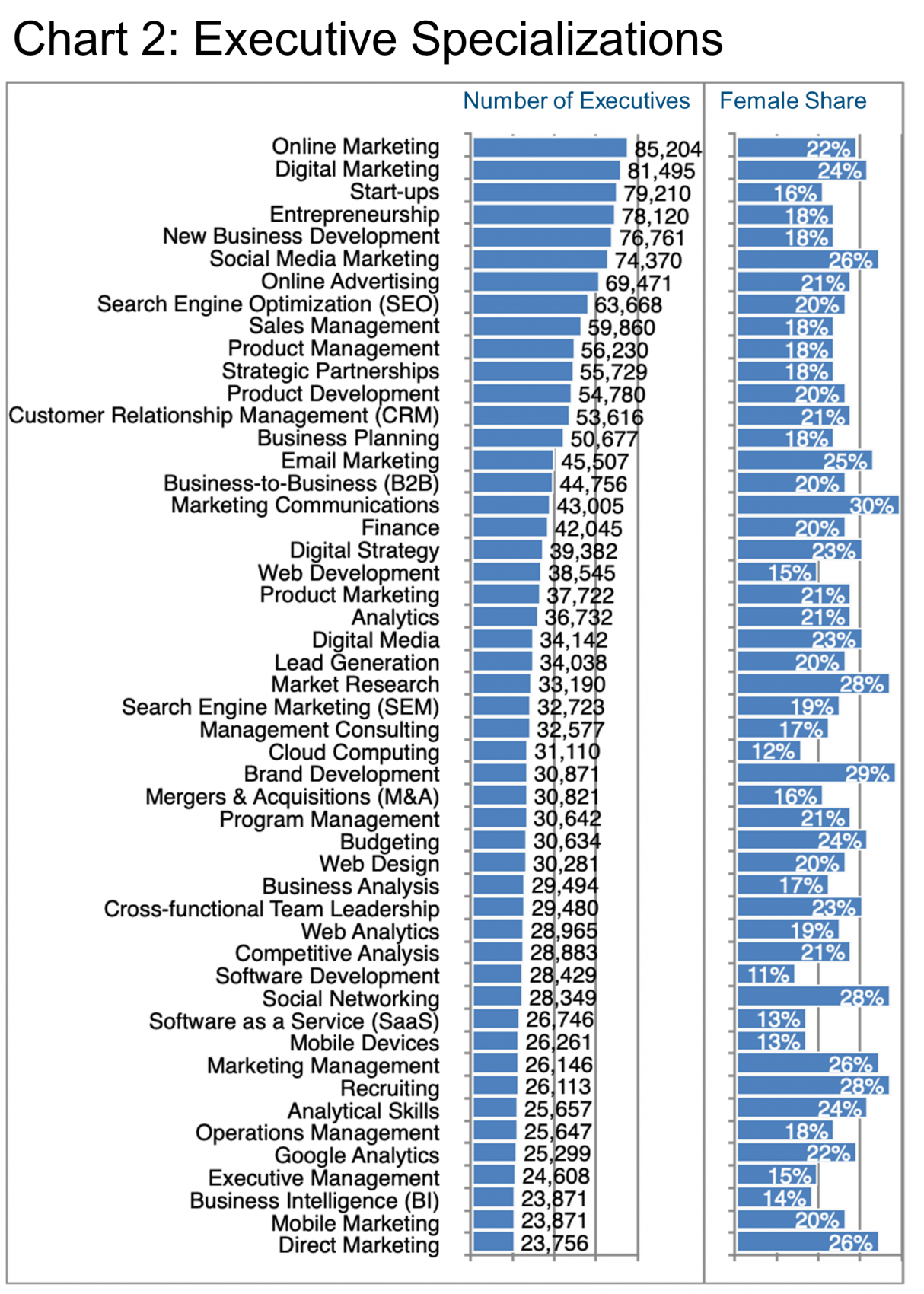

In terms of specializations (Chart 2), not surprisingly, Online Marketing and Digital Marketing top the list, though more general skills such as Start-ups, Entrepreneurship, Business Development, and Social Media Marketing are not far behind. Bear in mind that the specializations listed here are gleaned from executives’ LinkedIn profiles and relatively few will list only one specialization.

Nevertheless, if you search the web for “key skills for success in e-commerce” you are likely to find a list such as this one (See source):

- Copywriting

- SEO

- Facebook marketing

- Graphic design

- Email marketing

- Google Analytics

- Product photography

- Accounting

- Project management

- Microsoft Excel

Perhaps the specific references to Facebook and Microsoft might be viewed more generically as social media and analytical skills, however, all of these “key skills” appear in one form or other in Chart 2, though at scale companies need to manage whole teams of people engaged in any given specialization so that the whole dimension of “management” comes into play (e.g., Sales Management, Product Management, etc.).

It is indeed curious that female executives remain relatively scarce in this industry, reaching a peak in predictable subject areas such as Marketing Communication, Brand Development, Market Research, Social Networking, and Recruiting. At least according to one source, 72% of women and 68% of men shop online (in the US). The way the sexes shop is also apparently quite different. In short, more female executives would probably be good for this industry’s future.

As we often point out, many of the skills listed in Chart 2 are highly transferable from and to other industries, so if you feel that you are in an industry that has little room to grow you might want to consider a change. The Barrett Group’s career change process begins with a thorough exploration of clients’ interests, experience, skills, and aspirations and often leads to surprising epiphanies that may completely change our clients’ professional targets. (Learn more.)

Now some of the professionals we are exploring provide services to other companies while some work directly for the service or product supplier. (We will explore employer companies later in this Update.)

Whether they work directly for the seller of goods and services or provide services to another company, which industries actually employ e-commerce executives?

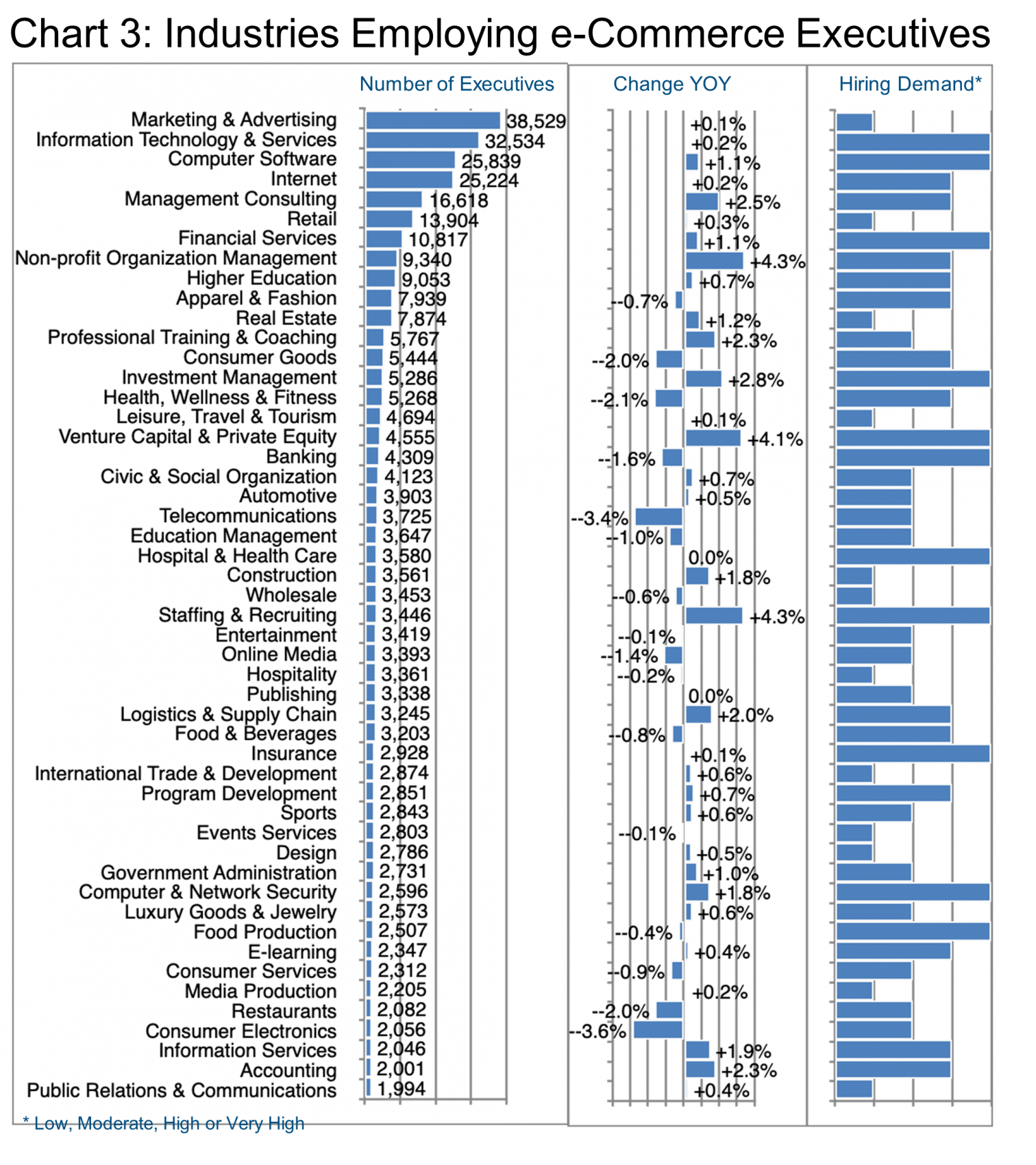

Chart 3 explores this question showing that about half of these executives are engaged in just four industries: Marketing & Advertising, Information Technology & Services, Computer Software, and Internet while Retail comes in only in sixth place.

In the past year, Non-profit Organization Management, Venture Capital & Private Equity, Staffing & Recruiting all grew about four times faster than the e-commerce segment as a whole, followed by Investment Management, Management Consulting, and Accounting—all growing 2 to almost 3 times faster.

Other industries contracted sharply, particularly Telecommunications and Consumer Electronics and to a lesser extent, Consumer Goods, Health, Wellness & Fitness, and Restaurants.

There is no necessary correlation between the growth in the number of executives and the hiring demand, though these often go hand in hand. Take the second and third-ranked industries on Chart 3, for example, Information Technology & Services and Computer Software. These were not among the fast growers, but LinkedIn still says these industries exhibit a very high hiring demand.

Or look at Venture Capital & Private Equity versus Banking adjacent to one another in Chart 3. One belongs to the fast-growing verticals while the other is actually contracting yet both see very high hiring demand according to LinkedIn due to skill scarcity.

Generally, it is best to approach a change of careers with your eyes open and with as much information as you can reasonably obtain. This is another reason thoughtful executives hire the Barrett Group to buttress their searches because each client is supported by a team of six professionals, including a research analyst with access to numerous data resources.

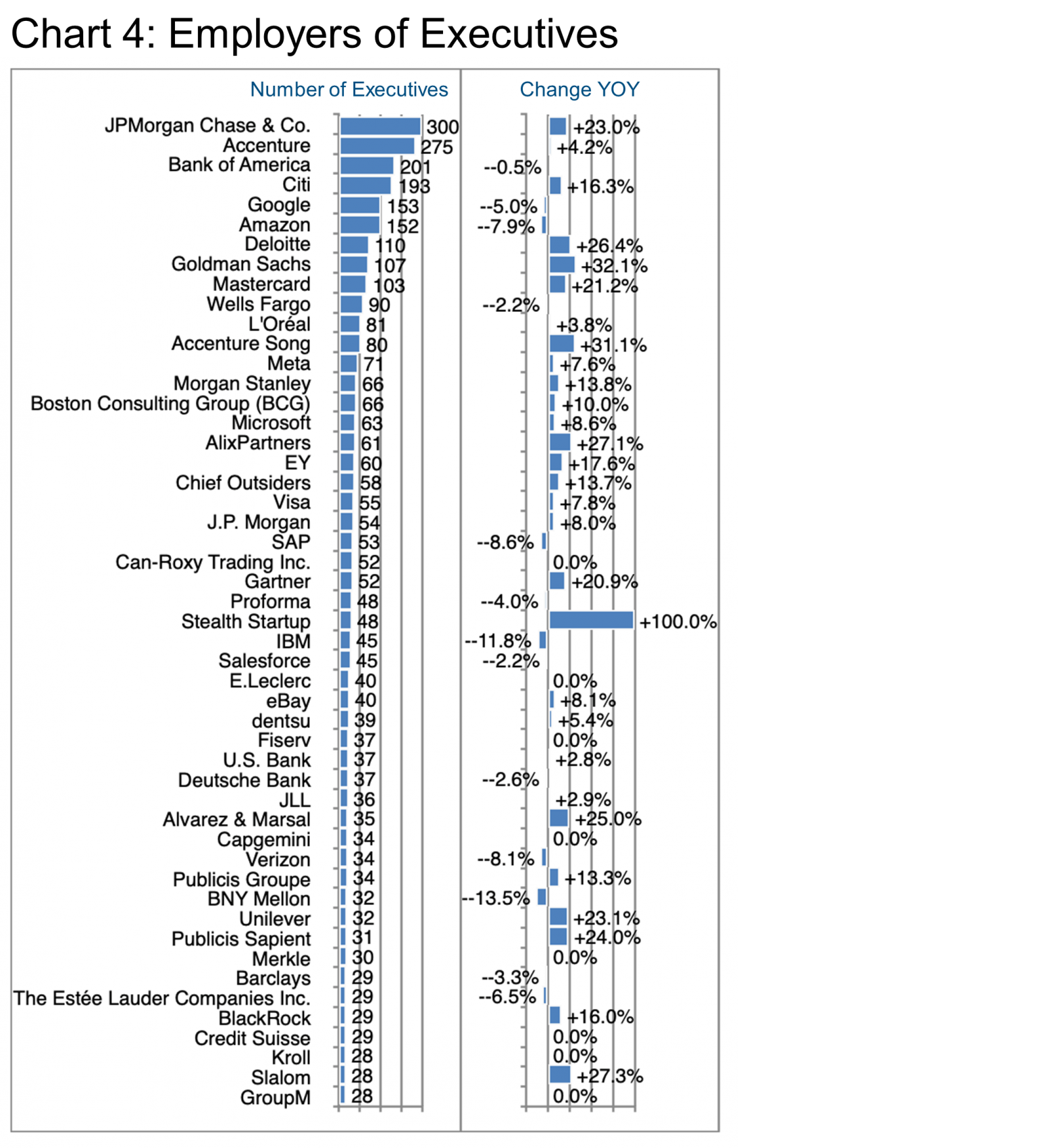

Those research capabilities could be useful, of course, when examining data such as in Chart 4, because some of this year-on-year growth is real and some of it may have been undercut by layoffs in the new year, for example, at Goldman Sachs. Google, Amazon, SAP, and Salesforce are already showing some of the effects from their restructuring. However, overall, retail banks make more money when interest rates rise so there may be good reason for their growth.

In fact, banks (retail and investment) number at least 12 out of the top 50 e-commerce executive employers on Chart 4. As a cohort, this group employs about 4,400 e-commerce executives, a group that has grown by 3% in the past year. We may not think about banking first when we think of e-commerce, but banks are obviously heavily investing in this field.

Take JPMorgan Chase & Co. According to LinkedIn, the company increased their overall Vice President rank by 11% in the most recent 12 month period to about 14,400, though they also added significantly to their Software Engineer teams (all titles, not only executives) to reach 8,000 (+25%). The growth at JPMorgan has been relatively steady during 2022, with significant give and take from Citi, Wells Fargo, Bank of America, etc., but also net talent acquisition from Tata Consultancy Services and Accenture.

Accenture Song also stands out at least as an intriguing name, not to mention due to 31% growth in their e-commerce executive team. This unit presents itself to be a life-style consultancy attempting to capture advantage from a unique understanding of consumer and client behavior. Their talent acquisition approach has been to acquire whole teams and/or business units from previous acquisitions Fjord (design), SinnerSchrader (digital marketing), and a fair number from Accenture itself.

On Chart 4 Stealth Startup also stands out, posting 100% growth, however, since their company website is a Wikipedia page and their LinkedIn job postings appear to be for different companies we believe this is more of an umbrella for multiple startup companies that do not wish to be clearly identified as yet, hence their need for stealth.

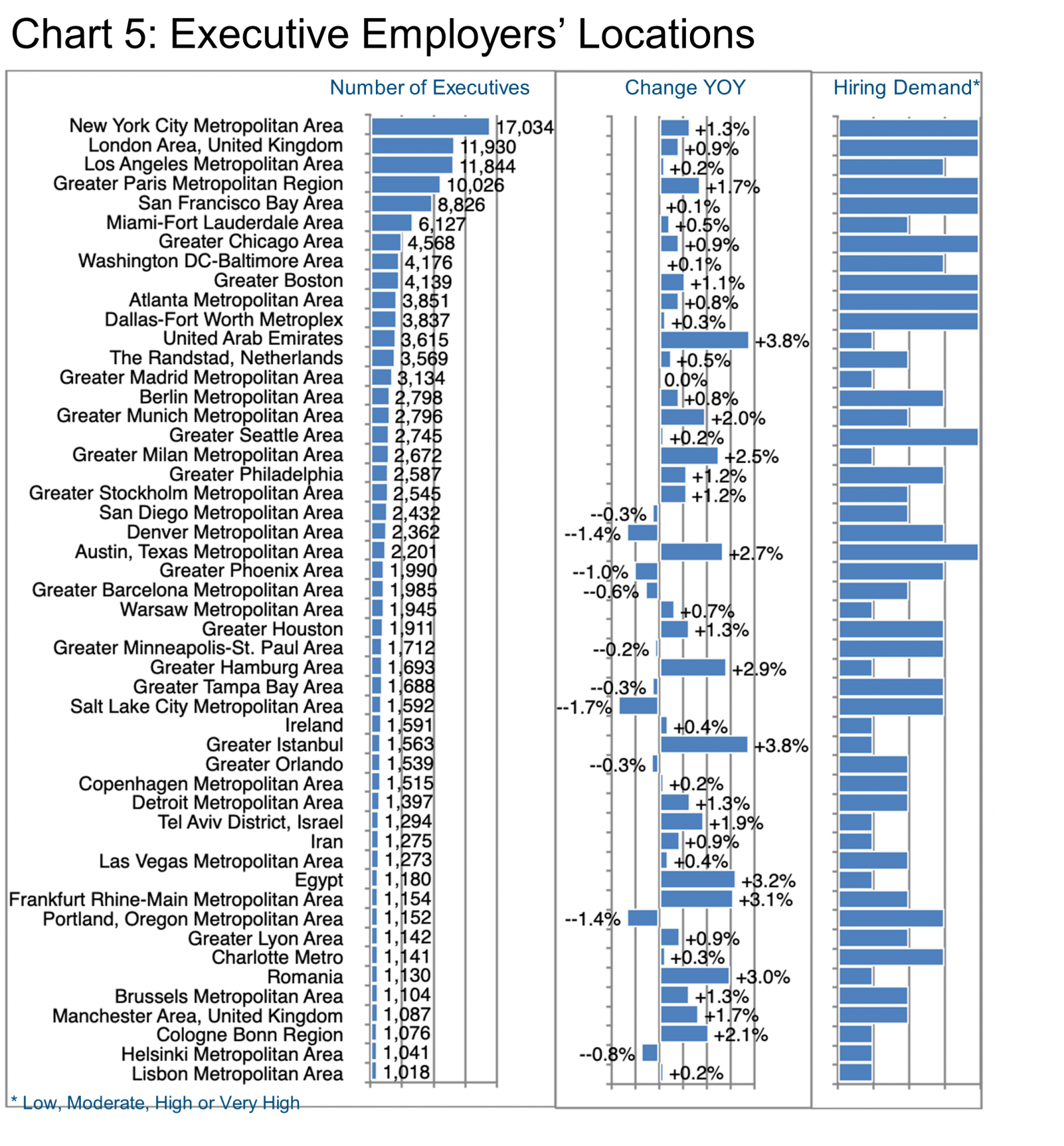

Chart 5 reveals the locations with the largest e-commerce executive populations, fastest YOY growth and highest hiring demand. There is not too much mystery here, as these are the locations of the largest employers, however, it is interesting to see how many of the fastest growing locations are not in the US, including the UAE, Milan, Hamburg, Egypt, Frankfurt, Romania, and Cologne.

LinkedIn also identifies numerous locations with high or very high hiring demand in this sector, whether they have grown quickly or not, presumably due to a skill shortage.

Peter Irish, CEO

The Barrett Group

Click here for a printable version of Industry Update – e-Commerce 2023.

Editor’s Note:

In this particular Update “executives” will generally refer to the Vice President, Senior Vice President, Chief Operating Officer, Chief Financial Officer, Managing Director, Chief Executive Officer, Chief Human Resources Officer, Chief Marketing Officer, Chief Information Officer, Managing Partner, General Counsel, Head, and President titles. Unless otherwise noted, the data in this Update will largely come from LinkedIn and represents a snapshot of the market as it was at the time of the research.

Is LinkedIn truly representative?

Here’s a little data: LinkedIn has more than 800 million users. (See Source) It is by far the largest and most robust business database in the world, now in its 19th year. LinkedIn defines the year-over-year change (YOY Change) as the change in the number of professionals divided by the count as of last year and “attrition” as the departures in the last 12 months divided by the average headcount over the last year.